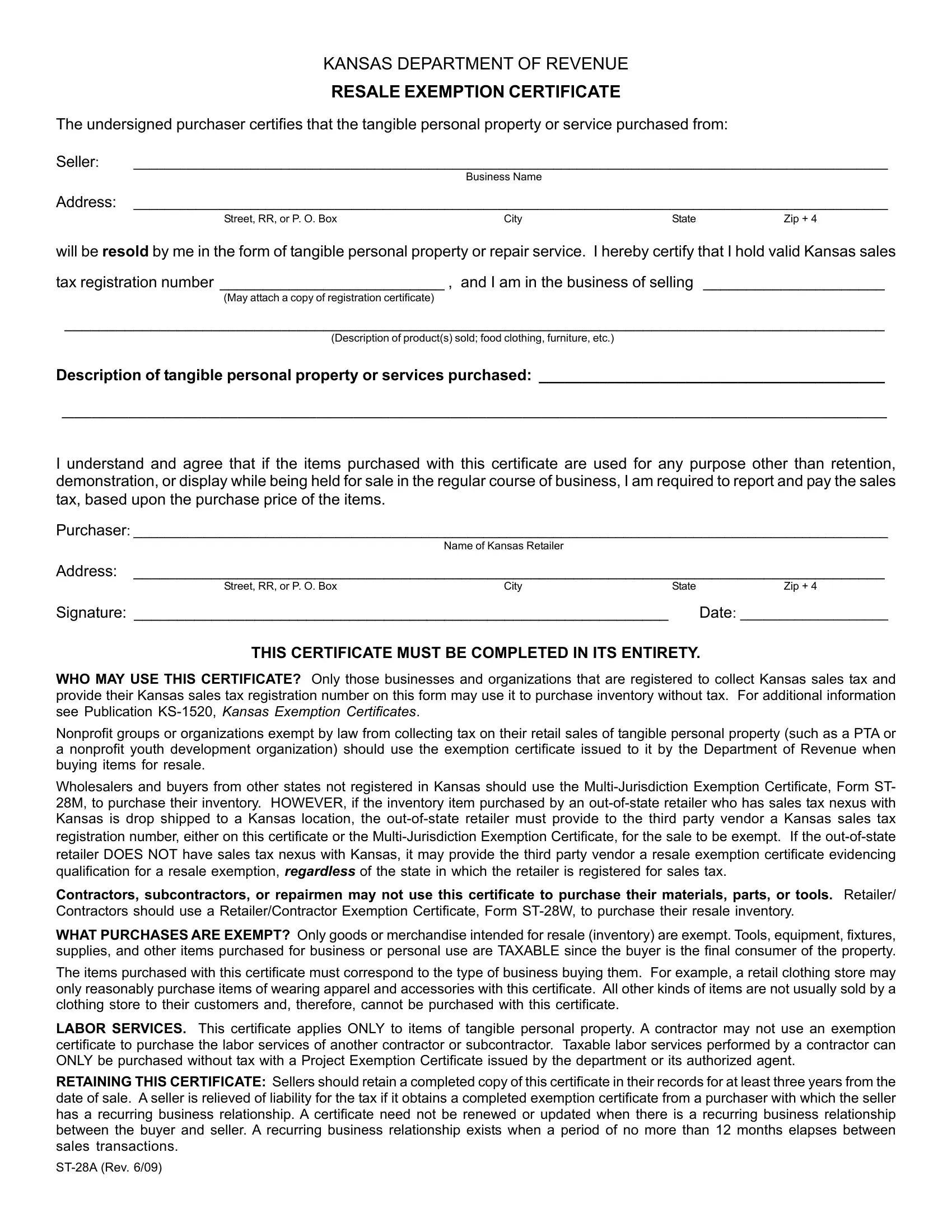

KANSAS DEPARTMENT OF REVENUE

RESALE EXEMPTION CERTIFICATE

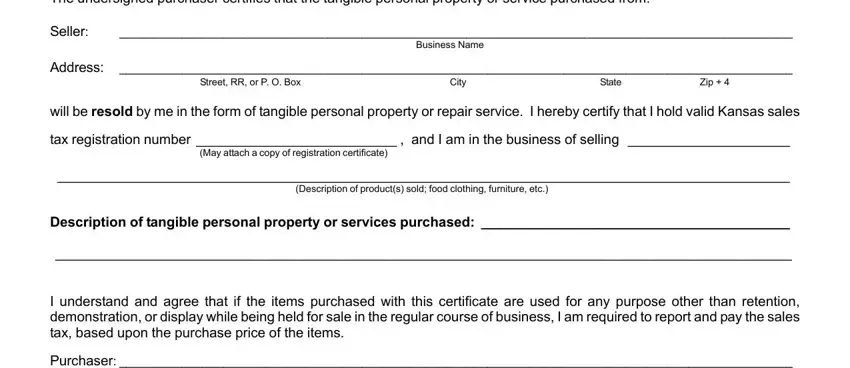

The undersigned purchaser certifies that the tangible personal property or service purchased from:

Seller: |

_________________________________________________________________________________________________ |

|

|

Business Name |

|

|

Address: |

_________________________________________________________________________________________________ |

|

Street, RR, or P. O. Box |

City |

State |

Zip + 4 |

will be resold by me in the form of tangible personal property or repair service. I hereby certify that I hold valid Kansas sales

tax registration number __________________________ , and I am in the business of selling _____________________

(May attach a copy of registration certificate)

_______________________________________________________________________________________________

(Description of product(s) sold; food clothing, furniture, etc.)

Description of tangible personal property or services purchased: ________________________________________

________________________________________________________________________________________________________________________________________

I understand and agree that if the items purchased with this certificate are used for any purpose other than retention, demonstration, or display while being held for sale in the regular course of business, I am required to report and pay the sales tax, based upon the purchase price of the items.

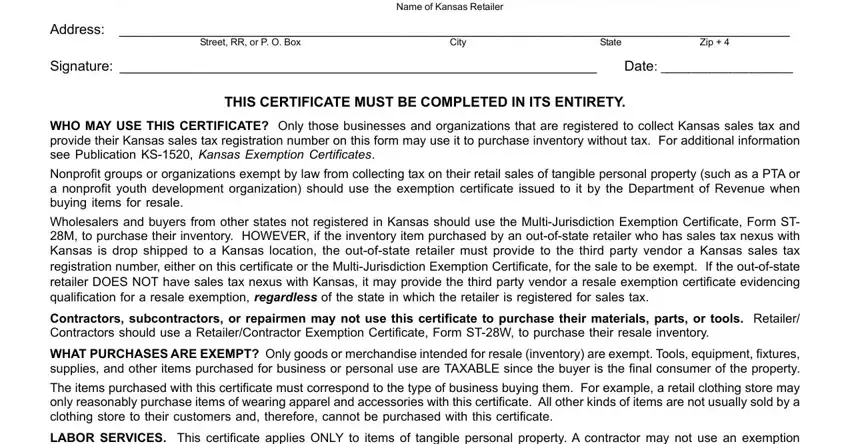

Purchaser: _________________________________________________________________________________________________

Name of Kansas Retailer

Address: _______________________________________________________________________________________

Street, RR, or P. O. Box |

City |

State |

Zip + 4 |

Signature: ______________________________________________________________ |

|

Date: ___________________ |

THIS CERTIFICATE MUST BE COMPLETED IN ITS ENTIRETY.

WHO MAY USE THIS CERTIFICATE? Only those businesses and organizations that are registered to collect Kansas sales tax and provide their Kansas sales tax registration number on this form may use it to purchase inventory without tax. For additional information see Publication KS-1520, Kansas Exemption Certificates.

Nonprofit groups or organizations exempt by law from collecting tax on their retail sales of tangible personal property (such as a PTA or a nonprofit youth development organization) should use the exemption certificate issued to it by the Department of Revenue when buying items for resale.

Wholesalers and buyers from other states not registered in Kansas should use the Multi-Jurisdiction Exemption Certificate, Form ST- 28M, to purchase their inventory. HOWEVER, if the inventory item purchased by an out-of-state retailer who has sales tax nexus with Kansas is drop shipped to a Kansas location, the out-of-state retailer must provide to the third party vendor a Kansas sales tax registration number, either on this certificate or the Multi-Jurisdiction Exemption Certificate, for the sale to be exempt. If the out-of-state retailer DOES NOT have sales tax nexus with Kansas, it may provide the third party vendor a resale exemption certificate evidencing qualification for a resale exemption, regardless of the state in which the retailer is registered for sales tax.

Contractors, subcontractors, or repairmen may not use this certificate to purchase their materials, parts, or tools. Retailer/ Contractors should use a Retailer/Contractor Exemption Certificate, Form ST-28W, to purchase their resale inventory.

WHAT PURCHASES ARE EXEMPT? Only goods or merchandise intended for resale (inventory) are exempt. Tools, equipment, fixtures, supplies, and other items purchased for business or personal use are TAXABLE since the buyer is the final consumer of the property.

The items purchased with this certificate must correspond to the type of business buying them. For example, a retail clothing store may only reasonably purchase items of wearing apparel and accessories with this certificate. All other kinds of items are not usually sold by a clothing store to their customers and, therefore, cannot be purchased with this certificate.

LABOR SERVICES. This certificate applies ONLY to items of tangible personal property. A contractor may not use an exemption certificate to purchase the labor services of another contractor or subcontractor. Taxable labor services performed by a contractor can ONLY be purchased without tax with a Project Exemption Certificate issued by the department or its authorized agent.

RETAINING THIS CERTIFICATE: Sellers should retain a completed copy of this certificate in their records for at least three years from the date of sale. A seller is relieved of liability for the tax if it obtains a completed exemption certificate from a purchaser with which the seller has a recurring business relationship. A certificate need not be renewed or updated when there is a recurring business relationship between the buyer and seller. A recurring business relationship exists when a period of no more than 12 months elapses between sales transactions.