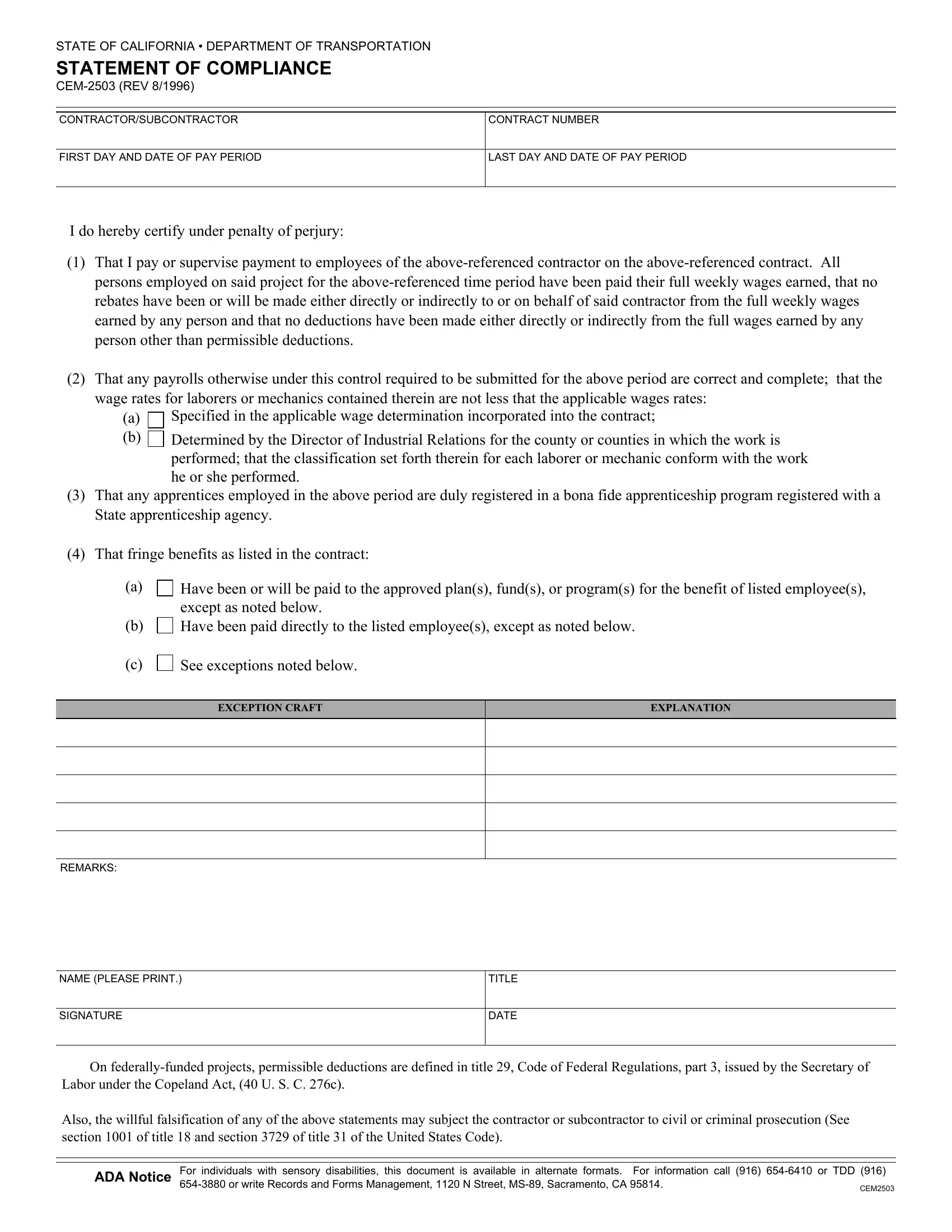

STATE OF CALIFORNIA • DEPARTMENT OF TRANSPORTATION

STATEMENT OF COMPLIANCE

CEM-2503 (REV 8/1996)

FIRST DAY AND DATE OF PAY PERIOD

LAST DAY AND DATE OF PAY PERIOD

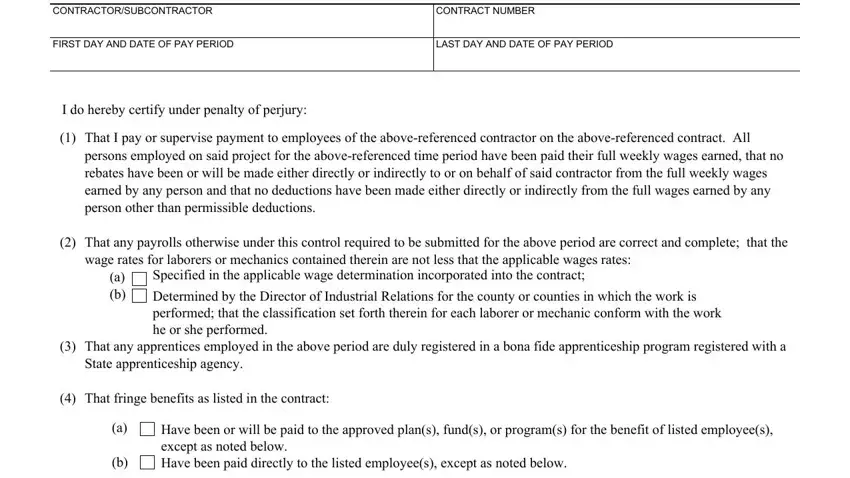

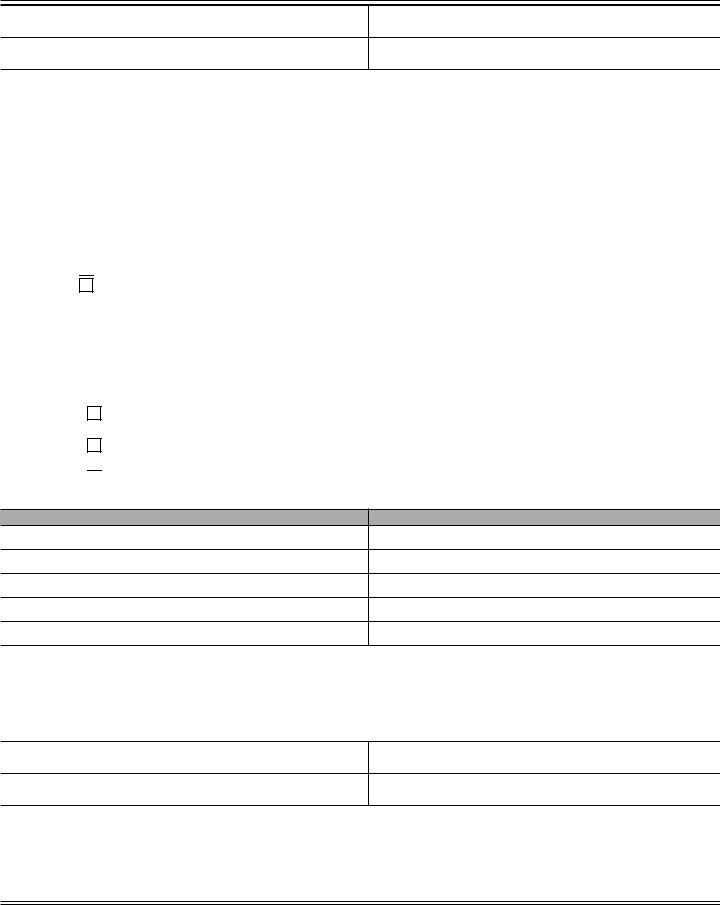

I do hereby certify under penalty of perjury:

(1)That I pay or supervise payment to employees of the above-referenced contractor on the above-referenced contract. All persons employed on said project for the above-referenced time period have been paid their full weekly wages earned, that no rebates have been or will be made either directly or indirectly to or on behalf of said contractor from the full weekly wages earned by any person and that no deductions have been made either directly or indirectly from the full wages earned by any person other than permissible deductions.

(2)That any payrolls otherwise under this control required to be submitted for the above period are correct and complete; that the wage rates for laborers or mechanics contained therein are not less that the applicable wages rates:

(a) Specified in the applicable wage determination incorporated into the contract;

(b) |

Determined by the Director of Industrial Relations for the county or counties in which the work is |

|

performed; that the classification set forth therein for each laborer or mechanic conform with the work |

|

he or she performed. |

(3)That any apprentices employed in the above period are duly registered in a bona fide apprenticeship program registered with a State apprenticeship agency.

(4)That fringe benefits as listed in the contract:

Have been or will be paid to the approved plan(s), fund(s), or program(s) for the benefit of listed employee(s), except as noted below.

Have been paid directly to the listed employee(s), except as noted below.

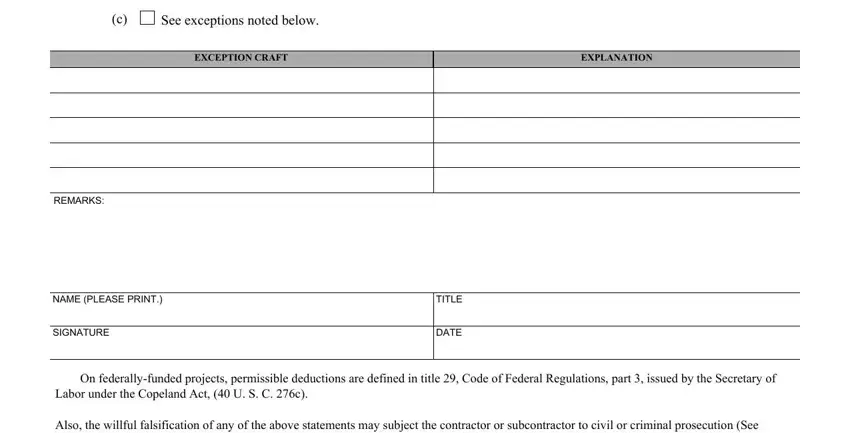

See exceptions noted below.

NAME (PLEASE PRINT.)

SIGNATURE

On federally-funded projects, permissible deductions are defined in title 29, Code of Federal Regulations, part 3, issued by the Secretary of Labor under the Copeland Act, (40 U. S. C. 276c).

Also, the willful falsification of any of the above statements may subject the contractor or subcontractor to civil or criminal prosecution (See section 1001 of title 18 and section 3729 of title 31 of the United States Code).

ADA Notice |

For individuals with sensory disabilities, this document is available in alternate formats. For information call (916) 654-6410 or TDD (916) |

|

654-3880 or write Records and Forms Management, 1120 N Street, MS-89, Sacramento, CA 95814. |

CEM2503 |

STATE OF CALIFORNIA • DEPARTMENT OF TRANSPORTATION

STATEMENT OF COMPLIANCE

CEM-2503 (REV 8/96) INSTRUCTIONS

This statement of compliance meets needs of the state and federal payroll requirements to pay fringe benefits in addition to payment of the minimum rates. The contractor's obligation to pay fringe benefits may be met by payment of the fringes to the various preapproved plans, funds, or programs or by making these payments directly to the employees as part of their weekly wage payments.

The contractor must show on the face of his or her payroll all monies paid to the employees whether as basic rates or total hourly wage amount in lieu of fringes. The contractor shall report in the statement of compliance that he or she is paying to others fringes required by the contract and not paid directly to the employees in lieu of fringes.

Detailed instructions follow:

Contractors required to pay Federal Wage Rates:

Such a contractor shall check paragraph 2(a) of the statement to indicate that the wage rates for laborers or mechanics contained in the payroll are not less than the applicable wage rates specified in the applicable wage determination incorporated into the contract.

Contractors required to pay the State Prevailing Wage Rates as determined by the Director of Industrial Relations:

Such a contractor shall check paragraph 2(b) of the statement to indicate that the wage rates for laborers or mechanics contained in the payroll are not less than the applicable wage rates determined by the Director of Industrial Relations for the county or counties in which the work is preformed.

Contractor who pay all required fringe benefits:

A contractor who pays fringe benefits to approved plans, funds, or programs in amounts not less than were determined in the applicable wage decisions shall continue to show on the face of his or her payroll the basic hourly rate and overtime rate paid to his or her employees, just as he or she has always done. Such a contractor shall check paragraph 4(a) of the statement to indicate that he or she is also paying approved plans, funds, or programs within the times required for the receipt of those sums, not less than the amount predetermined as fringe benefits for each craft. Any exception shall be noted in Section 4(c).

Contractors who pay no fringe benefits:

A contractor who does not pay fringe benefits to an approved plan shall pay a like amount to the employee. This payment can be reported by inserting in the straight time hourly rate column of his or her payroll an amount not less than the predetermined rate for each classification plus the amount of fringe benefits determined for each classification in the applicable wage decision. Inasmuch as it is not necessary to pay time and a half on wages paid in lieu of fringes, the overtime rate shall be not less than one and one-half the basic predetermined rate, plus the required cash in lieu of fringes at the straight time rate. To simplify computation of overtime, it is suggested that the straight time basic rate and payment in lieu of fringes be separately stated in the hourly rate column. In addition, the contractor shall check paragraph 4(b) of the statement to indicate that he or she is paying fringe benefits directly to his or her employees. Any exceptions shall be noted in Section 4(c).

Use of Section 4(c), Exceptions:

Any contractor who is making payment to approved plans, funds, or programs in amounts less than the wage determination required is obligated to pay the deficiency directly to the employees as wages in lieu of fringes. Any exceptions to Section 4(a) and 4(b), whichever the contractor may check, shall be entered in Section 4(c). Enter in the Exception column the craft, and enter in the Explanation column the hourly amount paid the employees as wages in lieu of fringes, and the hourly amount paid to plans, funds, or programs as fringes.