You'll be able to fill in tr1 easily in our PDFinity® online PDF tool. Our team is dedicated to making sure you have the absolute best experience with our editor by constantly releasing new capabilities and improvements. With all of these improvements, using our tool becomes better than ever before! In case you are looking to get started, this is what it will take:

Step 1: Access the PDF inside our tool by clicking the "Get Form Button" above on this page.

Step 2: The tool will allow you to modify most PDF forms in many different ways. Change it by writing personalized text, correct what's originally in the file, and add a signature - all doable in no time!

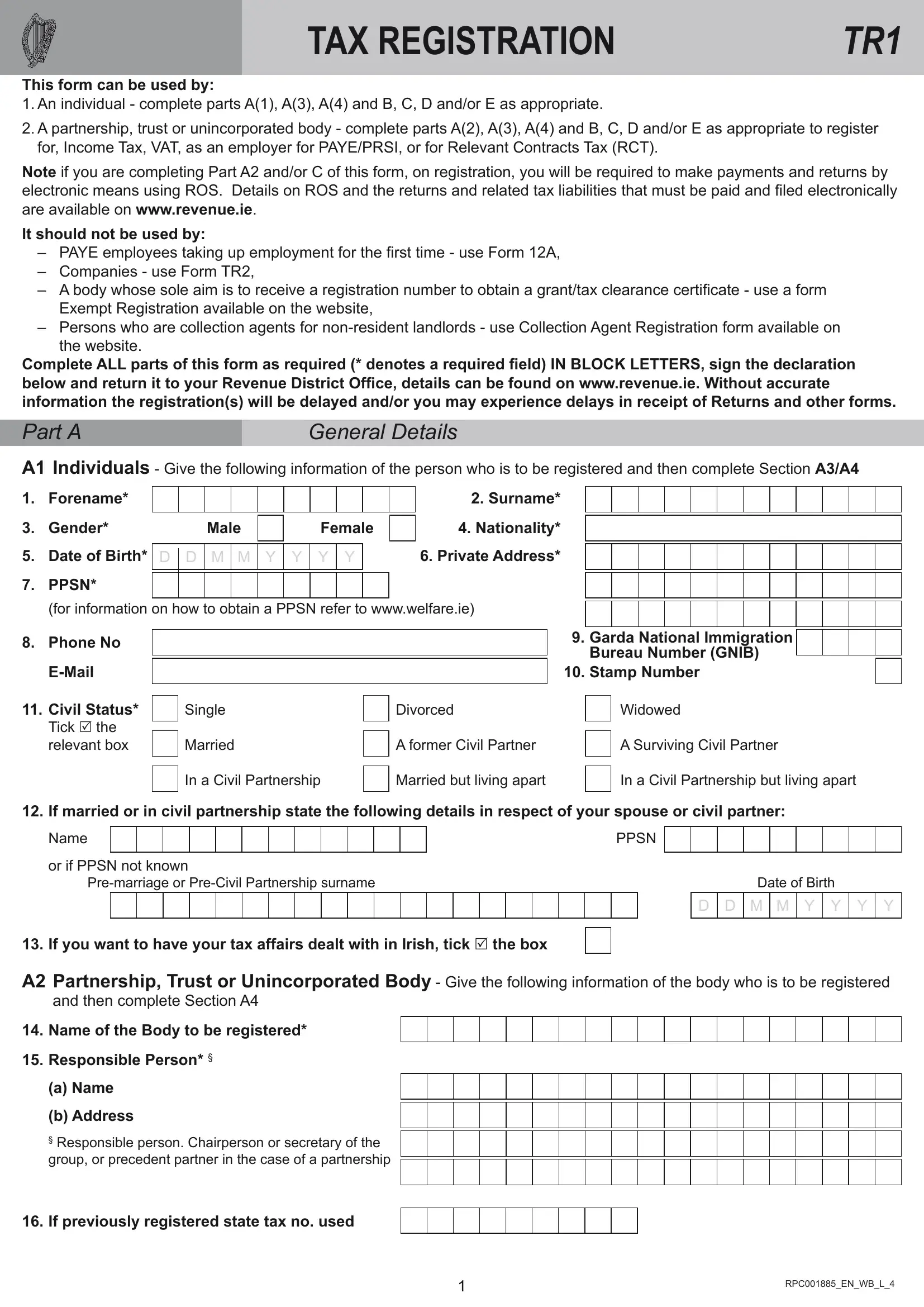

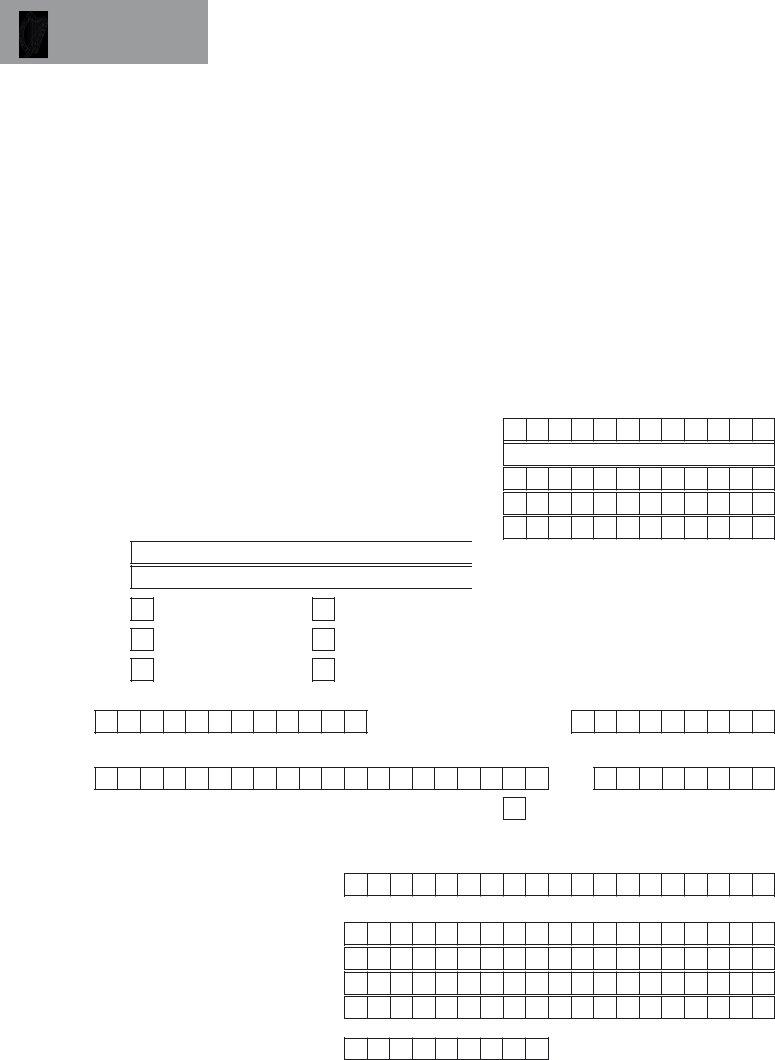

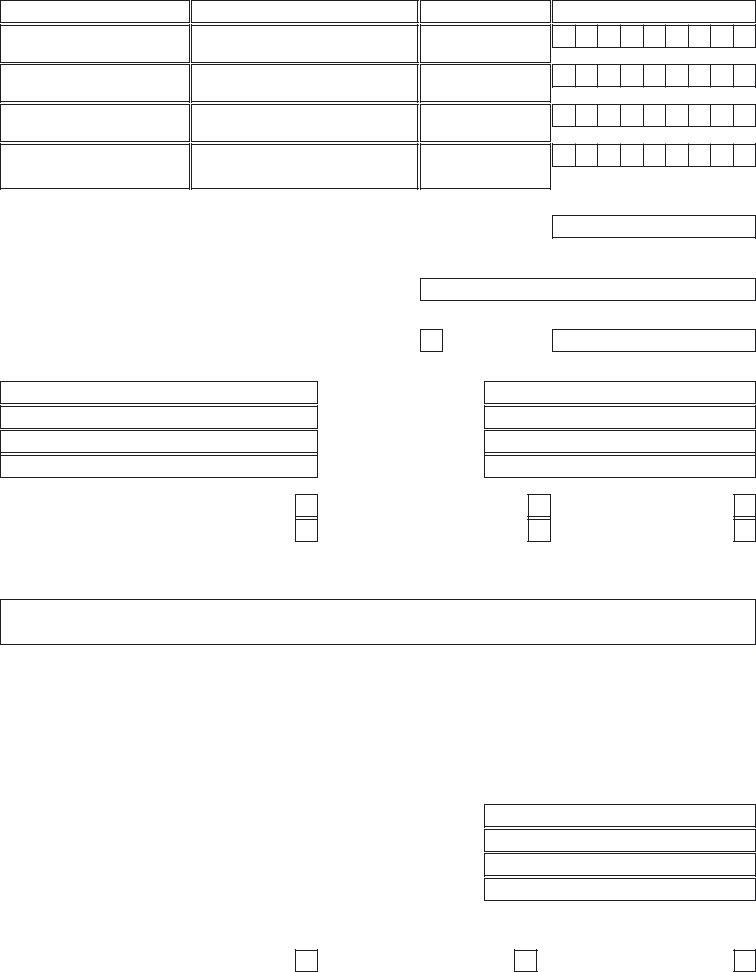

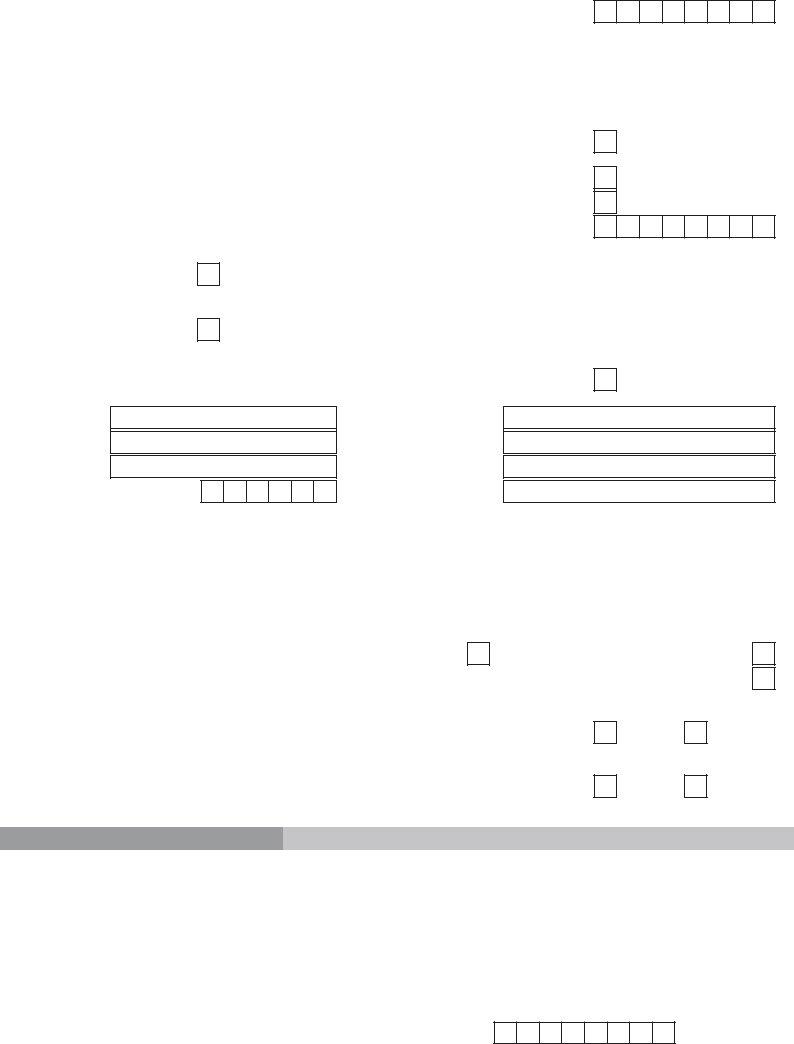

As a way to finalize this document, be sure to type in the right details in every single area:

1. You will want to fill out the tr1 correctly, so be mindful while working with the parts including all of these blanks:

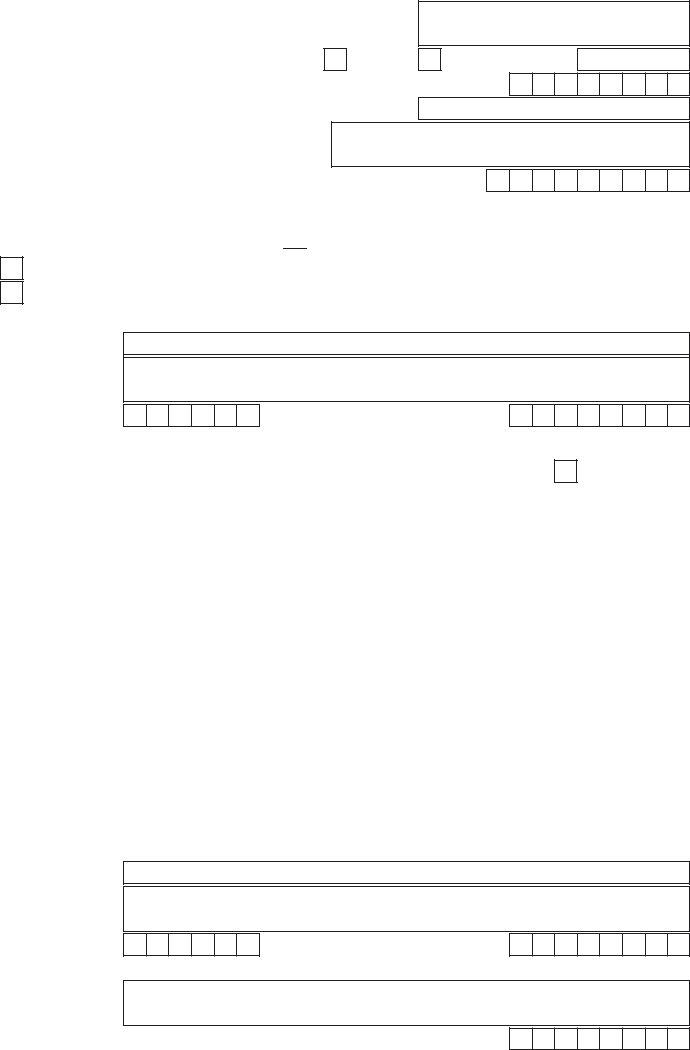

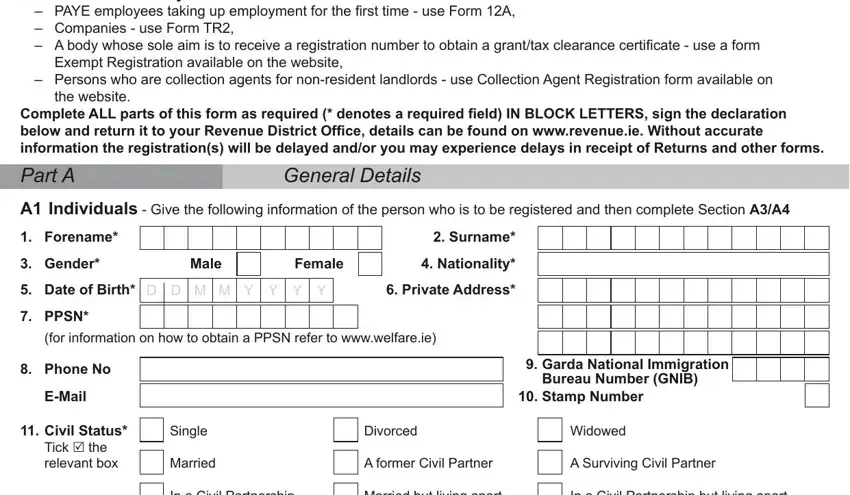

2. After the last part is completed, you're ready to add the essential details in Additional Information If you, I declare that the particulars, This must be made in every case, Individual secretary precedent, D D M M Y Y Y Y, SIGNATURE, in BLOCK LETTERS, and DATE in order to move on further.

As to Additional Information If you and I declare that the particulars, ensure that you don't make any errors in this current part. These two are the most important fields in the form.

Step 3: Right after you have looked over the information entered, just click "Done" to conclude your form. Find your tr1 once you register here for a free trial. Easily view the pdf file from your personal account page, with any edits and changes automatically synced! FormsPal guarantees your data confidentiality with a secure method that in no way records or shares any sensitive information used. Feel safe knowing your documents are kept safe each time you work with our services!