Dealing with the intricacies of unemployment insurance tax reporting is a crucial obligation for employers within the state of Idaho, and the Tax 020 form serves as a key component in meeting this legal requirement. Designed by the State of Idaho Department of Labor, this form facilitates the quarterly reporting of wages paid to employees, serves as the basis for calculating unemployment insurance tax due, and records changes in business ownership or address. It's a comprehensive document that requires accurate and timely submissions to avoid significant penalties, with fines reaching up to $250.00 or 100% of the amount due for failures to file or for filing false reports, underscoring the strict compliance measures in place. Besides financial summaries, the form also gathers data on the number of workers employed during specific periods, offering a snapshot of employment levels. Moreover, it provides a mechanism for employers to report any cessation of operations, ensuring the state's employment records remain current. While the form might seem daunting at first, its structured layout and clear instructions aid employers in navigating through the reporting process effectively, ensuring they contribute accurately to Idaho's workforce development initiatives.

| Question | Answer |

|---|---|

| Form Name | Tax 020 Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | idaho employer quarterly unemployment insurance tax020 form, idaho quarterly report, labor quarterly, idaho tax form tax020 |

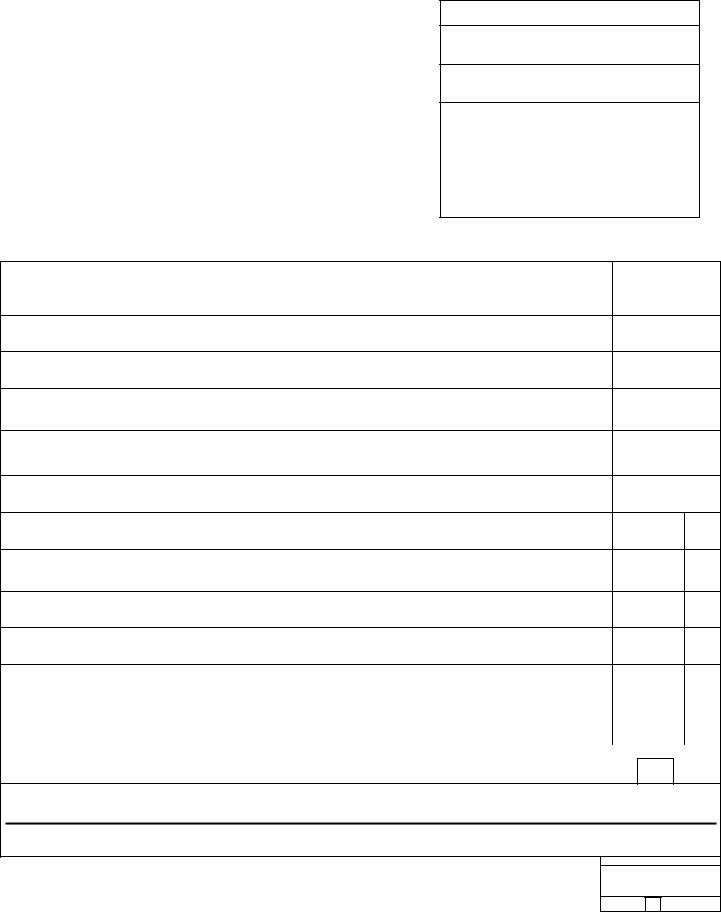

TAX020.doc

STATE OF IDAHO – DEPARTMENT OF LABOR

EMPLOYER QUARTERLY

UNEMPLOYMENT INSURANCE TAX REPORT

STATE ACCOUNT NUMBER:

FEDERAL IDENTIFICATION NUMBER:

(Verify and make necessary corrections)

1. LEGAL ENTITY NAME AND Physical ADDRESS:

CASHIER

IDAHO DEPARTMENT OF LABOR

317 W MAIN STREET

BOISE, IDAHO

TELEPHONE: (208)

SHOW BELOW ANY CHANGES IN NAME, MAILING ADDRESS OR OWNERSHIP TOGETHER WITH EFFECTIVE DATE

NAME CHANGED TO:

NEW MAILING ADDRESS:

OWNERSHIP CHANGED: |

EFFECTIVE DATE: |

|

|

NEW OWNERS: |

|

|

|

CEASED OPERATIONS: |

EFFECTIVE DATE: |

IMPORTANT: Employers who fail to file or file false reports may be fined up to $250.00 or 100% of the amount due, whichever is greater (Idaho Code Section

2.DATE QUARTERLY TAX REPORT IS DUE:

3.YEAR WAGES WERE PAID / CALENDAR QUARTER WAGES WERE PAID:

|

CONTRIBUTION RATE |

ADMINISTRATIVE RESERVE RATE |

WORKFORCE DEVELOPMENT RATE |

4. TAX RATE: |

+ |

+ |

= |

5.TOTAL GROSS WAGES PAID TO ALL EMPLOYEES THIS QUARTER. ENTER “0” IF NO EMPLOYMENT : (Should be the same as your Wage Report total.)

6.WAGES PAID TO INDIVIDUAL WORKERS

THIS QUARTER IN EXCESS OF $34,100.00

FOR THIS CALENDAR YEAR:

7. TAXABLE WAGES: (Line 5 minus line 6)

8. TAX DUE: (Multiply line 7 by |

%) |

9. ADD

LATE 4% of tax due times the number of months (or portion thereof) after due date OR

PENALTY $20.00 times the number of months (or portion thereof) after due date.

10.TOTAL DUE FOR THIS QUARTER: (Line 8 plus line 9)

11.PRIOR BALANCE: SUBTRACT CREDIT AND/OR ADD BALANCE DUE: (Attach supporting documents)

12. TOTAL AMOUNT DUE: |

(Check box if payment was made by E.F.T.) |

|

|

|

|

Make checks payable to : Idaho Department of Labor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

13. NUMBER OF WORKERS IN THE PAY PERIOD THAT INCLUDED THE 12th OF THE MONTH. IF NO |

1st |

2nd 3rd |

|||

EMPLOYEES, ENTER ZERO. |

|

|

|

|

|

DO NOT LEAVE MONTHS BLANK. |

|

|

|

|

|

***CHECK THE FOLLOWING BOX IF YOU HAVE SUBMITTED THE WAGE REPORT ON TAPE OR DISKETTE RATHER THAN ON THE REVERSE SIDE (Form TAX026)

I CERTIFY THAT THE INFORMATION ON THIS REPORT IS TRUE AND CORRECT UNDER CRIMINAL PENALTY PROVISIONS OF THE IDAHO CODE SECTION

Signature |

Date |

Phone Number |

DATE MAILED:

OFFICE USE ONLY

DATE RECEIVED OR

POSTMARK