The Texas 05 164 form, officially known as the Texas Franchise Tax Extension Request, plays a pivotal role for businesses operating within the state. It essentially allows companies more time to file their necessary franchise tax documents, providing a critical buffer for those that need extra time to ensure their filings are accurate and complete. Marked with Tcode 13258, this form outlines several important details, such as the taxpayer number, report year, and the due date, which for the year referenced, was May 15, 2014. Notably, it accommodates both individual businesses and combined groups (though the latter must submit an additional form, the 05-165, for a comprehensive extension request). Special attention is drawn to companies engaged in substantial financial transactions, as those who paid $10,000 or more in franchise taxes during the previous fiscal year are mandated to execute their tax payments electronically. To aid in the accuracy and validity of the data submitted, the form requires the taxpayer to declare that all information provided is true to the best of their knowledge. This is a proactive measure to ensure transparency and reliability in tax reporting. Companies are directed to send their completed forms to the Texas Comptroller of Public Accounts, with additional resources and instructions available online for those who may have questions or require further clarifications on the process.

| Question | Answer |

|---|---|

| Form Name | Texas Form 05 164 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | form 05 164, texas franchise extension, 05 164, tx 05 164 |

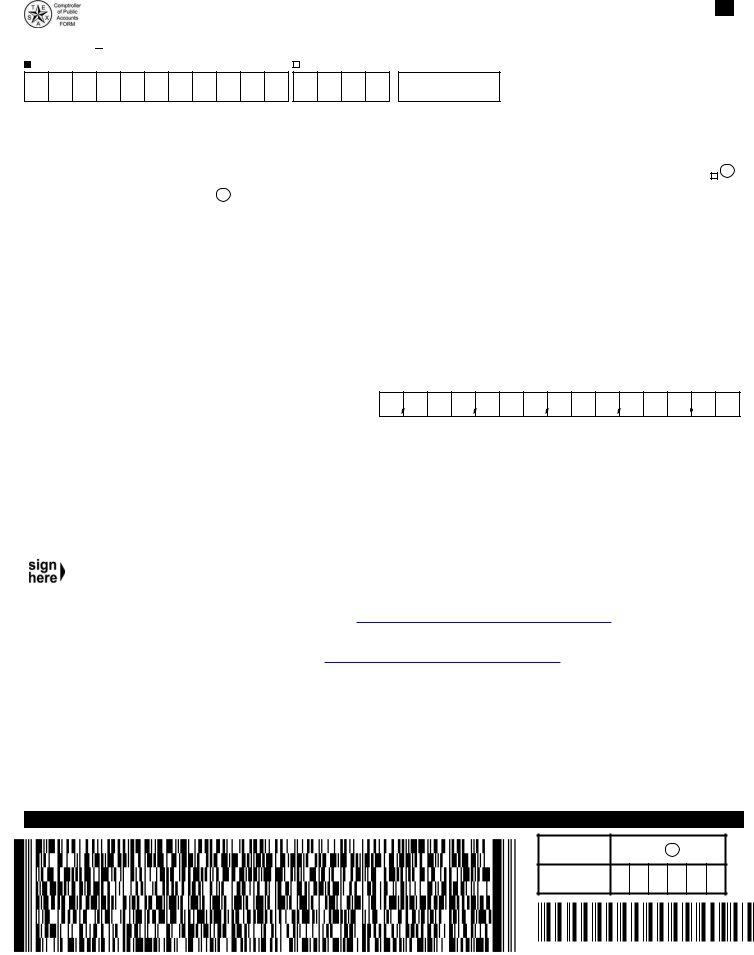

Texas Franchise Tax Extension Request

Tcode 13258 AnnualFranchise

Taxpayer number |

|

Report year |

Due date |

|

2 0

1 4

05/15/2014

Taxpayer name |

|

|

|

|

Secretary of State file number |

||

|

|

|

|

|

or Comptroller file number |

||

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

City |

State |

Country |

ZIP Code |

Plus 4 |

Blacken circle if the |

||

|

|

|

|

|

address has changed |

|

|

|

|

|

|

|

|

||

Blacken circle if this is a combined report |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If this extension is for a combined group, you must also complete and submit Form

Note to mandatory Electronic Fund Transfer(EFT) payers:

When requesting a second extension do not submit an Affiliate List Form

1. Extension payment (Dollars and cents) |

1. |

|

|

||

|

Print or type name |

Area code and phone number |

||||

|

|

( |

) |

- |

|

|

|

|

|

||

I declare that the information in this document and any attachments is true and correct to the best of my knowledge and belief. |

|

Mail original to: |

|||

Texas Comptroller of Public Accounts |

|||||

|

|

||||

|

Date |

|

P.O. Box 149348 |

||

|

|

|

Austin, TX |

||

|

|

|

|

|

|

If you have any questions regarding franchise tax, you may contact the Texas Comptroller's field office in your area or call

Instructions for each report year are online at

Taxpayers who paid $10,000 or more during the preceding fiscal year (Sept. 1 thru Aug. 31) are required to electronically pay their franchise tax.

For more information visit www.window.state.tx.us/webfile/req_franchise.html.

Texas Comptroller Official Use Only

VE/DE

PM Date