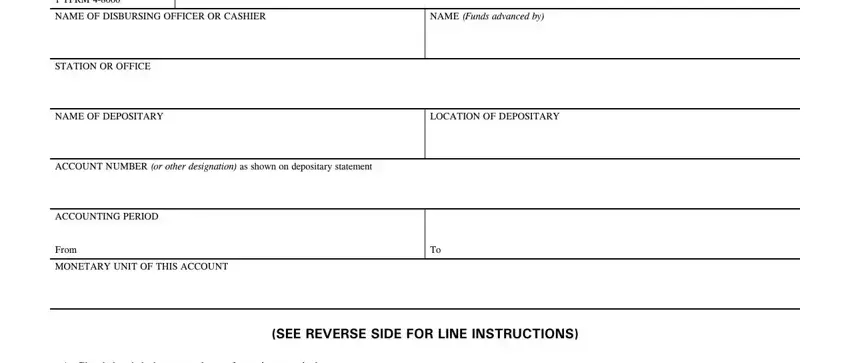

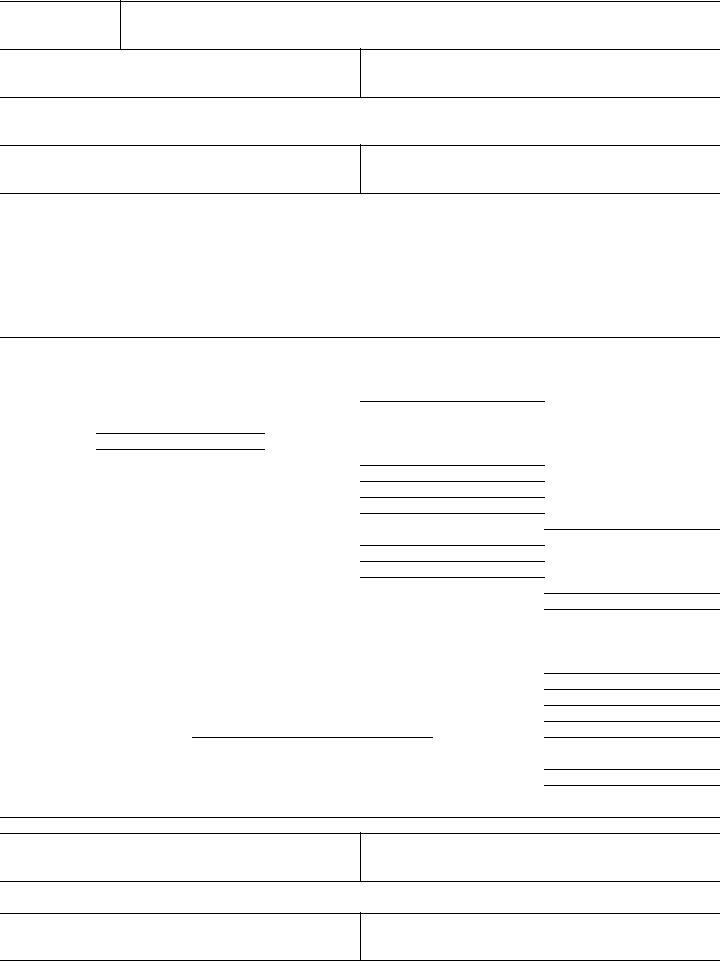

STANDARD FORM 1149

Revised March 1982

Dept. of the Treasury

1 TFRM 4-8000

STATEMENT OF DESIGNATED DEPOSITARY ACCOUNT

NAME OF DISBURSING OFFICER OR CASHIER

ACCOUNT NUMBER (or other designation) as shown on depositary statement

ACCOUNTING PERIOD |

|

From |

To |

|

|

MONETARY UNIT OF THIS ACCOUNT |

|

(SEE REVERSE SIDE FOR LINE INSTRUCTIONS)

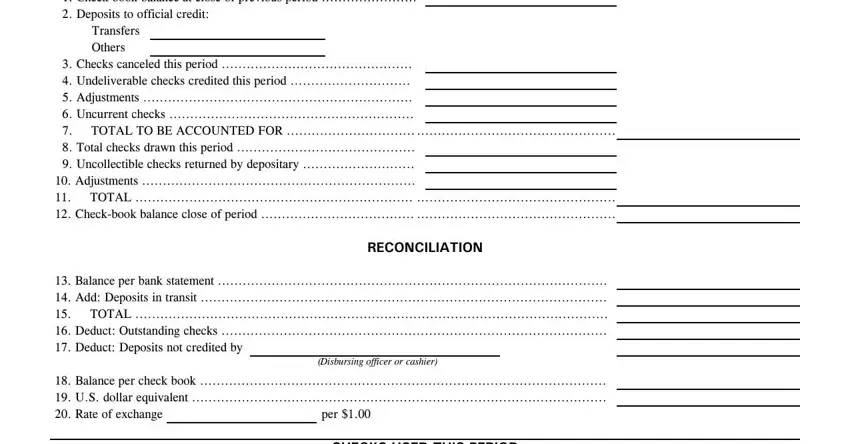

1. Check-book balance at close of previous period .......................

2. Deposits to official credit: Transfers

Others

3. Checks canceled this period ..............................................

4. Undeliverable checks credited this period .............................

5. Adjustments .................................................................

6. Uncurrent checks ...........................................................

7. TOTAL TO BE ACCOUNTED FOR ............................... ................................................

8. Total checks drawn this period ...........................................

9. Uncollectible checks returned by depositary ...........................

10. Adjustments ..................................................................

11. TOTAL ................................................................... ................................................

12. Check-book balance close of period ..................................... ................................................

RECONCILIATION

13.Balance per bank statement ..............................................................................................

14.Add: Deposits in transit ..................................................................................................

15.TOTAL ..................................................................................................................

16.Deduct: Outstanding checks .............................................................................................

17.Deduct: Deposits not credited by

(Disbursing officer or cashier)

18.Balance per check book

19.U.S. dollar equivalent ......................................................................................................................................................................................................

20. Rate of exchange |

|

per $1.00 |

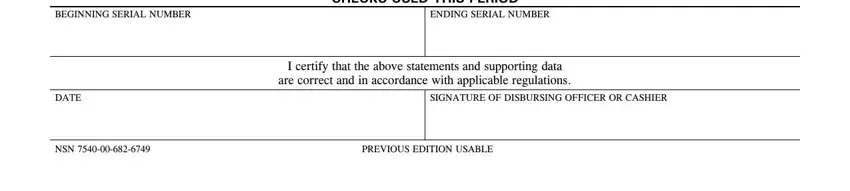

CHECKS USED THIS PERIOD

I certify that the above statements and supporting data are correct and in accordance with applicable regulations.

SIGNATURE OF DISBURSING OFFICER OR CASHIER

NSN 7540-00-682-6749 |

PREVIOUS EDITION USABLE |

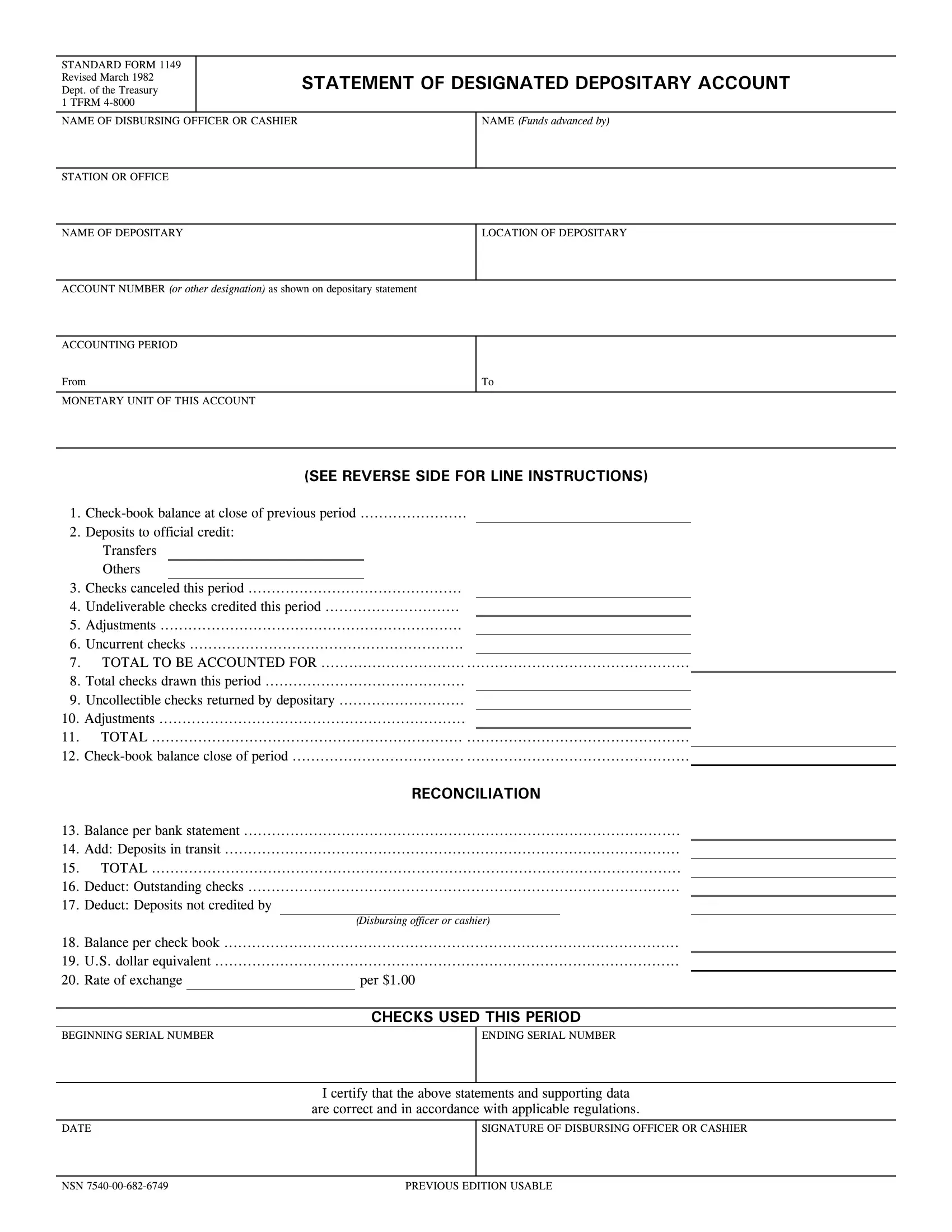

STANDARD FORM 1149 (REV. 3-82) BACK

LINE INSTRUCTIONS

1.Report the balance in checking account carried forward from previous statement.

2.Enter the totals of all deposits, segregating transfers, made to the checking account during the month and submit a list showing date and amount of each deposit.

3.Show the total of all checks canceled during the report period, to be supported by corresponding Schedules of Canceled Checks, Standard Form 1098, and Unavailable Check Cancellation, Standard Form 1184.

4.Show on this line the total of credits to the checking account for undeliverable checks which have been credited to appropriation or fund accounts as supported by Standard Form 1185 schedules.

5.Report the total of all adjustments increasing the accountability during the report period. A detailed explanation should support each adjustment.

6.Add the total of all checks that became uncurrent at the close of the fiscal year. A complete detailed listing of each uncurrent check should support the entry on this line.

7.Show the total of lines 1 through 6, reflecting total accountability for the report period.

8.The grand total of all checks drawn for the period will be shown here. A complete detailed list or check carbon copies should be submitted.

9.The total of uncollectible checks returned by the depositary during the report period will be shown here with supporting schedule showing the date and amount of the original certificate of deposit or deposit slip.

10.Enter the total of all no-check adjustments processed during the period which reduces the accountability, and submit a supporting detailed explanation of each adjustment.

11.Show the total of lines 8 through 10. This amount represents the total decrease in the checking account accountability for the report period.

12.The figure shown here will be the difference between the totals on lines 7 and 11.

13.Show on this line the balance of funds in the checking account as shown on the bank statement. Support with bank statement.

14.Show the total of all deposits in transit to the checking account, the amounts of which have been included in

line 2. A detailed list showing the amount and date of each deposit must support this line amount.

15.Show here a total of lines 13 and 14.

16.Report here the total of outstanding checks in the account. Support this figure with a detailed listing of each check.

17.Report here the total of deposits credited by the bank but not credited in the checking account. A detailed list showing the amount and date of each deposit must support this line.

18.The amount on this line should be the same as the total shown on line 12. If not, explain in detail.

19.The amount shown on this line will be the U.S. dollar equivalent of the monetary units shown on line 12 and as reported on the Statement of Accountability.

20.Show here the rate of exchange used in the conversion shown on line 19.