Through the online editor for PDFs by FormsPal, it is easy to fill in or modify texas form 01 922 right here and now. The editor is constantly updated by our staff, acquiring additional functions and becoming greater. If you're seeking to get started, here is what you will need to do:

Step 1: Open the PDF doc in our tool by clicking on the "Get Form Button" at the top of this webpage.

Step 2: With our handy PDF tool, you can actually do more than just fill out blank fields. Try each of the functions and make your documents seem sublime with custom text incorporated, or fine-tune the original content to excellence - all that comes with the capability to insert your own images and sign the document off.

This document will require specific details; in order to ensure correctness, be sure to bear in mind the following suggestions:

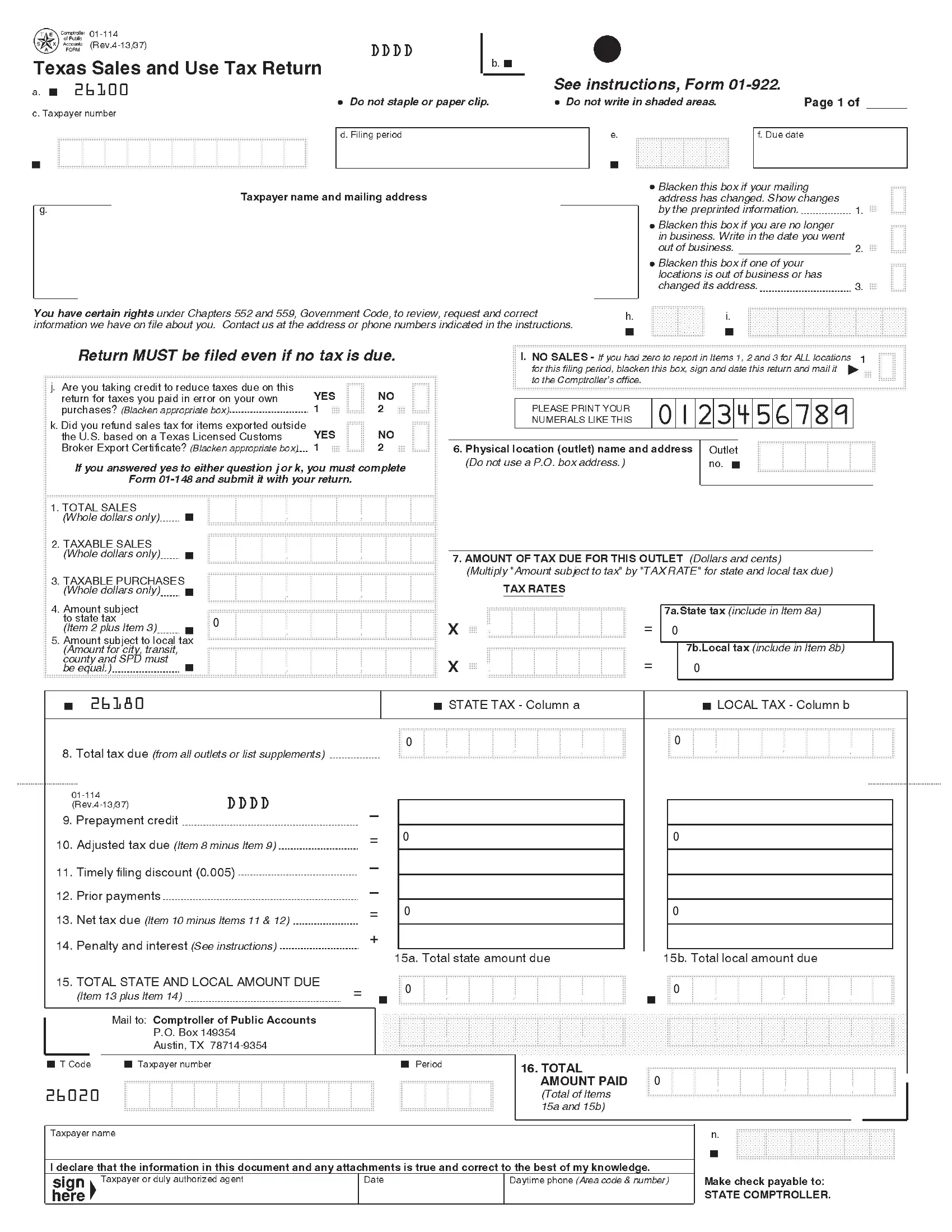

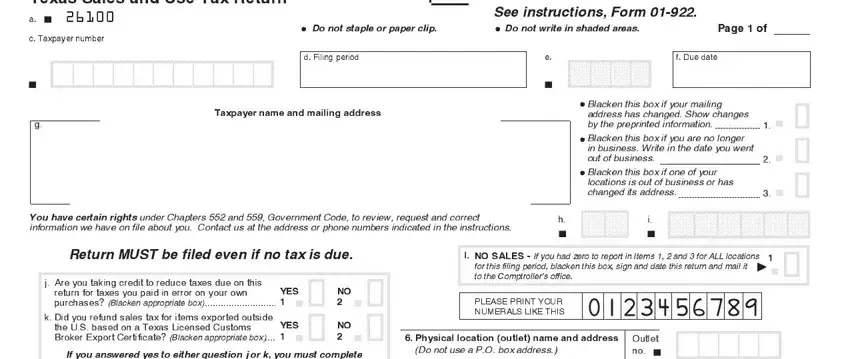

1. Before anything else, once completing the texas form 01 922, begin with the area that includes the next blank fields:

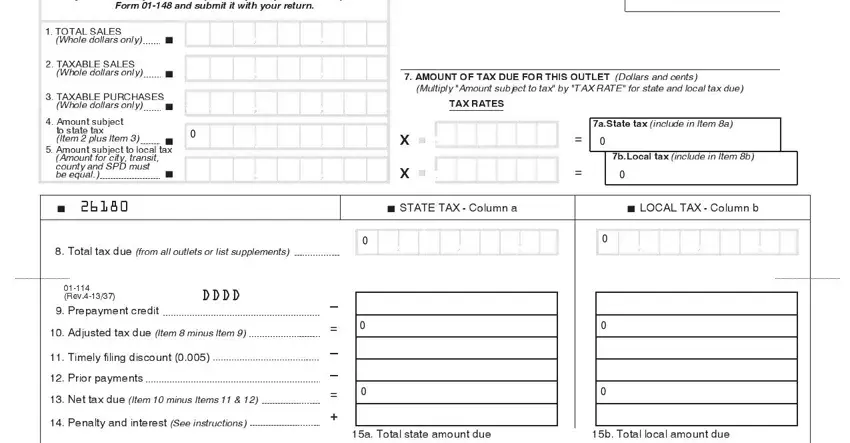

2. Soon after the previous array of fields is completed, go on to type in the suitable details in these - If you answered yes to either, Form and submit it with your, AMOUNT OF TAX DUE FOR THIS OUTLET, Multiply Amount subject to tax by, TAX RATES, aState tax include in Item a, bLocal tax include in Item b, STATE TAX Column a, LOCAL TAX Column b, TOTAL SALES Whole dollars only, TAXABLE SALES Whole dollars only, TAXABLE PURCHASES Whole dollars, Amount subject to state tax Item, Total tax due from all outlets or, and Rev.

It is possible to make an error while filling in your TAX RATES, consequently ensure that you go through it again before you decide to send it in.

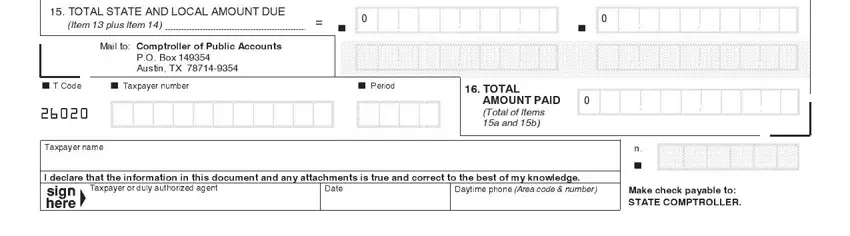

3. The following portion will be focused on TOTAL STATE AND LOCAL AMOUNT DUE, Mail to Comptroller of Public, T Code Taxpayer number Period, Taxpayer name, TOTAL AMOUNT PAID Total of Items, I declare that the information in, Taxpayer or duly authorized agent, Date, Daytime phone Area code number, and Make check payable to STATE - type in every one of these empty form fields.

Step 3: Once you have glanced through the details in the blanks, press "Done" to conclude your form. Join us today and instantly get texas form 01 922, available for download. All alterations you make are preserved , which enables you to edit the form at a later stage as required. We don't sell or share any details that you type in when completing documents at our website.