Whenever you need to fill out form 329c, you don't have to download and install any kind of programs - just make use of our PDF tool. The tool is continually updated by our staff, acquiring handy functions and becoming more convenient. Getting underway is easy! Everything you need to do is follow these basic steps below:

Step 1: Just press the "Get Form Button" at the top of this webpage to access our pdf file editing tool. There you will find all that is necessary to fill out your file.

Step 2: The tool offers the capability to change your PDF document in a range of ways. Modify it by writing customized text, correct what is already in the file, and add a signature - all within a couple of mouse clicks!

This document requires specific info to be typed in, hence be sure to take your time to fill in exactly what is requested:

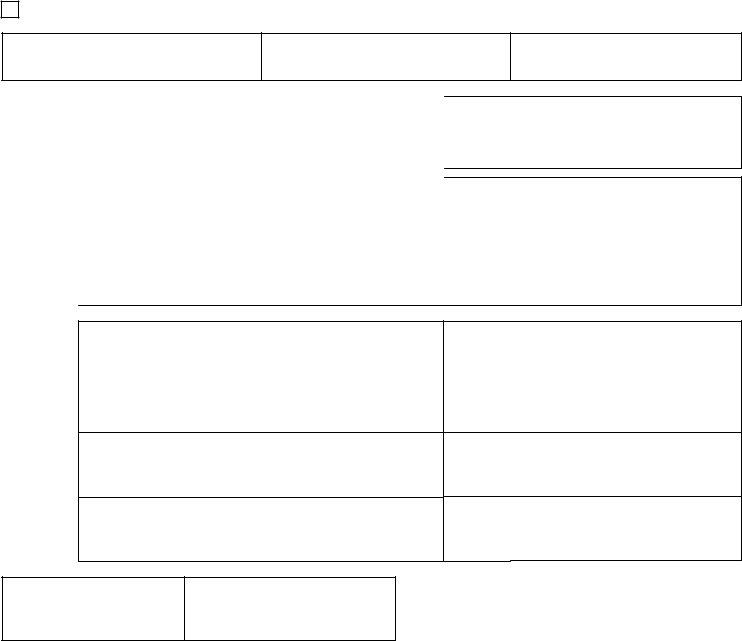

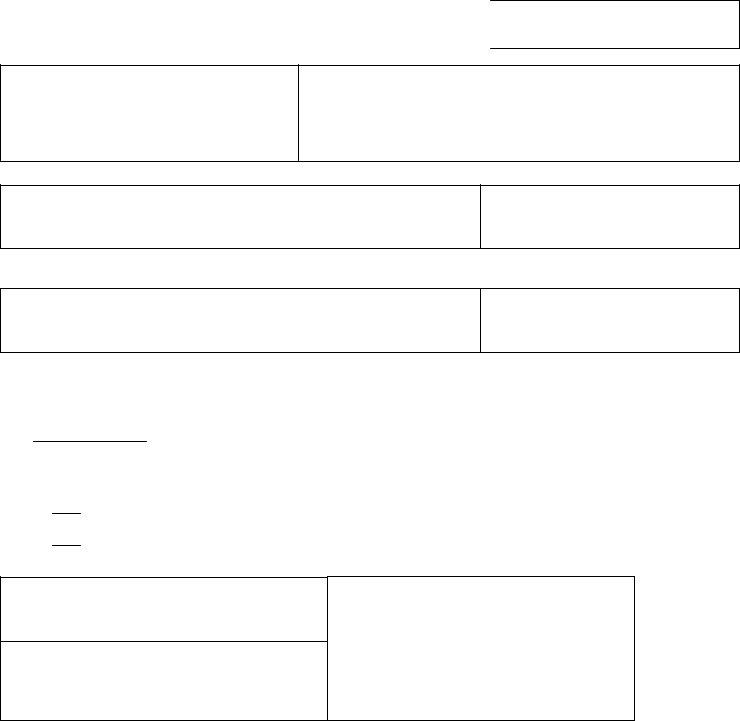

1. Before anything else, when filling out the form 329c, start in the area that includes the next blank fields:

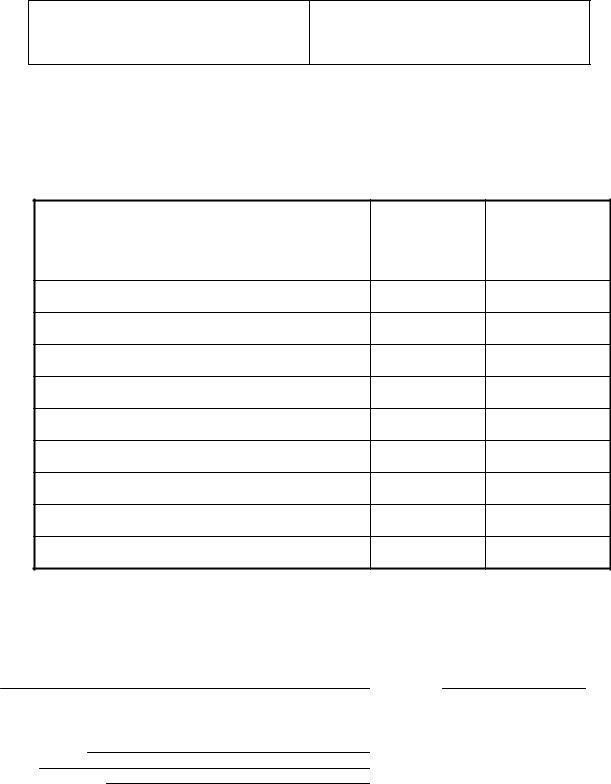

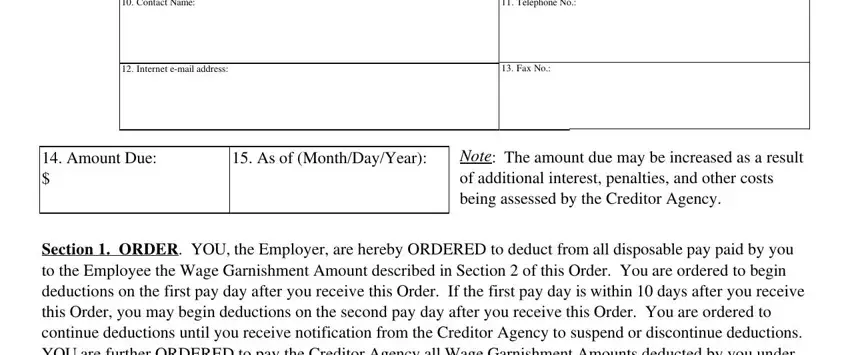

2. Now that the last section is completed, you'll want to add the needed specifics in Contact Name, Telephone No, Internet email address, Fax No, Amount Due, As of MonthDayYear, Note The amount due may be, and Section ORDER YOU the Employer in order to go further.

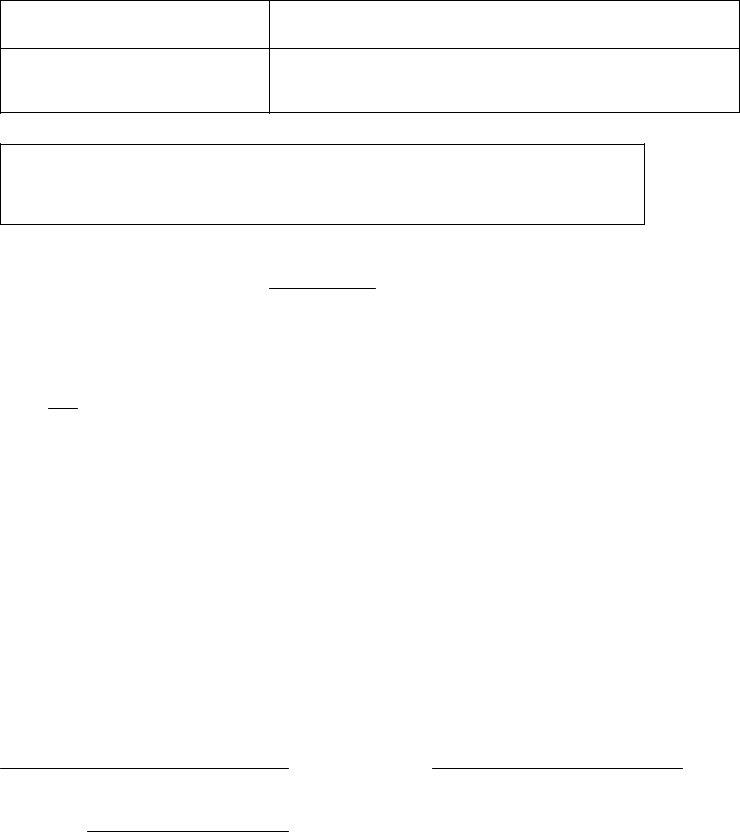

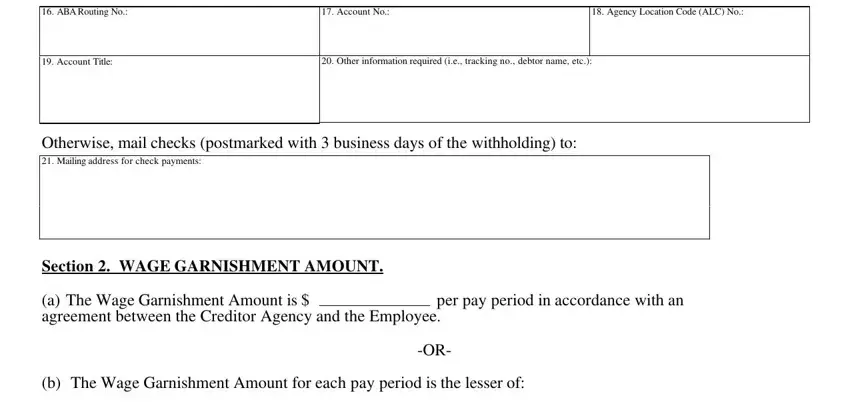

3. Completing ABA Routing No, Account No, Agency Location Code ALC No, Account Title, Other information required ie, Otherwise mail checks postmarked, Section WAGE GARNISHMENT AMOUNT, a The Wage Garnishment Amount is, per pay period in accordance with, b The Wage Garnishment Amount for, and ORcid is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

You can potentially make an error while completing the ABA Routing No, hence ensure that you take another look prior to when you submit it.

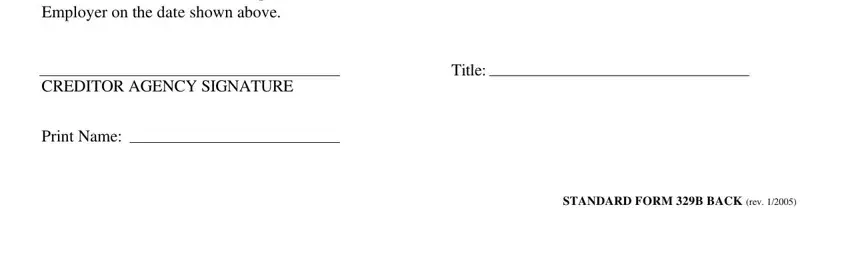

4. Completing CREDITOR AGENCY CERTIFICATION The, CREDITOR AGENCY SIGNATURE, Title, Print Name, and STANDARD FORM B BACK rev is crucial in this next stage - always invest some time and fill out each blank area!

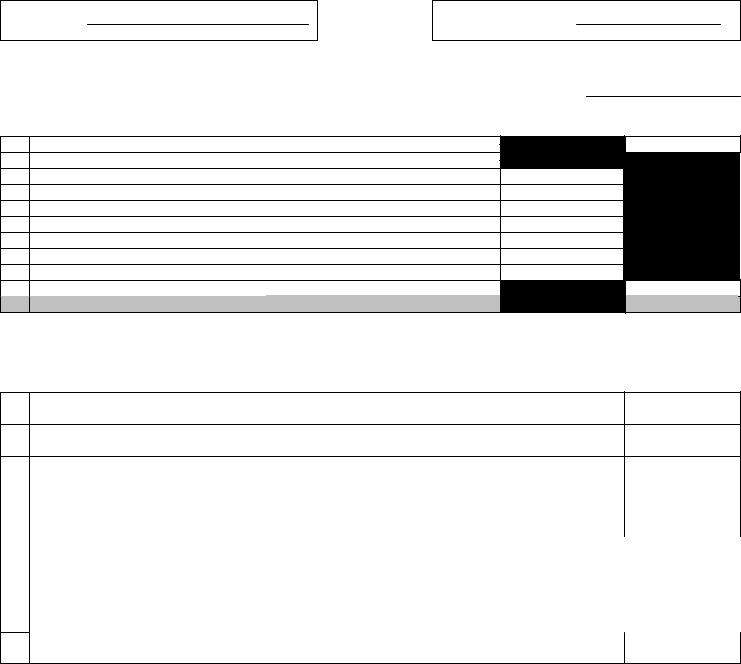

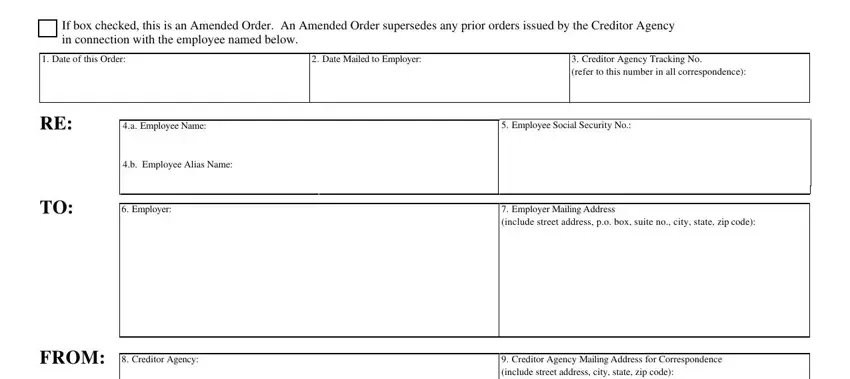

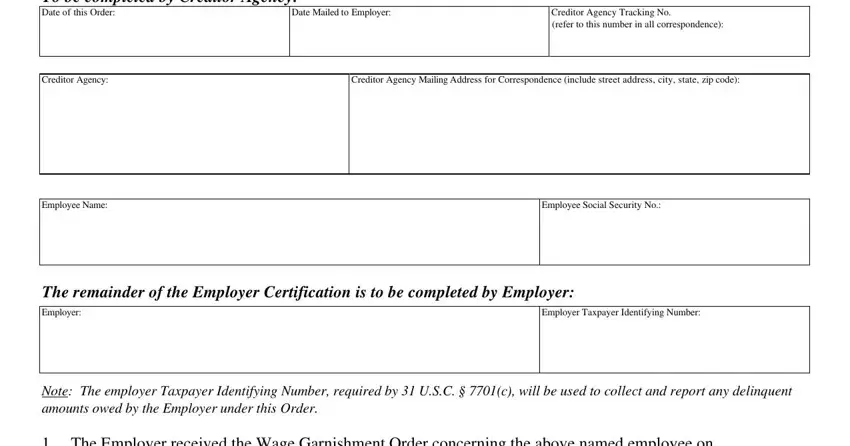

5. As you come close to the completion of this document, you'll notice a couple extra points to complete. Mainly, To be completed by Creditor Agency, Date Mailed to Employer, Creditor Agency Tracking No refer, Creditor Agency, Creditor Agency Mailing Address, Employee Name, Employee Social Security No, The remainder of the Employer, Employer, Employer Taxpayer Identifying, Note The employer Taxpayer, and The Employer received the Wage should be done.

Step 3: Right after you have looked again at the details in the blanks, simply click "Done" to complete your form at FormsPal. Join us today and instantly gain access to form 329c, available for download. All changes you make are saved , helping you to edit the pdf at a later stage as required. We don't sell or share any information you use whenever dealing with documents at our website.