With the help of the online tool for PDF editing by FormsPal, it is easy to fill in or edit Texas Form Ps 1040R here and now. To make our editor better and easier to utilize, we continuously design new features, with our users' feedback in mind. It merely requires several simple steps:

Step 1: Press the "Get Form" button above. It'll open our editor so that you can begin completing your form.

Step 2: This tool enables you to change nearly all PDF forms in a range of ways. Transform it by adding customized text, adjust original content, and add a signature - all when it's needed!

It is easy to complete the document with our detailed guide! Here is what you have to do:

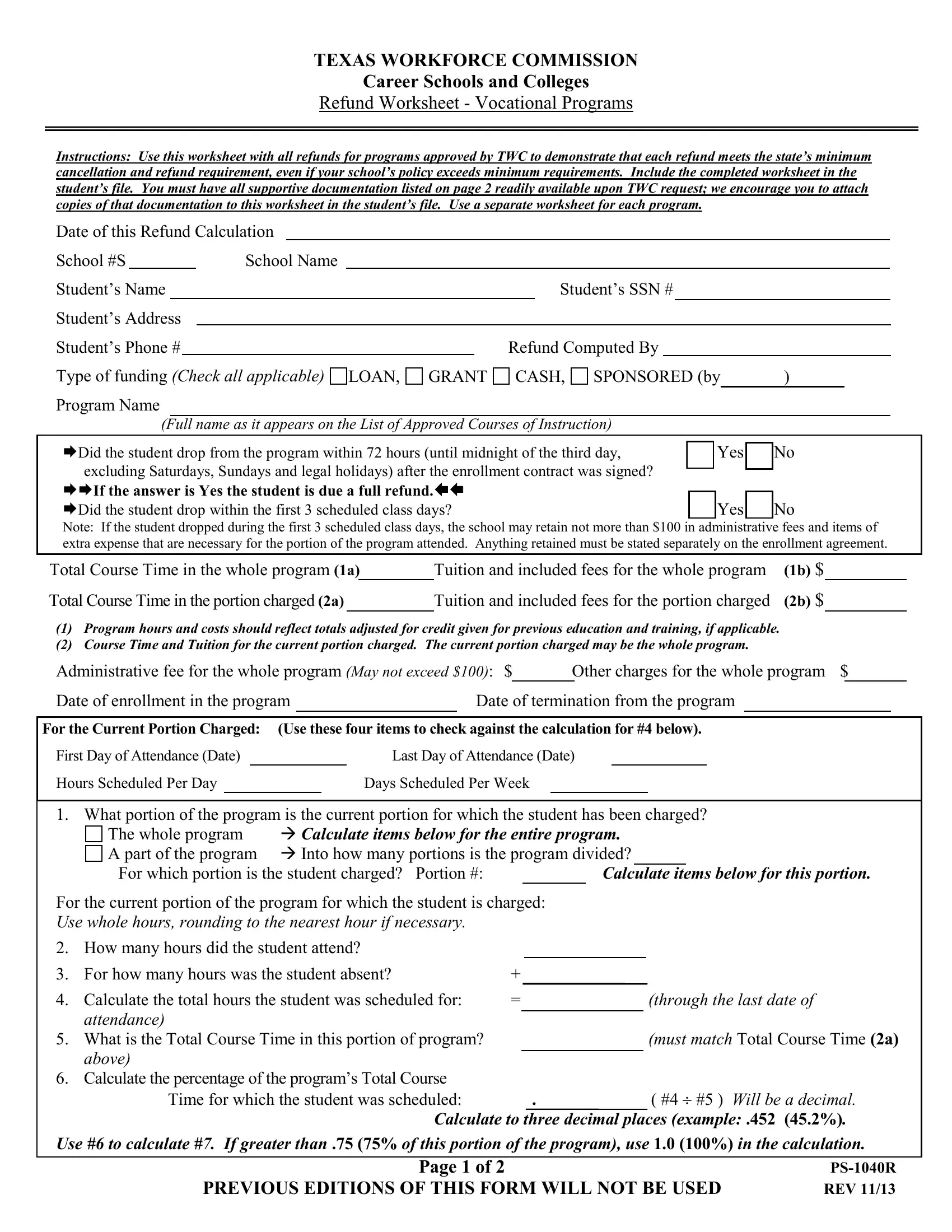

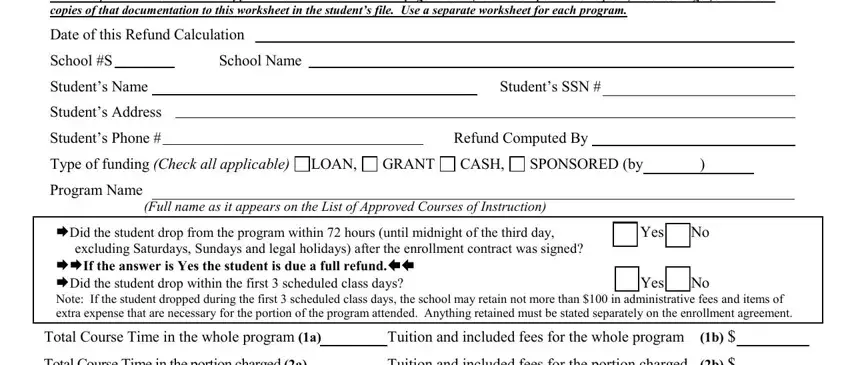

1. Before anything else, when completing the Texas Form Ps 1040R, start in the form section that features the subsequent blank fields:

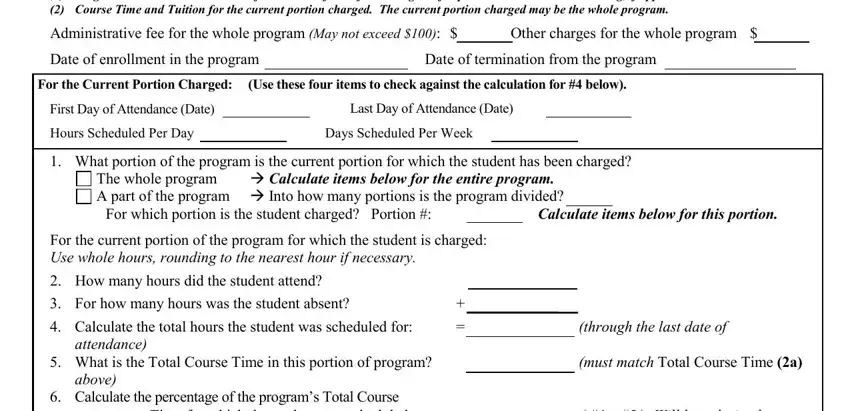

2. When this segment is complete, you're ready include the needed specifics in Program hours and costs should, Administrative fee for the whole, Date of enrollment in the program, Date of termination from the, For the Current Portion Charged, First Day of Attendance Date, Last Day of Attendance Date, Hours Scheduled Per Day What, Days Scheduled Per Week, The whole program Calculate items, For which portion is the student, Calculate items below for this, For the current portion of the, How many hours did the student, and For how many hours was the in order to proceed further.

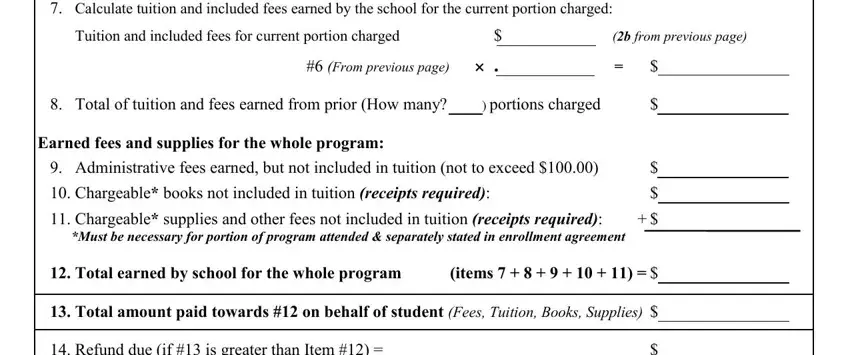

3. Your next step is usually straightforward - fill out every one of the form fields in Calculate tuition and included, Tuition and included fees for, b from previous page, Total of tuition and fees earned, From previous page, Earned fees and supplies for the, Administrative fees earned but, Chargeable books not included in, items, and Chargeable supplies and other to finish this part.

In terms of Chargeable supplies and other and Administrative fees earned but, be sure you double-check them in this section. The two of these are the most important fields in the PDF.

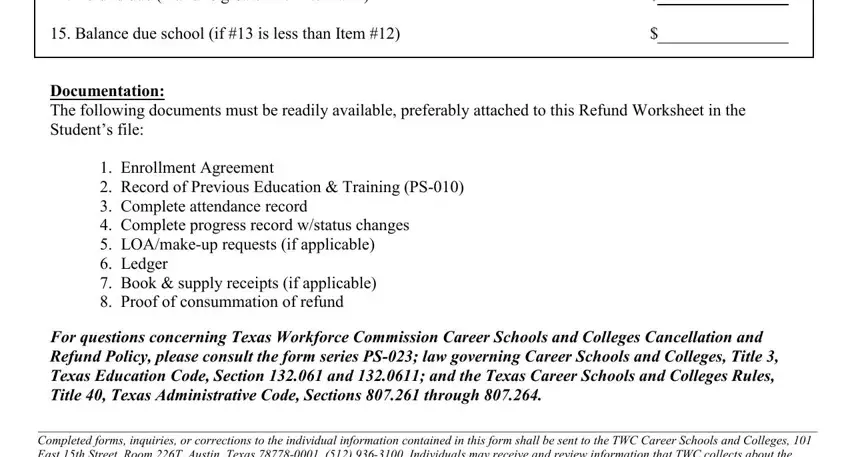

4. Filling out Chargeable supplies and other, Enrollment Agreement Record of, For questions concerning Texas, and Completed forms inquiries or is essential in the next stage - ensure to devote some time and be attentive with each empty field!

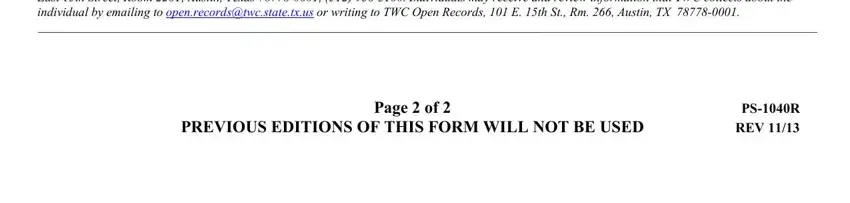

5. The final section to complete this document is pivotal. Make certain to fill out the appropriate blank fields, which includes Completed forms inquiries or, PREVIOUS EDITIONS OF THIS FORM, Page of, and PSR REV, before submitting. Failing to do it could contribute to an incomplete and possibly nonvalid document!

Step 3: Check that the details are accurate and just click "Done" to progress further. Go for a 7-day free trial account at FormsPal and obtain instant access to Texas Form Ps 1040R - available from your FormsPal account. FormsPal ensures your data privacy via a secure system that in no way saves or shares any sort of private data provided. Rest assured knowing your docs are kept protected when you use our tools!