In case you desire to fill out st 119 tax form, you don't need to download and install any sort of applications - simply give a try to our PDF tool. To make our editor better and easier to utilize, we continuously work on new features, taking into consideration feedback from our users. All it takes is several easy steps:

Step 1: Click on the "Get Form" button above. It's going to open our tool so that you can start filling in your form.

Step 2: When you start the editor, you'll notice the form ready to be completed. Apart from filling out various blank fields, you can also perform some other actions with the PDF, namely adding custom textual content, changing the initial text, inserting illustrations or photos, placing your signature to the PDF, and more.

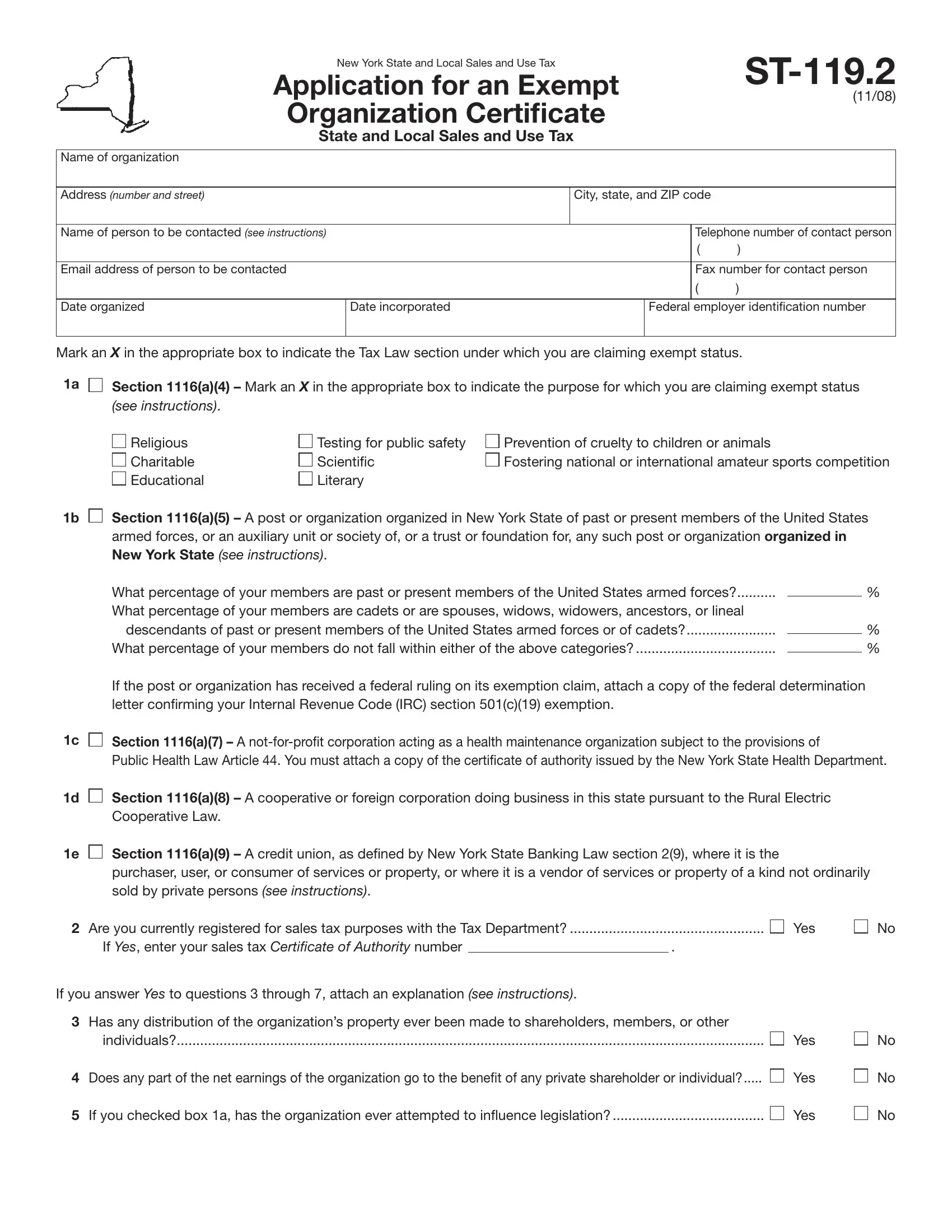

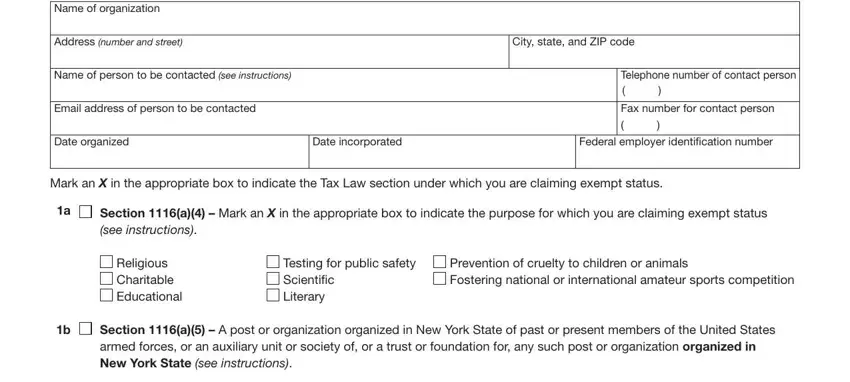

In an effort to fill out this PDF document, be certain to provide the necessary details in each and every blank:

1. To get started, when completing the st 119 tax form, begin with the section with the following blank fields:

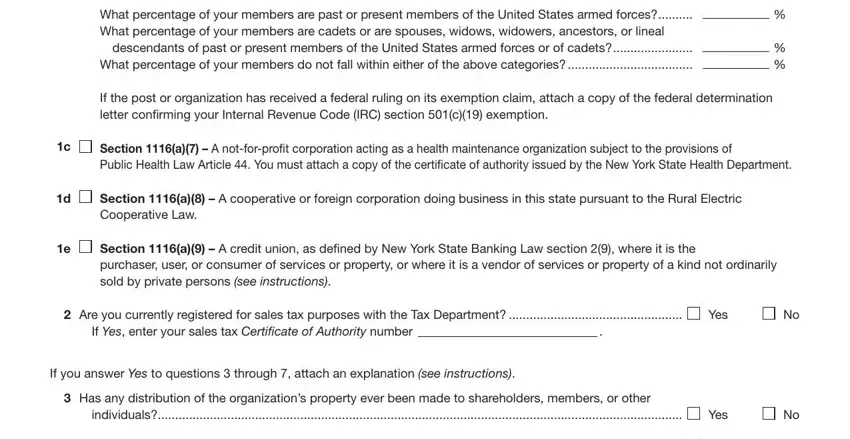

2. When the last section is finished, it is time to insert the necessary particulars in What percentage of your members, If the post or organization has, Section a A notforproit, Section a A cooperative or, Section a A credit union as, Are you currently registered for, If Yes enter your sales tax, Yes, If you answer Yes to questions, Has any distribution of the, individuals, and Yes so that you can proceed further.

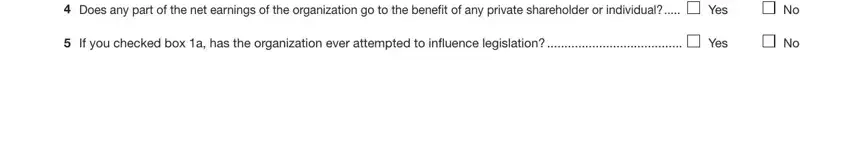

3. This next step is focused on Does any part of the net earnings, Yes, If you checked box a has the, and Yes - type in each of these blanks.

It's easy to make errors when filling out the Does any part of the net earnings, therefore ensure that you go through it again before you decide to send it in.

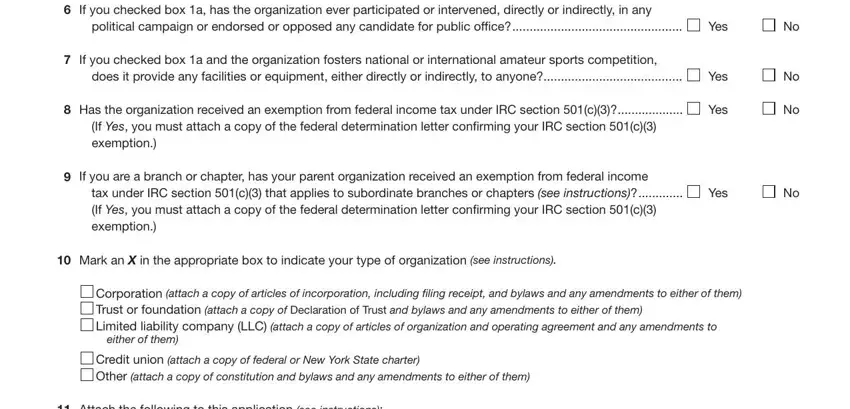

4. The following paragraph requires your information in the subsequent areas: If you checked box a has the, political campaign or endorsed or, If you checked box a and the, does it provide any facilities or, Has the organization received an, If Yes you must attach a copy of, exemption, If you are a branch or chapter, tax under IRC section c that, Yes, Yes, Yes, Yes, Mark an X in the appropriate box, and Corporation attach a copy of. Make certain you enter all of the requested info to move forward.

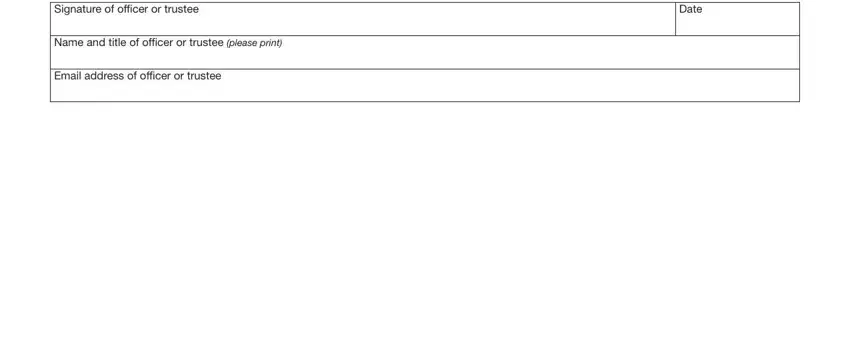

5. This very last point to submit this PDF form is integral. Ensure you fill out the necessary blank fields, particularly Signature of oficer or trustee, Date, Name and title of oficer or, and Email address of oficer or trustee, prior to using the document. Neglecting to do so can give you a flawed and potentially incorrect paper!

Step 3: When you've reviewed the information you given, just click "Done" to conclude your form. Try a 7-day free trial account with us and obtain direct access to st 119 tax form - download or edit inside your FormsPal account. FormsPal provides protected form tools devoid of personal information record-keeping or sharing. Feel at ease knowing that your information is secure with us!