Texas Motor Vehicle Power of Attorney Form

If a Texas resident has a vehicle and wants to appoint someone to use that vehicle in specific cases, the two parties should sign a Texas vehicle power of attorney (POA) form or the VTR-271 form. A POA form lets a person designate another individual or entity to use various properties.

An example of a case where a power of attorney form may be signed is when a person contracts a disease that leads to an incapacity to make sound decisions. Common types of POA forms are medical POA, durable POA, vehicle POA, and others.

Check out all the Texas POA forms you can use by clicking on this link to our Texas guide.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Every state has its laws that govern these documents. It often has to be notarized. Sometimes public authorities of the state recommend a vehicle POA template.

A vehicle POA usually contains:

- Details of the principal

- The name of an attorney

- A description of the subject property

Laws regulating the creation of POA forms in Texas are prescribed in Section 501.076 of the Texas Transportation Code. For a vehicle POA, notarization is not required in this state; however, the vehicle owner must sign the form.

Texas Motor Vehicle Power of Attorney Form Details

| Document Name | Texas Motor Vehicle Power of Attorney Form |

| State Form Name | Texas Form VTR-271 |

| Relevant Link | Texas Department of Motor Vehicles |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 16 |

| Available Formats | Adobe PDF |

Filling Out the Texas Vehicle POA Form

1. Get the Correct Template of the POA Form

If you need to complete a Texas vehicle power of attorney form, you should ensure that you have chosen the correct template. In Texas, a vehicle POA form is also referred to as the VTR-271 Form.

To get the file quickly, use our form-building software. Typically, you have to create no less than two copies of the vehicle POA form.

2. Read the Instructions

At the top of the vehicle POA form, you will see brief instructions on how to fill out the form. As the principal, you should check them out and read them carefully before you start writing anything.

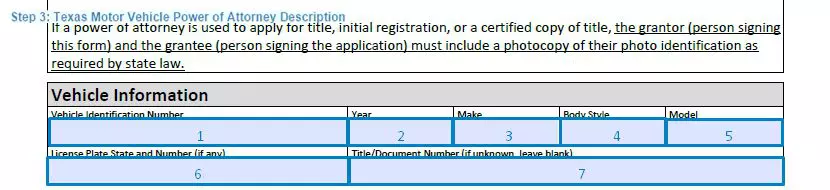

3. Describe Your Vehicle

Below the instructions, you will see a section dedicated to the vehicle description. In Texas, the POA form has blank lines for the vehicle’s year of production, make, and model—you should fill all of them. Also, you may add the license plate number and the number of the title, if applicable.

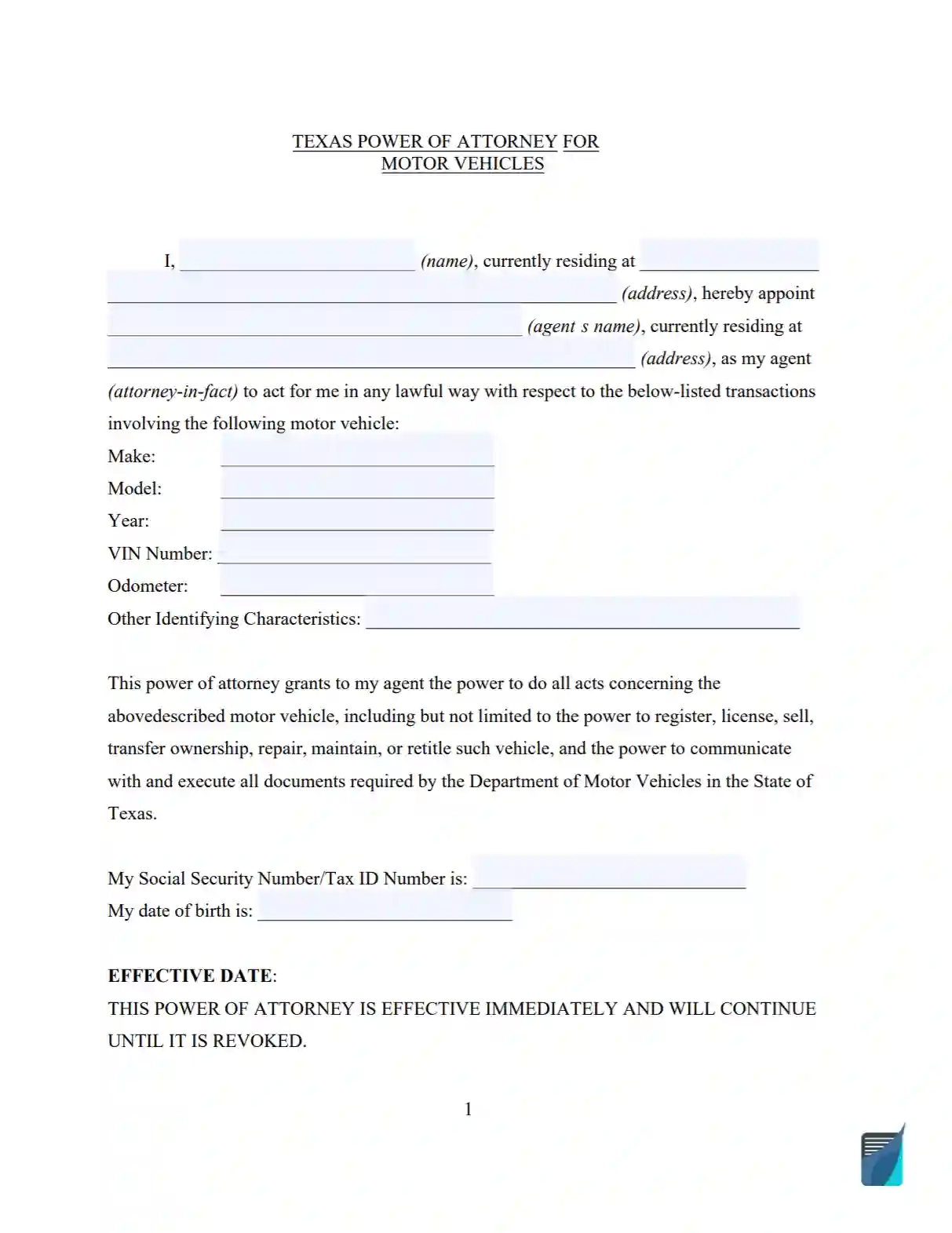

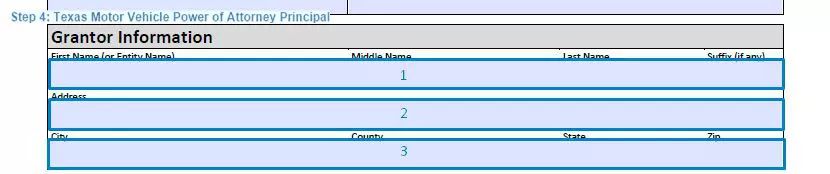

4. Enter the Principal’s (Grantor’s) Details

Here, the principal (also referred to as grantor) must enter their details: full name (or the name of an entity) and address.

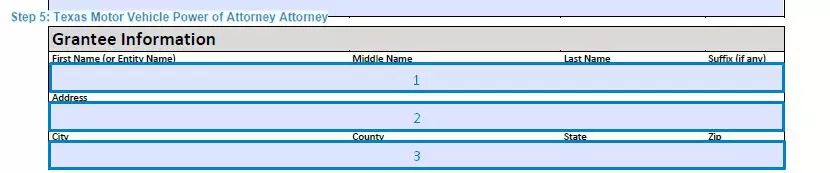

5. Add the Attorney’s (Grantee’s) Details

You need to add details of the appointed attorney (or grantee in this form). The information required is the same—their full name and address.

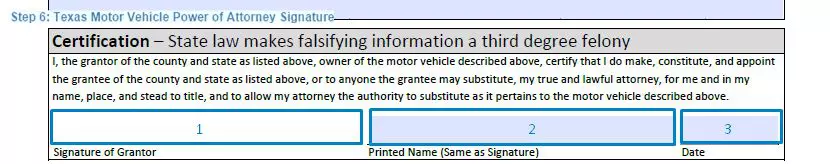

6. Sign the vehicle POA Form

As stated above, in Texas, you do not need to notarize a vehicle POA form. However, the owner of the vehicle has to sign this document. Append your signature, add the current date, and the name of the principal.