Handling PDF forms online is a breeze with this PDF tool. Anyone can fill in TDD here and use various other functions we provide. To retain our editor on the forefront of convenience, we work to put into action user-oriented features and improvements regularly. We are routinely thankful for any feedback - play a pivotal part in revolutionizing how you work with PDF docs. Here is what you will need to do to get started:

Step 1: Press the "Get Form" button at the top of this webpage to get into our PDF editor.

Step 2: As you launch the PDF editor, there'll be the form made ready to be filled in. In addition to filling in different blank fields, you could also do other sorts of things with the PDF, particularly adding your own text, changing the initial text, adding illustrations or photos, signing the document, and a lot more.

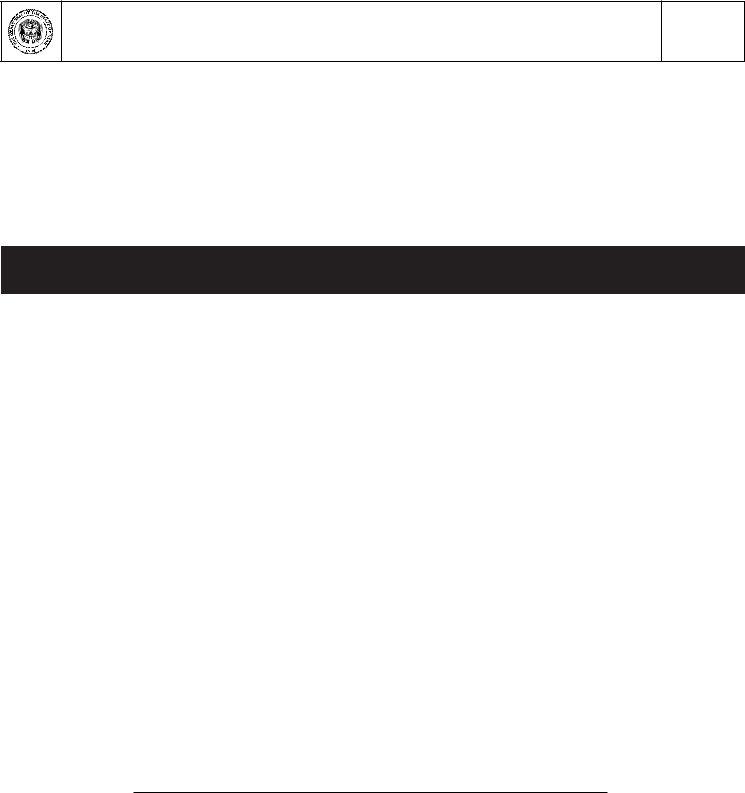

This PDF doc will need some specific information; to guarantee accuracy, be sure to consider the suggestions below:

1. The TDD needs certain information to be typed in. Ensure the subsequent blank fields are filled out:

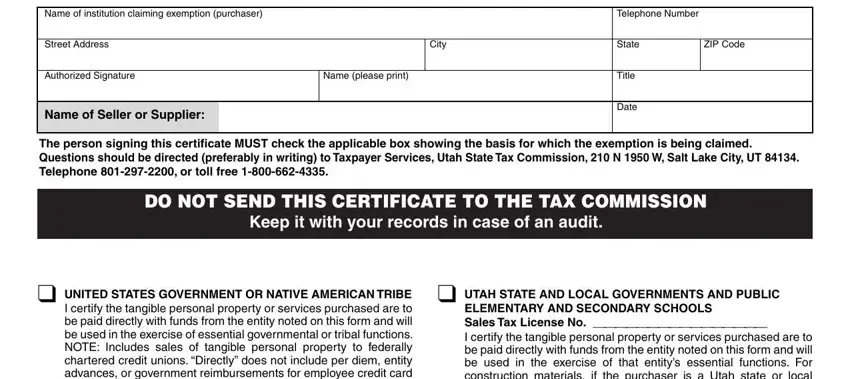

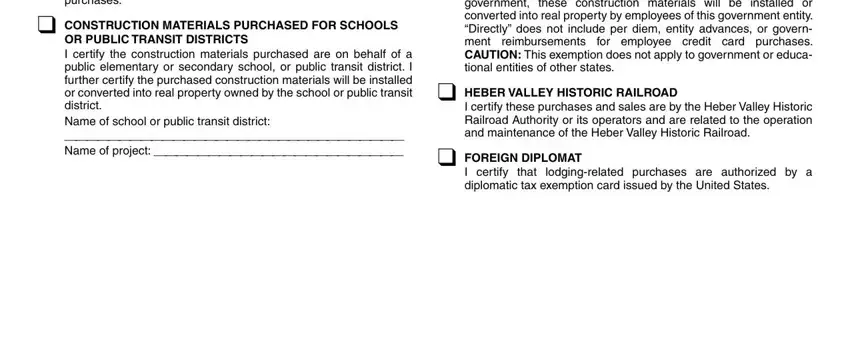

2. Once your current task is complete, take the next step – fill out all of these fields - UNITED STATES GOVERNMENT OR, CONSTRUCTION MATERIALS PURCHASED, OR PUBLIC TRANSIT DISTRICTS I, ELEMENTARY AND SECONDARY SCHOOLS, HEBER VALLEY HISTORIC RAILROAD, I certify these purchases and, FOREIGN DIPLOMAT, and I certify that lodgingrelated with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

People often make mistakes while filling out UNITED STATES GOVERNMENT OR in this section. You need to read twice whatever you enter right here.

Step 3: Make sure that your information is accurate and just click "Done" to progress further. Right after setting up a7-day free trial account at FormsPal, you will be able to download TDD or email it promptly. The document will also be readily available in your personal account page with all of your modifications. FormsPal offers protected document editor devoid of personal data recording or sharing. Feel at ease knowing that your information is in good hands with us!