Understanding the intricacies and applications of State Tax Form 97 is crucial for Massachusetts residents who are seniors, 65 years old and above, looking to manage their fiscal responsibilities better through property tax deferral. Introduced by the Commonwealth of Massachusetts and revised in July 2009, this form serves as a critical tool for eligible seniors aiming to defer property taxes under the provisions of General Laws Chapter 59, § 5, CLAUSE 41A. It underscores the state's commitment to providing financial relief to its senior residents by allowing them to postpone tax payments under specific conditions, thereby easing their financial burden. The form mandates detailed information, including ownership history, income sources, and personal identification to ensure applicants meet the criteria, such as age, ownership, residency duration within Massachusetts, and income limits. Importantly, the application process emphasizes confidentiality, stating that these applications are not open to public inspection in accordance with General Laws Chapter 59, § 60, thereby maintaining the privacy of the applicants. The procedure involves a detailed assessment by the Board of Assessors, who review the application, ultimately deciding on the deferral based on parameters such as ownership, occupancy, age, and income. The form also highlights the imperative conditions of repayment, typically necessitated upon the sale or transfer of the property, the demise of the applicant, or that of a surviving spouse who also qualifies for the deferral. It explicitly states the application deadlines and the critical understanding that filing the form does not halt the collection of taxes, an aspect that applicants must consider to avoid unintended consequences. Through this comprehensive framework, State Tax Form 97 facilitates a supportive avenue for seniors in Massachusetts to alleviate immediate property tax burdens whilst complying with the legal statutes in place.

| Question | Answer |

|---|---|

| Form Name | State Form 97 |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | mortgagee, massachusetts state tax forms printable, overpayment, Deferred |

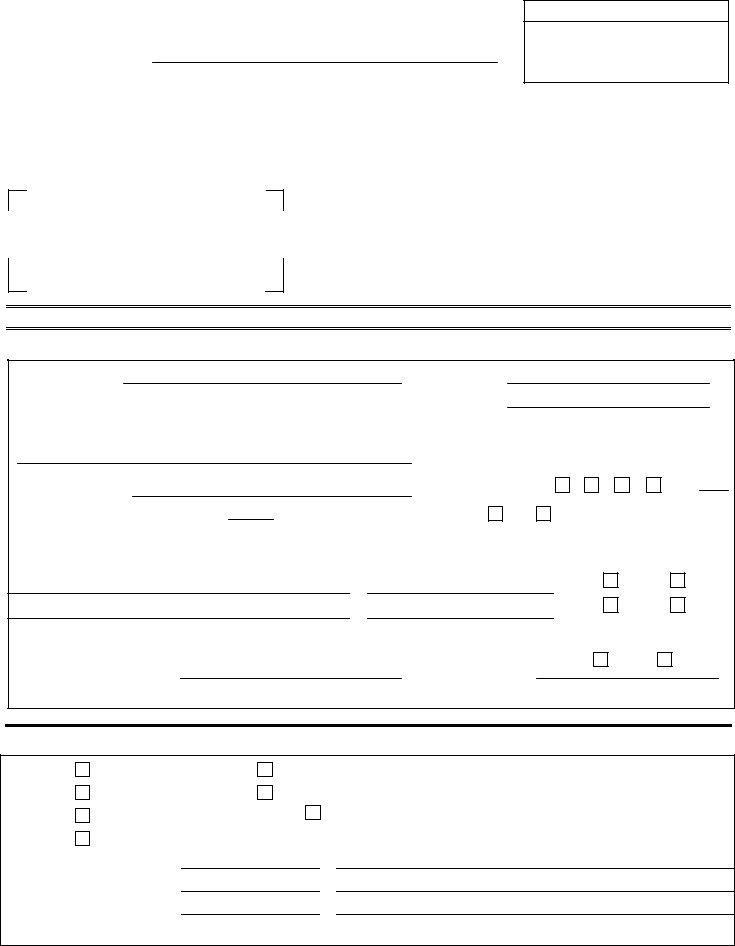

State Tax Form 97 |

The Commonwealth of Massachusetts |

Revised 7/2009 |

|

|

Name of City or Town |

Assessors’ Use only

Date Received

Application No.

Parcel Id.

SENIORS 65 AND OLDER

FISCAL YEAR _______ APPLICATION FOR PROPERTY TAX DEFERRAL

General Laws Chapter 59, § 5, CLAUSE 41A

THIS APPLICATION IS NOT OPEN TO PUBLIC INSPECTION

(See General Laws Chapter 59, § 60)

Return to: Board of Assessors

Must be filed with assessors on or before December 15 or 3 months after actual (not preliminary) tax bills are mailed for fiscal year if later. Tax Deferral and Recovery Agreement (Form

INSTRUCTIONS: Complete all sections fully. Please print or type.

A. IDENTIFICATION.

Name of Applicant: |

|

|

Marital Status: |

Telephone Number |

_______________________________________ |

Date of birth |

|

|

|

|

If first year of application, attach copy of birth certificate. |

Legal residence (domicile) on July 1, __________ |

|

Mailing address (if different) |

|

No. Street |

City/Town |

Zip Code |

|

|

|||

Location of property: |

|

Did you own the property on July 1, |

and for the prior 10 years? Yes |

If no, list the other properties you owned and/or occupied during the past 10 years. |

|

Address |

Dates |

No

2 |

3 |

4 |

Other |

Owned Occupied

Continue list on attachment in same format as necessary.

Have you been granted any exemption in any other city or town (MA or other) for this year? Yes

If yes, name of city or townAmount exempted $

Amount of tax you are seeking to defer this year $ _____________________________

No

DISPOSITION OF APPLICATION (ASSESSORS’ USE ONLY)

Ownership |

GRANTED |

Assessed Tax |

$ |

|

Occupancy |

DENIED |

Deferred Tax |

$ |

|

Age |

DEEMED DENIED |

Adjusted Tax |

$ |

|

Income |

|

|

|

Board of Assessors |

Date Voted/Deemed Denied

Certificate No.

Date Cert./Notice Sent

Date:

FILING THIS FORM DOES NOT STAY THE COLLECTION OF YOUR TAXES

THIS FORM APPROVED BY THE COMMISSIONER OF REVENUE

B. PERSONS WITH INTEREST IN PROPERTY.

Did you own the property on July 1, _________ as |

|

|

Sole owner |

||

Was there a mortgage on the property as of July 1, ________? Yes |

No |

|

If yes, amount due on mortgage $__________________ Name of mortgagee(s) ______________________________

Was the property subject to a life estate as of July 1, _______? Yes |

No |

If yes, name(s) of Remaindermen (person(s)receiving property after your death)

Was the property subject to a trust as of July 1, _________ Yes

If yes, please attach trust instrument including all schedules.

No

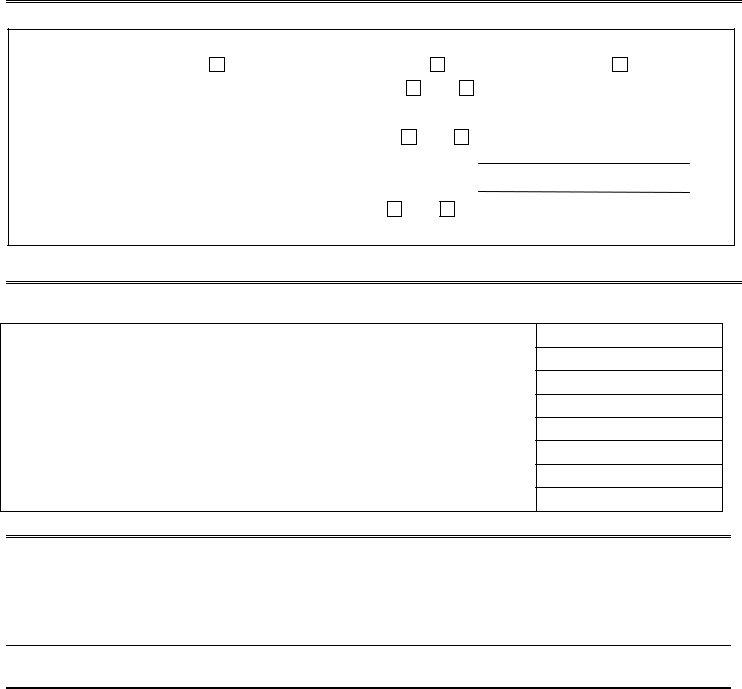

C.GROSS RECEIPTS FROM ALL SOURCES IN PRECEDING CALENDAR YEAR. Copies of your federal and state income tax returns, and other documentation, may be requested to verify your income.

Retirement Benefits (Social Security, Railroad, Federal, MA & Political Subdivisions).……………...

Other Pensions and Retirement Allowances.......................................................................……………...

Wages, Salaries and other Compensation............................................................................……………...

Net Profits from Business, Profession or Property Rental....................................................……………

Interest and Dividends...........................................................................................................……………...

Other Receipts (Capital Gains, Public Assistance, etc.)……………………………………………...…...

TOTALS

Applicant & Spouse

D.SIGNATURE. Sign here to complete the application.

This application has been prepared or examined by me. Under the pains and penalties of perjury, I declare that to the best of my knowledge and belief, this return and all accompanying documents and statements are true, correct and complete.

Signature |

Date |

If signed by agent, attach copy of written authorization to sign on behalf of taxpayer.

TAXPAYER INFORMATION ABOUT PROPERTY TAX DEFERRAL

SENIOR DEFERRAL. You may be eligible to defer payment of all or a portion of the taxes assessed on property you own and occupy as your domicile if you meet certain age, ownership, residency and income qualifications, and enter into a tax deferral agreement with the board of assessors. If you also qualify for a personal exemption, you may defer all or a portion of the remaining taxes on the property.

WHO MAY FILE AN APPLICATION. You may file an application if as of July 1 you:

•Are 65 or older,

•Owned and occupied the property as your domicile,

•Owned and occupied any property in Massachusetts as your domicile for at least 5 years,

•Lived in Massachusetts for at least the prior 10 years, and

•Have an annual income not more than $20,000 or a locally adopted income limit. Locally adopted income limits cannot be more than the income limit that applies under the “circuit breaker” state tax credit for single seniors who are not heads of households. Your board of assessors can tell you the limit that applies in your community.

REPAYMENT. Unlike an exemption, a tax deferral simply allows you to postpone payment of your taxes. If you qualify, you must enter into a tax deferral agreement that requires the deferred taxes along with interest to be paid in full (1) when the property is sold or transferred, (2) upon your death, or (3) upon the death of your surviving spouse if he or she qualifies for a deferral and enters into a new tax deferral agreement. Anyone having any legal interest in the property must also approve the tax deferral agreements.

Once you have entered into a tax deferral agreement, the assessors will record a statement at the Registry of Deeds. That statement continues the lien that already exists on your property by law to ensure the payment and collection of your taxes. Once the deferred taxes are repaid, the lien is released. However, if the deferred taxes are not repaid when due, your city or town will then be able to recover the amount by foreclosing on the lien in Land Court.

INTEREST. If you qualify for a deferral in subsequent years, you may defer taxes until the amount due, including accrued interest, equals 50% of your share of the full and fair cash value of the property. Interest at an annual rate of 8%, or a locally adopted lower rate, is charged on deferred taxes until the property is sold, your death, or the death of your surviving spouse if a new agreement has been entered into. Your board of assessors can tell you the rate that applies to the taxes deferred for each fiscal year. After the property is sold or your death, the annual interest rate increases to 16% until the deferred taxes are repaid.

WHEN AND WHERE APPLICATION MUST BE FILED. Your application must be filed with the Board of Assessors by December 15 or 3 months after the actual bills were mailed for the fiscal year, whichever is later. An application is filed when (1) received by the assessors on or before the filing deadline, or (2) mailed by United States mail, first class postage prepaid, to the proper address of the assessors, on or before the filing deadline, as shown by a postmark made by the United States Postal Service. THIS DEADLINE CANNOT BE EXTENDED OR WAIVED BY THE ASSESSORS FOR ANY REASON. IF YOUR APPLICATION IS NOT TIMELY FILED, YOU LOSE ALL RIGHTS TO AN EXEMPTION AND THE ASSESSORS CANNOT BY LAW GRANT YOU ONE.

PAYMENT OF TAX. Filing an application does not stay the collection of your taxes. In some cases, you must pay the tax when due to appeal the assessors’ disposition of your application. Failure to pay the tax when due may also subject you to interest charges and collection action. To avoid any loss of rights or additional charges, you should pay the tax as assessed. If a deferral is granted and you have already paid the entire year’s tax as deferred, you will receive a refund of any overpayment.

ASSESSORS DISPOSITION. Upon applying for a deferral, you may be required to provide the assessors with further information and supporting documentation to establish your eligibility. The assessors have 3 months from the date your application is filed to act on it unless you agree in writing before that period expires to extend it for a specific time. If the assessors do not act on your application within the original or extended period, it is deemed denied. You will be notified in writing whether a deferral has been granted or denied.

APPEAL. You may appeal the disposition of your application to the Appellate Tax Board, or if applicable, the County Commissioners. The appeal must be filed within 3 months of the date the assessors acted on your application, or the date your application was deemed denied, whichever is applicable. The disposition notice will provide you with further information about the appeal procedure and deadline.