Form 25-104 (Back)(Rev.1-14/21)

Inst uctio |

f r Completing the Texas Annual Insurance T x Report |

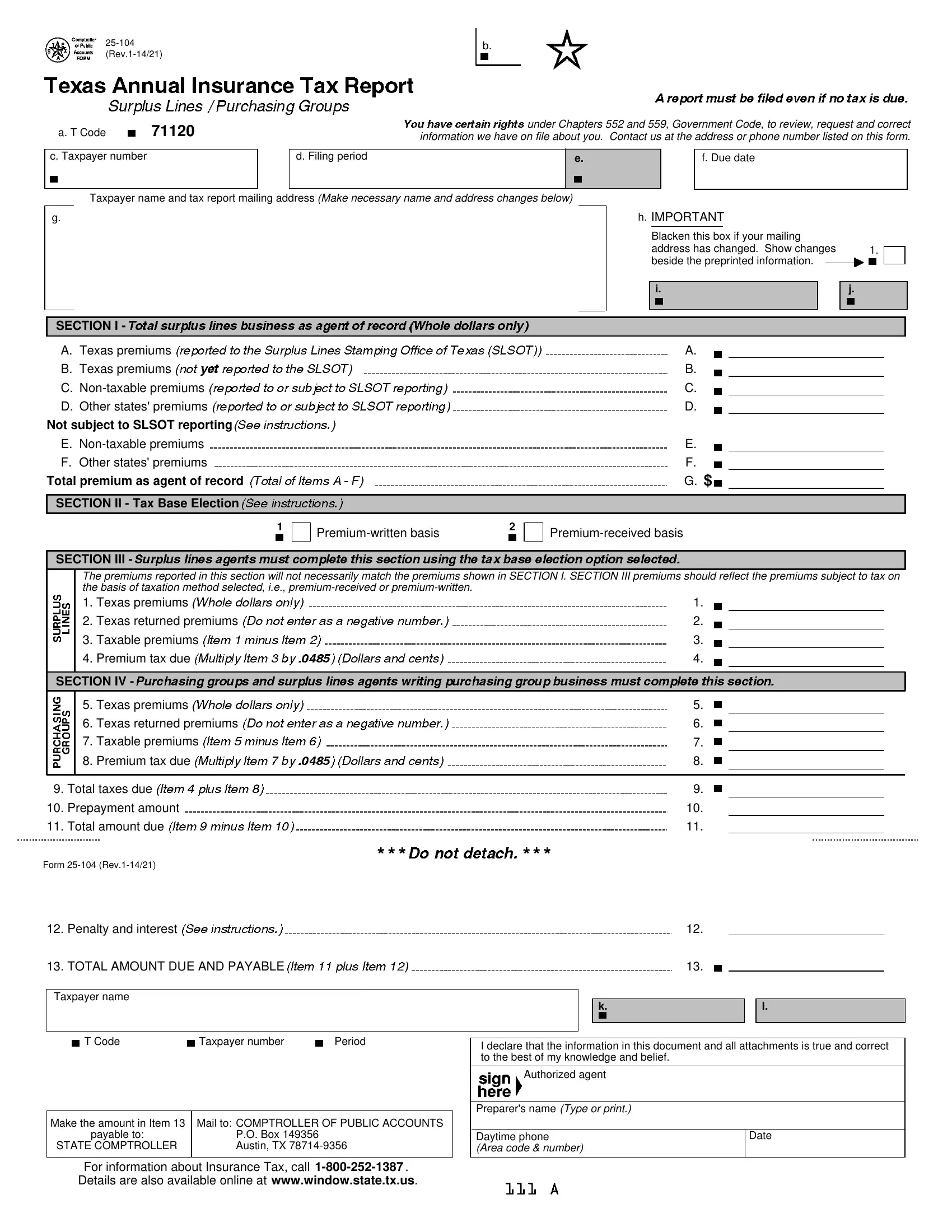

Who Must File |

|

All surpl lines ag ts licen ed Texas and a |

purchasi gr ups registered in Texas must file this report, even if no tax is due. |

When to File

he report and payment are d on March 1 of the year following the tax year.

Section I

he Non-admitted and Rein urance form Act of 2010 went into effect July 21, 2011. This Act created a split year for tax-reporting purposes to reflect busine s under T xas law rior to July 21 and changes in Texas law to comply with the federal law for policies effective on or after July 21, 2011.

Item A - Texas Pr miums - Enter the total Texas premiums for policies that were effective prior to July 21, 2011 (net of return premiums) that were reported to the SLSOT during the tax year. Enter the total amount of premiums for policies that were effective on or after July 21, 2011 (net of return premiums) that have been reported to the SLSOT where Texas is the home tate of the insured.

Item - Texas Pr miums - Enter the total Texas premiums for policies that were effective prior to July 21, 2011 (net of return premiums) that have NOT YET been reported to the SLSOT during the tax year. Ent r he total amount of premiums for policies that were effective on or after July 21, 2011 (net of return premiums) that have NOT YET been reported to the SLSOT where Texas is the home state of the insured.

Item C - Non-taxable Premiums - Enter the total non-taxable premiums for policies that were effective prior to July 21, 2011 (net of return premiums) that cover a risk located

entirely Texas and the non-taxable Texas premiums for a multi-state policy. Both of these categories must be reported to the SLSOT. Enter the total amount of remiums for polices that were effective on or after July 21, 2011 (net of return premiums) where Texas is the home state of the insured and that are non-taxable: either

the premiums are exem t from taxation or are preempted from taxation.

Item D - Oth r States' Premi ms - Enter the total premiums for policies that were effective prior to July 21, 2011 (net of return premiums) allocated to all other states from a multi-state policy that includes coverage for Texas. This category must be reported to the SLSOT. For multi-state policies in which Texas is the home state of the ins r d that have an effective date on or after July 21, 2011, report the total policy premium as Texas premium in Item A. Report to the SLSOT the amount of the policy remium that is applied to risks located outside of Texas, using the new category called "Breakdown of States Summary." This will ensure that Texas tax is charged on

100% of the policy premium, but also allows the monitoring of the amount of non-Texas premium for multi-state policies when Texas is the home state of the insured. Item E - Non-taxable Premiums - This category does not apply to policies that are effective on or after July 21, 2011. For policies that are effective prior to July 21, 2011,

enter the premiums (net of return premium ) that are 100% exempt or pre-empted and cover risks entirely in states other than Texas.

Item F - Oth r States' Premi ms - This category does not apply to policies that are effective on or after July 21, 2011. For policies that are effective prior to July 21, 2011, enter the to al taxable premiums (net of return premiums) allocated to other states for policies that exclusively cover states other than Texas.

Section II

lines agents who received a license during the reporting year must elect one of the tax base options shown.

Rle 34 TAC, Sec. 3.822, provides specific information on the requirements for reporting surplus lines tax. Agents have the option of reporting tax using a premium-written or premium-receiv d basis and may change their election every four years. An agent who changes from a premium-received to a premium-written basis will owe taxes on all outstanding rec ivables as of January 1 of the year of the change. If an agent fails to file the election, the agent will be subject to tax on a premium-written basis.

Section III

These premiums will not necessarily match the premiums shown in Section I, because they are based on the reporting method chosen. The term "premium" includes all

premiums, premi m deposits, membership fees, registration fees, assessments, dues and any other consideration for surplus lines insurance. Texas premiums include: premiums written or received for policies that are effective prior to July 21, 2011 that cover risks in this state;

premiums written or received for new or renewal Texas or multi-state policies that are effective on or after July 21, 2011 when Texas is the home state of the insured and any endorsements on these policies.

Exempt premiums are premiums for a surplus lines policy that covers risks or exposures that are properly allocated to federal waters, international waters, or risks or exposures that are under the jurisdiction of a foreign government. Effective Jan. 1, 2014, premiums on risks or exposures under ocean marine insurance coverage of sto ed or -transit baled cotton for export are exempt from surplus lines premium tax.

Feder l preemptions to state taxation for surplus lines insurance include premiums for policies that are issued to the following entities:

the Federal Deposit Insurance Corporation (FDIC), when it acts as the receiver of a failed financial institution that holds the property being insured; the National Credit Union Administration;

a federally chartered credit union; and

Indian Tribal Nations (see Publication 94-142).

Texas returned premiums - Report the unearned portion of the premium that is credited or refunded to a policyholder as a result of cancellation or premium adjustment prior to the policy expiration. An age t reporting on the premium received basis will not have returned premiums.

Endorsements and audits on surplus lines insurance policies must be reported based on the date of the endorsement or audit, not the date of the original policy. The tax for endorsements and audits that generate return premiums due a policyholder must be calculated using the tax rate that was originally charged.

Section IV

Purchasing groups obtaining coverage from insurers licensed in Texas or surplus lines agents licensed in Texas do NOT owe tax on this report, but must a zero report. Purchasing groups obtaining coverage independently through negotiations and procurement occurring outside Texas are subject to tax on the premiums paid for coverage of their members located in Texas.

Check this box if insurance was obtained from a licensed insurance company or a licensed or registered risk retention group.