Embarking on a journey through the intricate world of taxation and finance forms can be daunting, yet understanding the TP-650 Application for Registration under Articles 12-A and 13-A provides a vivid illustration of just how detailed and specific the process can be. Intended for applicants desiring registration for various fuel-related activities in New York State (NYS), the TP-650 form encompasses a broad array of sections that meticulously gather information to evaluate eligibility. It demands information ranging from basic identification details like legal and trade names, addresses, and contact information, to more complex data regarding the type of organization, IRS Letter of Registration, and the specific type of fuel-related activities one intends to engage in. More so, it delves into past affiliations, convictions, and financial details that attest to the applicant's history and current standing. This thorough form serves as a cornerstone for regulatory compliance, ensuring that fuel distribution and sales within the state operate within the legal framework established by NYS taxation laws. Its comprehensive nature not only filters applicants through rigorous criteria but also mirrors the state's dedication to maintaining stringent standards in its fuel markets.

| Question | Answer |

|---|---|

| Form Name | Tp650 Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | york tp application, department registration under, tp 650, form 650 12 |

Department of Taxation and Finance |

|

Application for Registration Under Articles |

(1/21) |

Read Form TP‑650‑I, INSTRUCTIONS FOR FORM TP‑650, carefully before completing this form. Attach additional sheets as necessary to fully answer all questions.

Print or type. All applicants must complete lines 1 through 14.

1 |

Legal name |

|

|

|

|

|

|

|

|

|

|

|

|

2 |

DBA or trade name (if different from legal name above) |

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Address of principal place of business (number and street; not a PO Box) |

City |

|

State |

ZIP code |

|

|

|

|

|

|

|

|

4 |

Mailing address (if different from business address) |

City |

|

State |

ZIP code |

|

|

|

|

|

|

||

5 |

Business telephone |

|

6 |

Date business began or will begin in New York State (NYS) (mmddyyyy) |

||

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

7a |

Employer identification number (EIN) |

|

7b |

Email address |

|

|

|

|

|

|

|

|

|

8Type of organization (mark an X in one or more boxes)

Sole proprietor (individual) |

Partnership |

Limited liability partnership (LLP) |

Limited liability company (LLC) |

Corporation

Other (specify):

9Do you have an IRS Letter of Registration as a result of filing a federal Form 637, Application for Registration (For Certain Excise Tax Activities)?

Yes (attach a copy) |

No |

10Types of registration

Mark an X in the appropriate box for which this form applies (see instructions):

New applicant |

Change of registration |

Transfer of registration

Mark an X in the box(es) for the license/registration for which you are applying and complete the lines indicated (see instructions):

a. |

Distributor of diesel motor fuel (lines |

b. |

Retailer of |

c. |

Distributor of |

d. |

Aviation fuel business (lines |

e. |

Residual petroleum product business (lines |

11Activities (mark an X in all boxes that apply)

A Importing or causing to import product owned by the applicant

into NYS for use, distribution, storage, or sale in NYS:

motor fuel

diesel motor fuel (includes No. 2 heating oil) kero‑jet fuel

residual petroleum product other fuel

B Refining, manufacturing, compounding, blending, or otherwise producing within NYS:

motor fuel

diesel motor fuel (includes No. 2 heating oil) kero‑jet fuel

residual petroleum product other fuel

C Selling to other resellers in NYS:

motor fuel

diesel motor fuel (includes No. 2 heating oil)

kero‑jet fuel

residual petroleum product

other fuel

f. |

Retail seller of aviation gasoline (lines |

g. |

Importing/exporting transporter (lines |

h. |

Terminal operator (lines |

i. |

Distributor of motor fuel (lines |

j. |

Metropolitan Commuter Transportation District (MCTD) motor fuel |

|

wholesaler (lines |

k. |

Liquefied petroleum gas permittee (lines |

D Selling at retail in NYS (other than at a filling station):

motor fuel

diesel motor fuel (includes No. 2 heating oil) kero‑jet fuel

residual petroleum product other fuel

E Owner of a vehicle powered by:

liquefied petroleum gas

compressed natural gas

propane

other (identify)

F Retailing aviation gasoline at an airport

G Retailing kero‑jet fuel and no other diesel product

H Industrial user:

diesel motor fuel (includes No. 2 heating oil) residual petroleum product

I Importing kero‑jet fuel into NYS in fuel tanks of aircraft

J Supplying passenger or cargo air carrier services to others

K Selling or purchasing motor fuel in the Metropolitan Commuter Transportation District

L |

Other (explain): |

Page 2 of 4

12a List owner(s), officers, directors, partners, and responsible employees (see instructions). Attach additional sheets if necessary.

Name |

|

|

Social Security number (SSN) or EIN |

Type(s) of registration(s) (a‑j) (see instr.) |

||

|

|

|

|

|

|

|

Home address (number and street) |

|

|

Percentage of ownership |

Title |

|

|

|

|

|

|

|

|

|

City |

State |

ZIP code |

Duties (a‑g) (see instructions) |

Telephone number |

||

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

Name |

|

|

SSN or EIN |

Type(s) of registration(s) (a‑j) (see instr.) |

||

|

|

|

|

|

|

|

Home address (number and street) |

|

|

Percentage of ownership |

Title |

|

|

|

|

|

|

|

|

|

City |

State |

ZIP code |

Duties (a‑g) (see instructions) |

Telephone number |

||

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

Name |

|

|

SSN or EIN |

Type(s) of registration(s) (a‑j) (see instr.) |

||

|

|

|

|

|

|

|

Home address (number and street) |

|

|

Percentage of ownership |

Title |

|

|

|

|

|

|

|

|

|

City |

State |

ZIP code |

Duties (a‑g) (see instructions) |

Telephone number |

||

|

|

|

|

( |

) |

|

|

|

|

|

|||

12b For a corporation only, enter the total percentage of voting stock held by all shareholders (the percentage of voting stock in lines 12a and 12b |

% |

|||||

must total 100%; see instructions) |

.......................................................................................................................................................................... |

|

|

|

||

13During the last five years, has the applicant or any person listed in line 12a:

•owned or controlled, directly or indirectly, more than 10% (25% or more if there are four or fewer shareholders) of the voting stock of a business other than the applicant, or

•been an employee of a business (other than the applicant) who was under a duty to file a return or pay taxes under Articles

•been an officer, director, or partner of a business other than the applicant?

Yes |

No |

If Yes, complete below (see instructions; attach additional sheets if necessary) |

|

|

|

|

|

|

|

Name of other business |

|

EIN |

|

|

|

|

|

|

|

Address (number and street) |

City |

State |

ZIP code |

|

|

|

|

|

|

Name of person or applicant |

|

Inclusive dates |

|

|

|

|

|

|

|

Name of other business |

|

EIN |

|

|

|

|

|

|

|

Address (number and street) |

City |

State |

ZIP code |

|

|

|

|

|

|

Name of person or applicant |

|

Inclusive dates |

|

|

|

|

|

|

|

14In the past five years, was any person listed in line 12a convicted of any crime, or was any person listed in line 12a associated with a business (as described in line 13) at the time the business was convicted of any crime (see instructions)?

Yes |

No |

If Yes, complete below (see instructions; attach additional sheets if necessary) |

|

|

||

|

|

|

|

|

|

|

Name of person |

|

|

Name of business (if applicable) |

|

City and state of arrest |

|

|

|

|

|

|

||

Date of conviction (mmddyyyy) |

Court of conviction |

Statute section convicted of violating |

Disposition (fine, imprisonment, etc.) |

|||

|

|

|

|

|

|

|

Description of charges: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

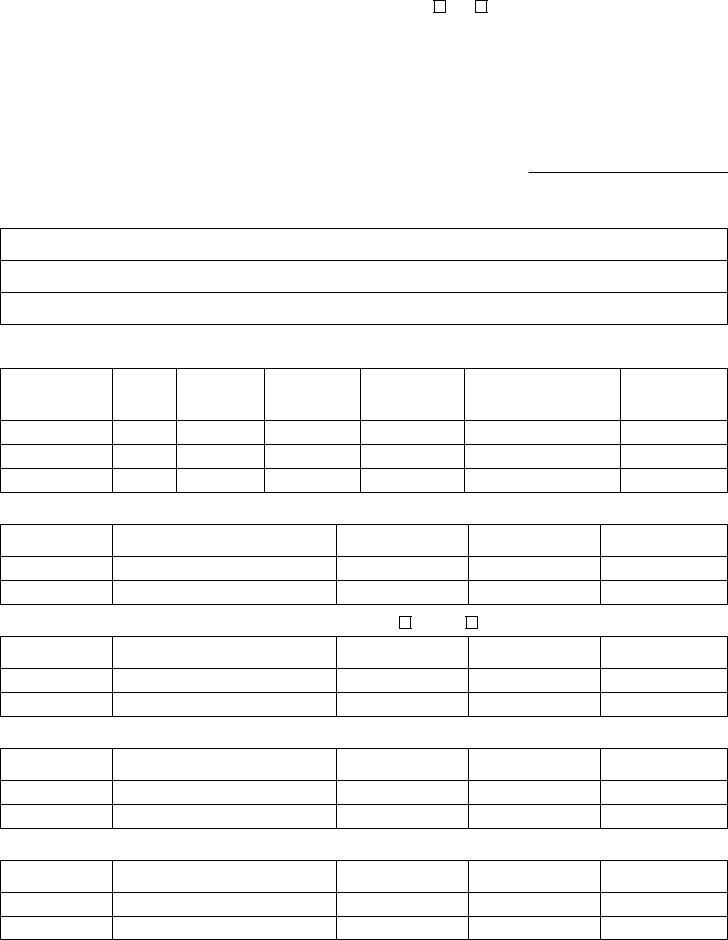

Lines 15 and 16 should be completed by a distributor of diesel motor fuel, retailer of non‑highway diesel motor fuel only, distributor of kero‑jet fuel only, residual petroleum product business, retail seller of aviation gasoline, distributor of motor fuel, and MCTD motor fuel wholesaler.

15Depending on the type of registration for which you are applying, enter the number of gallons of fuel sold or used in each of the last three years

(see instructions).

Year

Diesel motor fuel (gal.)

Kero‑jet fuel (gal.)

Residual petroleum product (gal.)

Aviation gasoline (gal.)

Motor fuel (gal.)

|

|

Page 3 of 4 |

|||

16 |

Capacity of bulk storage tanks you own (see instructions) |

|

|

gal. |

|

|

Capacity of bulk storage tanks you lease or rent from another |

|

|

gal. |

|

|

Is any motor fuel or diesel motor fuel stored on the site of these bulk storage tanks? Yes |

No |

|

|

|

17 |

Only distributors of diesel motor fuel should complete line 17 (see instructions). |

|

|

|

|

|

a. Gallons of diesel motor fuel you expect to sell or use each month in NYS |

|

|

gal. |

|

|

b. Gallons included in 17a that you expect to sell for specific exempt purposes |

|

|

gal. |

|

|

c. Gallons of |

|

|

gal. |

|

|

d. Gallons of highway diesel motor fuel included on line 17a sold to a registered distributor within a terminal |

|

gal. |

||

|

e. Gallons of highway diesel motor fuel included in 17a and purchased tax paid in NYS |

|

|

gal. |

|

18 |

Only distributors of motor fuel should complete line 18. |

|

|

|

|

|

Gallons of motor fuel you expect to import, manufacture, refine, produce, or compound each month in NYS |

|

|

gal. |

|

19Only importing/exporting transporters should complete line 19.

a. Identify your method(s) of transporting motor fuel (truck, tractor‑trailer, barge, tanker, pipeline, railroad, etc.)

b. |

Gallons of motor fuel you expect to import into NYS during the next 12 months |

|

gal. |

c. |

Gallons of motor fuel you expect to export out of NYS during the next 12 months |

|

gal. |

d.List all terminals/storage facilities located in NYS where you load/unload motor fuel: Location of terminal/facility

20Only terminal operators should complete line 20 (attach additional sheets if necessary).

a. List all terminals/storage facilities located in NYS where you will store motor fuel or diesel motor fuel.

Location

Owned (O) or

Leased (L)

Capacity

Method of

supply

Method of distribution

Blending |

Type of fuel |

capability |

stored |

(Yes OR No) |

(premium OR |

|

regular) |

|

|

Gallons of motor fuel or diesel motor fuel handled during the last 12 months

b. For all leased terminals/storage facilities listed in line 20a, complete the following:

Location

Lessor’s name and address

Lessor’s EIN

or SSN

Capacity leased

Lease expiration

date (mmddyyyy)

c. Do you lease or sublease any terminals listed in line 20a to other persons? Yes |

No |

If Yes, complete the following: |

Location

Lessee’s/sublessee’s name and address

Lessee’s/sublessee’s EIN or SSN

Capacity leased

Lease expiration

date (mmddyyyy)

d. List principal suppliers of each terminal/storage facility:

Location of

terminal/facility

Supplier’s name and address

Method of transportation

Supplier’s EIN

or SSN

Gallons supplied for last 12 months

e. List principal transporters from each terminal:

Location of

terminal/facility

Transporter’s name and address

Method of transportation

Transporter’s EIN

or SSN

Gallons transported during last 12 months

Page 4 of 4

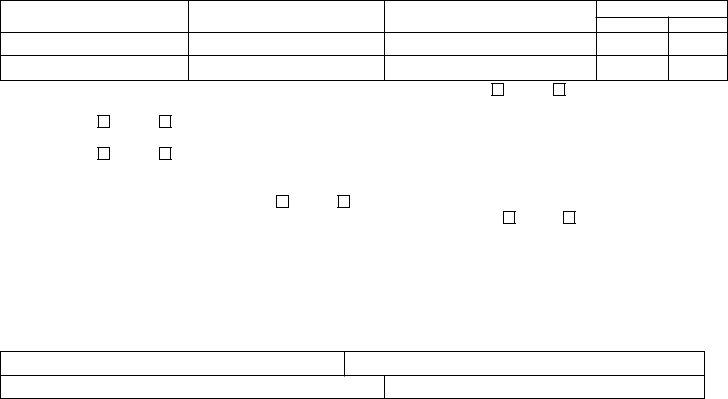

21Only distributors of

Name of place of business

Name of airport

Location of airport (street, city, county)

Type of fuel

Kero‑jet Aviation

b. |

Are all sales of kero‑jet and aviation gasoline delivered directly into the fuel tanks of aircraft? |

Yes |

No |

|

c. |

If you are registering as a distributor of |

|||

|

NYS? Yes |

No |

|

|

d. If you are registering as a retail seller of aviation gasoline, do you sell any motor fuel (other than aviation gasoline at retail) at any location within

NYS? Yes |

No |

22 |

Only aviation fuel business applicants should complete line 22. |

|

|

|

Are you an airline (see Definitions in instructions)? Yes |

No |

|

|

If you are not an airline, would you prefer to file monthly tax returns instead of annual tax returns? |

Yes |

|

23 |

Signature (all applicants must complete line 23) |

|

|

No

I certify that all information provided is true and complete, and that this application has been completed with the knowledge that making a willfully false written statement is a felony under Tax Law § 1812(c)(1) and a misdemeanor under Tax Law §§ 1812(c)(2),

false statement herein may result in the cancellation, suspension, or revocation of any license or registration issued by the Tax Department pursuant to the tax articles to which this form applies. I also understand that the Tax Department is authorized to investigate the validity of the accuracy of any information entered on this application.

Printed name

Title

Signature

Date (mmddyyyy) |

Daytime telephone number |

|

|

( |

) |

|

|

|

Additional attachments required

If you are applying for a license/registration as a distributor or motor fuel, liquefied petroleum gas fuel permittee, distributor of diesel motor fuel, retailer of

non‑highway diesel motor fuel only, distributor of kero‑jet fuel only, residual petroleum product business, or retail seller of aviation gasoline, you must submit:

•a current financial statement (to register as a distributor of motor fuel, your current financial statement must be a certified, unqualified statement); and

•a letter from each supplier that includes the following information:

–the quantity and type of product that they agree to supply to you each month;

–payment and/or credit terms; and

–the terminals from which the fuel will be shipped and the method of shipment (ocean vessel, barge, tank truck, pipeline, etc.).

If you are not currently registered as a sales tax vendor, you must apply and receive your NYS Certificate of Authority before this application will be approved for licensing/registration. You may apply online by using the New York Business Express at www.businessexpress.ny.gov.

The Tax Department will notify you if you are required to file a bond or other acceptable security (see Bonding requirements in instructions).

Mail completed application and all required documents to:

NYS TAX DEPARTMENT

REGISTRATION AND BOND UNIT

W A HARRIMAN CAMPUS

ALBANY NY

If not using U.S. Mail, see Publication 55, Designated Private Delivery Services.