Navigating the complex landscape of tax matters in Tennessee can be a daunting task for both individuals and businesses alike. The Tennessee Department of Revenue Power of Attorney (POA) form emerges as a critical document in this journey, offering a means to appoint a trusted representative to act on behalf of the taxpayer regarding tax affairs. This form encompasses several key aspects, starting with the basic taxpayer information and extending to the designation of a representative who is empowered to handle a wide array of tax-related activities. These include the authority to inspect confidential tax information and perform acts ranging from signing agreements to representing the taxpayer in communications with the department. Importantly, while this form bestows significant powers, it explicitly excludes the ability to receive refund checks, highlighting a thoughtful balance between delegation and control. The form also touches on procedural necessities such as how notifications and communications are managed, ensuring that the appointed representative is the main point of contact. The final segments of the form concentrate on the formalities of execution, requiring signatures from both the taxpayer and the representative, underscored by a declaration from the latter to uphold the integrity of their representation under penalty of perjury. This declaration not only solidifies the representative’s commitment but also underscores the legal seriousness and implications of the form. Overall, the Tennessee Department of Revenue Power of Attorney form is a testament to the robust mechanisms in place for managing tax matters, offering a structured yet flexible pathway for taxpayers to navigate their obligations and rights.

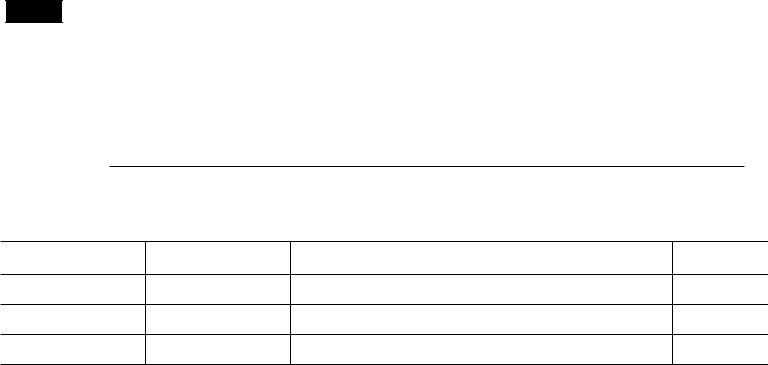

| Question | Answer |

|---|---|

| Form Name | Tn Department Of Revenue Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | tennessee department of revenue power of attorney, agreements, specified, RV-F0103801 |

TENNESSEE DEPARTMENT OF REVENUE

POWER OF ATTORNEY

PART1

Power ofAttorney (Please type or print.)

1. Taxpayer Information (Taxpayer must sign and date this form on line 6.)

Taxpayer name and address |

Account number(s) |

Daytime telephone number

()

hereby appoints the following representative as

2.Representative (Representative must sign and date this form on page 2, Part II.)

Name and address

Telephone No. ( |

) |

|

||

Fax No. ( |

) |

|

|

|

to represent the taxpayer before the Tennessee Department of Revenue for the following tax matters:

3.Tax Matters

|

Type of Tax (Sales and Use, Franchise, Excise, etc.) |

Year(s) or Period(s) |

|

|

|

|

|

4.ActsAuthorized.

5.

6.Signature of Taxpayer.- If signed by a corporate officer, partner, guardian, tax matters partner/person, executor, receiver, administrator,ortrusteeonbefalfofthetaxpayer,I certifythatIhavetheauthoritytoexecutethisformonbehalfofthetaxpayer.

Signature |

Date |

Title (if applicable) |

Print Name

PART II

Declaration of Representative

Under penalties of perjury, I declare that:

..I am authorized to represent the taxpayer(s) identified in Part 1 for the tax matter(s) specified there; and I am one of the following:

a.Attorney or Certified PublicAccountant

b.Officer or

c.Other

If this declaration of representative is not signed and dated, the power of attorney will be returned.

Designation

above letter

Jurisdiction (state)

Signature

Date