Our PDF editor that you're going to work with was created by our top level web programmers. One could get the tx application homestead exemption form easily and effortlessly applying our app. Just keep up with this particular guide to get started.

Step 1: On this website page, click the orange "Get form now" button.

Step 2: You're now able to enhance tx application homestead exemption. You've got numerous options with our multifunctional toolbar - you'll be able to add, remove, or customize the content, highlight its specific parts, as well as undertake various other commands.

In order to fill in the document, type in the content the system will request you to for each of the appropriate areas:

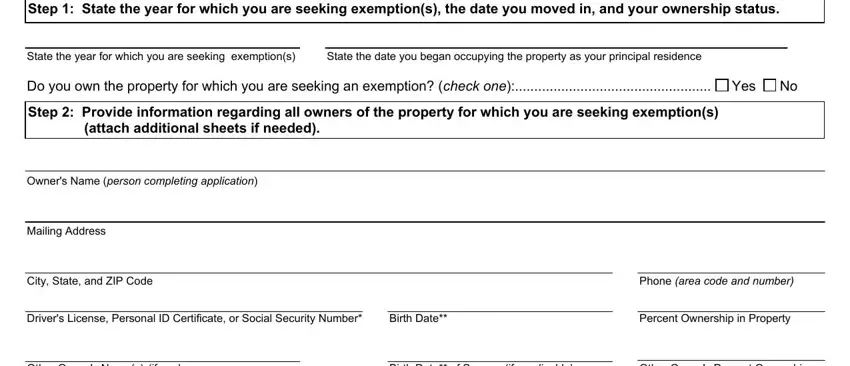

You have to submit the Step State the year for which you, State the year for which you are, State the date you began occupying, Do you own the property for which, Yes, Step Provide information, attach additional sheets if needed, Owners Name person completing, Mailing Address, City State and ZIP Code, Phone area code and number, Drivers License Personal ID, Birth Date, Percent Ownership in Property, and Other Owners Names if any area with the demanded particulars.

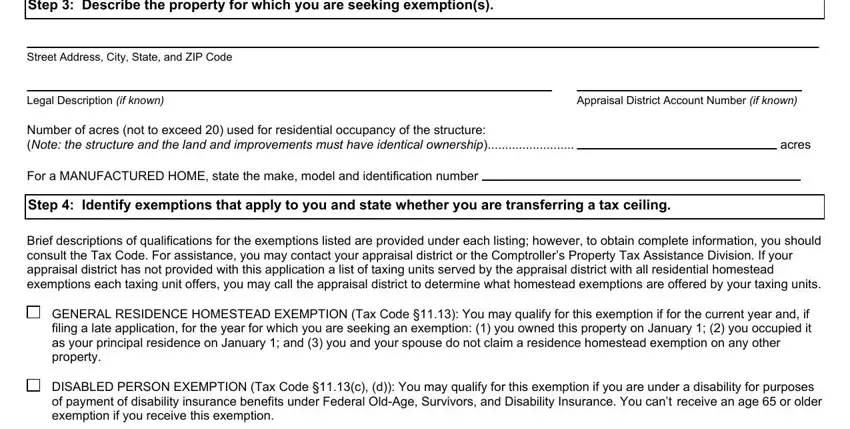

Note the crucial particulars in Step Describe the property for, Street Address City State and ZIP, Legal Description if known, Appraisal District Account Number, Number of acres not to exceed, acres, For a MANUFACTURED HOME state the, Step Identify exemptions that, Brief descriptions of, GENERAL RESIDENCE HOMESTEAD, and DISABLED PERSON EXEMPTION Tax Code box.

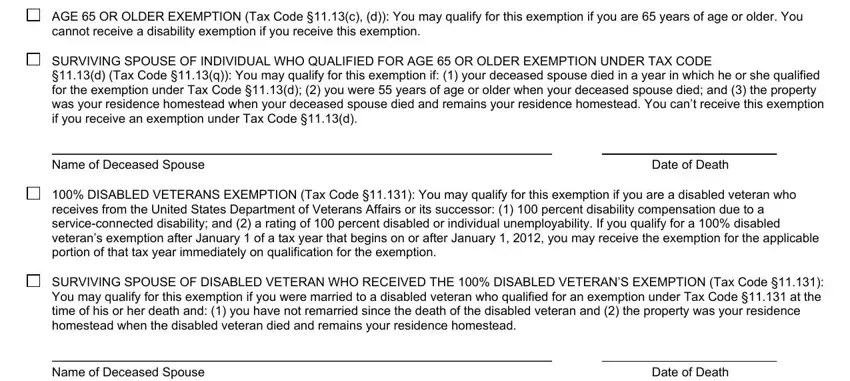

The area AGE OR OLDER EXEMPTION Tax Code c, SURVIVING SPOUSE OF INDIVIDUAL WHO, Name of Deceased Spouse, Date of Death, DISABLED VETERANS EXEMPTION Tax, SURVIVING SPOUSE OF DISABLED, Name of Deceased Spouse, and Date of Death is going to be for you to put both parties' rights and obligations.

Terminate by reading the following sections and preparing them as required: Check if you seek to transfer a.

Step 3: When you have hit the Done button, your file will be obtainable for transfer to any kind of gadget or email address you identify.

Step 4: Create duplicates of the document - it can help you keep away from upcoming problems. And don't worry - we cannot reveal or check your information.

No

No