In case you would like to fill out Texas Form Ap 206, you won't have to download any kind of applications - just try using our PDF editor. Our tool is continually evolving to grant the best user experience achievable, and that is due to our commitment to continual enhancement and listening closely to customer opinions. All it requires is just a few simple steps:

Step 1: First of all, access the pdf tool by clicking the "Get Form Button" in the top section of this webpage.

Step 2: This editor enables you to modify PDF files in various ways. Enhance it with your own text, adjust existing content, and place in a signature - all close at hand!

As for the blanks of this precise PDF, here is what you should know:

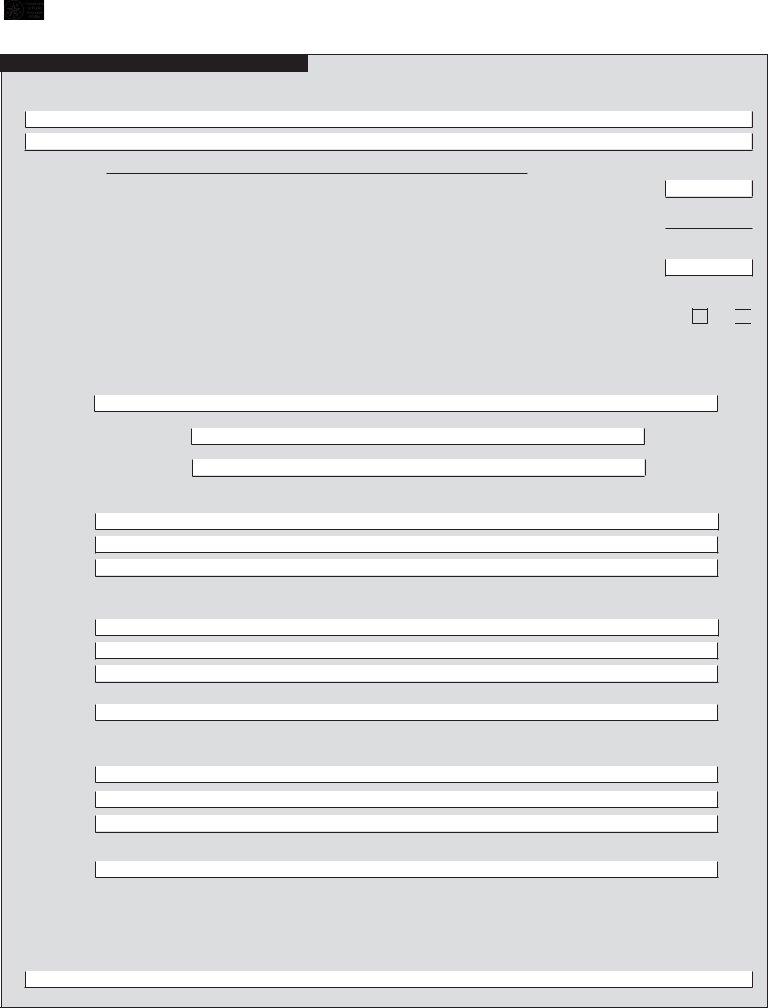

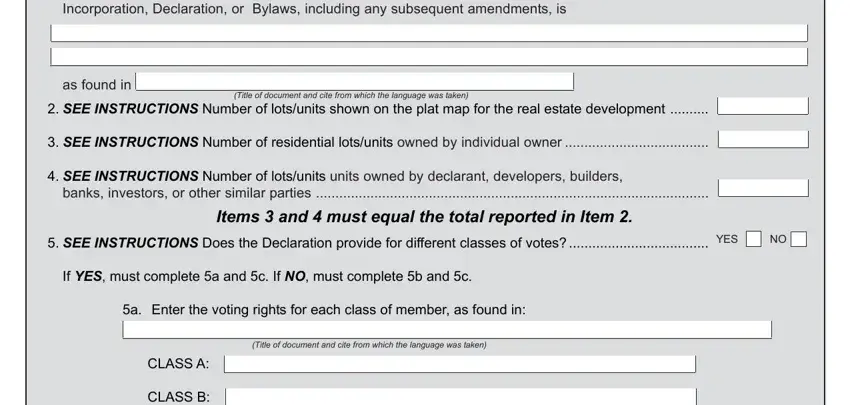

1. The Texas Form Ap 206 needs particular details to be typed in. Ensure the next blank fields are complete:

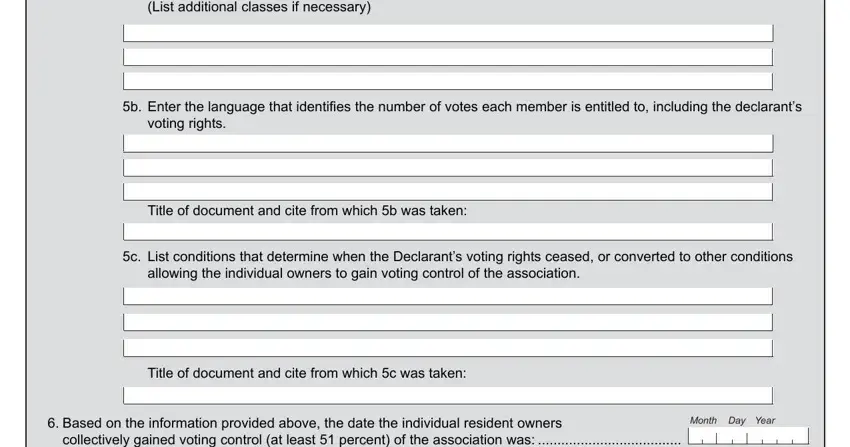

2. After the previous section is finished, you need to add the essential details in List additional classes if, b Enter the language that, voting rights, Title of document and cite from, c List conditions that determine, allowing the individual owners to, Title of document and cite from, Based on the information provided, Month Day Year, and collectively gained voting control so you're able to proceed to the next part.

It's very easy to make an error when filling in your Title of document and cite from, so be sure to take another look prior to when you submit it.

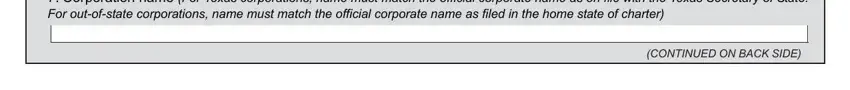

3. This next section is fairly straightforward, Corporation name For Texas, and CONTINUED ON BACK SIDE - each one of these empty fields will need to be completed here.

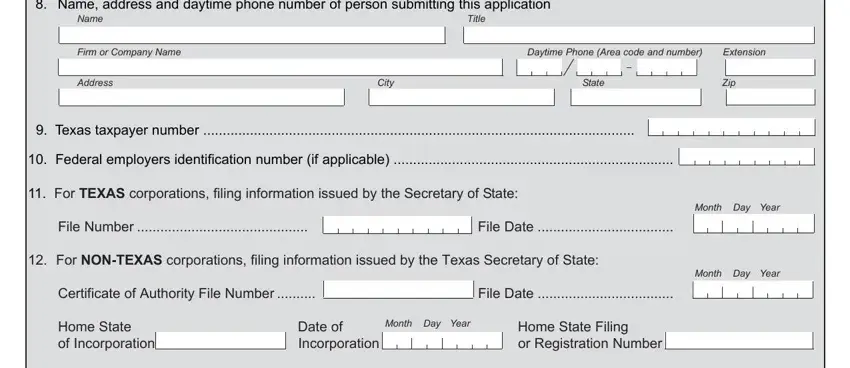

4. It's time to begin working on this next section! In this case you have all of these Name address and daytime phone, Name, Title, Firm or Company Name, Daytime Phone Area code and number, Extension, Address, City, State, Zip, Texas taxpayer number, Federal employers identification, For TEXAS corporations filing, File Number, and File Date blanks to fill out.

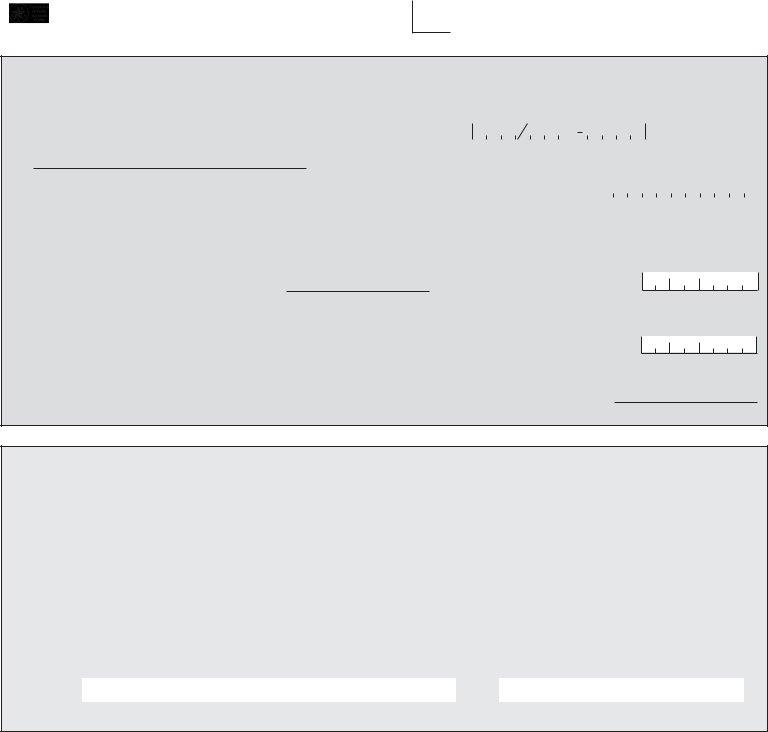

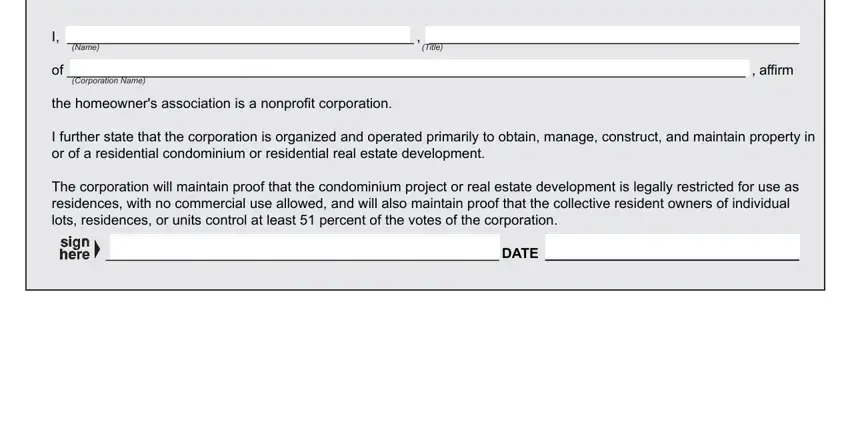

5. To conclude your form, this last section requires a couple of extra blanks. Filling out Name, Title, of affirm, Corporation Name, the homeowners association is a, I further state that the, The corporation will maintain, and DATE should conclude everything and you can be done very fast!

Step 3: Before getting to the next stage, it's a good idea to ensure that blanks have been filled in properly. Once you’re satisfied with it, click “Done." Right after creating a7-day free trial account here, you'll be able to download Texas Form Ap 206 or send it through email right off. The document will also be readily available from your personal account with all your edits. FormsPal provides protected form tools devoid of personal data record-keeping or any type of sharing. Rest assured that your information is in good hands with us!