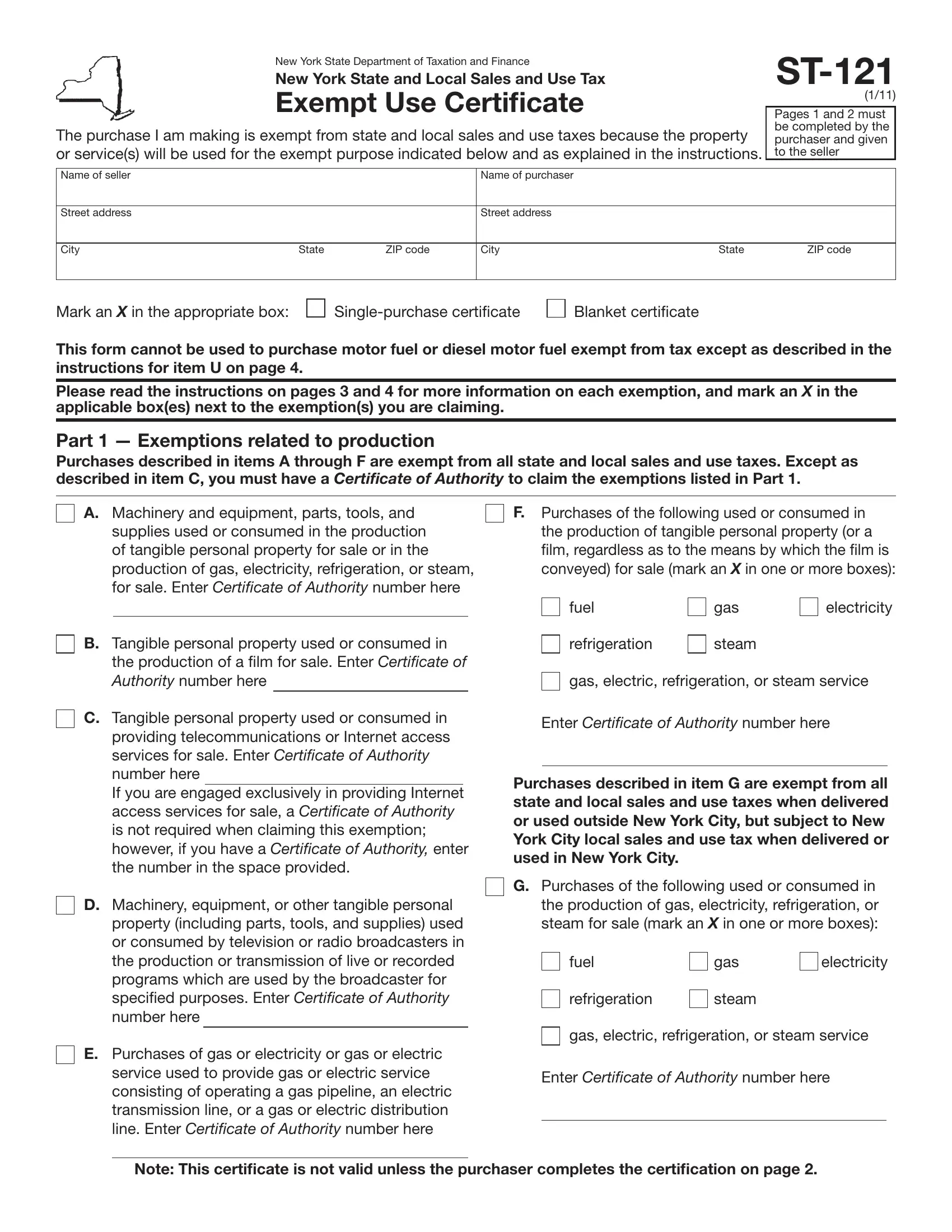

To the purchaser

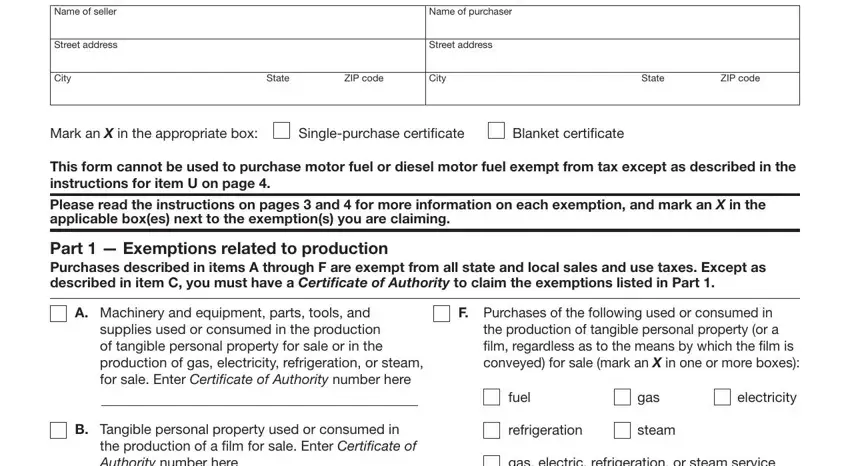

If you have a valid Certificate of Authority, you may use Form ST-121 to purchase, rent, or lease tangible personal property or services exempt from tax to the extent indicated in these instructions. Complete all required entries on the form and give it to the seller.

You may use Form ST-121 as a blanket certiicate covering the irst and subsequent purchases of the same general type of property or service. However, each subsequent sales slip or purchase invoice (excluding utility bills) based on this blanket certiicate must show your name, address, and Certificate of Authority identiication number.

If you make further purchases from the seller that do not qualify for the exemption, you must pay the appropriate sales tax at the time of purchase.

As used in this document, the term predominantly means that the property or service(s) is used more than 50% of the time directly for the purpose stated in the particular section. The term exclusively means that the property or service(s) is used 100% of the time directly for the purpose stated in the particular section. The term primarily means that the property or service(s) is used 50% or more of the time directly for the purpose stated in the particular section.

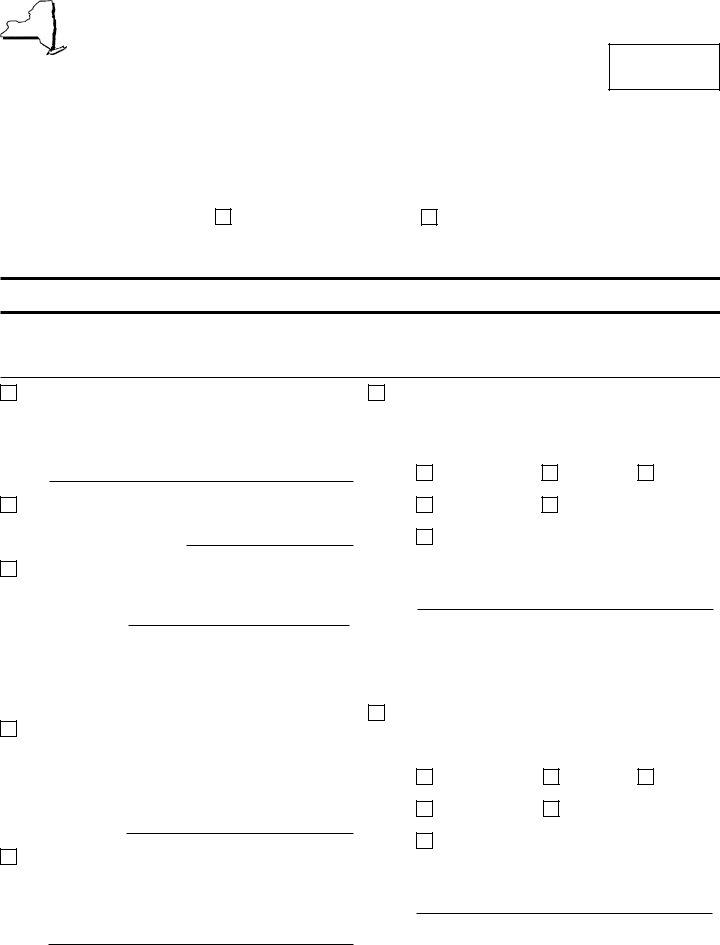

Part 1 — Exemptions related to production

Except as described in item C, you must have a Certificate of Authority to claim the exemptions listed in Part 1.

A — You may purchase, exempt from tax, machinery and equipment, including parts, tools, and supplies, used or consumed directly and predominantly in the production of tangible personal property, gas, electricity, refrigeration, or steam for sale by manufacturing, processing, generating, assembling, reining, mining, or extracting. For more information on these various production exemptions, see Publication 852, Sales Tax Information for: Manufacturers, Processors, Generators, Assemblers, Refiners, Miners and Extractors, and Other Producers of Goods and Merchandise.

B — You may purchase, exempt from tax, tangible personal property used directly and predominantly in the production (including editing, dubbing, and mixing) of a ilm for sale regardless of the medium by which the ilm is conveyed to the purchaser. (For purposes of this exemption, the term film means feature ilms, documentary ilms, shorts, television ilms, television commercials, and similar productions.)

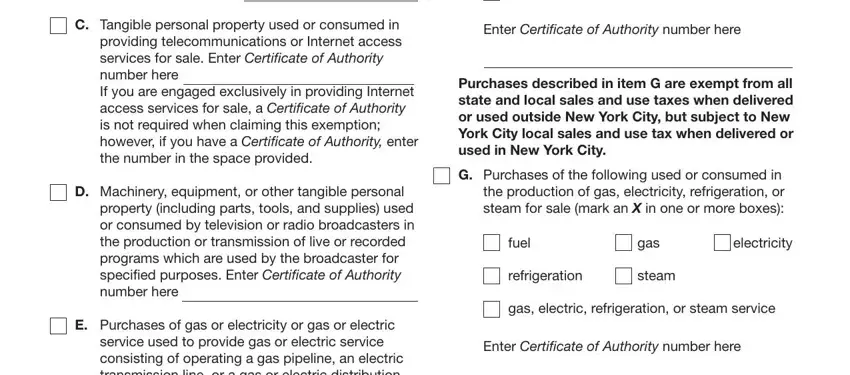

C — You may purchase, exempt from tax, tangible personal property used directly and predominantly in the receiving, initiating, amplifying, processing, transmitting, retransmitting, switching, or monitoring of switching of telecommunications services for sale, or Internet access services for sale, or any combination of the two services. If you are engaged exclusively in providing Internet access services for sale, a Certificate of Authority is not required when claiming this exemption; however, if you have a Certificate of Authority, enter the number in the space provided on page 1.

D — You may purchase, exempt from tax, machinery, equipment, or other tangible personal property (including parts, tools, and supplies) used or consumed by television or radio broadcasters directly

and predominantly in the production (including post-production) of live or recorded programs which are used or consumed by a broadcaster predominantly for the purpose of broadcast over the air by the broadcaster or for transmission through a cable television or direct-broadcast satellite system by the broadcaster. You may also purchase, exempt from tax, machinery, equipment, and other tangible personal property (including parts, tools, and supplies) used or consumed directly and predominantly in the transmission of live or recorded programs over the air or through a cable television or direct-broadcast satellite system by the broadcaster. Tangible personal property purchased by a broadcaster (lessor) for lease to another person (lessee) for that person’s use or consumption directly and predominantly in the production (including post production) of live or recorded programs by the person will be deemed to be used or consumed by the lessor broadcaster for purposes of determining whether the lessor broadcaster has met the direct and predominant use requirement of the exemption described in the above sentence. (For more information concerning this exemption, see TSB-M-00(6)S, Summary of the 2000 Sales and Compensating Use Tax Budget Legislation.)

E — You may purchase, exempt from tax, gas or electricity or gas or electric service used or consumed directly and exclusively to provide

gas or electric service of whatever nature consisting of operating a gas pipeline, a gas distribution line, or an electric transmission or distribution line or to ensure the necessary working pressure in an underground gas storage facility.

F —You may purchase, exempt from tax, fuel, gas, electricity, refrigeration, and steam and gas, electric, refrigeration, and steam service used or consumed directly and exclusively in the production of tangible personal property (or a ilm, regardless as to the means by which the ilm is conveyed) for sale, by manufacturing, processing, assembling, generating, reining, mining, or extracting. You must pay any state and local taxes due on any part of any fuel or utility service not used directly and exclusively for an exempt purpose. For example, electricity purchased solely to light a factory must be purchased tax paid, but electricity used for both an exempt purpose and a taxable purpose may be purchased exempt from tax. However, you must report the tax due on the electricity used for the taxable purpose on your sales and use tax return as a purchase subject to tax.

G —You may purchase, exempt from tax (except for the local tax imposed on sales and uses in New York City), fuel, gas, electricity, refrigeration, and steam and gas, electric, refrigeration, and steam service used or consumed directly and exclusively in the production of gas, electricity, refrigeration, and steam for sale by manufacturing, processing, assembling, generating, reining, mining, or extracting. You must pay any state and local taxes due on any part of any fuel or utility service not used directly and exclusively for an exempt purpose.

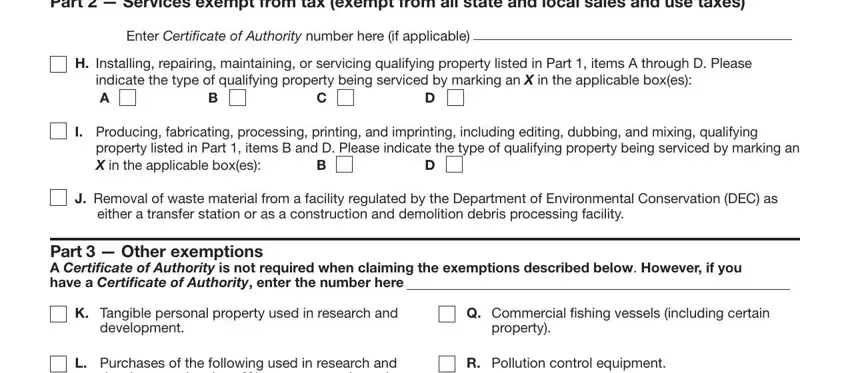

Part 2 — Services exempt from tax

H — You may purchase the services of installing, repairing, maintaining, and servicing qualifying property listed in Part 1, items A through D, exempt from tax.

I — You may purchase the services of producing, fabricating, processing, printing, and imprinting, including editing, dubbing, and mixing, qualifying property listed in Part 1, items B and D, exempt from tax.

J — If you are a facility regulated by the DEC as either a transfer station or construction and demolition debris processing facility, you may purchase the service of waste removal exempt from tax, provided that the waste is not generated by your facility. Under the DEC regulations, a transfer station is deined generally as a solid waste management facility other than a recyclables handling and recovery facility, used oil facility, or a construction and demolition debris processing facility, where solid waste is received for the purpose of subsequent transfer to another solid waste management facility for further processing, treating, transfer, or disposal. A construction and demolition debris processing facility

is a processing facility that receives and processes construction and demolition debris by any means.

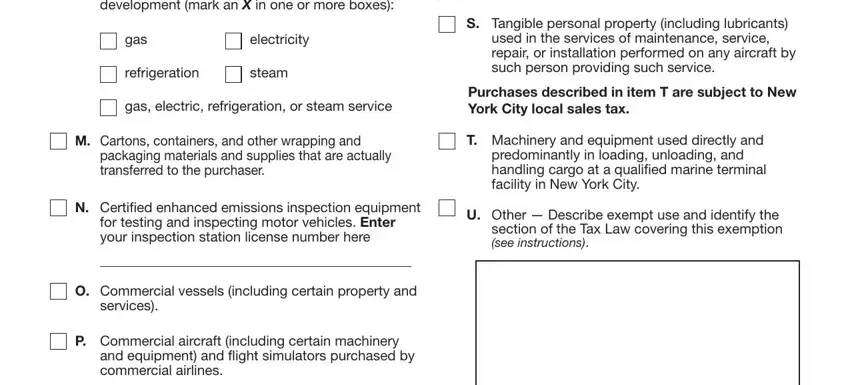

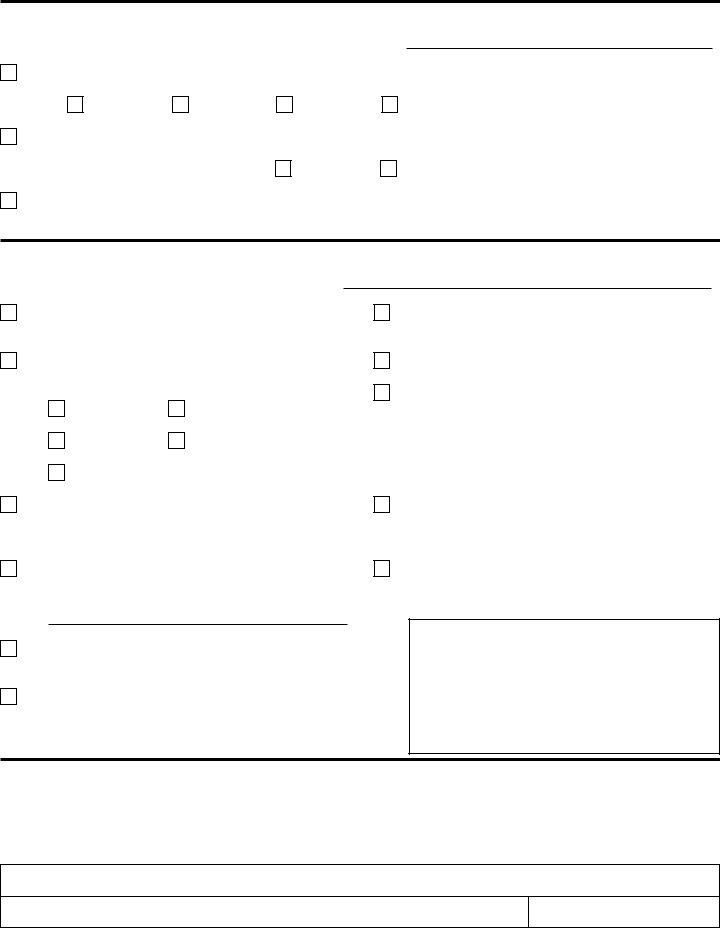

Part 3 — Other exemptions

A Certificate of Authority is not required when claiming the exemptions described in Part 3 on page 2. However, if you have a Certificate of Authority, enter the number in the space provided on page 2.

K — Tangible personal property used or consumed directly and predominantly in research and development in the experimental or laboratory sense is exempt from tax.

L — Gas, electricity, refrigeration, and steam, and gas, electric, refrigeration, and steam service used or consumed directly and exclusively in research and development in the experimental or laboratory sense may be purchased exempt from tax.

Research and development does not include the ordinary testing or inspection of materials or products for quality control, eficiency surveys, management studies, consumer surveys, advertising, promotions, or research in connection with literary, historical, or similar projects.

M—Vendors may purchase, exempt from tax, cartons, containers, and other wrapping and packaging materials and supplies and components thereof used to package tangible personal property for sale if the property is actually transferred by the vendor to the purchaser of the property.

N — Enhanced emissions inspection equipment certiied by the DEC for use in testing and inspecting motor vehicles as part of the enhanced emissions inspection and maintenance program required by the Federal Clean Air Act and the New York State Clean Air Compliance Act may be purchased without payment of tax. To qualify for the exemption, the equipment must be purchased and used by an oficial inspection station which is licensed by the Department of Motor Vehicles and authorized to conduct enhanced emissions inspections. (For more