Retailers’ Sales Tax (ST-36)

Tired of paper and postage?

Try our online business center – a secure, convenient, and simple way to manage all of your business tax accounts. Visit ksrevenue.org and sign into the KDOR Customer Service Center to get started.

GENERAL INFORMATION

•The due date is the 25th day of the month following the ending date of this return.

•Keep a copy of your return for your records.

•You must file a return even if there were no taxable sales.

•Write your Tax Account Number on your check or money order

and make payable to Retailers’ Sales Tax. Send your return and payment to: Kansas Department of Revenue, PO Box 3506 Topeka, KS 66601-3506.

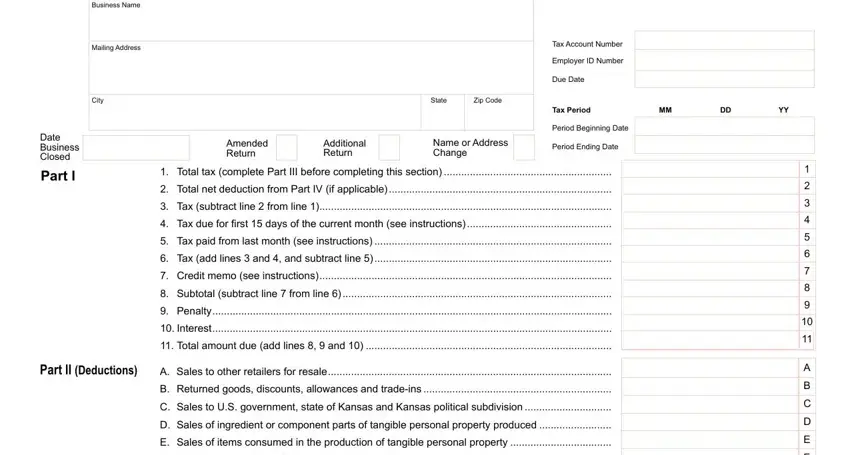

PART I

(complete Parts II, III and IV, as applicable, before completing Part I)

Line 1. Enter the total tax from Part III, line 10.

Line 2. Utility Retailers Only – enter the total net tax deduction from Part IV, line 7.

Line 3. Subtract line 2 from line 1 and enter result.

If your filing frequency is prepaid monthly, lines 4 and 5 must be completed. If your filing frequency is not prepaid monthly, skip

lines 4 and 5 and proceed to line 6.

Line 4. If your filing frequency is prepaid monthly, enter the amount of the estimated tax due for the current calendar month

of this return. A retailer whose total tax liability exceeds $40,000 in any calendar year is required to pay the sales tax liability for the first 15 days of each month or before the 25th day of that month. A retailer will be in compliance with this requirement if,

on or before the 25th day of the month, the retailer paid 90% of the liability of that 15 day period, or 50% of the tax liability for the same month of the previous year. Do not enter an amount

less than zero.

Line 5. If your filing frequency is prepaid monthly, enter the estimated amount from line 4 of last month’s return.

Line 6. Add lines 3 and 4, and subtract line 5. Enter result.

Line 7. Enter the amount from any credit memorandum issued by the Department of Revenue. If filing an amended return, enter the total amount previously paid for this filing period.

Line 8. Subtract line 7 from line 6 and enter result.

Line 9. If filing a late return, enter the amount of penalty due (see

ksrevenue.org for current rates).

Line 10. If filing a late return, enter the amount of interest due (see ksrevenue.org for current rates).

Line 11. Add lines 8, 9 and 10. Enter result on line 11.

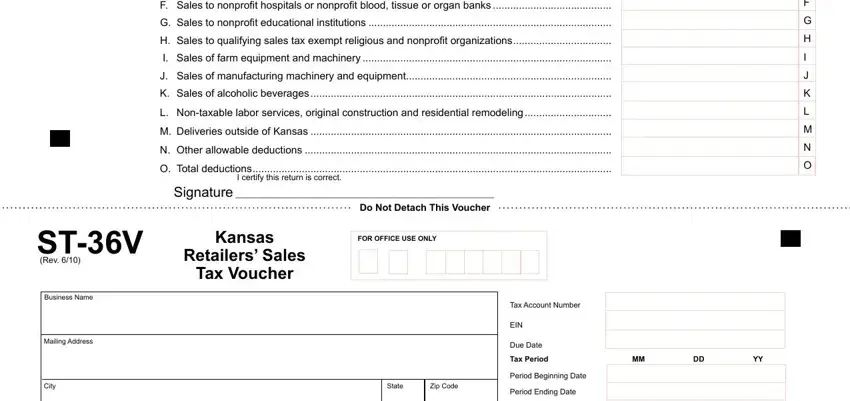

PART II (Deductions)

Complete lines A through N, if applicable, and enter the sum on line O. Other allowable deductions must be itemized. Use a separate schedule if necessary.

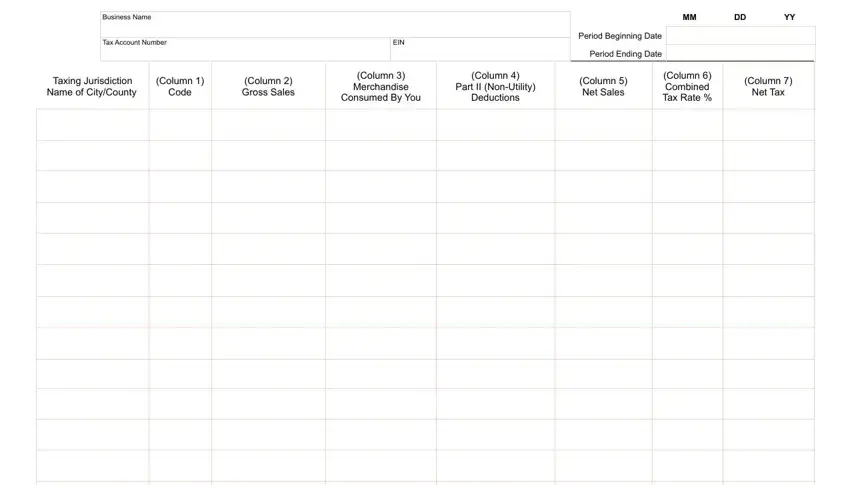

PART III (Location Breakdown)

If more space is needed, complete Part III Supplement Schedule.

Taxing Jurisdiction. If the tax jurisdiction is not complete or is incorrect, enter the name of the city, county and jurisdiction code in which tax is due.

Column 1. Enter the jurisdiction that coincides with the name of the city/county where the Kansas customer took delivery/

possession of the purchased item(s). (Refer to your Jurisdiction Code Booklet, Pub. KS-1700.)

Column 2. Enter the gross receipts or sales during the tax period,

both taxable and non-taxable. DO NOT include the sales taxes collected in this figure.

Column 3. Enter your cost of tangible personal property consumed or used by you that was purchased without tax.

Column 4. Enter allowable Non-Utility deductions. All deductions

in this column must also be itemized in Part II on the front of the return. (Column 4 total should equal Part II, line O.)

Column 5. Add columns 2 and 3, then subtract column 4. Enter result.

Column 6. Enter the appropriate tax rate (see Pub. KS-1700).

Column 7. Multiply amounts in column 5 by amounts in column 6 for each taxing jurisdiction. Enter result.

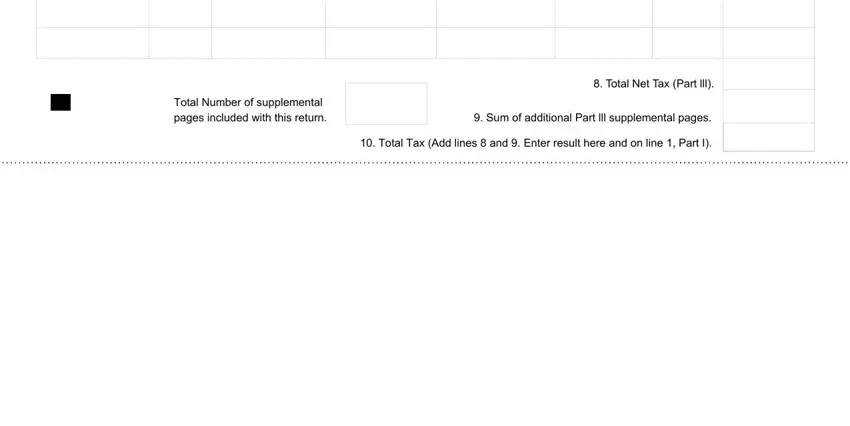

Line 8. Add the net tax due in column 7 and enter the result.

Line 9. Enter the sum of all Part II supplement pages. Enter the total number of supplemental pages included with this return. Count front and back as separate pages.

Line 10. Add lines 8 and 9. Enter total on line 10 and on line 1 of Part I.

PART IV (Utility Providers Only)

Part IV is to be completed by retailers in the business of selling natural gas, electricity, or heat (propane gas, LP-Gas, coal, wood)

to residential or agricultural customers.

Propane sales for agricultural use should be entered in Part III because it is exempt from both state and local sales tax. Water sales, delivered through mains, lines or pipes, for residential or

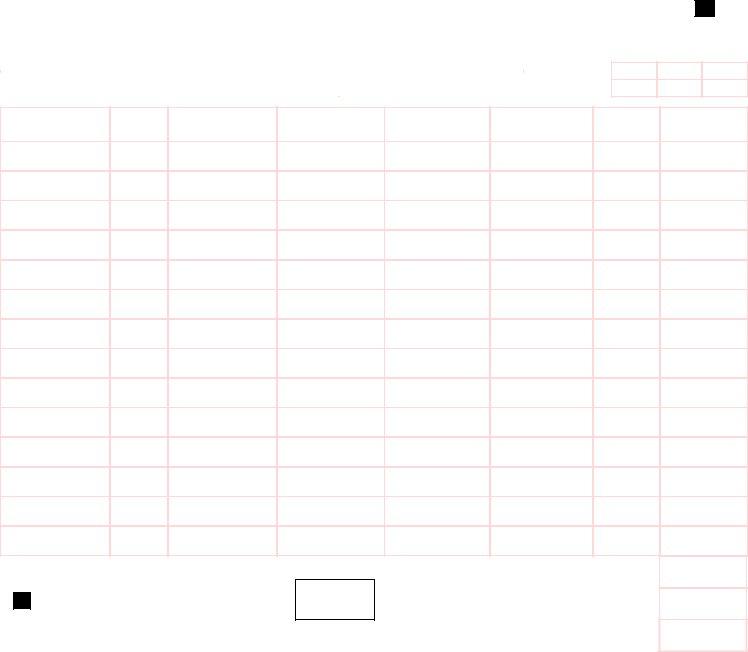

401103

State Zip Code

Kansas

Retailers' Sales

Tax Voucher

Period Beginning Date

AmendedAdditionalName orPeriod Ending Date

ReturnReturnAddress Change

1. Total Tax (Complete Part III before completing this section) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Total Net Deduction from Part IV (if applicable) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Tax (Subtract line 2 from line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ..

4. Estimated Tax Due for Next Month (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Estimated Tax Paid from Last Month (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Tax (Add lines 3 and 4, and subtract line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. Credit Memo (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. Subtotal (Subtract line 7 from line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9. Penalty . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10. Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11. Total Amount Due (Add lines 8, 9 and 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

A. Sales to other retailers for resale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

B. Returned goods, discounts, allowances and trade-ins . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

C. Sales to U.S. government, State of Kansas, & Kansas political subdivision . . . . . . . . . . . . . . . . . .

D. Sales of ingredient or component parts of tangible personal property produced . . . . . . . . . . . . . . .

E. Sales of items consumed in the production of tangible personal property . . . . . . . . . . . . . . . . . . . .

F. Sales to nonprofit hospitals or nonprofit blood banks, tissue or organ bank. . . . . . . . . . . . . . . . . . .

G. Sales to nonprofit education institutions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

H. Sales to qualifying sales tax exempt religious and nonprofit organizations . . . . . . . . . . . . . . . . . . .

I. Sales of farm equipment and machinery . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

J. Sales of manufacturing machinery and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

K. Sales of alcoholic beverages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

L. Non-taxable labor services, original construction and residential remodeling . . . . . . . . . . . . . . . . .

M. Deliveries outside of Kansas. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

N. Other allowable deductions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

O. Total deductions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I certify this return is correct.

Signature __________________________________

FOR OFFICE USE ONLY

State Zip Code

Kansas

Retailers' Sales

Tax Return

Do Not Detach This Voucher

FOR OFFICE USE ONLY

ST-36

(Rev. 5/08)

Business Name

Mailing Address

City

Date

Business

Closed

Part I

Part II Deductions

ST-36V

(Rev. 5/08)

Business Name

Mailing Address

454003

Tax Account Number

EIN

Due Date

1

2

3

4

5

6

7

8

9

10

11

A

B

C

D

E

F

G

H

I

J

K

L

M

N

O

Tax Account Number

EIN

Due Date

City

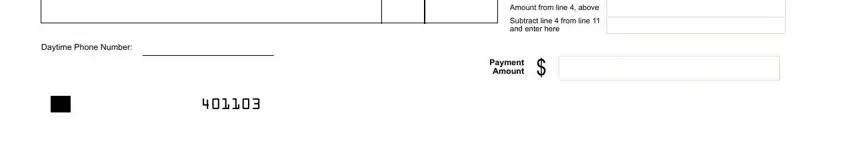

Daytime Phone Number:

Period Beginning Date

Period Ending Date

Amount from line 4, above

Subtract line 4 from line 11 and enter here

Payment $

Amount

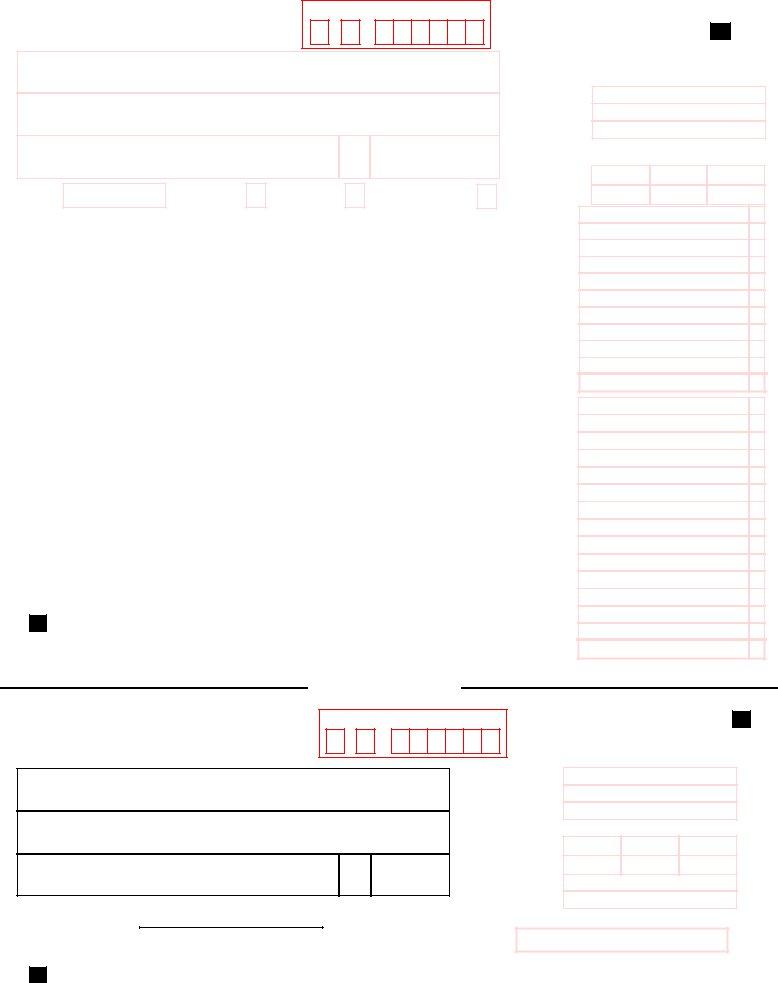

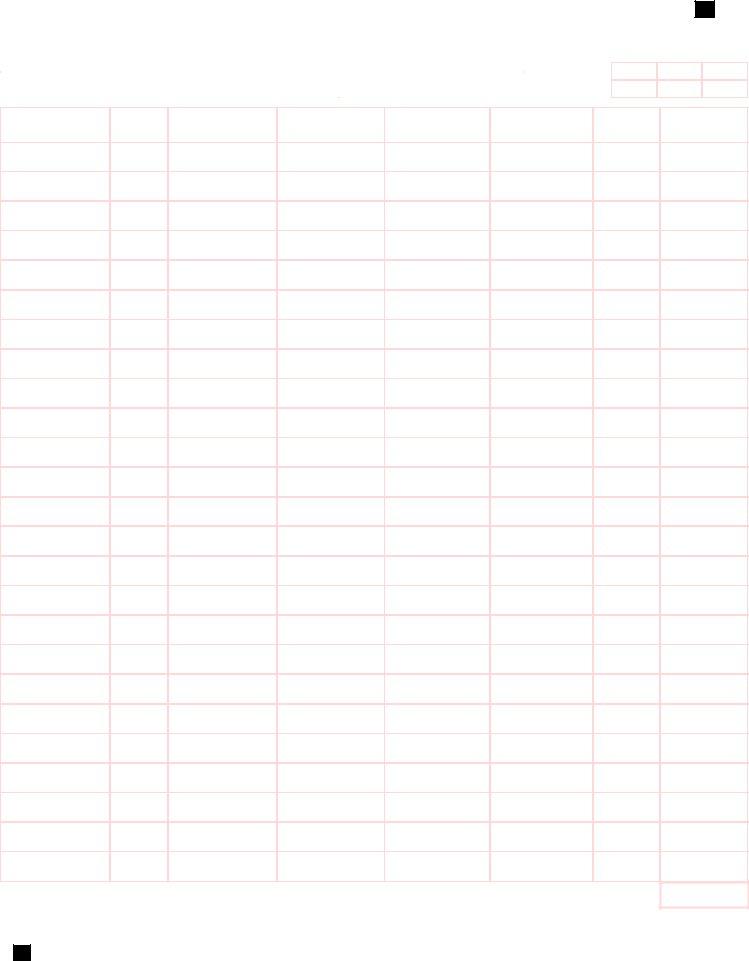

ST-36 |

Part lll |

Kansas Retailers' Sales |

(Rev. 7/03) |

Supplement |

|

Tax Return |

|

|

|

|

Business Name |

|

|

|

|

|

|

|

Tax Account Number |

|

|

EIN |

|

|

|

|

454203

MMDDYY

Period Beginning Date

Period Ending Date

Taxing Jurisdiction Name of City / County

(Column 3) Merchandise Consumed By You

(Column 4)

Part II (Non-Utility)

Deductions

(Column 6) Combined Tax Rate %

8. Total Net Tax (Add totals in column 7. Enter result here and on line 9, Part III).

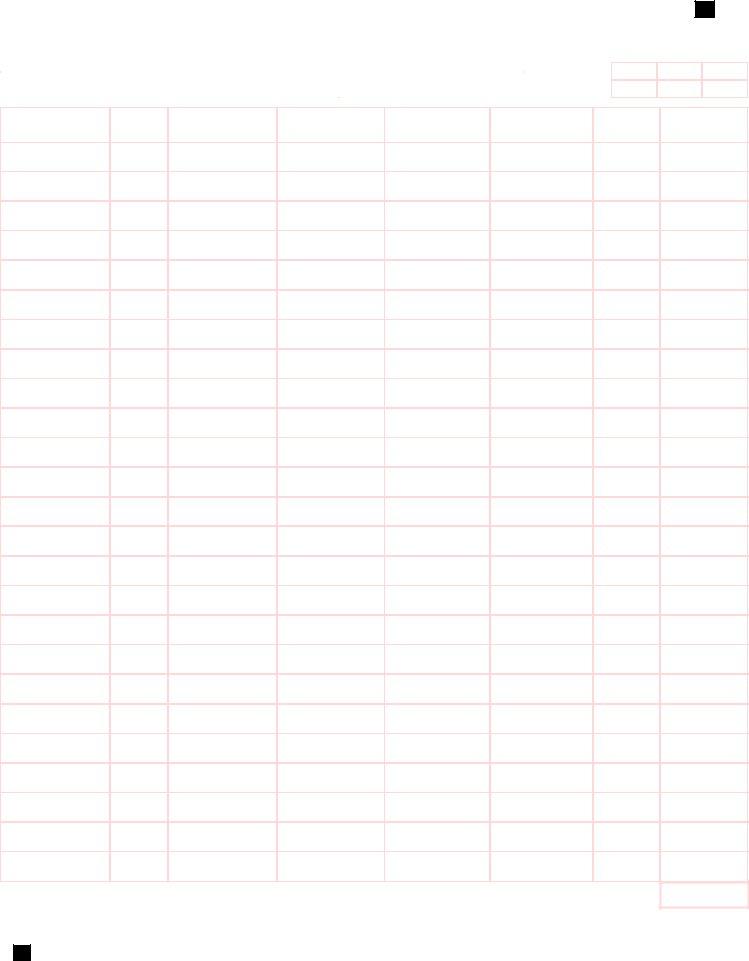

ST-36 |

Part lll |

Kansas Retailers' Sales |

(Rev. 7/03) |

Supplement |

|

Tax Return |

|

|

|

|

Business Name |

|

|

|

|

|

|

|

Tax Account Number |

|

|

EIN |

|

|

|

|

454203

MMDDYY

Period Beginning Date

Period Ending Date

Taxing Jurisdiction Name of City / County

(Column 3) Merchandise Consumed By You

(Column 4)

Part II (Non-Utility)

Deductions

(Column 6) Combined Tax Rate %

8. Total Net Tax (Add totals in column 7. Enter result here and on line 9, Part III).