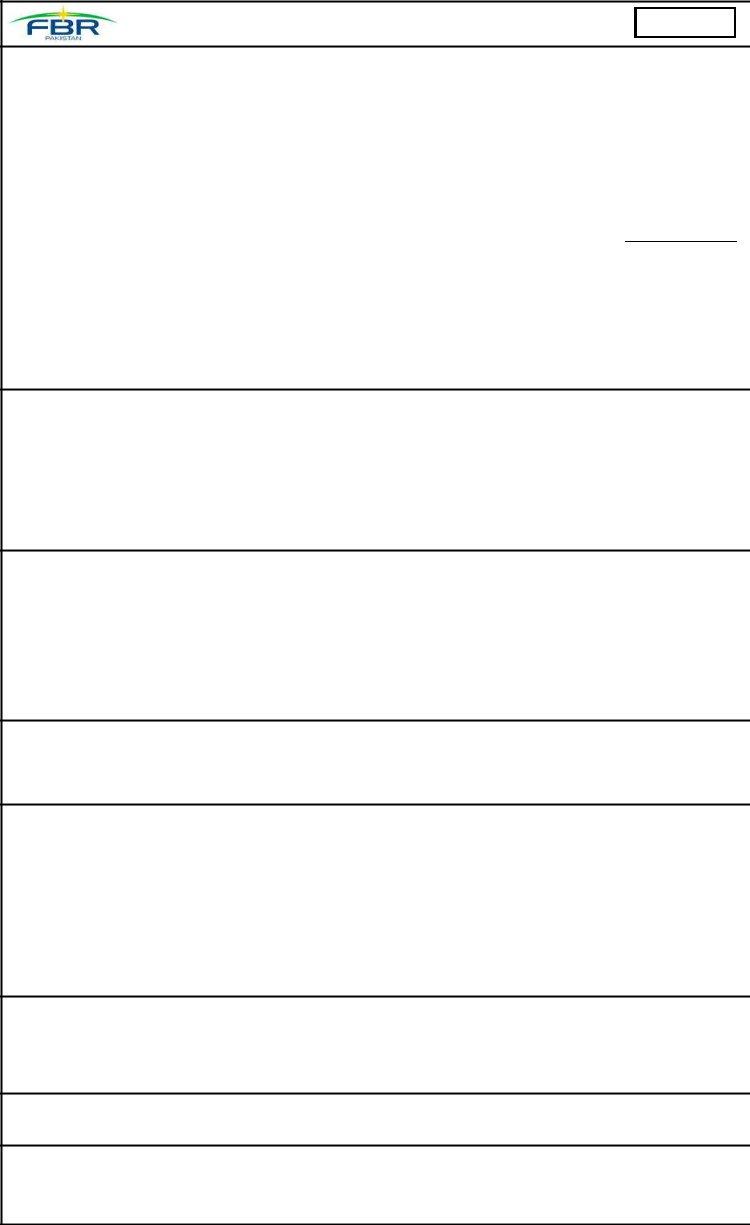

Understanding the Government of Pakistan's Federal Board of Revenue TRF-01 Taxpayer Registration Form is crucial for anyone looking to engage in business within the country. This form is your gateway to becoming a registered taxpayer, essential for conducting business activities legally. It covers a wide range of tax-related registrations including Income Tax, Sales Tax, and Federal Excise among others. It's designed for various entities like companies, trusts, individuals, and NGOs to name a few. Whether you're applying for a new registration, updating details, or requiring a duplicate certificate, the TRF-01 form accommodates your needs. The form asks for detailed information such as personal or company details, business activities, and bank accounts. It is also the document where you can request changes in particulars or additional business branches. Moreover, the submission process is flexible, offering options to submit physically at Regional Tax Offices (RTO) or Taxpayer Facilitation Centers (TFC), and even online through the FBR's dedicated portal. Understanding and accurately completing this form is a step towards compliance and ensuring your business operations are smooth and uninterrupted.

| Question | Answer |

|---|---|

| Form Name | Trf 01 Form Fbr Pakistan |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | fbr sales tax return form in excel format, trf01, withholding tax certificate form excel, trf taxpayer form get |

`

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Government of Pakistan |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Board of Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer Registration Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

Sheet No. |

|

|

|

of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Token No. |

N° |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

Apply |

|

|

New Registration (for Income Tax, Sales Tax, Federal Excise, I.T W/H Agent or S.T W.H Agent ) |

|

|

|

Current NTN |

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

For |

|

|

ST or FED Registration, who already have NTN |

|

|

|

|

Change in Particulars |

|

Duplicate Certificate |

|

|

|

|

|

|

|

- |

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

Category |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

3 |

|

|

|

Company |

|

|

Company Type |

|

|

Pvt. Ltd. |

|

|

Public Ltd. |

|

Small Company |

|

Trust |

|

Unit Trust |

|

|

Modarba |

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

Individual |

|

|

|

|

|

|

|

|

|

|

|

NGO |

|

|

Society |

|

Any other (pl specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

AOP |

|

|

|

|

AOP Type |

=> |

|

|

|

HUF |

|

|

Firm |

|

|

|

|

Artificial Juridical Person |

|

|

|

Body of persons formed under a foreign law |

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

4 |

|

Status |

|

|

Resident |

|

|

|

|

|

|

Country of Non Resident |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

5 |

|

CNIC/PP No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[for Individual only , |

|

|

|

|

|

|

|

|

|

Gender |

|

|

|

|

Male |

|

|

Female |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

6 |

|

Reg./ Inc. No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[for Company & Registered AOP only] |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Birth/ Inc. Date |

` |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

7 |

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

Name of Registered Person (Company, Individual or AOP Name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

8 |

|

Address |

|

Registered Office Address for Company and Mailing/Business Address for Individual & AOP, for all correspondence |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

Office/Shop/House /Flat /Plot No |

|

|

Street/ Lane/ Plaza/ Floor/ Village |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Block/ Mohala/ Sector/ Road/ Post Office/ etc |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

Province |

|

|

|

|

|

|

|

District |

|

|

|

|

|

|

|

|

|

|

|

|

City/Tehsil |

|

|

|

|

|

|

|

|

|

|

Area/Town |

|

|

|

|

|

|

|

|

|

Activity Code |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Registry |

9 |

|

Principal Activity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

Register for |

|

|

Income Tax |

|

|

|

Sales Tax |

|

Federal Excise |

|

Withholding agent for I/Tax |

|

|

|

Withholding Agent for S/Tax |

Revision |

N° |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

Rep. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In Capacity as |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

` |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

11 |

|

Rep. Type |

|

|

Representative |

|

Authorized Rep. u/s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

u/s 172 |

|

|

|

223 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Authorized |

|

|

CNIC/ NTN |

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

Office/Shop/House /Flat /Plot No |

|

|

Street/ Lane/ Plaza/ Floor/ Village |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Block/ Mohala/ Sector/ Road/ Post Office/ etc |

|||||||||||||||||||||||||||||||||

Representative/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

` |

|

|

Province |

|

|

|

|

|

|

|

District |

|

|

|

|

|

|

|

|

|

|

|

|

City/Tehsil |

|

|

|

|

|

|

|

|

|

|

Area/Town |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

12 |

|

Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mobile |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

Area Code |

|

|

|

Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Area Code |

|

|

|

Number |

|

|

|

|

|

|

|

|

|

|

|

|

Area Code |

|

|

Number |

|||||||||||||||||||

|

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

14 |

|

|

Total Director/Shareholder/Partner |

|

|

|

|

Please provide information about |

|

|

|

|

|

Total Capital |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

Director/Shareholder/Partner |

16 |

|

|

|

|

|

|

|

|

|

|

All Other Shareholders/ Directors/Partners (in addition to 10) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Action |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Add/ Remove) |

||||||||||||||||||||||||||||

|

15 |

Type |

NTN/CNIC/ Passport No. |

Name of Director/Shareholder/Partner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share Capital |

Share % |

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ActivitiesOther |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Action |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

17 |

|

Activity Code |

|

|

|

|

Other Business Activities in addition to the Principal Activity given at |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Add/ Close) |

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18 |

|

|

TOTAL BUSINESS/BRANCHES |

|

|

|

Provide details of all business/branches/outlets/etc., use additional copies of this form if needed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

19 |

|

Bus/Br. Serial |

|

|

|

|

|

|

|

|

|

|

|

Action Requested |

|

|

Add |

|

|

Change |

|

|

|

Close |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

20 |

|

Bus/Br. Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business/ Branch Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

HQ/Factory/Showroom/Godown/Sub Off./etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Office/Shop/House /Flat /Plot No |

|

|

Street/ Lane/ Plaza/ Floor/ Village |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Block/ Mohala/ Sector/ Road/ Post Office/ etc |

|||||||||||||||||||||||||||||||||

Branches |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

Premises Possession |

Owned |

|

|

Rented |

|

Others |

Owner's CNIC/ NTN/ FTN |

|

|

|

|

|

|

|

|

|

|

|

Owner's Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

Province |

|

|

|

|

|

|

|

District |

|

|

|

|

|

|

|

|

|

|

|

|

City/Tehsil |

|

|

|

|

|

|

|

|

|

|

Area/Town |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

21 |

|

Nature of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Area Code |

|

|

|

Number |

|

|

|

|

|

|

|

|

|

|

Gas Connection installed |

|

Yes |

|

|

No |

|

|

Gas Consumer No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

22 |

|

Electricity Ref. No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

23 |

|

Phone No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business/ Branch Start Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

Business/ Branch Close Date, |

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

if applicable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

24 |

|

|

TOTAL BANK ACCOUNTS |

|

|

|

Provide details of all bank accounts, use additional copies of this form if needed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

Accounts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25 |

|

Account Sr. |

|

|

|

|

|

|

|

|

|

|

|

Action Requested |

|

|

Add |

|

|

Change |

|

|

|

Close |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

26 |

|

A/C No. |

|

|

|

|

|

|

|

|

|

|

|

A/C Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type |

|

|

|

|

|

|

|

|

|

|

|

||||||

Bank |

27 |

|

Bank Name |

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

Branch |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

(NBP, MCB, UBL, Citi, etc.) |

|

|

Account Start Date |

|

|

|

|

|

|

|

|

|

|

|

|

Account CLOSE DATE , if close action is requested |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

Employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29 |

|

NTN/ FTN |

|

|

|

|

|

|

- |

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

30 |

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

||

|

31 |

|

I, the undersigned solemnly declare that to the best of my knowledge and belief the information given above is correct and complete. It is further declared that any notice sent on the |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Declaration |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

Date |

|

|

|

|

|

|

CNIC/ Passport No. |

|

|

|

|

|

|

|

|

|

|

Name of Applicant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

address or the address given in the registry portion will be accepted as legal notice served under the law. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

__________________________ |

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

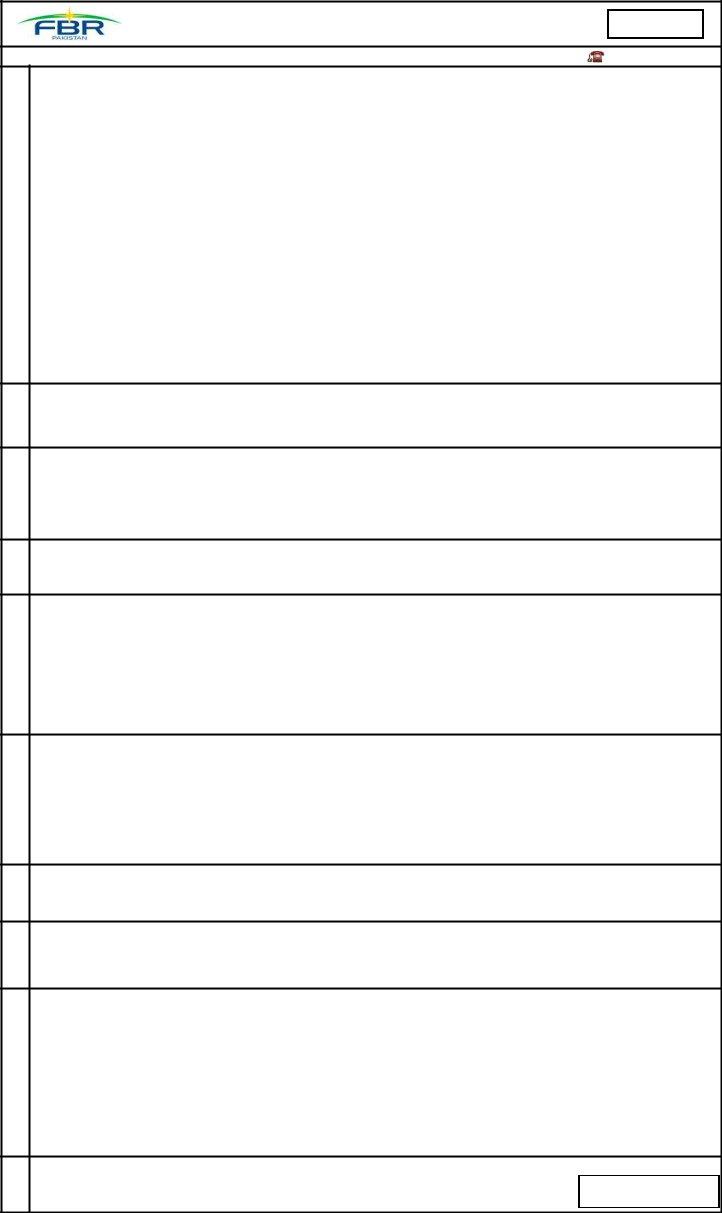

Registry |

|

Representative/ /Auth- |

Rep |

Directors/ |

Partners |

Other |

Activities |

Businesses/ Branches |

|

Declaration Employer Bank Accounts

RTO/ TFC Application Modes

|

|

Government of Pakistan |

|

|

|

Federal Board of Revenue |

|

|

|

Taxpayer Registration Form |

|

|

|

|

|

|

|

FILLING INSTRUCTIONS |

051 |

1 |

Sheet No. |

Usually only one sheet of this form is sufficient. However more sheets will be needed in case of more than |

|

|

|

||

|

|

Activities or more than |

|

|

|

is attached, then write Sheet 1 of 1. |

|

|

Application No. |

This field is for official use. All the grey fields are for official use and should be left blank by the applicant. |

|

2 |

Application Type |

Tick (√) the relevant box. If the box for change in particulars is selected the current NTN should also be provided. Grey box is for check digit. |

|

|

|

If a person has already obtained NTN and now wants to apply for Sales Tax/ FED, he should tick (√) Apply for Sales Tax / FED Registration |

|

|

|

If application is issuance of Duplicate Certificate, then Current NTN should also be provided. Current Certificate should be surrendered |

|

3 |

Category |

Check (√) the relevant box showing the Person Category as Company, AOP or Individual. If Category is selected as Company or AOP then one of the types of |

|

|

|

Company/AOP should also be checked (√). |

|

4 |

Status |

Check the Status as Resident or |

|

5 |

CNIC/ PP No. |

All Resident Individuals should write CNIC Number and |

|

|

|

In case of Company and AOP this column should be left blank. |

|

|

Gender |

Gender is required only for Individual, for Company and AOP it should be left blank |

|

6 |

Reg./ Inc. No. |

In case of Company, write SECP incorporation number. In case of AOP write the registration number of AOP if available, otherwise leave it blank. |

|

|

Birth/ Inc. Date |

Individual should write the Birth Date and Company/AOP should write the date of incorporation/formation |

|

7 |

Name |

Name of Registered Person. Individual should write the name as appearing in the CNIC/ Passport, Company should write the name as appearing in SECP and |

|

|

|

AOP should write the name as shown in the AOP Agreement. |

|

8 |

Address |

Company should write the address of Registered Office, Individual and AOP should write Business/Mailing Address. |

|

9 |

Principal Activity |

Principal Activity of the Person being registered should be written here, in case of multiple business activities the Principal Activity at the time of registration |

|

|

|

should be determined on the basis of major revenue generating business activity. Detailed list of Business Activities can be accessed from FBR's web site |

|

|

|

http://fbr.gov.pk or https://e.fbr.gov.pk. Individuals having only salary income should write Salary Income as Principal Activity. Professionals should specify their |

|

|

|

profession as Principal Activity or Other Activity as the case may be. |

|

|

Activity Code |

Activity Code is for official use, applicant should leave it blank. |

|

10 |

Register for |

Tick (√) the relevant boxes. All the relevant boxes should be checked. |

|

|

Revision N° |

This is for official use, and should be left blank by the applicant. |

|

11 |

Rep. Type |

"Representative as defined u/s 172" or "Authorized Representative in case of Company not having Permanent Establishment in Pakistan, as defined u/s 223" of |

|

|

|

the Income Tax Ordinance 2001. |

|

|

In Capacity as |

Capacity in which Representative/ Authorized Representative is mentioned as defined u/s 172 or |

223(2) of Income Tax Ord. 2001 |

12 |

Phone, Mobile, Fax |

Phone, Mobile and Fax number of the Legal Representative or Individual (in case of Self) should also be written. Fax number is optional. |

|

13 |

|||

14 |

Total No. of Directors |

Total Number of directors/shareholders/partners of the business. |

|

|

Total Capital |

Total Capital of the business and shareholder wise share to be provided in case of Company. Particulars of all Partners should be provided for AOP |

|

15 |

Type of Identification |

Type of Identification: N=> NTN, C=> CNIC, P=> Passport Number, M=> CNIC number issued in |

|

|

NTN/CNIC |

NTN/ CNIC of all the shareholders/ directors/ partners should be provided in this portion. More sheets should be added for more than 5. |

|

|

Name of Director |

Name of Director/Shareholder/Partner. |

|

|

Capital |

Capital share of owner in terms of capital amount, for Company only |

|

|

Share % |

%age of share will be calculated by the system on the basis of share value provided in the capital column |

|

16 |

Others |

Others Share of owners in terms of capital amount |

|

17 |

Activity Code |

Activity Code is for official use, applicant should leave it blank. |

|

|

Business Activity |

Detailed list of Business Activities can be accessed from FBR's web at site http://fbr.gov.pk or http://e.fbr.gov.pk. Do not |

|

9.Hence if there is no activity other than the Principal Activity, then this portion should be left blank. More activities can be added later through the Change Request as explained at

18 |

Total Business/branches |

Total Number of Businesses/ Branches, details of which should be provided in the following columns. |

19 |

Business / Branch Sr. |

Serial Number of the Business/ Branch. Separate sheets are required to provide information about each additional business/ branch including HQ |

|

Action Requested |

Check (√) the relevant box as Add Business, Change Particulars or Close Business/ Branch |

20 |

Business/Branch Type |

Type of Business/ Branch such as Head Office, |

|

Business/ Branch Name |

Write name of the Business or Branch in accordance with the Business Branch Type selected |

21 |

Nature of Premises |

Nature of Premises Possession as Owned, Rented or Others, along with CNIC/NTN/FTN and Name of the Owner should be written |

22 |

Electricity Reference No. |

Electricity Consumer number of the connection installed at the business/ HQ/ branch premises |

|

Gas Connection installed |

Tick the relevant box, showing the gas connection installed at the premises |

|

Gas Consumer No. |

If Gas connection is installed, then write here Gas Consumer number of the connection installed at the business/ branch premises |

23 |

Phone No. |

Phone number with area code should be written for the Business/ Brach written at Sr. 20 |

|

Business/Br. Start Date |

Start Date of the Business/ Branch, date should be written in the format of |

|

Business/Br. Close Date |

Closing Date of the Business/ Branch. This is applicable only when Close Business/ Branch is selected as Action Requested |

24 |

Total Bank Accounts |

Total Number of Bank Accounts, details of which should be provided in the following columns |

25 |

Account Sr. |

Serial Number of the Bank Account. Separate sheets are required to provide information about each additional bank account |

|

Action Requested |

Check (√) the relevant box as Add Account, Change Particulars or Close Account |

26 |

A/C No. |

Bank Account No. as allotted by the bank |

|

A/C Title |

Title of Account |

|

Type |

Check (√) the relevant box showing Account Type such as PLS or Current as the case may be. |

27 |

Bank Name |

Write bank name in abbreviated form, e.g. MCB for Muslim Commercial Bank, NBP for National Bank of Pakistan, City Bank for City Bank |

|

City |

Name of the City in which bank branch is located |

|

Branch |

Name of the bank branch with branch Code |

28 |

Start Date |

Start Date of the bank Account, date should be written in the format of |

|

Close Date |

Close Date of the bank Account, in case the account is closed. This is applicable only when Close Account is selected as Action Requested |

29 |

NTN/ FTN |

NTN/ FTN of the Employer, in case of applicant having Salary Income as Principal Activity. (FTN = Free Tax Numbers allotted to Govt. Departments) |

|

Name |

Name of Employer |

30 |

Address |

Address of Employer |

|

City |

City of Employer's Head Office |

31 |

Declaration |

Declaration to be signed by the applicant or his/her authorized representative. |

32 |

Date |

Date of signing the application, in the format of |

|

CNIC/Passport No. |

CNIC/Passport No. of the applicant. Applicant can be the Person him/her self or his/her authorized representative having written Authorization. |

|

Name of Applicant |

Name of Applicant as appearing in the CNIC/Passport. |

|

Signatures |

Signatures of the applicant. |

Tax Registration Form can be submitted as follows:

1)Duly completed application form along with copies of required documents can be submitted at any of the (13) Regional Tax Offices or TFCs.

2)Online application can also be prepared by visiting the FBR website https://e.fbr.gov.pk. Online tutorial for assistance can also be downloaded.

3)NTN Certificate should be received in person at RTO by the applicant or his authorized representative, after one working day of successful telephonic verification. At the time of receiving the NTN Certificate, Original CNIC should be shown. If an authorized representative is to receive the NTN Certificate then Original Authority Letter and original CNIC of the authorized person should be shown at the RTO/ TFC Counter.

4)Request for Change in Particulars is also processed as described at Sr.

5)For Request of Duplicate Certificate, complete particulars should be provided. Current Certificate should be surrendered, if available. If current certificate is lost, then an affidavit on Stamp Paper of Rs. 10 should be attached with the application.

Attachments |

For all applications : Copy of the last paid Electricity Bill of the connection installed at the address given in the Registry Portion of the form |

|||

|

||||

|

For Individual |

1) Copy of CNIC/ Passport |

|

|

|

For Company |

1) Copy of CNIC of Applicant |

2) Copy of SECP Incorporation Certificate |

3) Applications of all owners, if not already NTN holder |

|

For AOP |

1) Copy of CNIC of Applicant |

2) Copy of AOP Agreement, if applicable |

3) Applications of all Partners, if not already NTN holder |

01) RTO Karachi, Opposite Sindh Secretariat |

05) RTO Rawalpindi, Kachery Road |

09) RTO Hyderabad, Site Area |

13) RTO Islamabad, Blue Area |

||

02) RTO Lahore, Nabah Road |

06) RTO Gujranwala, GT Road |

10) RTO Sukkur, Income Tax Building |

|

||

03) |

RTO Peshawar, Jamrud Road |

07) RTO Sialkot, Kachary Road |

11) RTO Multan, Shamsabad Colony |

List of TFCs available at |

|

http://fbr.gov.pk |

|||||

|

|

|

|

||

04) |

RTO Quetta, Chaman Housing Scheme |

08) RTO Faisalabad, New Civil Lines |

12) RTO Abbottabad, Main Mansehra Road |

||