fill in nm form acd 31102 can be filled out easily. Just open FormsPal PDF editing tool to do the job without delay. To make our editor better and less complicated to use, we constantly design new features, bearing in mind suggestions coming from our users. Starting is simple! What you need to do is adhere to the next simple steps below:

Step 1: Open the PDF doc in our tool by clicking the "Get Form Button" above on this webpage.

Step 2: With our handy PDF tool, you could accomplish more than merely fill out blanks. Edit away and make your docs appear professional with customized text incorporated, or fine-tune the original input to excellence - all comes with an ability to incorporate any kind of graphics and sign the file off.

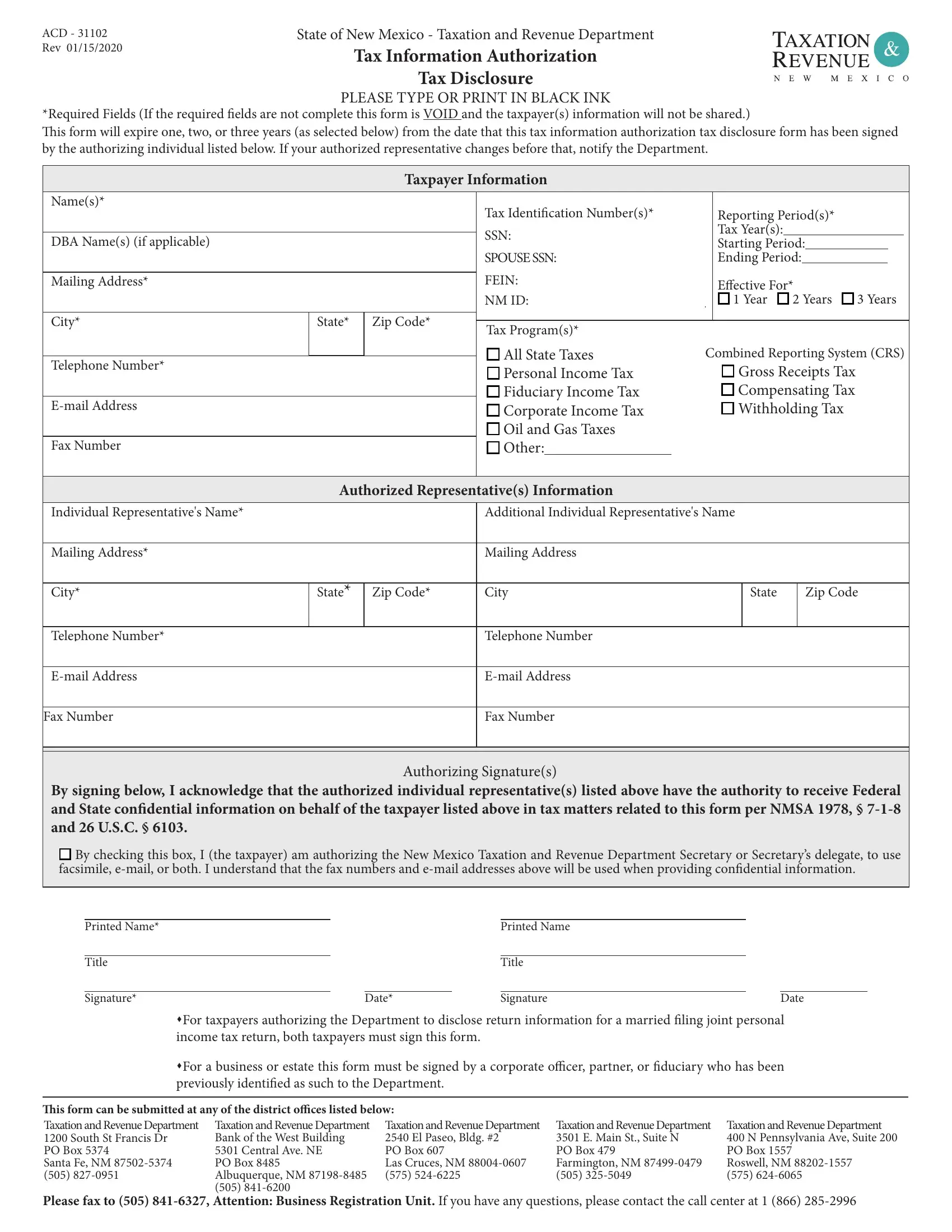

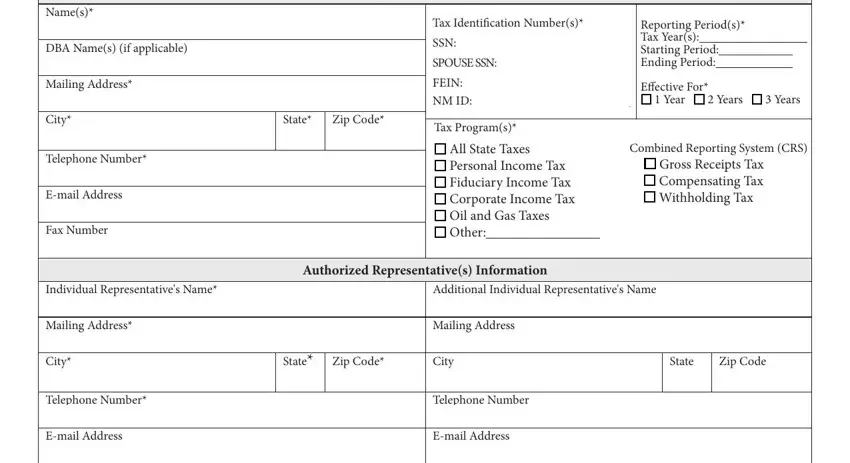

This PDF form will need some specific details; to ensure consistency, you should adhere to the suggestions down below:

1. Begin filling out your fill in nm form acd 31102 with a group of necessary fields. Consider all the important information and be sure absolutely nothing is missed!

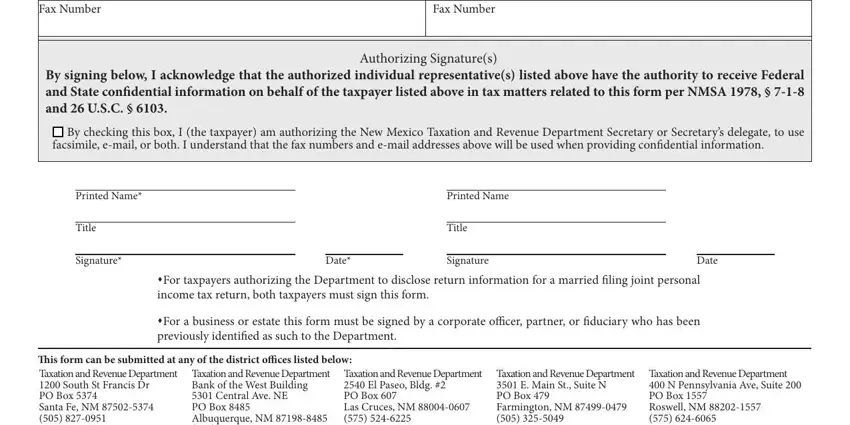

2. After this section is filled out, proceed to enter the applicable information in all these - Fax Number, Fax Number, By signing below I acknowledge, q By checking this box I the, Authorizing Signatures, Printed Name Title Signature, Date, Printed Name Title Signature, Date, sFor taxpayers authorizing the, sFor a business or estate this, This form can be submitted at any, Taxation and Revenue Department, Taxation and Revenue Department, and Taxation and Revenue Department E.

Regarding Printed Name Title Signature and Fax Number, ensure you double-check them in this current part. The two of these could be the most important ones in this page.

Step 3: Right after you have looked over the information in the blanks, simply click "Done" to finalize your form at FormsPal. After creating a7-day free trial account with us, you will be able to download fill in nm form acd 31102 or email it at once. The PDF document will also be readily accessible in your personal cabinet with your each and every change. FormsPal provides secure document editor devoid of personal data record-keeping or any sort of sharing. Be assured that your information is in good hands with us!