Form AP-180 (Back)(Rev.10-13/8)

General Information

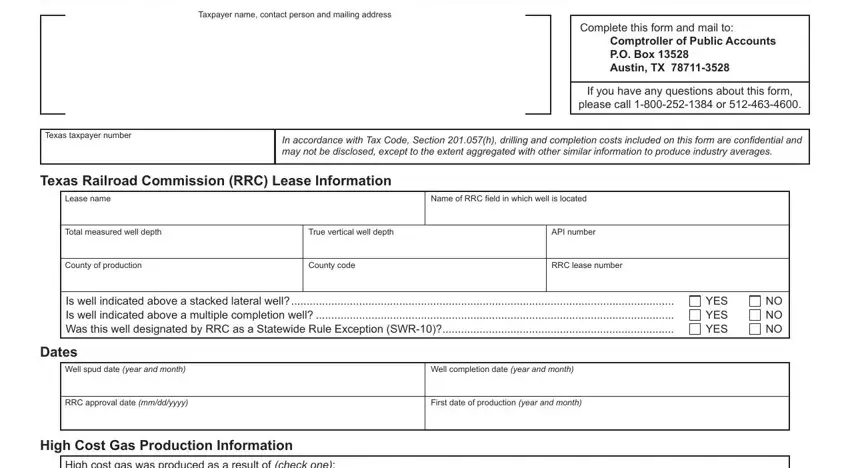

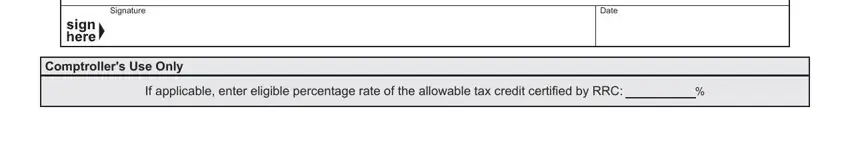

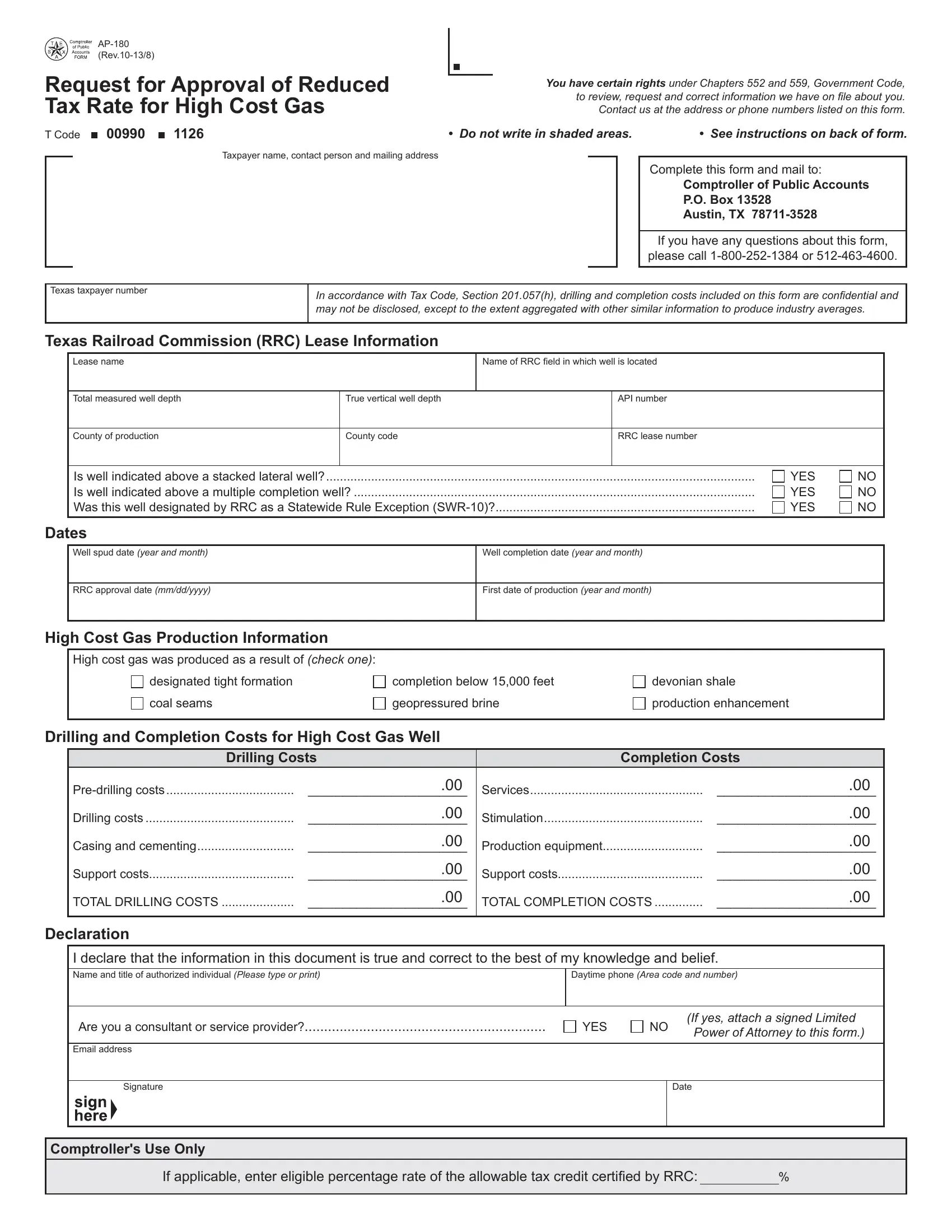

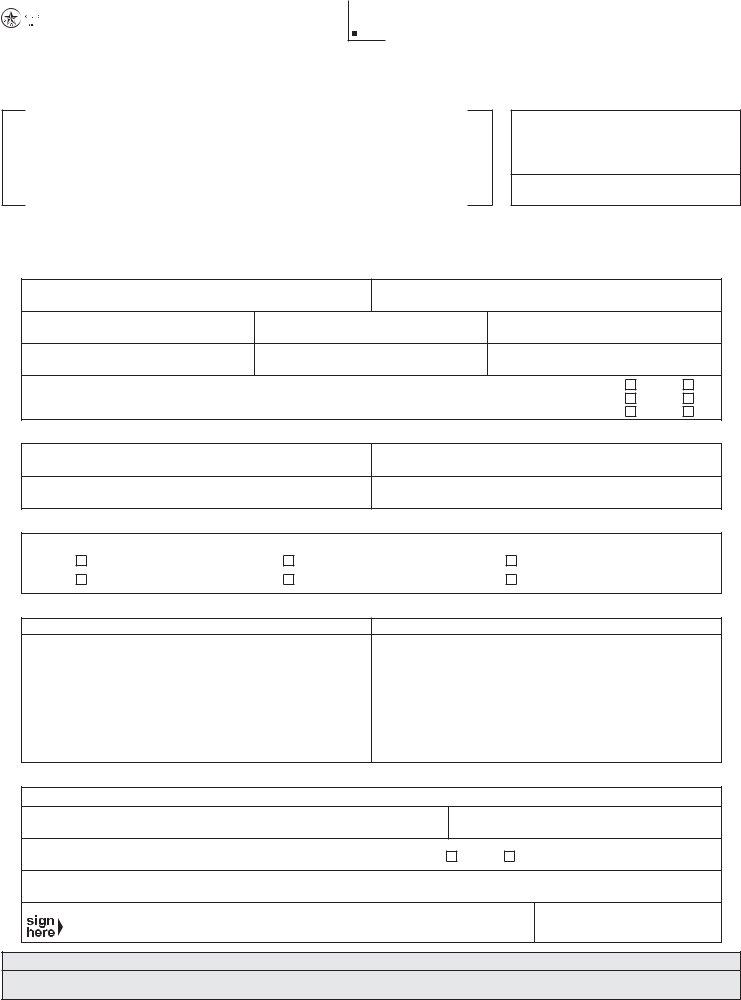

Who Files: Form AP-180 must be filed by any producer seeking a reduced tax rate for gas on gas wells certified as high cost gas wells by the Texas Railroad Commission (RRC). A Limited Power of Attorney must be included with a completed Form AP-180 whenever a consultant and/or service provider files Form AP-180 on behalf of a taxpayer.

What is Needed: A copy of a letter of certification from the Texas Railroad Commission must accompany each completed Form AP-180.

When to File: To recoup credits for previously paid tax on approved reduced tax rates for high cost gas leases, the information filed on credit-amended reports must meet all of the following criteria:

•Four-Year Statute of Limitation: Credit-amended reports must be filed within four years from the due date of a production period.

•Ten Percent Penalty: Form AP-180 must be filed at the later of the 180th day after the date of first production or the 45th day after the date of approval by the commission. If Form AP-180 is not filed by the applicable deadline, the tax exemption or tax deduction is reduced by 10 percent for the period beginning on the 180th day after the first day of production and ending on the date on which Form AP-180 is filed with the Comptroller.

•One-Year Window Requirement: Credit-amended reports containing approved exempt high cost gas wells which have production periods that are prior to the Comptroller’s signature date must be filed by the first anniversary from the Comptroller’s signature date.

•Two-Year Window Requirement: If the application for certification is submitted to the Texas Railroad Commission after Jan. 1, 2004, the total allowable credit for taxes paid for reporting periods before the date the application is filed may not exceed the total tax paid on the gas that otherwise qualified for the exemption or tax reduction and that was produced during the 24 consecutive calendar months immediately preceding the month in which the application for certification was filed with the Texas Railroad Commission.

End Date of Exemption: The end date of an approved exempt high cost gas well is determined by either the earliest of 120 months from the date of first production or when the cumulative value of the tax savings equal to 50 percent of the total drilling and completion costs, whichever situation occurs first.

How to File Reports: An amended report is required to claim a credit for tax previously paid on an approved reduced tax rate for high cost gas leases. On natural gas producer and purchaser tax reports, report approved high cost gas leases as “Type 05” with the actual RRC lease number. Scenarios requiring an amended report are as follows:

•If the actual RRC lease number was previously reported as “Type 02”, credit out volumes and values reported and rebook volumes and values as “Type 05”.

•If no lease data was previously reported, report volumes and values as “Type 05” with the actual RRC lease number.

•If a drilling permit number was previously reported as “Type 02” and the corresponding lease is later approved for the reduced tax rate, credit out volumes and values and rebook as “Type 05” with the actual RRC lease number. Do not report a drilling permit number when initially reporting a “Type 05” lease.

Comptroller’s Website: Detailed Information on approved reduced tax rate for high cost gas leases is available at: http://window.state.tx.us/taxinfo/nat_gas/index.html. Click on the link labeled “CONG WEB Inquiry.”

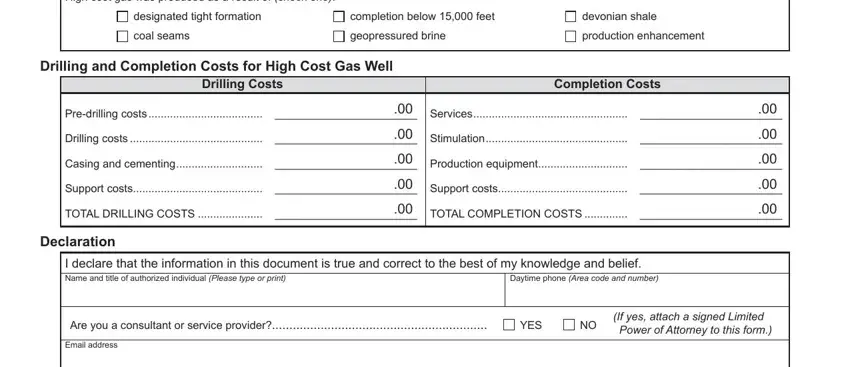

Drilling Costs to be Included by Category

Predrilling - Damage payments to surface owner and any petroleum engineering or geoscience costs associated with the well location are not to be included. All costs related to surveying, permitting, constructing roads to well sites, including fences and gates, costs to build pad, cellar, concrete pad, rat and mouse holes, conductor hole and pipe, drilling pit and liner and the cost of any water well. Costs of any environmental surveys performed including any monitoring wells drilled at or near the wellsite and the preparation of environmental impact study that may be required and any necessary remediation.

Drilling - Day rates or footage costs including general costs associated with normal rig operations. Include rig mobilization, rig positioning and rig demobiliza- tion charges where applicable. All costs for fuel and power, mud and chemical materials used to drill and condition the hole and/or restore and maintain circulation and chemical materials such as weighting materials, lost circulation materials, crude oil, diesel oil or mineral oil used in the circulating system. Also, if applicable, include the cost for air or gas compression if used for drilling. Cost of drill bits used to drill the well from conductor to total depth including the cost of any diamond drilling bits that are used. Labor, material transportation, services, standby time, tool rentals for setting whipstocks, milling casing windows, setting casing whipstocks, cement plugs for directional drilling, any special bottomhole assemblies or equipment such as Dynadrills, Turbodrills, measurement while drilling assemblies and costs, jet deflecting stabilizers, reamers, hole openers and any other items that affect or influence the directional tendencies of a wellbore. Labor, material and services for mud logging and any drill stem testing during drilling operations. Include test analysis costs where applicable. Open-hole logging costs including wireline formation tests and inclination and directional survey costs. Costs required to cut and recover cores, including sidewall cores and core analysis. Costs of rental tools and equipment including BOP’s, drill pipe, drill, collars and bottomhole assemblies, mud motors, shale shakers, degassers, desanders, desilters and centrifuges.

Casing and Cementing - Cost of casing, float shoes, float collars, and centralizers used in any portion of the casing program including any liners and liner hangers. Cost of cement, additives and pumping charges for the cement and costs for all plugs.

Support Costs - Costs associated with hauling water, casing or rental equipment to the well site. Costs for special equipment testing. Costs for roustabout crews. Costs of direct supervision of drilling operations.

Completion Costs to be Included by Category

Services - Rig used in completion operations. If the drilling rig is used for the completion operations, the costs must be separated. All wireline operations performed in the cased hole, including logging, perforating and setting tools on wireline. Costs of any fluids used in the wellbore (except fluids used during stimulation) during well operations from the time production casing is cemented until the well is turned to sales. Costs related to testing pay intervals that cannot be attributed to any other category. Costs for site restoration and for any remediation associated with the completion operations.

Well Stimulation - All costs associated with stimulating the pay interval. This includes acidizing and hydraulic fracturing charges as well as equipment costs that are specifically related to stimulation operations such as frac tanks. It includes the cost of coil tubing units and operations if used.

Production Equipment - The production tubing string, packers, bridgeplugs, tubing anchors and gravel packing. Any equipment installed on the wellhead including the wellhead itself. All equipment costs associated with gas lift or rod pumping equipment, including both down hole and surface equipment. Also included in this category are plunger lift and cavity displacement pumps and associated equipment. All equipment from the wing valve to the sales meter that is required to produce the well. This includes production, storage and separation equipment, meters, flowlines, chemical pumps and any location costs such as gates, roads and fences associated with the lease equipment. Drilling and Completion Costs does not include any costs incurred after the outlet of a lease separator or that would otherwise be considered a marketing cost for severance tax purposes.

Support Costs - Costs to transport materials and equipment to the well site that are not specifically chargeable to other more specific operations. This category includes hauling casing or tubing to location, but would not include the cost to haul water for a fracture stimulation. Rental equipment used to complete the well. Costs of roustabout crews used during and after drilling operations have ceased. Costs of direct supervision of completion operations.