tc ut forms can be filled in with ease. Just use FormsPal PDF editor to finish the job right away. The tool is constantly upgraded by our staff, receiving additional features and growing to be better. To get the process started, take these easy steps:

Step 1: Click on the "Get Form" button above on this page to open our PDF editor.

Step 2: Using this state-of-the-art PDF file editor, you are able to do more than just complete blank form fields. Express yourself and make your documents appear sublime with custom text added in, or tweak the file's original content to excellence - all comes along with the capability to add almost any graphics and sign the document off.

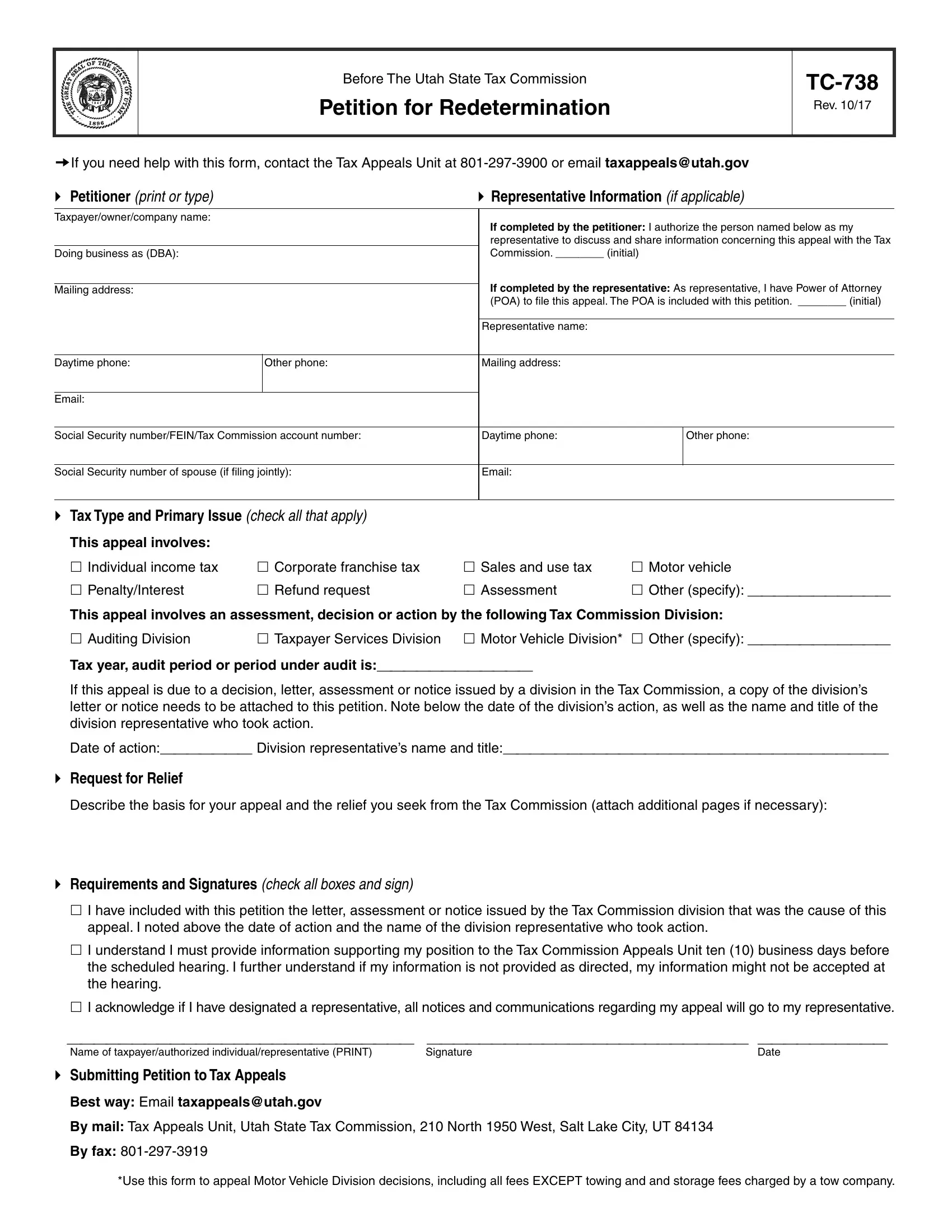

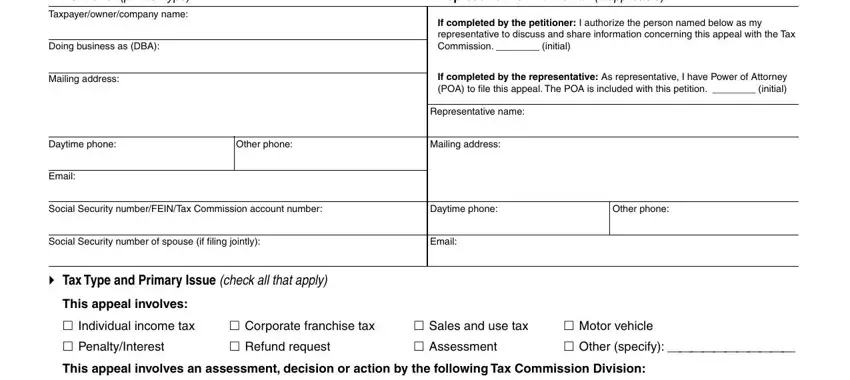

To be able to fill out this PDF document, make sure that you provide the information you need in each and every blank field:

1. Begin completing your tc ut forms with a selection of necessary blank fields. Get all of the required information and ensure there is nothing missed!

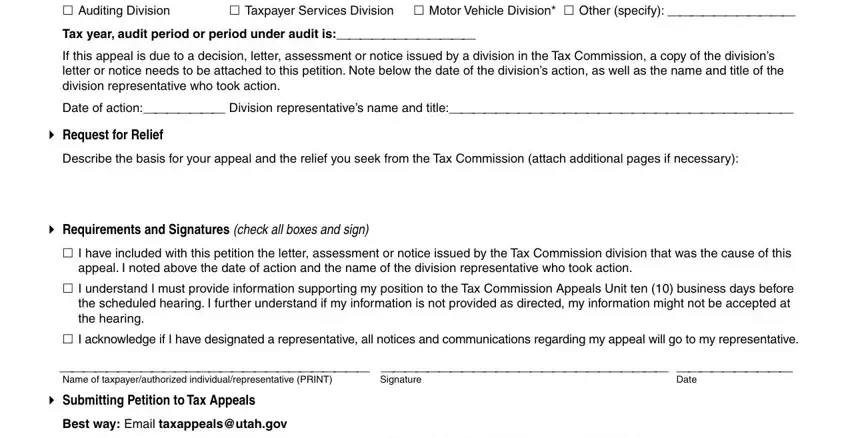

2. Given that the previous part is done, you're ready to add the necessary details in Auditing Division, Taxpayer Services Division Motor, Tax year audit period or period, If this appeal is due to a, Date of action Division, Request for Relief, Describe the basis for your appeal, Requirements and Signatures check, I have included with this petition, appeal I noted above the date of, I understand I must provide, I acknowledge if I have designated, Name of taxpayerauthorized, Signature, and Date so that you can move forward further.

People generally make some mistakes when filling out Describe the basis for your appeal in this section. Make sure you go over whatever you enter right here.

Step 3: Ensure that the information is correct and press "Done" to continue further. Right after registering a7-day free trial account at FormsPal, you will be able to download tc ut forms or send it via email without delay. The form will also be easily accessible through your personal cabinet with all of your adjustments. FormsPal guarantees your data privacy by using a secure method that in no way saves or shares any personal data typed in. Rest assured knowing your files are kept protected whenever you use our editor!