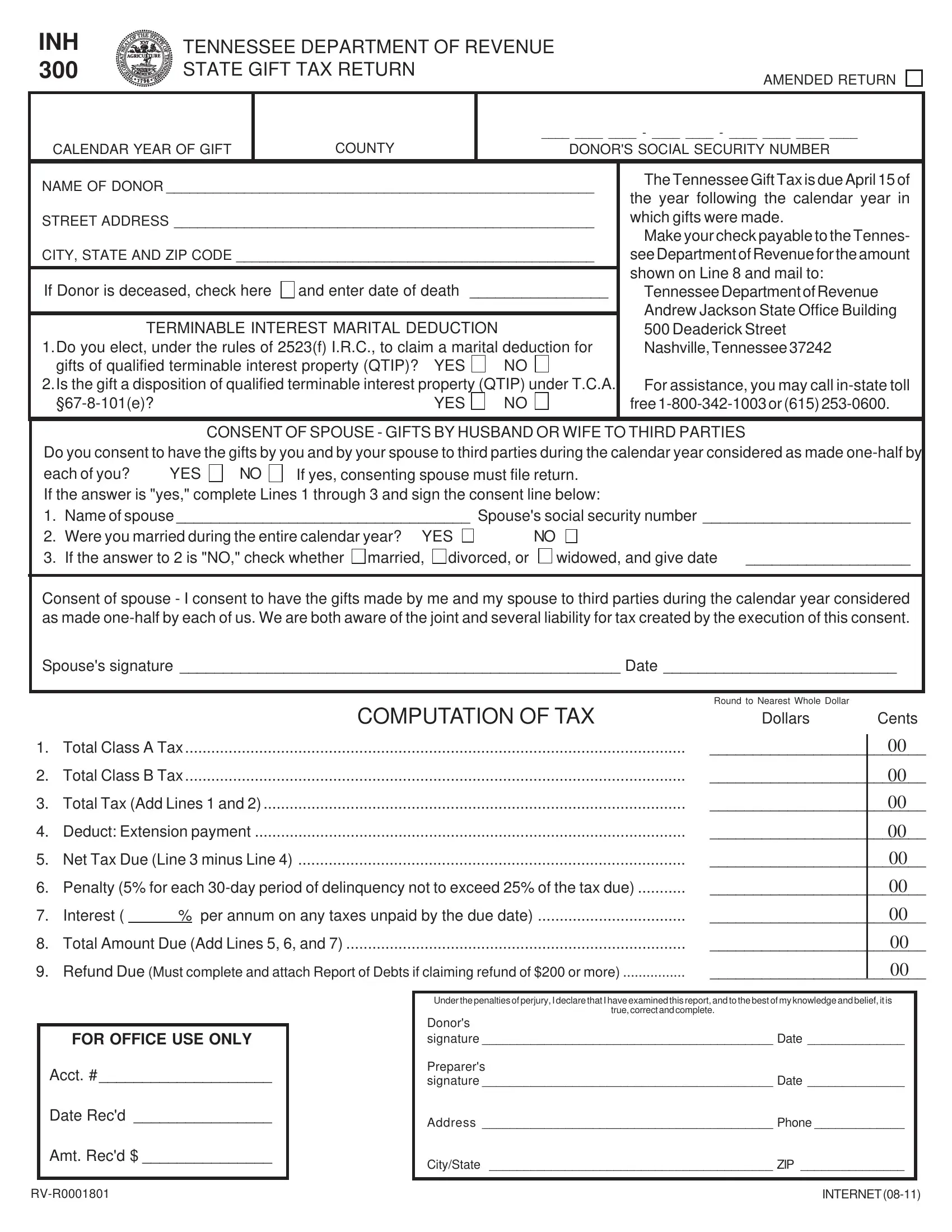

INSTRUCTIONS

WHO MUST FILE A RETURN:

Provided that the total value of all gifts during the calendar year exceeds the applicable exemption levels, the State Gift Tax Return must be filed upon transfer by gift by any person of the following property or any interest therein:

(a)When the transfer is from a resident of this state:

(1)Real property situated in Tennessee.

(2)Tangible personal property, except that which is actually situated outside of Tennessee.

(3)All intangible personal property.

(b)When the transfer is from a nonresident of this state:

(1)Real property situated in Tennessee.

(2)Tangible personal property which is actually situated in Tennessee.

(c)Property in which a person holds a qualifying income interest for life, which is included for taxation pursuant to §67-8-101(e) Tennessee Code Annotated.

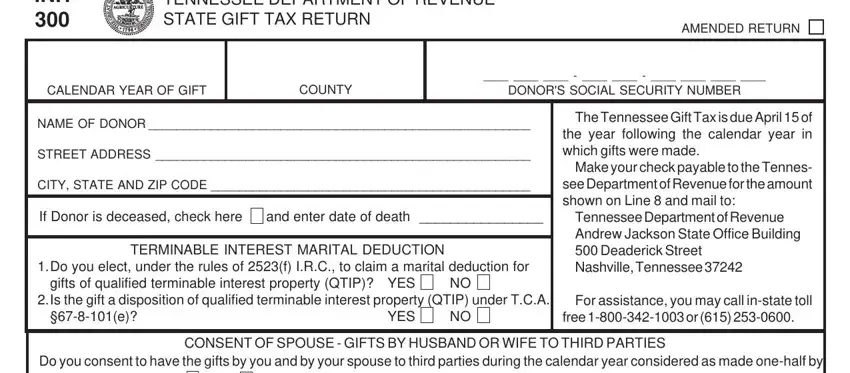

CLASSIFICATION OF DONEES:

CLASS A - Husband, wife, son, daughter, lineal ancestor, lineal descendant, brother, sister, son-in-law, daughter-in-law, or step- child. For purposes of the Gift Tax, a person who is related to the donor as a result of legal adoption shall be considered to have the same relationship as a natural lineal ancestor, lineal descendant, brother, sister, or step-child. If a person has no child or grandchild, a niece or nephew of such person and the issue of such niece or nephew shall be a class A donee, for transfers made on or after January 1, 1996.

CLASS B - Any other relative, person, association, or corporation not specifically designated in Class A.

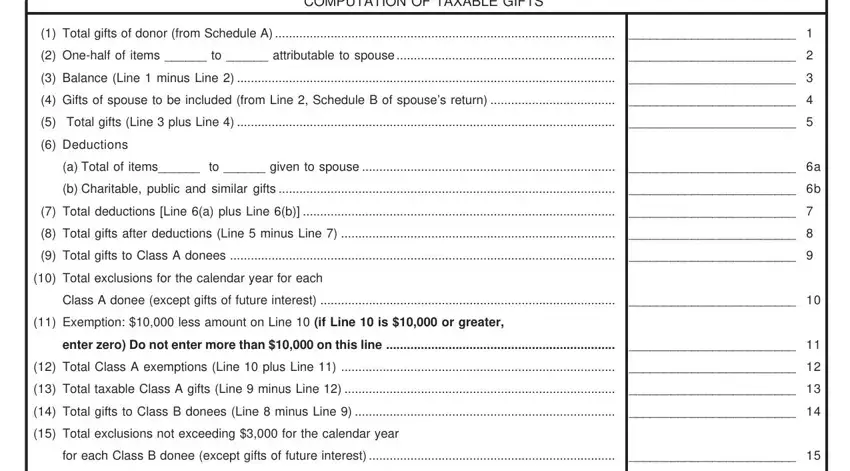

EXEMPTIONS:

(a)There shall be allowed against the net gifts made during any calendar year a maximum single exemption of ten thousand dollars ($10,000) against that portion of the net gifts going to donees of class A, and maximum single exemption of five thousand dollars ($5,000) against that portion of the net gifts going to the donees of Class B.

(b)In the event the aggregate net gifts for any calendar year exceed the allowable maximum single exemptions, the tax shall be applicable only to the extent that the gifts, (other than gifts of future interest in property) to each donee exceed the following amounts:

CLASS A - Gifts made before 2002 - The sum of $10,000

CLASS A - Gifts made in 2002 through 2005 - The sum of $11,000 CLASS A - Gifts made in 2006 through 2008 - The sum of $12,000 CLASS A - Gifts made in 2009 and after - The sum of $13,000 CLASS B - The sum of $3,000

"Net gifts" mean that total amount of gifts made during any calendar year less allowable deductions.

IF THE TOTAL VALUE OF ALL GIFTS MADE BY A PERSON DURING ANY CALENDAR YEAR DOES NOT EXCEED THE EXEMPTION LEVELS, NO GIFT TAX RETURN IS REQUIRED OF SUCH PERSON, UNLESS CONSENTING TO SPLIT GIFTS.

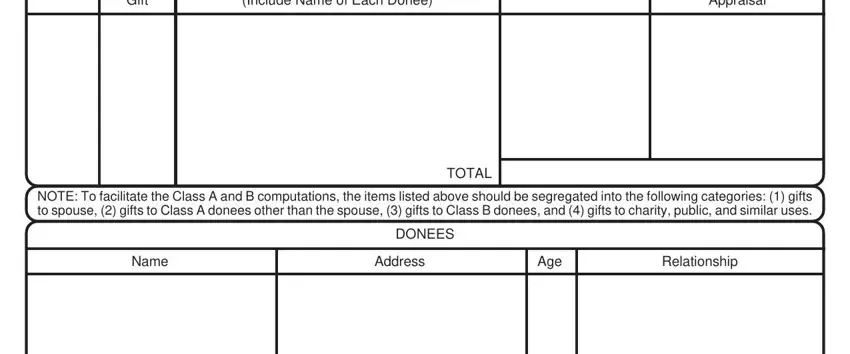

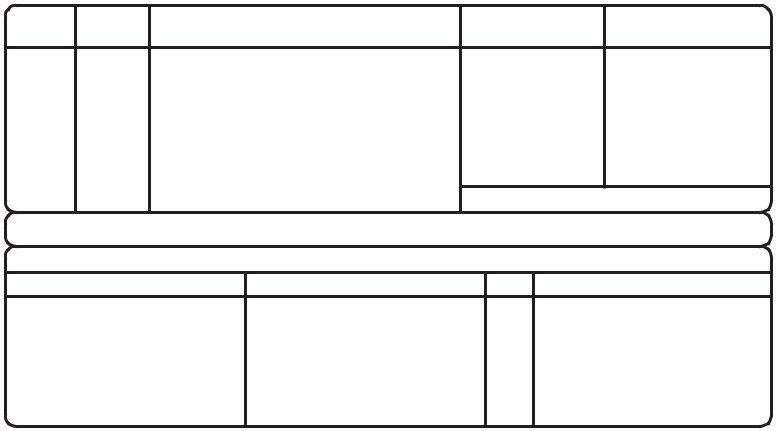

SCHEDULE A

Description of Gift - See Instructions

(Include Name of Each Donee)

TOTAL

NOTE: To facilitate the Class A and B computations, the items listed above should be segregated into the following categories: (1) gifts to spouse, (2) gifts to Class A donees other than the spouse, (3) gifts to Class B donees, and (4) gifts to charity, public, and similar uses.

DONEES

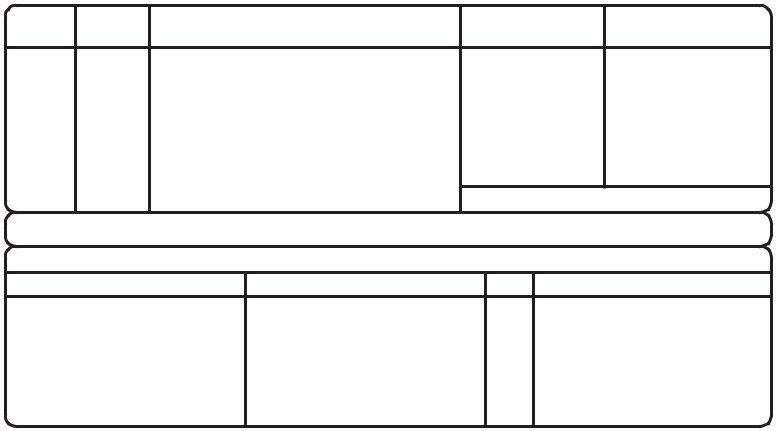

SCHEDULE B

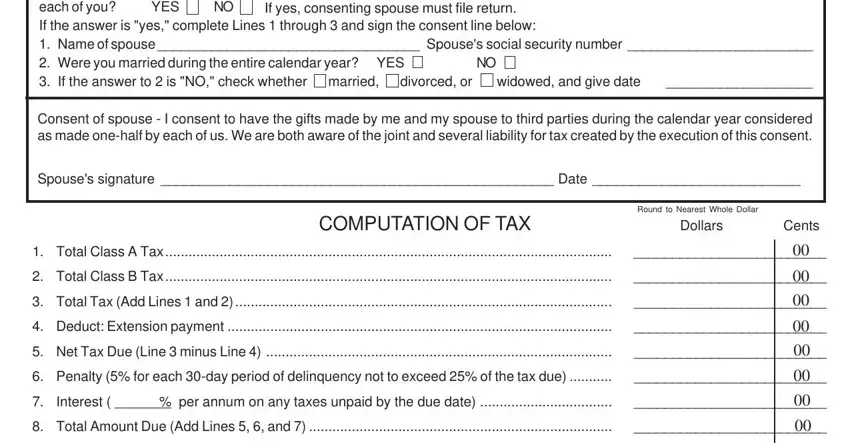

COMPUTATION OF TAXABLE GIFTS

(1)Total gifts of donor (from Schedule A) ..................................................................................................

(2)One-half of items ______ to ______ attributable to spouse ...............................................................

(3)Balance (Line 1 minus Line 2) .............................................................................................................

(4)Gifts of spouse to be included (from Line 2, Schedule B of spouse’s return) ....................................

(5)Total gifts (Line 3 plus Line 4) .............................................................................................................

(6)Deductions

(a)Total of items______ to ______ given to spouse .........................................................................

(b)Charitable, public and similar gifts .................................................................................................

(7)Total deductions [Line 6(a) plus Line 6(b)] ..........................................................................................

(8)Total gifts after deductions (Line 5 minus Line 7) ...............................................................................

(9)Total gifts to Class A donees ...............................................................................................................

(10)Total exclusions for the calendar year for each

Class A donee (except gifts of future interest) .....................................................................................

(11)Exemption: $10,000 less amount on Line 10 (if Line 10 is $10,000 or greater,

enter zero) Do not enter more than $10,000 on this line ..................................................................

(12)Total Class A exemptions (Line 10 plus Line 11) ...............................................................................

(13)Total taxable Class A gifts (Line 9 minus Line 12) ..............................................................................

(14)Total gifts to Class B donees (Line 8 minus Line 9) ...........................................................................

(15)Total exclusions not exceeding $3,000 for the calendar year

for each Class B donee (except gifts of future interest) .......................................................................

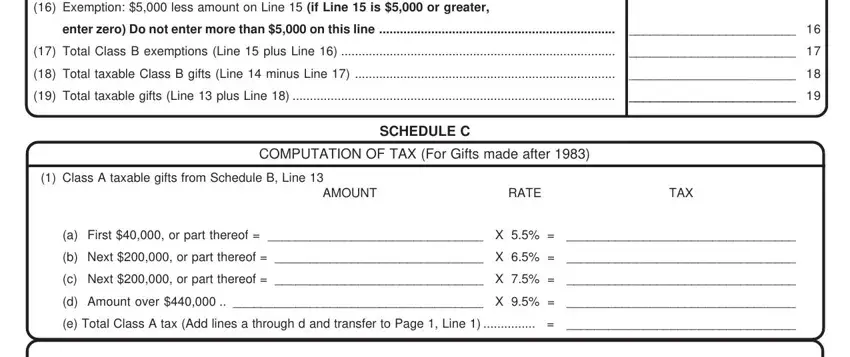

(16)Exemption: $5,000 less amount on Line 15 (if Line 15 is $5,000 or greater,

enter zero) Do not enter more than $5,000 on this line ....................................................................

(17)Total Class B exemptions (Line 15 plus Line 16) ...............................................................................

(18)Total taxable Class B gifts (Line 14 minus Line 17) ...........................................................................

(19)Total taxable gifts (Line 13 plus Line 18) .............................................................................................

________________________ |

1 |

________________________ |

2 |

________________________ |

3 |

________________________ |

4 |

________________________ |

5 |

________________________ |

6a |

________________________ |

6b |

________________________ |

7 |

________________________ |

8 |

________________________ |

9 |

________________________ |

10 |

________________________ |

11 |

________________________ |

12 |

________________________ |

13 |

________________________ |

14 |

________________________ |

15 |

________________________ |

16 |

________________________ |

17 |

________________________ |

18 |

________________________ |

19 |

SCHEDULE C

COMPUTATION OF TAX (For Gifts made after 1983)

(1) Class A taxable gifts from Schedule B, Line 13 |

|

|

AMOUNT |

RATE |

TAX |

(a)First $40,000, or part thereof = _______________________________ X 5.5% = _________________________________

(b)Next $200,000, or part thereof = ______________________________ X 6.5% = _________________________________

(c)Next $200,000, or part thereof = ______________________________ X 7.5% = _________________________________

(d)Amount over $440,000 .. ____________________________________ X 9.5% = _________________________________

(e) Total Class A tax (Add lines a through d and transfer to Page 1, Line 1) |

............... = |

_________________________________ |

(2) Class B taxable gifts from Schedule B, Line 18 |

|

|

AMOUNT |

RATE |

TAX |

(a)First $50,000, or part thereof = _______________________________ X 6.5% = _________________________________

(b)Next $50,000, or part thereof = _______________________________ X 9.5% = _________________________________

(c)Next $50,000, or part thereof = _______________________________ X 12.0% = _________________________________

(d)Next $50,000, or part thereof = _______________________________ X 13.5% = _________________________________

(e)Amount over $200,000 .. ____________________________________ X 16.0% = _________________________________

(f) Total Class B tax (Add lines a through e and transfer to Page 1, Line 2) |

= _________________________________ |

INTERNET (08-11)

INSTRUCTIONS

DEDUCTION:

(a)Marital Deductions - There shall be allowed as a deduction in computing taxable gifts for a calendar year an amount equal to the gift(s) made by a donor to his/her spouse, provided they were married to each other at the time such gift(s) were made, and further provided that the property so transferred is not either of the following:

(1)Characterized as being a terminable interest; however, see (QTIP) election below.

(2)An interest in unidentified assets.

(b)Election to Deduct Qualified Terminable Interests - You may elect to claim a marital deduction for qualified terminable property or property interests. The election is irrevocable. The effect of the election is that the property (interest) will be treated as passing to the spouse and will not be treated as a nondeductible terminable interest. All of the other martial deduction requirements must still be satisfied before you may make this election.

Qualified terminable interest property is property that: (1 ) passes from the donor; and

(2) in which the spouse has qualifying income interest for life.

The spouse has a qualifying income interest for life if the spouse is entitled to all of the income for the property payable annually or at more frequent intervals, and during the spouse’s lifetime no person has a power to appoint any part of the property to any person other than the spouse.

In order to claim this election, you must check “yes” in the appropriate box on the face of the return. On Schedule A, you should group the property interests for which you made the election separately and mark them “Qualified Terminable Interest Property.” (QTIP)

(c)Charitable Deduction - There shall be allowed as a deduction in computing taxable gifts for a calendar year those gifts transferred to the United States, the State of Tennessee, or to any political subdivision thereof, any public institution herein for exclusively public purpose, or any corporation, society, association or trust therein, or in a state which grants a like exemption to such institutions in Tennessee formed for charitable, educational, scientific, or religious purposes.

DATES AND VALUATION:

The valuation of all property, real and personal, shall be appraised at its full and true value as of the date of the making of the gift.

INFORMATION REQUIRED:

1.REAL ESTATE - describe and identify each parcel so that it may be readily located for inspection and valuation. If formal appraisals are accomplished, attach a copy of the appraisal to the tax return. For city properties, state the street and number, ward, subdivision, block and lot identification numbers or letters. For rural properties, state the township, range, landmarks, number of acres and the road or street name upon which the property is located. For all improved properties, include a short statement of the type and description of the improvement(s). State the gross monthly rental for all parcels of real estate that are rented. Attach a copy of the lease for all leased parcels.

2.STOCKS AND BONDS - the description of stocks should indicate the number of shares, whether common or preferred price per share, exact name of corporation and, if not listed on a stock exchange, the address of the principal business office. If stock is listed, state the principal stock exchange upon which sold. The description of bonds should include quantity and denomination, name of the obligor, kind of bond, date of maturity, interest rate, and interest due dates. State the exchange upon which the bonds are listed, or if unlisted, the principal business office address of the company or municipality.

3.NON-LISTED CORPORATIONS, PARTNERSHIPS, AND PROPRIETORSHIPS - attach copies of the balance sheets and income statements for the five full years ending nearest to the date of the gift. Also, attach a statement which sets forth the criteria considered and the valuation method used in determining the full and true value.

4.NOTES AND MORTGAGES RECEIVABLE - indicate the face value, unpaid balance, date of the note or mortgage, date of maturity, name of maker, interest rate, interest dates, and a brief description of the property mortgaged.

5.ARTISTIC OR INTRINSICALLY VALUABLE GIFTS - attach a copy of the expert appraisal of the gift items.

6.GIFTS TO A TRUST - attach a copy of the trust agreement or governing instrument.

7.PARTIAL CONSIDERATION GlFTS-where property is transferred for less than an adequate and full consideration in money or money’s worth, then the amount by which the value of the property exceeds the value of the consideration shall be deemed a gift, and shall be included in computing the amount of gifts made during the calendar year.

8.POWERS OF APPOINTMENT - the exercise or release of a power of appointment may constitute a gift by the individual possessing such a power. In any case where such action has been taken, see §67-8-101 (c) Tennessee Code Annotated.

9.ACTUARIAL VALUATION OF FUTURE AND LlMITED ESTATES - computation of the values of any future, contingent or limited estate, income interest, or annuity must be attached to the tax return. Under §67-8-107(b) Tennessee Code Annotated, such interest shall, so far as possible, be determined by the rule, method, and standard of mortality in use by the Internal Revenue Service at the time of the gift.

10.OTHER GIFTS - all other gifts should be fully described so that the value placed on the gift can be verified.

11.CONSENT OF SPOUSE - gifts made during the calendar year by the donor and spouse to third parties may be considered as being made one-half by each. This election can be made only if the donor and spouse are married at the time of the gift and do not remarry during the remainder of the year. The "Consent of Spouse" part of the gift tax return, even if Non-Taxable, must be completed in its

entirety, to perfect the election for gift splitting.