Navigating the complexities of financial aid for the 2016-17 school year requires attention to detail, especially for those with farm or business assets. The Business/Farm Supplement form stands as a crucial piece of documentation, designed to paint a comprehensive picture of an owner's financial circumstances. Applicants are advised to meticulously draw information from their 2014 and 2015 IRS tax returns, including specific forms relevant to their business type, such as Schedules C, D, and F, or Form 1120 for incorporated businesses, among others. This detailed approach ensures that financial aid administrators receive a clear view of an applicant's income, expenses, and net profit, which are central to determining eligibility for assistance. The form also addresses unique situations, such as businesses or farms serving as primary family support despite reporting low profits, urging applicants to provide explanatory details in such cases. Moreover, it distinguishes between different sources of income and expenses, whether from traditional business operations or farm-specific activities, with precision on acreage and the value of owned land. Assets and liabilities are dissected with equal thoroughness, guiding owners through a process to accurately report current and fixed assets alongside any debts. Ultimately, this supplement form is a critical tool for both families and financial aid officers, facilitating a fair and accurate financial aid process by ensuring that every significant detail of one's business or farm is accounted for without having to submit exhaustive supplementary financial documents.

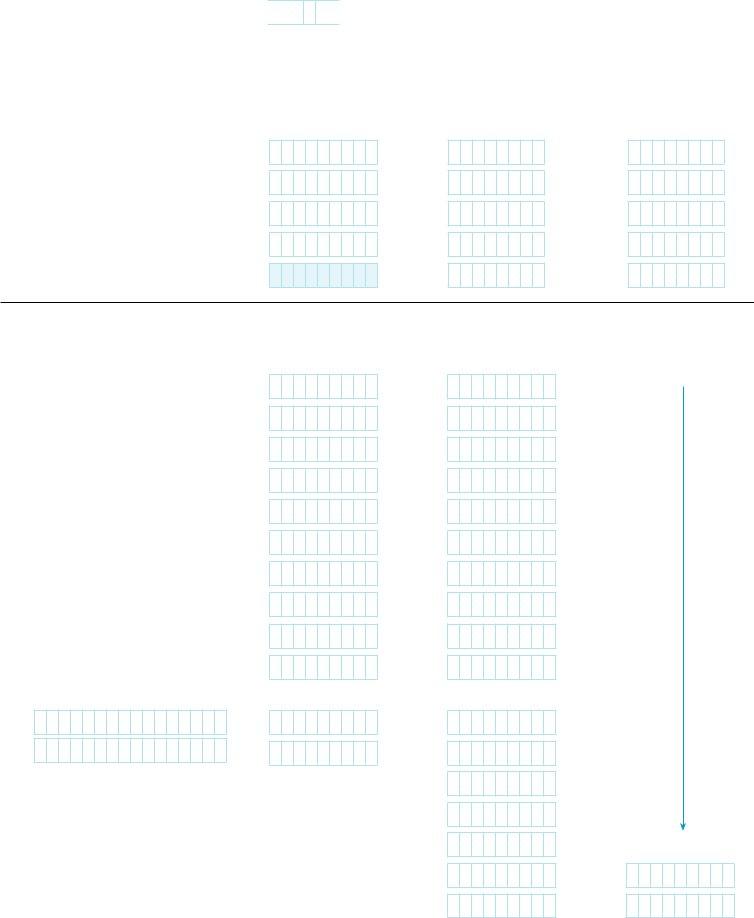

| Question | Answer |

|---|---|

| Form Name | Supplement Farm Business Form |

| Form Length | 5 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 15 sec |

| Other names | 17 supplement, business farm d, business supplement, business or fam supplement |

BUSINESS/FARM SUPPLEMENT

SCHOOL YEAR

Instructions for Completing the Business/Farm Supplement

Complete a supplement for each business or farm.

When completing this supplement, refer to both your 2014 and 2015 IRS tax returns — specifically, Form 1040, Schedules C, D, and F, as applicable. If an incorporated business is involved, refer to Form 1120 as well. If a partnership is involved, also refer to Form 1065 and/or Schedule K1. For any year for which tax forms have not been completed, estimate as accurately as possible.

The financial aid administrator may later ask you to provide copies of your tax returns, including your corporate and partnership tax return(s).

If you are the owner or part owner of a partnership or a corporation: (1) Enter your percentage of ownership (question 6); (2) enter total income, expense deductions and profit for the entire business entity (questions

IMPORTANT: If a business is a major source of family support but no salaries are reported and business net profit is under $10,000, explain on an attached sheet how basic family expenses are met.

Don’t submit balance sheets, profit and loss statements, cash flow statements, or tax returns in place of the Business/Farm Supplement, unless specifically request- ed by your college.

If your home is part of the business or farm, enter its value and the amount of its mortgage on the CSS/Financial Aid PROFILE® Application. Don’t include your home value on the Business/Farm Supplement.

If farm income is reported on an accrual basis, the required information can be found on IRS Form 1040, Schedule F, Part III. In this case, disregard questions

If you have gains or losses from the sale or exchange of livestock and/or farm machinery, report the full amount of such gains or losses in question 16 below. Don’t include in this question gains or losses arising from the sale or exchange of other property, as reported on your IRS Form 1040, Schedule D.

If a financial question does not apply to you, write 0. Do not leave questions blank unless the instructions tell you to do so.

Student’s Information

Student’s name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Number |

|

Date of Birth |

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Last |

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

M.I. |

|

|

|

|

|

|

|

Month Day |

|

Year |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

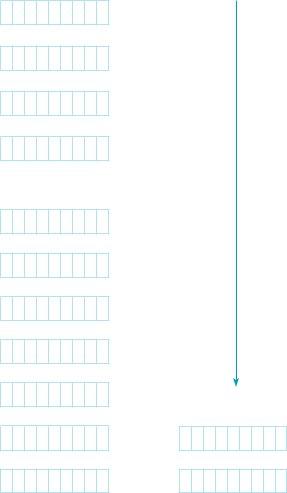

Parent’s Business/Farm Information

1. Name of Business/Farm

3. Location of Business/Farm

Street Address

City/Township

County

State |

Zip Code |

5.Give Name(s) of Owners and Partners, Their Relationship to the Parent(s), and Their Percentage of Ownership

Name

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Relationship |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

% |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Relationship |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage |

|||||||

2.Date Business Commenced or Farm Purchased

Day |

Month |

Year |

4. Type of Business/Farm

oSole proprietor

oPartnership

oCorporation

Indicate type

6. Your Percentage of Ownership |

7. Number Employees |

%

8. Describe Principal Product or Service

1

9. Residence and Mortgage Information

Monthly mortgage payment on the business or farm |

$ |

|

|

|

Farm owners |

|

|

|

|

|

|

|

|

|

Do you live on the farm? |

o Yes |

|||

10. Total Acres Owned (Farm Owners Only) |

|

|

|

|

|

|

.00 |

Business owners |

|

|

|

|

|

|

|

|

Is the business a part of your home? |

o Yes |

o No |

|||

|

|

|

||||||

o No |

If yes, what percentage of home is claimed for business use? |

% |

|

|

|

|

||

|

|

|

|

|||||

|

|

|

|

|

||||

Market value per acre |

No. of acres owned |

No. rented to others |

Tillable land |

$ |

.00

Nontillable land |

$ |

|

.00

Woodlands and waste |

$ |

|

.00

Agricultural reserve |

$ |

.00

TOTAL |

$ |

.00

Business Owners Only — Income and Expenses

11.Business Income

a.Gross receipts of sales less returns and allowances

b.Cost of goods sold and/or operations (Don’t include salaries paid to yourself, your dependents or others, or any item listed below.)

c.Gross profit (Line 11a minus 11b)

d.Other business income

12.Total Income (Add 11c and 11d)

13.Business Deductions (Don’t include any amount entered in 11b above.)

a.Depreciation

b.Interest expense

c.Rent on business property

d.Parents’

e.Salaries and wages paid to family members other than yourself employed in the business

Name and Relationship

2014

(Jan.

$

$

$

$

$

$

$

$

$

$

$

$

.00 |

$ |

.00 |

$ |

.00 |

$ |

.00 |

$ |

.00 |

$ |

.00 |

$ |

.00 |

$ |

.00 |

$ |

.00 |

$ |

.00 |

$ |

|

Salary |

.00 |

$ |

.00 |

$ |

2015

(Jan.

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

Estimated 2016

(Jan.

|

f. All other salaries and wages |

$ |

|

g. Other business expenses (Itemize on a |

$ |

|

separate sheet any single item over $1,000.) |

|

|

|

|

14. |

Total Deductions (Add |

$ |

15. |

Net Proit (or Loss) (Line 12 minus line 14) |

$ |

16. |

Your Share of Line 15 (Multiply line 15 |

$ |

|

by your percentage of ownership, question 6.) |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

$ |

|

|

|

|

|

|

|

|

|

.00 |

$ |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

.00

.00

.00

.00 $

.00 $

Estimated 2016

.00

.00

2

Farm Owners Only — Income and Expenses

The IRS line references are for 2014. For 2015, use the corresponding lines from 2015 IRS forms.

17.Farm Income

a.Profit (or loss) on sales of livestock and other items purchased for resale (from Form 1040, Schedule F, line 1e)

b.Sales of livestock and produce raised (from Schedule F, lines 2a and 2b)

c.Other farm income (from Schedule F, lines 3b, 4b, 5a, 5c, 6b, 6d, 7a, 7b, 8a, 8b)

18.Gross Income (Add

$

$

$

$

2014

(Jan.

|

|

|

|

|

|

|

|

|

.00 |

$ |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

2015 |

Estimated 2016 |

(Jan. |

(Jan. |

.00

.00

.00

.00

19.Farm Expenses

a.Farm deductions less depreciation (from Schedule F, lines

b.Depreciation (from Schedule F, line 14)

20.Total Expenses (Add 13a and 13b) (from Schedule F, line 33)

21.Net Farm Proit (or Loss) (Line 12 minus line 14)

(from Schedule F, line 34)

22.

23.Net Proit (or Loss) (Add lines 15 and 16)

24.Your Share of Line 17 (Multiply line 17 by your percentage of ownership, question 6.)

$

$

$

$

$

$

$

|

|

|

|

|

|

|

|

|

.00 |

$ |

|

|

|

|

|

|

|

|

|

.00 |

$ |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

.00 |

$ |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

.00 |

|

.00 |

|

.00 |

|

.00 |

|

.00 |

$ |

.00 |

$ |

Estimated 2016

.00

.00

3

Student’s SSN

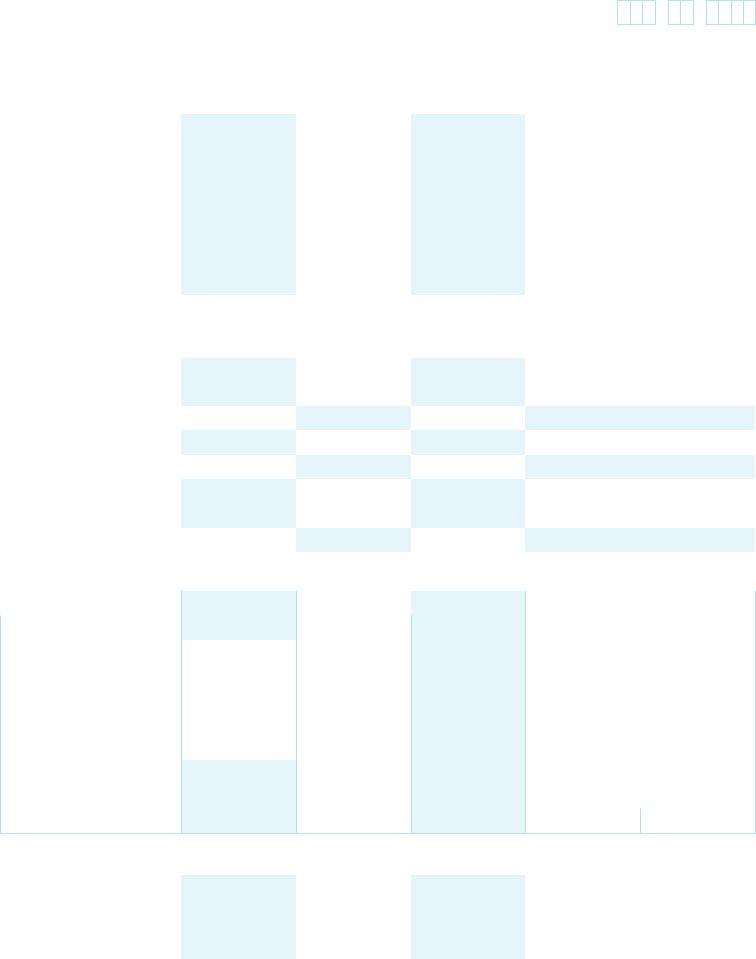

Business/Farm Assets

The igures you report in column C should relect the fair market value of the business or farm (a reasonable estimate of what each asset is worth and could be sold for). Filers of IRS Form 1120, 1120S, or 1065 should refer to Schedule L to complete columns A and B. If you don’t ile any of these

IRS forms, you may leave columns A and B blank.

1. Current Assets |

|

Column A |

|

Column B |

Column C |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Book Value at Beginning |

|

|

Book Value at End |

Fair Market Value at End |

|

|

|

|

of Tax Year 2015 |

|

|

of Tax Year 2015 |

of Tax Year 2015 |

a. |

Cash and |

|

|

$ |

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

b. |

Receivables (total) |

|

|

$ |

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

c. |

Allowance for bad debts |

|

|

$ |

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

d. |

Inventories |

|

|

$ |

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

e. |

Other current assets not included |

|

|

|

|

|

|

|

|

above (Do not include loans to |

|

|

$ |

|

|

$ |

$ |

|

partners or shareholders.) |

|

|

|

|

|

|

|

f. |

Total current assets (Add 1a,1b, |

|

|

$ |

|

|

$ |

$ |

|

1d, and 1e, then subtract 1c) |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

2. Fixed Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

Book Value at Beginning |

Accumulated |

|

Book Value at End |

Fair Market Value at End |

|

|

Depreciation |

|

of Tax Year 2015 |

Depreciation |

|

of Tax Year 2015 |

of Tax Year 2015 |

a. |

Land |

|

|

$ |

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

b. |

Buildings (purchase price) |

|

|

$ |

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

c. |

Accumulated depreciation |

$ |

|

|

$ |

|

|

|

|

on buildings |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

d. |

Machinery and equipment |

|

|

$ |

|

|

$ |

$ |

|

(purchase price) |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

e. |

Accumulated depreciation |

$ |

|

|

$ |

|

|

|

|

on machinery |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

f. |

Other fixed assets |

|

|

$ |

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

g. |

Total fixed assets (Add 2a, 2b, |

|

|

$ |

|

|

$ |

$ |

|

2d, and 2f) |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

h. |

Total depreciation (Add 2c and 2e) |

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

3. All Other Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Book Value at Beginning |

|

|

Book Value at End |

Fair Market Value at End |

|

|

|

|

of Tax Year 2015 |

|

|

of Tax Year 2015 |

ofTaxYear 2015 |

a. |

Total loans to partners or |

|

$ |

|

$ |

$ |

||

|

shareholders listed in 5 on page 1 |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

Itemize by partner or shareholder |

|

$ |

|

$ |

$ |

||

|

|

|

|

|

|

|

||

|

Name: |

|

$ |

|

$ |

$ |

||

|

|

|

|

|

|

|

||

|

Name: |

|

$ |

|

$ |

$ |

||

|

|

|

|

|

|

|

||

|

Name: |

|

$ |

|

$ |

$ |

||

|

|

|

|

|

|

|

||

|

Name: |

|

$ |

|

$ |

$ |

||

|

|

|

|

|

|

|

|

|

b. |

Loans to others than partners |

|

$ |

|

$ |

$ |

||

|

or shareholders |

|

|

|||||

|

|

|

|

|

|

|

|

|

c. |

All other assets |

|

$ |

|

$ |

$ |

||

|

|

|

|

|

|

|

|

|

d. Total other assets (Add

$

$

$

4. Total Assets

|

|

|

Book Value at Beginning |

|

Book Value at End |

Fair Market Value at End |

|

|

|

of Tax Year 2015 |

|

of Tax Year 2015 |

of Tax Year 2015 |

a. |

Add 1f, 2g, and 3d |

|

$ |

|

$ |

$ |

|

|

|

|

|

|

|

b. |

Your share of total assets |

|

|

|

|

|

|

(Multiply line 4a by your percentage |

|

$ |

|

$ |

$ |

|

of ownership.) |

|

|

|

|

|

|

|

4 |

|

|

|

|

Business/Farm Liabilities

5.Liabilities

a.Accounts payable

b.Other current debts

c.Total current debts (Add 5a and 5b)

6.

(Don’t include any amount listed above.)

a.Mortgages on land and buildings (Don’t include home mortgages.)

b.Debts secured by equipment

c.Loans from partner(s) or shareholder(s) Itemize by shareholder:

Name Name Name

Name

d.Other debts

e.Total

7.Total Liabilities (Add 5c and 6e)

8.Your Share of Total Liabilities

(Multiply line 7 by your percentage of ownership.)

Beginning of Tax Year 2015 |

|

End of Tax Year 2015 |

|||||||||||||||||||

$ |

|

|

|

|

|

|

|

|

|

.00 |

$ |

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

$ |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|||

$ |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

.00 |

$ |

|

|

|

|

|

|

|

|

|

.00 |

$ |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

.00 |

||

$ |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

.00 |

||

$ |

|

|

|

|

|

|

|

|

|

.00 |

$ |

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

$ |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

.00 |

||

$ |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

.00 |

||

$ |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

.00 |

||

$ |

|

|

|

|

|

|

|

|

|

.00 |

$ |

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

$ |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

.00 |

||

$ |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

.00 |

||

$ |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

.00 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Remarks

Use this space to explain any special circumstances. If more space is required, attach a letter to this form.

Signatures

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Parent’s signature |

Date completed: |

Day |

|

Month |

Year |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Parent’s signature |

Date completed: |

Day |

|

Month |

Year |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

© 2015 The College Board. College Board, CSS/Financial Aid PROFILE, and the acorn logo are registered trademarks of the College Board. Visit the College Board on the Web: www.collegeboard.org.

5 |

00121_007 |