You may prepare csrs standard form 2801 instantly by using our online PDF tool. FormsPal development team is continuously working to enhance the tool and help it become much faster for people with its many features. Take advantage of present-day innovative possibilities, and discover a myriad of new experiences! To begin your journey, consider these easy steps:

Step 1: Press the orange "Get Form" button above. It's going to open up our pdf tool so that you could begin filling out your form.

Step 2: The editor will give you the capability to modify almost all PDF forms in a variety of ways. Modify it by writing your own text, correct existing content, and include a signature - all at your convenience!

It is simple to finish the document with this helpful guide! Here's what you have to do:

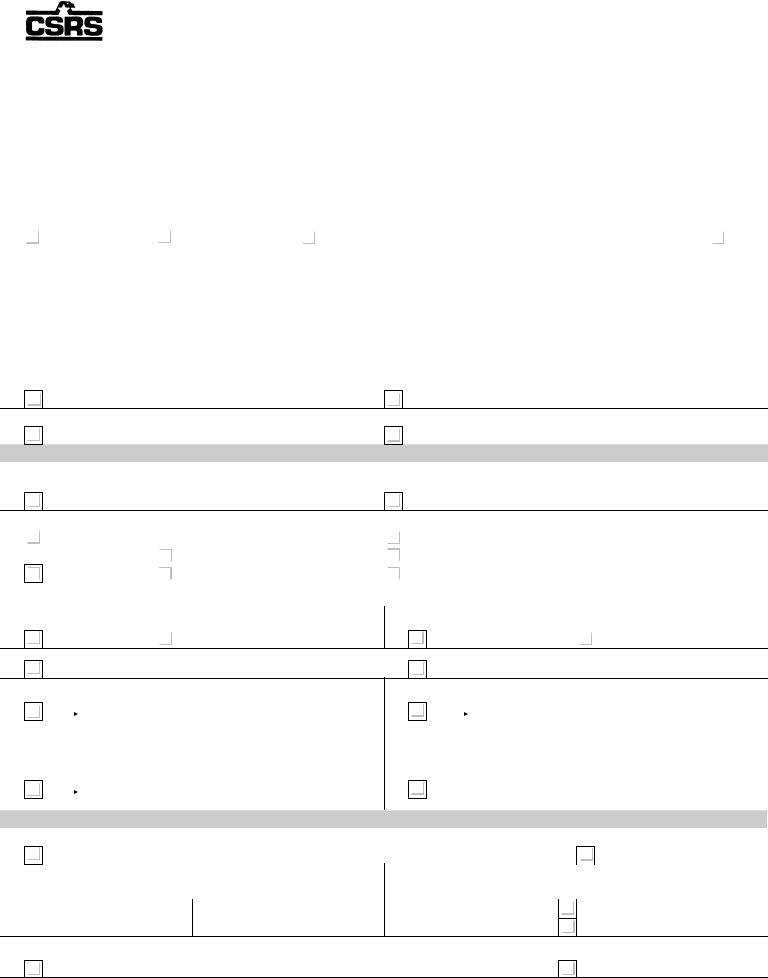

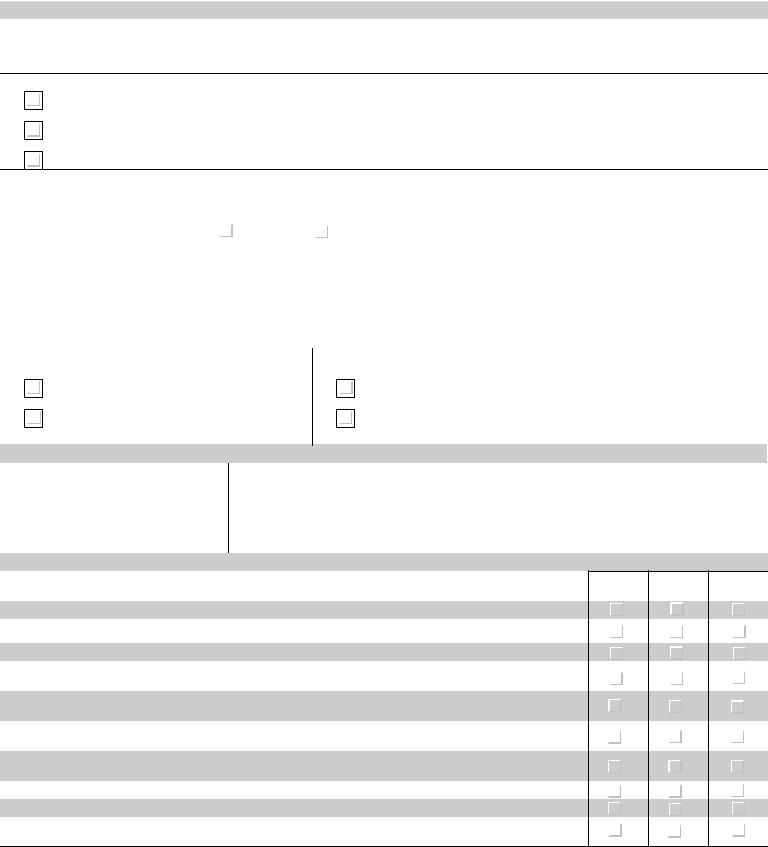

1. When completing the csrs standard form 2801, ensure to complete all of the important fields in their corresponding area. It will help to facilitate the process, which allows your information to be handled promptly and properly.

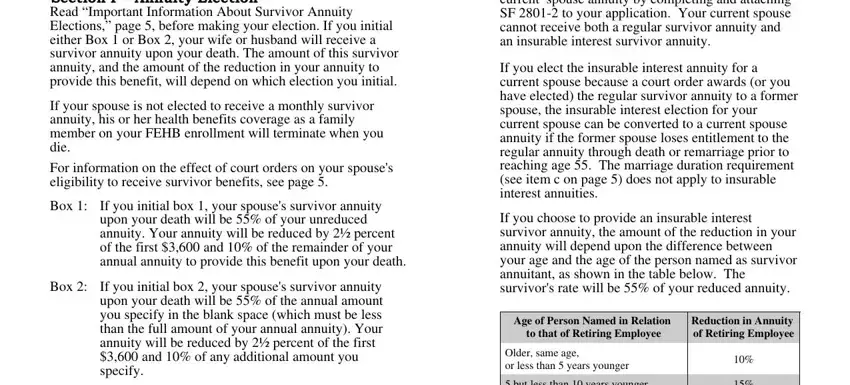

2. After the previous array of fields is complete, you need to include the required details in Section F Annuity Election Read, If your spouse is not elected to, For information on the effect of, upon your death will be of your, Box If you initial box your, current spouse annuity by, If you elect the insurable, If you choose to provide an, Age of Person Named in Relation, to that of Retiring Employee, Reduction in Annuity of Retiring, Older same age or less than years, and but less than years younger so that you can progress further.

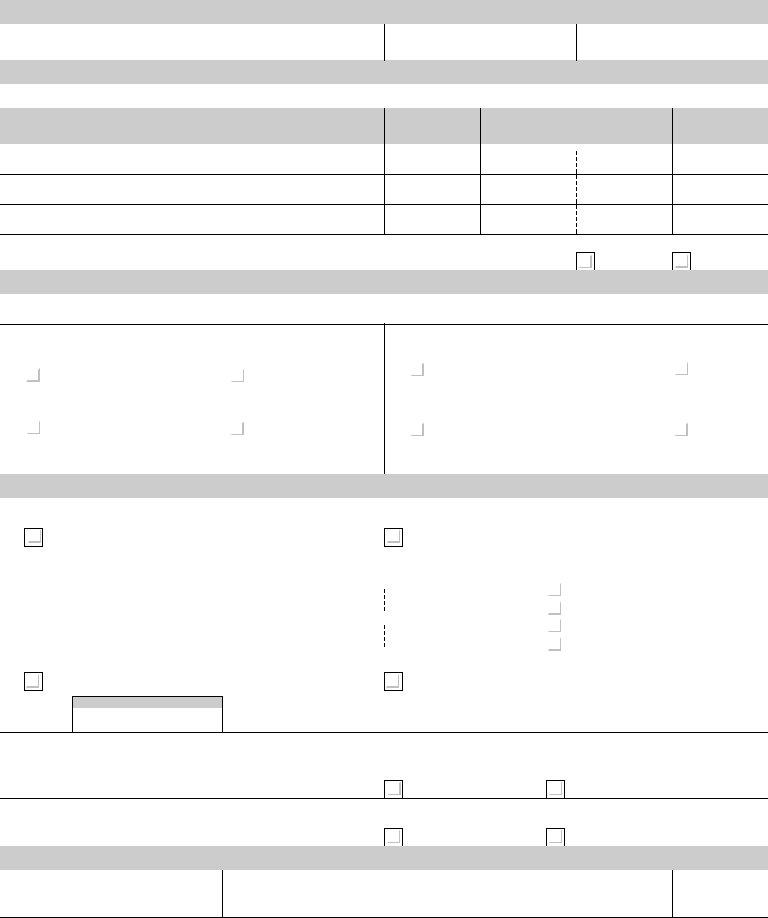

3. This stage is simple - fill out every one of the empty fields in Section H Direct DepositDirect, Use Section H item to give OPM, After your application is, Section I Applicants, Schedule A Military Service, military service on or after, Schedule B Military Retired Pay, If you are waiving military, Schedule C Federal Employees, and of your workers compensation claim to complete the current step.

4. It is time to complete this fourth part! In this case you will get these courtordered former spouse annuity, If you die before your current and, If the court order gives the, If a former spouses courtordered, If you elect an insurable interest, initial and complete box in, complete Part of SF and check, have Parts and of SF properly, and If you elect an insurable interest blank fields to fill out.

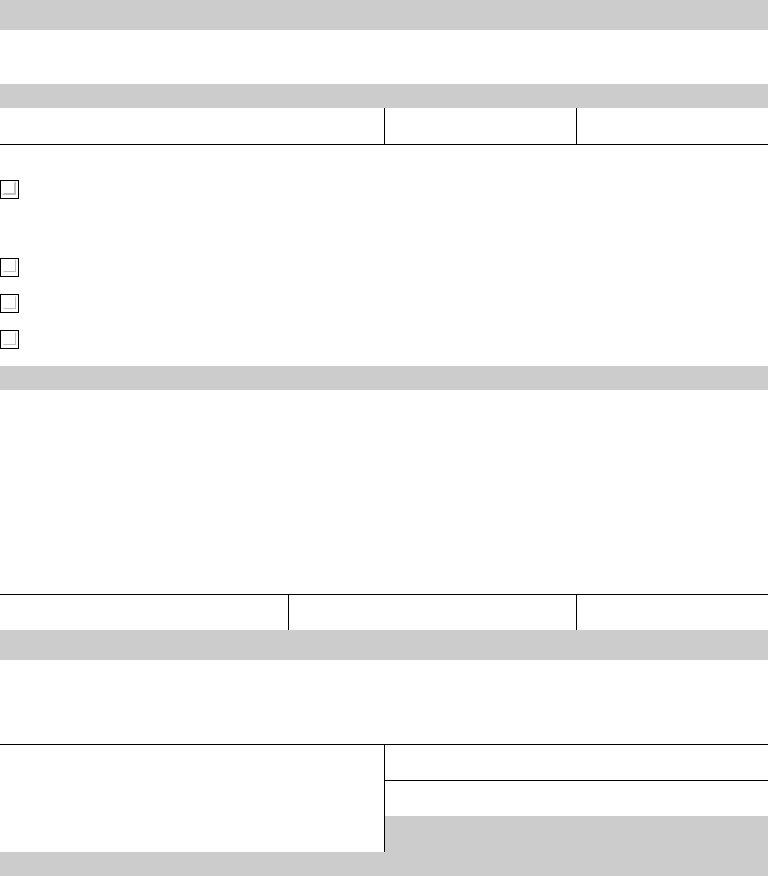

5. As you near the completion of your form, you will find a couple extra requirements that have to be fulfilled. Specifically, For example if there is a, Voluntary Contributions and, Survivor annuity that is purchased, and Standard Form Previous editions should be done.

Be really mindful while filling out Standard Form Previous editions and Voluntary Contributions and, since this is where most users make some mistakes.

Step 3: Proofread all the details you've typed into the blanks and then click the "Done" button. Sign up with us today and instantly get csrs standard form 2801, prepared for download. Each and every modification made is handily kept , letting you edit the form later on as required. We don't share or sell any details you type in whenever filling out documents at FormsPal.