The Tennessee Department of Revenue offers a solution for businesses needing extra time to file their Franchise and Excise Tax Returns through the FAE 173 form, also known as the Application for Extension of Time to File Franchise, Excise Tax Return. This form plays a crucial role in helping entities manage their tax liabilities by providing an additional six months to file the required documents. To be eligible for this extension, taxpayers must adhere to certain requirements outlined by the department, including the submission of an estimated tax payment, calculated based on the previous year's tax liability or 90% of the current year's tax, whichever is less. It's important for taxpayers to enter accurate information such as their account number or FEIN/SSN and ensure that any payments due with the extension request are properly computed and submitted alongside the form. The procedure for requesting an extension distinguishes between those who have already met their payment obligations through quarterly estimated payments or overpayments from prior years, and those who need to make a payment to fulfill the requirement. Additionally, specific guidelines are provided for taxpayers filing as part of a consolidated group. Despite the relief offered by the extension, it's vital to note that interest will continue to accrue on any unpaid taxes until they are fully paid, and penalties may apply if the extension terms are not met or the tax return is filed after the extended due date. With meticulous adherence to the form's instructions and timely filing, taxpayers can navigate their tax responsibilities more effectively.

| Question | Answer |

|---|---|

| Form Name | Tennessee Fae 173 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | tn fae 173 instructions, tn 173 instructions, tennessee form fae 173 instructions, tn fae extension |

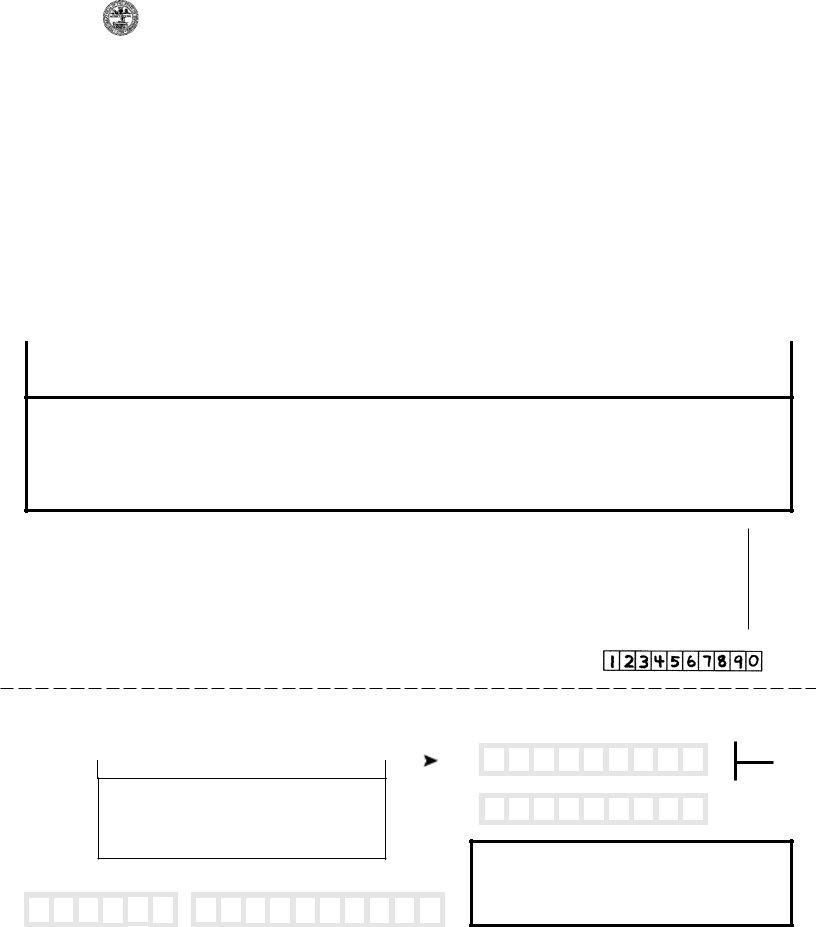

TENNESSEE DEPARTMENT OF REVENUE

APPLICATION FOR EXTENSION OF TIME TO FILE

FRANCHISE, EXCISE TAX RETURN

|

FAE |

Taxable Year |

|

Account No. |

FEINorSSN |

|

|

Beginning: |

|

|

|

|

|

|

173 |

Ending: |

|

Due Date |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

Make your check payable to the Tennessee |

|

|

|

|

|

|

|

|

|

|

|

|

|

Department of Revenue for the amount shown on |

|

|

TAXPAYER NAME AND MAILING ADDRESS |

|

|

Line 4 of the worksheet and mail to: |

|

|

|

|

|

|||

|

NAME ___________________________________________________________________ |

|

Tennessee Department of Revenue |

|||

|

|

|

|

|

|

|

|

BOX(STREET) ____________________________________________________________ |

|

Andrew Jackson State Office Bldg. |

|||

|

|

500 Deaderick Street |

||||

|

|

|

|

|

|

|

|

CITY ____________________________________________________________________ |

|

Nashville, TN 37242 |

|||

|

|

|

||||

|

STATE ________________ ZIP __________________________ |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

An extension of time of six (6) months will be granted, provided you meet the requirements outlined on the reverse side of the form.

REMINDERS

1)Enter account number or FEIN in the spaces provided.

2)Quarterly estimated tax payments made for the year, available tax credits, and overpayments from prior years should be deducted when computing the payment due.

3)If previous year's credit(s) and current year's estimated tax payment exceed estimated liability, enter 0 on Line 4.

4)Sign and date your return in the signature box below.

5)See reverse side for additional procedures for obtaining an extension of time.

WORKSHEETFORCOMPUTATIONOFEXTENSIONPAYMENT

1.EstimatedFranchiseTaxcurrentyear .....................................................................................................................

2.EstimatedExciseTaxcurrentyear ............................................................................................................................

3.Deduct: Prior year's overpayment, estimated payments and tax credits for current year ..........................................

4.Amount due with extension request (Lines 1 and 2 less Line 3; if Line 3 is greater than total

of Lines 1 and 2, enter 0 and return form without payment) ......................................................................................

Keep Upper Portion For Your Records

Return Copy Below - Detach Here

ROUND TO NEAREST DOLLAR

00

___________________________00

00

00

WRITENUMBERSLIKETHIS

FAE

173

TENNESSEE DEPARTMENT OF REVENUE

Application for Extension of Time to File Franchise, Excise Tax

Filing |

|

Extended |

|

Period |

|

DueDate |

|

|

|

|

|

ACCOUNT

FOROFFICEUSEONLY

If your account number is not preprinted or unknown, enter federal identification number/social security number.

(FEIN/

SSN)

AMOUNT DUE

(Line 4 of 00 worksheet)

Under penalties of perjury, I declare that I have examined this report, and to the best of my knowledge and belief, it is true, correct, and complete.

________________________________________ |

_________ |

______________ |

|||

Taxpayer's Signature |

|

Date |

|

|

Title |

________________________________________ |

_________ |

______________ |

|||

Tax Preparer's Signature |

|

Date |

|

Telephone |

|

________________________________ |

____________ |

_________ |

_______ |

||

Preparer's Address |

City |

|

|

State |

ZIP |

INTERNET |

PROCEDURES FOR OBTAINING AN EXTENSION OF TIME

NOTE: This form can be filed electronically free of charge at apps.tn.gov/fnetax

1.Required Payment:

•Payments equal to the lesser of 100% of the prior year tax liability or 90% of the current year tax liability must be made by the original due date.

•If the prior tax year covered less than twelve months, the prior period tax must be annualized when calculating the required payment.

•If there was no liability for the prior year, the required payment is $100.

•Quarterly estimated payments, prior year overpayments and any other

2.Extension requests should be made as follows:

•If you are not required to make a payment because you have already made sufficient payments, either the state form or a copy of your federal extension request can be submitted. The form or copy of the federal extension need not be filed on the original due date of the return. Instead, it should be attached to the return itself, which is to be filed on or before the extended due date.

•If a payment is needed to meet the payment requirement and you do not file your federal return as part of a consolidated group, either the state form or a copy of your federal extension request can be submitted. In this case, the form or copy of your federal extension must be filed with the extension payment on or before the original due date of the return.

•If a payment is required and you file your federal return as part of a consolidated group, you must use this form or file an extension request electronically. This form or the electronic version of this form must be filed with the extension payment on or before the original due date of the return.

3.Other important information:

•Penalty will be computed as though no extension had been granted if, (1) the amount paid on or before the original due date does not satisfy the payment requirement indicated above, or (2) the return is not filed by the extended due date.

•An approved extension does not affect interest. Interest will be computed on any unpaid tax from the original due date of the return until the date the tax is paid.