Should you would like to fill out Texas Form Ap 175, you don't have to install any programs - just make use of our PDF tool. Our team is relentlessly working to develop the editor and ensure it is much faster for clients with its multiple features. Enjoy an ever-evolving experience now! With just a few easy steps, you can start your PDF journey:

Step 1: Press the orange "Get Form" button above. It'll open up our tool so that you can begin completing your form.

Step 2: This tool will let you change your PDF in a range of ways. Improve it with your own text, correct existing content, and put in a signature - all at your fingertips!

Filling out this form requires attentiveness. Ensure each field is filled in accurately.

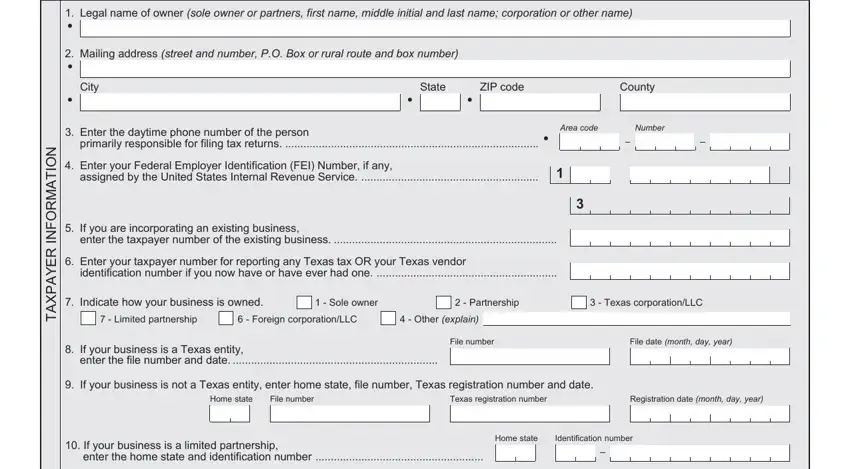

1. Complete the Texas Form Ap 175 with a number of essential fields. Consider all of the necessary information and make certain nothing is left out!

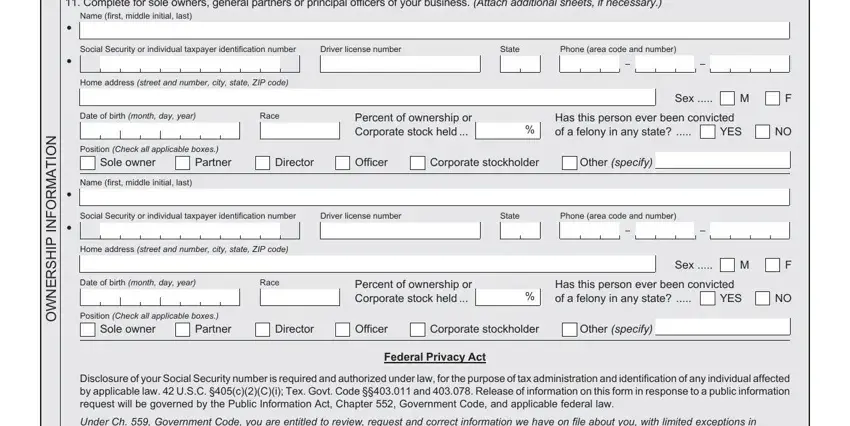

2. Once this section is completed, go to enter the suitable details in all these - Complete for sole owners general, Name first middle initial last, cid, cid, cid, cid, Social Security or individual, Driver license number, State, Phone area code and number, Home address street and number, Date of birth month day year, Race, Position Check all applicable boxes, and Percent of ownership or Corporate.

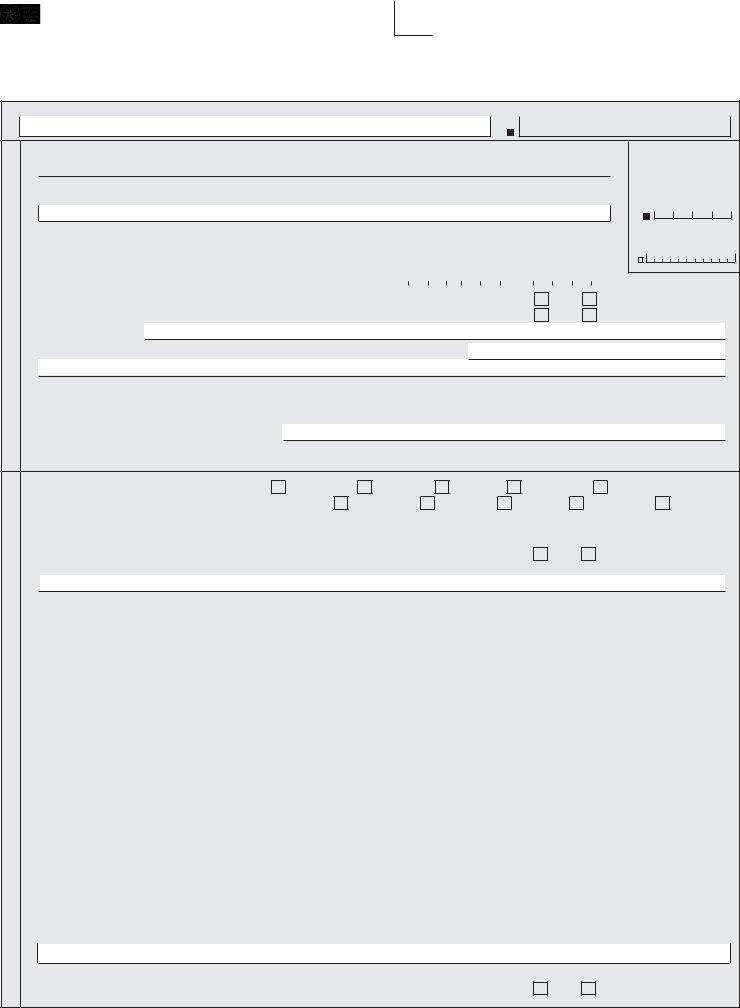

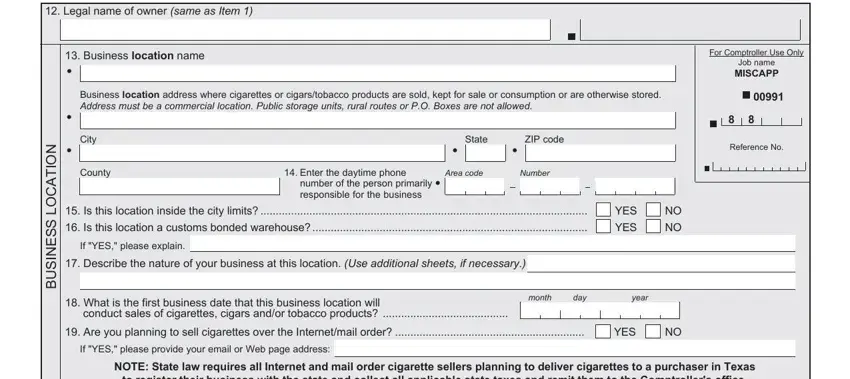

3. The following part will be about Legal name of owner same as Item, Business location name cid, Page, For Comptroller Use Only, Job name MISCAPP, Reference No, Business location address where, cid, cid, City, County, State, ZIP code, cid, and cid - fill out all these blanks.

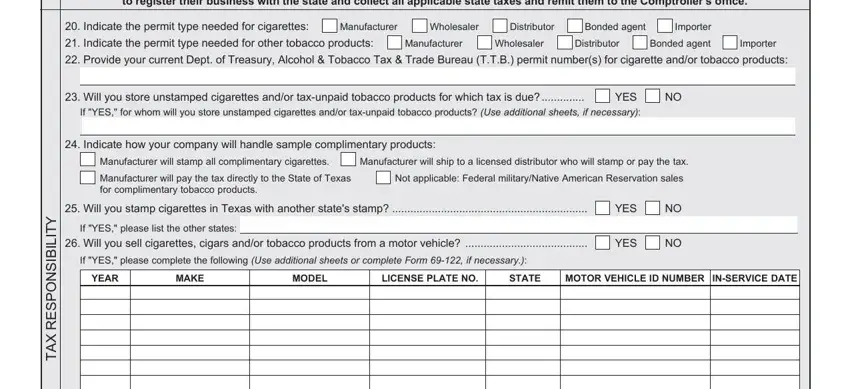

4. The subsequent paragraph comes with the next few form blanks to consider: to register their business with, Indicate the permit type needed, Manufacturer, Wholesaler, Distributor, Bonded agent, Importer, Indicate the permit type needed, Manufacturer, Wholesaler, Distributor, Bonded agent, Importer, Provide your current Dept of, and Will you store unstamped.

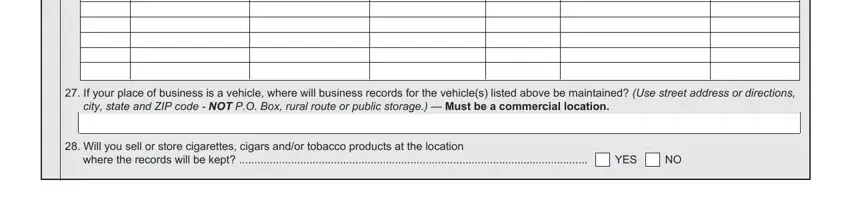

5. This form must be wrapped up with this section. Further you can see a detailed list of fields that need correct information in order for your form submission to be faultless: If your place of business is a, city state and ZIP code NOT PO, Will you sell or store cigarettes, where the records will be kept, and YES.

People who work with this PDF frequently make mistakes when filling in city state and ZIP code NOT PO in this area. You should definitely reread whatever you type in here.

Step 3: Before submitting the document, ensure that all blank fields are filled in correctly. When you think it's all fine, press “Done." After setting up afree trial account at FormsPal, you will be able to download Texas Form Ap 175 or email it at once. The PDF form will also be easily accessible via your personal account menu with all of your adjustments. With FormsPal, you can fill out forms without having to be concerned about personal data incidents or entries being shared. Our secure platform helps to ensure that your personal information is stored safely.