TN FORM UCC1 (07/13)

BUSINESS SERVICES DIVISION

Tre Hargett, Secretary of State

State of Tennessee

INSTRUCTIONS

UCC Financing Statement (TN Form UCC1)

Filing Fee: $15.00 per Debtor

Maximum Principal Indebtedness Tax due upon filing (see instructions)

A UCC1 financing statement may be filed using one of the following methods:

•E-file: Go to http://tnbear.tn.gov/UCC. Use the online tool to complete the filing and pay the filing fee and indebtedness tax by credit card, debit card or ACH. When paying by credit card, debit card or ACH, there is a convenience fee that covers the credit card fees and transaction costs incurred by the Business Services Division when accepting online payments. Filers who do not wish to pay the convenience fee to file online may choose the “Print and Mail” option at no additional cost.

•Print and Mail: Go to http://tnbear.tn.gov/UCC. Use the online tool to complete the filing. Print and mail the application along with the required filing fee and indebtedness tax to the Secretary of State’s office at ATTN: UCC, 312 ROSA L PARKS AVE #6, NASHVILLE TN 37243-1102.

•Paper submission: A blank form may be obtained by going to http://www.tn.gov/sos/forms/ucc1.pdf, by emailing the Secretary of State at Business.Services@tn.gov, or by calling (615) 741-3276. The application is hand printed in black ink or computer generated and mailed along with the required filing fee and indebtedness tax to the Secretary of State’s office at ATTN: UCC, 312 ROSA L PARKS AVE #6, NASHVILLE TN 37243-1102.

•Walk-in: A blank UCC1 form may be obtained in person at the Secretary of State Business Services Division located on the 6th Floor of the Snodgrass Tower at 312 Rosa L. Parks AVE, Nashville, TN 37243.

Please type or laser-print this form. Be sure it is legible. Read all instructions, especially instruction 1; correct Debtor name is crucial. Follow instructions completely.

Fill in form very carefully; mistakes may have important legal consequences. If you have questions, consult your attorney. Filing office cannot give legal advice.

Do not insert anything in the open space in the upper right portion or in the right hand vertical margin of this form. It is reserved for filing office use.

Page 1 of 3

If you need to provide additional information, you must use a UCC Financing Statement Addendum form (TN Form UCC1Ad) or a UCC Financing Statement Additional Party form (TN Form UCC1Ap).

To assist the filing office in communicating with the filer to resolve any issues, the filer may provide information in items A and B.

Complete item C if you want an acknowledgment sent to you and your original documents returned.

1.DEBTOR’S NAME - Enter only one Debtor name in item 1: either an organization's name (1a) or an individual’s name (1b). Enter Debtor’s exact full legal name. Do not abbreviate. Name fields are a maximum of 256 characters in length.

1a ORGANIZATION DEBTOR - “Organization” means an entity having a legal identity separate from its owner. A partnership is an organization; a sole proprietorship is not an organization, even if it does business under a trade name. If Debtor is a partnership, enter the exact full legal name of the partnership. You need not enter names of partners as additional Debtors. If Debtor is a registered organization (e.g., corporation, limited partnership, limited liability company), it is advisable to examine the Debtor’s current filed formation documents to determine the exact legal name of the Debtor.

1b. INDIVIDUAL DEBTOR - “Individual” means a natural person; this includes a sole proprietorship, whether or not operating under a trade name. Do not use prefixes (Mr., Mrs., Ms.). Use suffix box only for titles of lineage (Jr., Sr., III) and not for other suffixes or titles (e.g., M.D.). Use a married woman’s personal name (Mary Smith, not Mrs. John Smith). Enter individual Debtor’s family name in INDIVIDUAL’S SURNAME box, first given name in FIRST PERSONAL NAME box, and all additional given names in ADDITIONAL NAME(S) INITIAL(S) box. Individual Debtor’s name should be the same as the name on the driver’s license or photo identification license, if applicable.

For both organization and individual Debtors: do not use Debtor’s aliases (e.g. trade name, DBA, AKA, FKA, division name) in place of or combined with Debtor’s legal name; you may add such other names as additional Debtors if you wish (this is neither required nor recommended).

1c. MAILING ADDRESS - A complete address is always required for the Debtor named in 1a or 1b. Our system will standardize the address in USPS format.

2.DEBTOR’S NAME - If an additional Debtor is included, complete item 2, determined and formatted per instruction 1. To include further additional Debtors, or one or more additional Secured Parties, attach a UCC Financing Statement Addendum form (TN Form UCC1Ad) using correct name format. Follow instruction 1 for determining and formatting additional names.

3.SECURED PARTY’S NAME - Enter information for Secured Party or Total Assignee, determined and formatted per instruction 1. To include further additional Secured Parties, attach either a UCC Financing Statement Addendum form (TN Form UCC1Ad) or a UCC Financing Statement Additional Party form (TN Form UCC1Ap) using correct name format. Follow instruction 1 for determining and formatting additional names. If there has been a total assignment of the Secured Party’s interest prior to filing this form, you may either (1) enter Assignor Secured Party‘s name and address in item 3 and file an Amendment (Form UCC3) [see item 5 of that form]; or (2) enter Total Assignee’s name and address in item 3 and, if you wish, also attach Addendum (Form UCC1Ad) giving Assignor Secured Party’s name and address in item 12.

4.COLLATERAL - Use item 4 to indicate the collateral covered by this Financing Statement. If space in item 4 is insufficient, put the entire collateral description or continuation of the collateral description on UCC1 Addendum (Form UCC1Ad). Pursuant to T.C.A. § 67-4-409(b) every recorded instrument evidencing an indebtedness must contain, either on the face of the instrument or in an attached sworn statement, the following language: "Maximum principal indebtedness for Tennessee recording tax purposes is $_____."

5.If the collateral is held in Trust or being administered by a Decedent’s Personal Representative, check the appropriate box in item 5.

6a. If the filing is a Public-Finance Transaction, a Manufactured-Home Transaction, or if the Debtor is a Transmitting Utility, select the appropriate box in 6a.

Page 2 of 3

6b. If this is an agricultural lien (as defined in applicable Commercial Code) filing or is otherwise not a UCC security interest filing (e.g., a tax lien, judgment lien, etc.), check the appropriate box in item 6b and attach any other items required under other law.

7.ALTERNATIVE DESIGNATION - If filer desires (at filer's option) to use titles of lessee and lessor, or consignee and consignor, or seller and buyer (in the case of accounts or chattel paper), or bailee and bailor, or licensee and licensor instead of Debtor and Secured Party, check the appropriate box in item 7.

8.OPTIONAL FILER REFERENCE DATA - This item is optional and is for filer's use only. Filer may enter in item 8 any identifying information (e.g., Secured Party's loan number, law firm file number, Debtor's name or other identification, state in which form is being filed, etc.) that filer may find useful. Do not include confidential personal information such as birth dates or social security numbers.

Filing Fee and Maximum Principal Indebtedness Tax

•The filing wizard (http://tnbear.tn.gov/UCC) correctly calculates both the filing fee and the maximum principal indebtedness tax.

•The filing fee is $15.00 per Debtor.

•There is an additional fee of fifty cents ($0.50) per page for each page in excess of ten (10) pages.

•The maximum principal indebtedness tax is calculated at 11.5 cents for each $100.00 of indebtedness or major fraction thereof ($50.00 or more rounds up). The first $2,000.00 is tax exempt. In order to properly record your lien amount, the full indebtedness amount must be provided. The filing wizard calculates the tax due taking into consideration the $2,000.00 exemption and any taxes you report as paid to another jurisdiction

•Make check, cashier’s check or money order payable to the Tennessee Secretary of State. Cash is only accepted for walk-in filings. Filings submitted without the proper filing fee and maximum principal indebtedness tax will be rejected. Checks, cashier’s checks or money orders made out to any payee other than the Tennessee Secretary of State will not be accepted and will result in the rejection of the document.

Page 3 of 3

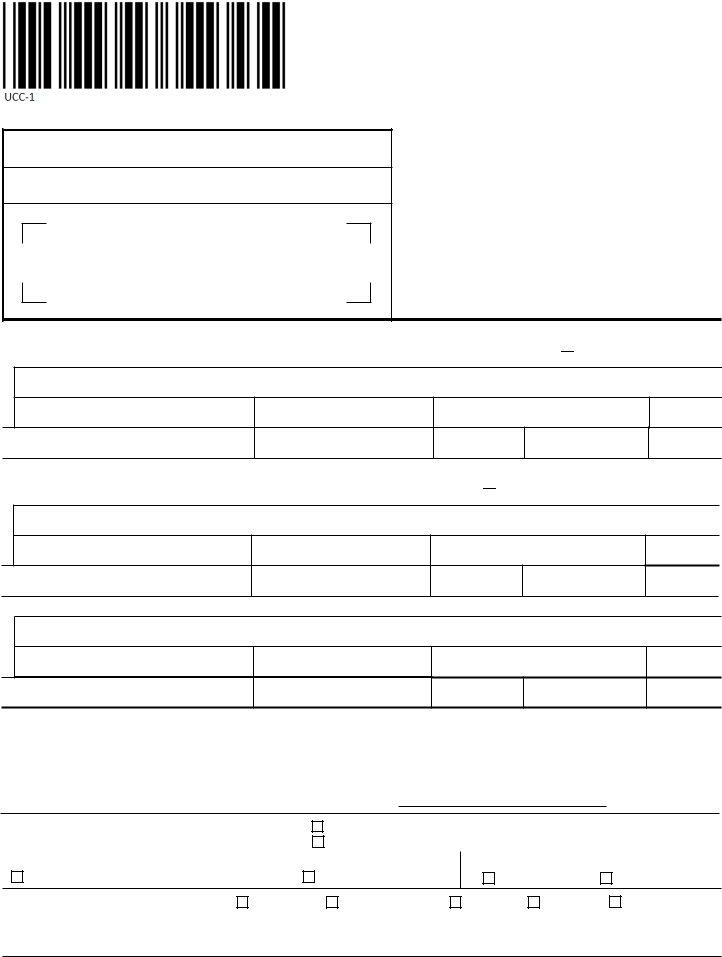

UCC FINANCING STATEMENT

FOLLOW INSTRUCTIONS

A. NAME & PHONE OF CONTACT AT FILER (Optional)

B. EMAIL CONTACT AT FILER (Optional)

C. SEND ACKNOWLEDGMENT TO: (Name and Address)

THE ABOVE SPACE IS FOR FILING OFFICE USE ONLY

1.DEBTOR’S NAME: Provide only one Debtor name (1a or 1b) (use exact full name; do not omit, modify, or abbreviate any part of the

Debtor’s name); if any part of the Individual Debtor’s name will not it in line 1b, leave all of item 1 blank, check here and provide the Individual Debtor Information in item 10 of the Financing Statement Addendum (Form UCC1Ad)

1a. ORGANIZATION’S NAME

OR

1b. INDIVIDUAL’S SURNAME |

FIRST PERSONAL NAME |

ADDITIONAL NAME(S) INITIAL(S) |

SUFFIX |

2.DEBTOR’S NAME: Provide only one Debtor name (2a or 2b) (use exact full name; do not omit, modify, or abbreviate any part of the Debtor’s name); if any part of the individual Debtor’s name will not it in line 2b, leave all of item 2 blank, check here and provide the Individual Debtor Information in item 10 of the Financing Statement Addendum (Form UCC1Ad)

2a. ORGANIZATION’S NAME

OR

2b. INDIVIDUAL’S SURNAME |

FIRST PERSONAL NAME |

ADDITIONAL NAME(S) INITIAL(S) |

SUFFIX |

3.SECURED PARTY’S NAME (or NAME of ASSIGNEE of ASSIGNOR SECURED PARTY): Provide only one Secured Party name (3a or 3b) 3a. ORGANIZATION’S NAME

OR

3b. INDIVIDUAL’S SURNAME |

FIRST PERSONAL NAME |

ADDITIONAL NAME(S) INITIAL(S) |

SUFFIX |

4. COLLATERAL: This inancing statement covers the following collateral:

Maximum principal indebtedness for Tennessee recording tax purposes is $

5. Check only if applicable and check only one box: Collateral is |

held in Trust (see UCC1Ad, Item 17 and instructions) |

|

being administered by a Decedent’s Personal Representative |

|

|

6a. Check only if applicable and check only one box:

Public-Finance Transaction |

|

Manufactured-Home Transaction |

A Debtor is a Transmitting Utility

6b. Check only if applicable and check only one box:

Agricultural Lien |

Non-UCC Filing |

7. ALTERNATIVE DESIGNATION (if applicable): |

Lessee/Lessor |

Consignee/Consignor |

Seller/Buyer |

Bailee/Bailor |

Licensee/Licensor |

|

|

|

|

|

|

8. OPTIONAL FILER REFERENCE DATA: |

|

|

|

|

|

NOTE: All information on this form is public record.

UCC FINANCING STATEMENT (TN FORM UCC1) (REV. 07/01/2013)