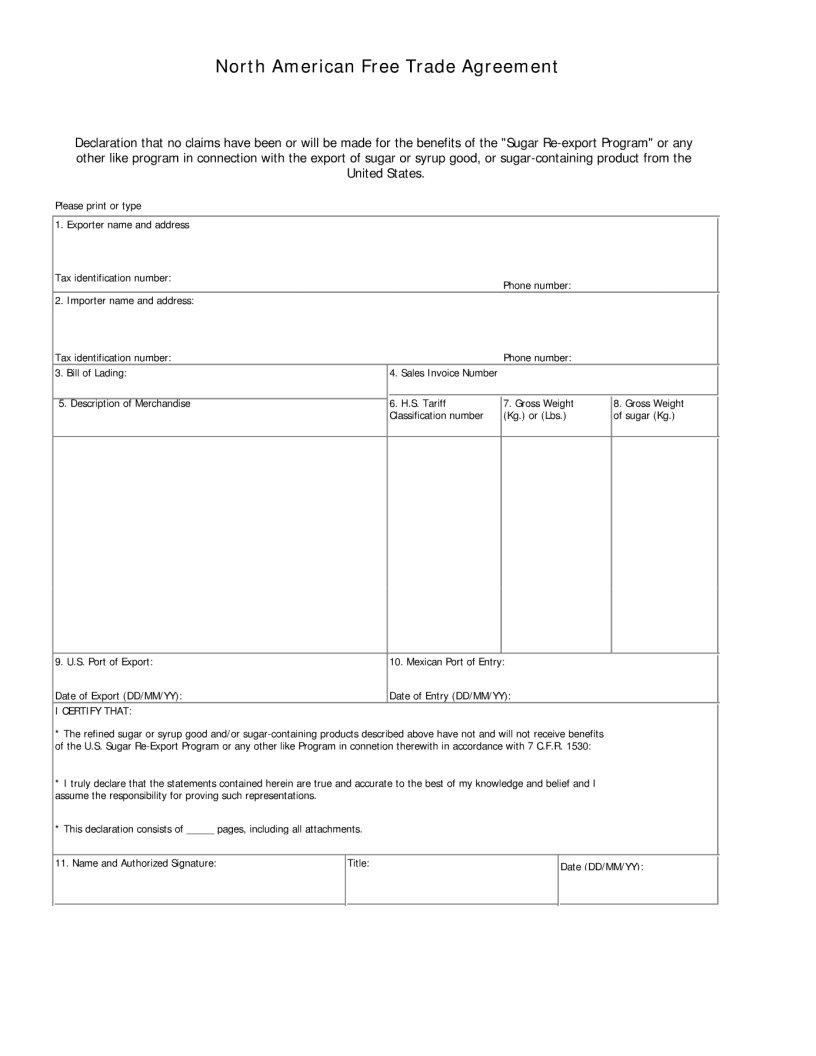

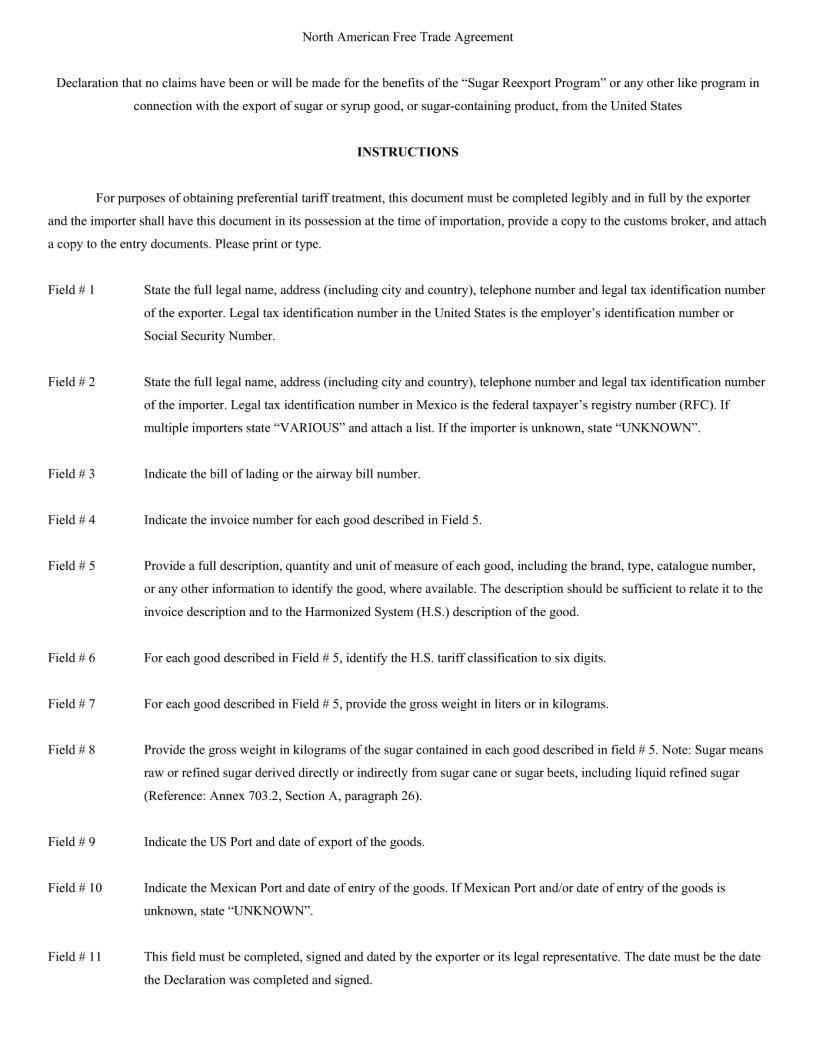

In the complex world of international trade, navigating the requirements for exporting goods between countries is critical for businesses to succeed and remain compliant with trade agreements. The Sugar Re-export form, associated with the North American Free Trade Agreement (NAFTA), serves as a pivotal document for those in the business of exporting sugar, syrup goods, or sugar-containing products from the United States. This form acts as a declaration that no claims have been or will be made for the benefits of the U.S. Sugar Re-Export Program or any similar program, ensuring that all transactions adhere to the stipulated regulations. With fields ranging from the exporter and importer's name and address to the description of merchandise, H.S. Tariff Classification number, and gross weights, the form requires detailed information to ensure transparency and compliance. Additionally, it is mandatory for the exporter to certify that the goods have not received benefits from any like programs and that all statements made are true to the best of their knowledge. Proper completion and possession of this document at the time of importation not only facilitate preferential tariff treatment but also bolster the integrity of the trade process. This underscores the importance of thoroughly understanding and accurately completing the Sugar Re-export form, an imperative step for entities engaged in the trade of sugar-based products across NAFTA territories.

| Question | Answer |

|---|---|

| Form Name | Sugar Re Export Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | sugar re export, declaration that no claims have been or will be made for the benefits of the sugar reexport program, what is the north american trade agreement, sugar re export program certificate format |