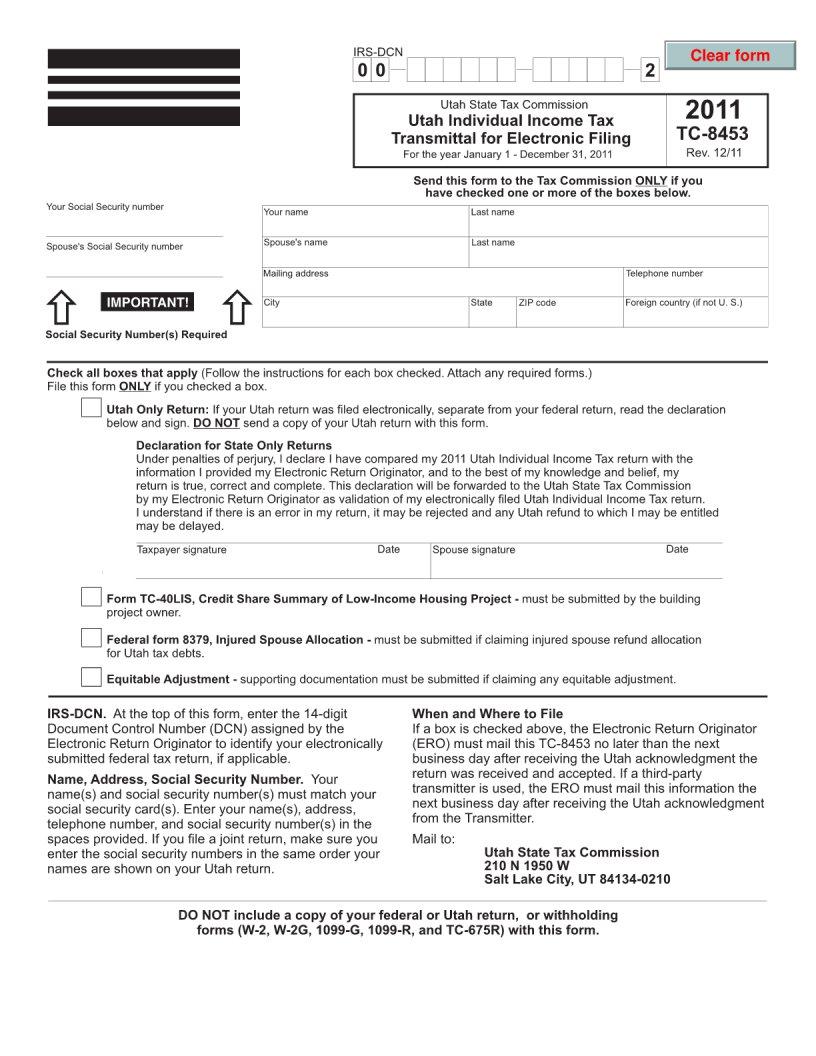

The TC-8453 form, recognized by the Utah State Tax Commission, serves a pivotal role for taxpayers who choose the electronic filing route for their Utah individual income tax returns for the tax year starting January 1 and ending December 31, 2011. This form acts as a transmittal document, which is required under specific conditions outlined by the tax authorities; it is only necessary if the taxpayer needs to report particular adjustments or claims that cannot be digitally processed. The form requests detailed information like Social Security numbers for both the individual and spouse, if applicable, alongside their names, mailing address, and contact numbers. It strictly stipulates that certain declarations, such as the 'Declaration for State Only Returns', must be signed under penalties of perjury, ensuring that all information aligns with what was provided to the Electronic Return Originator (ERO). Additionally, it outlines instructions for other critical attachments like Form TC-40LIS for low-income housing project credit share summaries or the federal form 8379 for injured spouse allocation. A crucial requirement is the inclusion of the IRS-DCN (Document Control Number), which links the submission to the federally filed return. The form is explicit about the timeline and procedure for submission, directing that it must be mailed by the ERO no later than the next business day after acknowledgment of receipt and acceptance from the Utah State Tax Commission. This form underscores the meticulousness required in electronic tax filing, ensuring accuracy and compliance with state tax laws.

| Question | Answer |

|---|---|

| Form Name | Tc 8453 Form Utah |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | tc 8453 tc 8453 form utah |