Whenever you need to fill out dssr 120 fillable, there's no need to install any programs - simply try using our PDF editor. In order to make our tool better and simpler to utilize, we continuously come up with new features, with our users' feedback in mind. With some easy steps, you can begin your PDF editing:

Step 1: Open the PDF in our tool by clicking the "Get Form Button" above on this webpage.

Step 2: The tool will allow you to modify PDF documents in a range of ways. Change it by writing personalized text, adjust original content, and include a signature - all at your disposal!

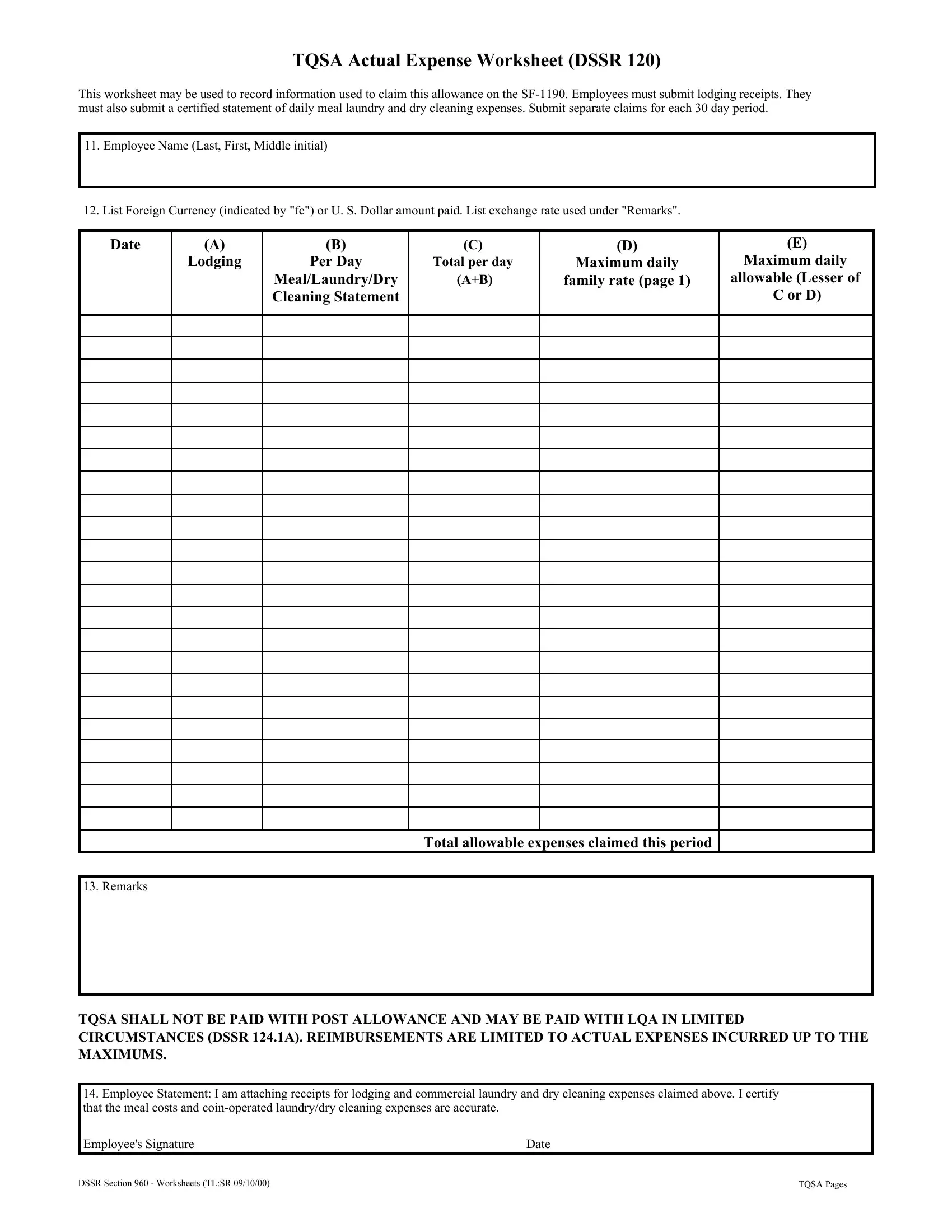

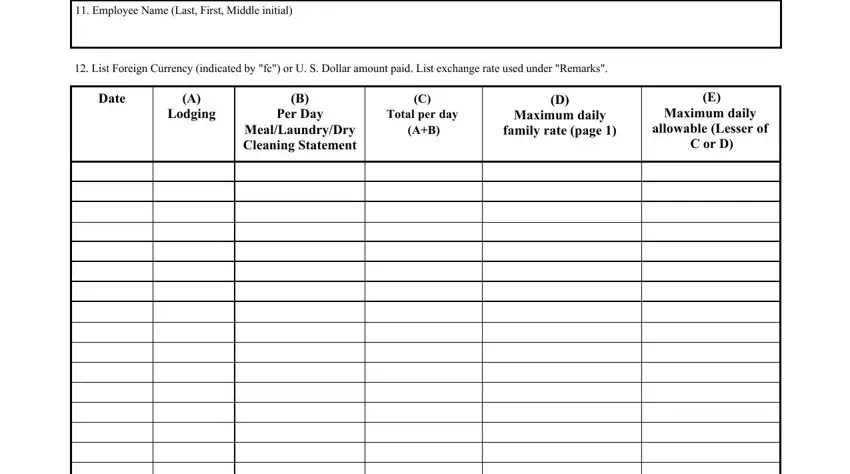

This form will require you to type in some specific information; to ensure accuracy and reliability, remember to take heed of the following guidelines:

1. Whenever filling in the dssr 120 fillable, be certain to incorporate all of the essential blank fields in its corresponding form section. It will help to expedite the work, enabling your details to be processed promptly and properly.

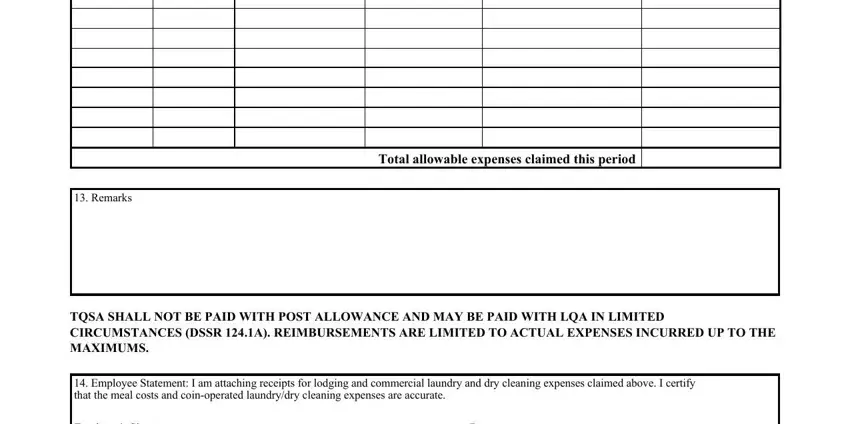

2. Right after this array of blanks is filled out, go to enter the suitable details in all these: Remarks, Total allowable expenses claimed, TQSA SHALL NOT BE PAID WITH POST, and Employee Statement I am attaching.

It is easy to make a mistake when filling out your Remarks, therefore be sure to go through it again before you'll submit it.

3. Completing Employees Signature, Date, DSSR Section Worksheets TLSR, and TQSA Pages of is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Step 3: Before moving forward, make sure that blanks were filled in right. When you think it's all fine, click “Done." Get the dssr 120 fillable after you register at FormsPal for a 7-day free trial. Conveniently use the form inside your FormsPal account, together with any modifications and adjustments conveniently kept! Whenever you work with FormsPal, you'll be able to complete documents without having to get worried about data incidents or data entries getting shared. Our protected platform makes sure that your personal data is kept safe.