The PDF editor that you can go with was designed by our leading computer programmers. You may submit the usaa blank check file instantly and efficiently with our software. Merely keep up with the procedure to get going.

Step 1: Select the "Get Form Now" button to start out.

Step 2: You're now on the document editing page. You may edit, add content, highlight specific words or phrases, place crosses or checks, and insert images.

The PDF template you decide to fill out will contain the next segments:

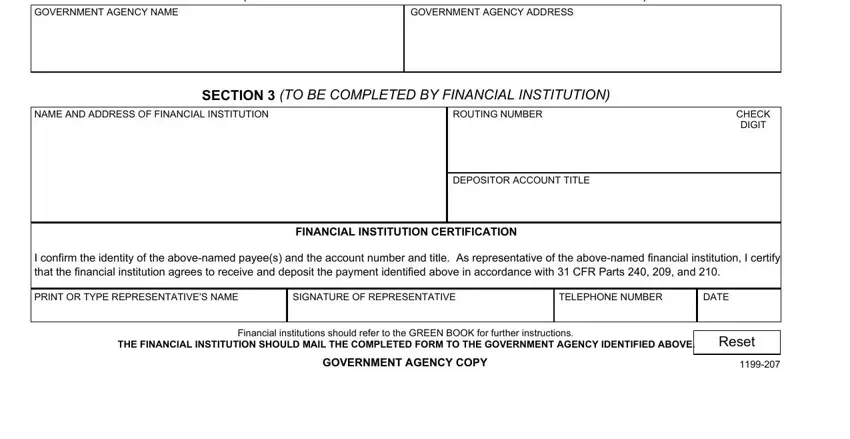

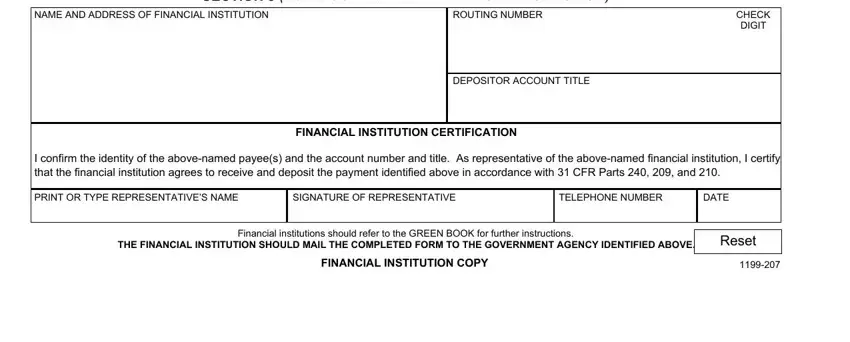

You should enter the particulars within the box GOVERNMENT AGENCY NAME, GOVERNMENT AGENCY ADDRESS, SECTION TO BE COMPLETED BY PAYEE, NAME AND ADDRESS OF FINANCIAL, ROUTING NUMBER, SECTION TO BE COMPLETED BY, CHECK DIGIT, DEPOSITOR ACCOUNT TITLE, FINANCIAL INSTITUTION CERTIFICATION, I confirm the identity of the, PRINT OR TYPE REPRESENTATIVES NAME, SIGNATURE OF REPRESENTATIVE, TELEPHONE NUMBER, DATE, and Financial institutions should.

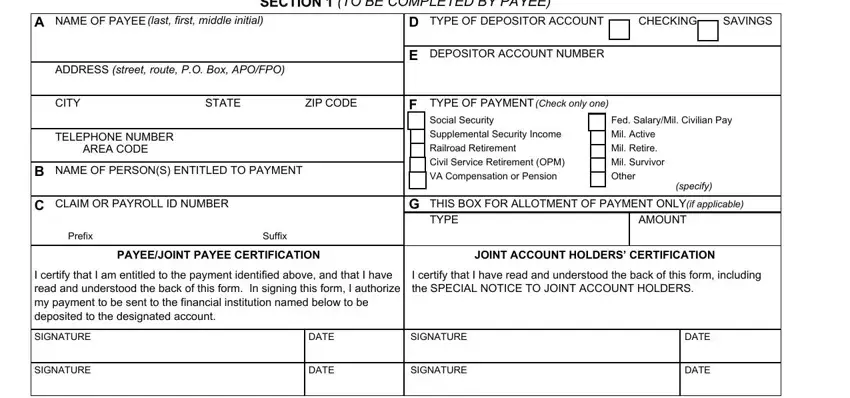

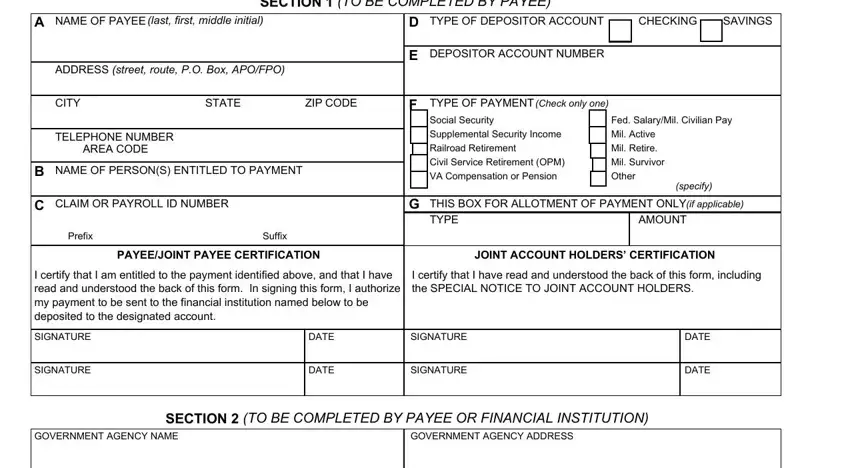

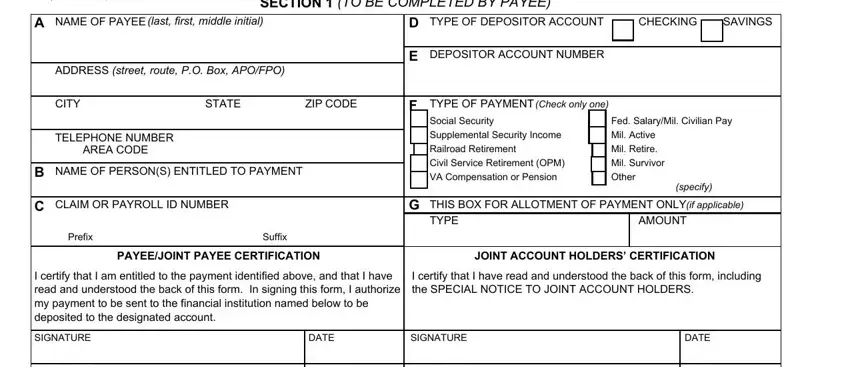

It's essential to point out the relevant details within the A separate form must be completed, SECTION TO BE COMPLETED BY PAYEE, NAME OF PAYEE last first middle, ADDRESS street route PO Box APOFPO, CITY, STATE, ZIP CODE, TELEPHONE NUMBER AREA CODE, NAME OF PERSONS ENTITLED TO PAYMENT, CLAIM OR PAYROLL ID NUMBER, Prefix, Suffix, TYPE OF DEPOSITOR ACCOUNT, CHECKING, and SAVINGS area.

The NAME AND ADDRESS OF FINANCIAL, ROUTING NUMBER, SECTION TO BE COMPLETED BY, CHECK DIGIT, DEPOSITOR ACCOUNT TITLE, FINANCIAL INSTITUTION CERTIFICATION, I confirm the identity of the, PRINT OR TYPE REPRESENTATIVES NAME, SIGNATURE OF REPRESENTATIVE, TELEPHONE NUMBER, DATE, Financial institutions should, and FINANCIAL INSTITUTION COPY section is the place to include the rights and obligations of each side.

Complete the template by reviewing the following areas: A separate form must be completed, SECTION TO BE COMPLETED BY PAYEE, NAME OF PAYEE last first middle, ADDRESS street route PO Box APOFPO, CITY, STATE, ZIP CODE, TELEPHONE NUMBER AREA CODE, NAME OF PERSONS ENTITLED TO PAYMENT, CLAIM OR PAYROLL ID NUMBER, Prefix, Suffix, TYPE OF DEPOSITOR ACCOUNT, CHECKING, and SAVINGS.

Step 3: Click "Done". You can now export your PDF form.

Step 4: To protect yourself from all of the issues in the long run, you will need to make around several duplicates of your form.

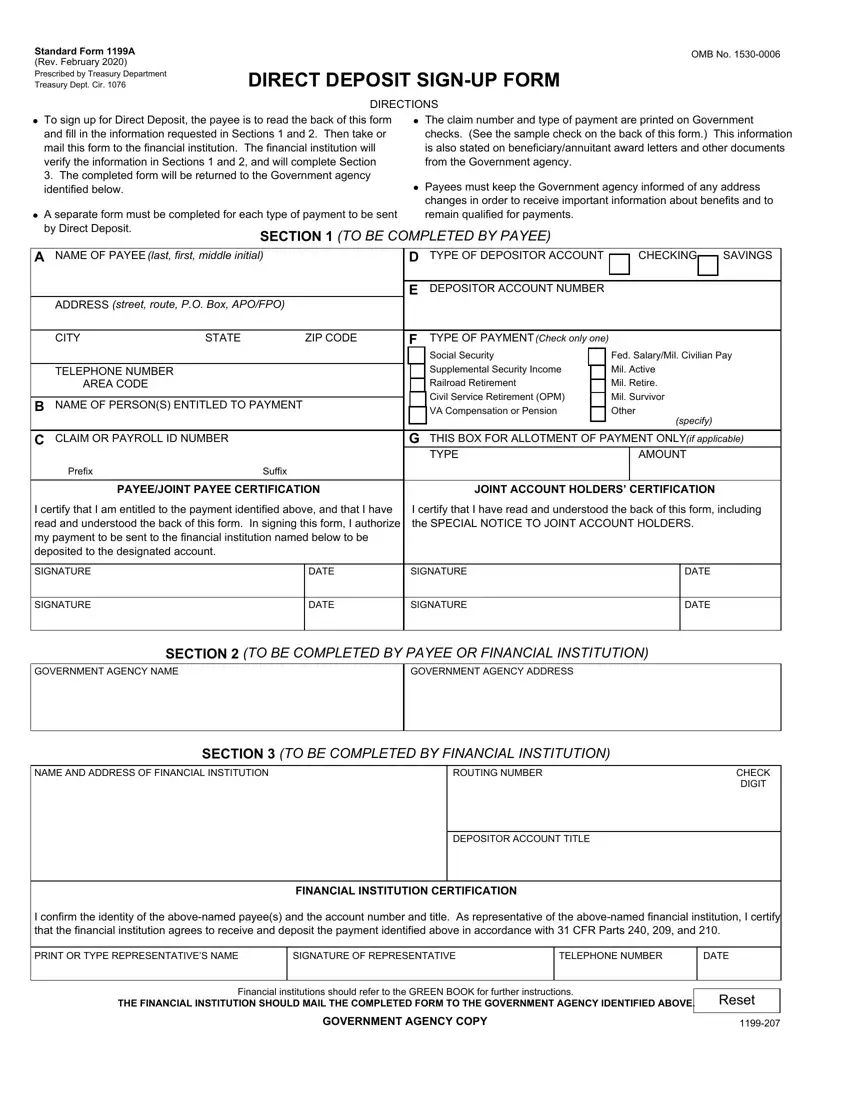

To sign up for Direct Deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2. Then take or mail this form to the financial institution. The financial institution will verify the information in Sections 1 and 2, and will complete Section

To sign up for Direct Deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2. Then take or mail this form to the financial institution. The financial institution will verify the information in Sections 1 and 2, and will complete Section A separate form must be completed for each type of payment to be sent by Direct Deposit.

A separate form must be completed for each type of payment to be sent by Direct Deposit. The claim number and type of payment are printed on Government checks. (See the sample check on the back of this form.) This information is also stated on beneficiary/annuitant award letters and other documents from the Government agency.

The claim number and type of payment are printed on Government checks. (See the sample check on the back of this form.) This information is also stated on beneficiary/annuitant award letters and other documents from the Government agency. Payees must keep the Government agency informed of any address changes in order to receive important information about benefits and to remain qualified for payments.

Payees must keep the Government agency informed of any address changes in order to receive important information about benefits and to remain qualified for payments.

To sign up for Direct Deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2. Then take or mail this form to the financial institution. The financial institution will verify the information in Sections 1 and 2, and will complete Section

To sign up for Direct Deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2. Then take or mail this form to the financial institution. The financial institution will verify the information in Sections 1 and 2, and will complete Section A separate form must be completed for each type of payment to be sent by Direct Deposit.

A separate form must be completed for each type of payment to be sent by Direct Deposit. The claim number and type of payment are printed on Government checks. (See the sample check on the back of this form.) This information is also stated on beneficiary/annuitant award letters and other documents from the Government agency.

The claim number and type of payment are printed on Government checks. (See the sample check on the back of this form.) This information is also stated on beneficiary/annuitant award letters and other documents from the Government agency. Payees must keep the Government agency informed of any address changes in order to receive important information about benefits and to remain qualified for payments.

Payees must keep the Government agency informed of any address changes in order to receive important information about benefits and to remain qualified for payments.

To sign up for Direct Deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2. Then take or mail this form to the financial institution. The financial institution will verify the information in Sections 1 and 2, and will complete Section

To sign up for Direct Deposit, the payee is to read the back of this form and fill in the information requested in Sections 1 and 2. Then take or mail this form to the financial institution. The financial institution will verify the information in Sections 1 and 2, and will complete Section A separate form must be completed for each type of payment to be sent by Direct Deposit.

A separate form must be completed for each type of payment to be sent by Direct Deposit. The claim number and type of payment are printed on Government checks. (See the sample check on the back of this form.) This information is also stated on beneficiary/annuitant award letters and other documents from the Government agency.

The claim number and type of payment are printed on Government checks. (See the sample check on the back of this form.) This information is also stated on beneficiary/annuitant award letters and other documents from the Government agency. Payees must keep the Government agency informed of any address changes in order to receive important information about benefits and to remain qualified for payments.

Payees must keep the Government agency informed of any address changes in order to receive important information about benefits and to remain qualified for payments.