Navigating the complexities of tax forms is essential for businesses, and the Transaction Privilege, Use, and Severance Tax Return form, commonly known as TPT-1, plays a crucial role in Arizona's tax landscape. Mandated by the Arizona Department of Revenue, this form is a comprehensive document that must be meticulously filled out and submitted by businesses engaged in various transactions that are subject to tax within the state. Due to its significance, understanding the deadlines for submission, the availability of online filing through AZTaxes.gov, and the nuances of filing for both "program" and "non-program" cities becomes vital. The form serves multiple functions, including the reporting of transaction privilege tax, county excise tax, use tax, and severance tax. It acts as a one-stop document for businesses to declare their tax liability for a given period, allowing for amendments if necessary. Importantly, the form also elaborates on penalties for late submissions, thereby emphasizing the importance of adherence to due dates. Assistance with the form is accessible, with customer service centers and telephone numbers provided for support, ensuring that businesses can seek help when needed. This broad overview is intended to guide businesses through the process of completing the TPT-1 form, making sure they meet compliance requirements while also taking advantage of the facilities provided by Arizona's Department of Revenue.

| Question | Answer |

|---|---|

| Form Name | Transaction Privilege Severance Tax Return Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | use and severance, privilege return, privilege and return, instructions tpt |

GENERAL INSTRUCTIONS

Transaction Privilege, Use, and Severance Tax Return (TPT‑1)

ARIZONA DEPARTMENT OF REVENUE

www.azdor.gov

MAILING ADDRESS

Arizona Department of Revenue

PO Box 29010

Phoenix, AZ 85038‑9010

If you are mailing your Transaction Privilege Tax Return, it must received by the Department on or before the second to last business day of the month.

ONLINE FILING

Go to www.AZTaxes.gov

CUSTOMER SERVICE

CENTER LOCATIONS

8:00 a.m. ‑ 5:00 p.m.

Monday through Friday

(except Arizona holidays)

Phoenix Office

1600 W Monroe

Phoenix, AZ 85007

Tucson Office

400 W Congress

Tucson, AZ 85701

7:00 a.m. ‑ 6:00 p.m.

Monday through Thursday

8:00 a.m. ‑ 12:00 p.m.

Friday

(except Arizona holidays)

Mesa Office

55 N Center

Mesa, AZ 85201

(This office does not handle billing or account disputes.)

CUSTOMER SERVICE

TELEPHONE NUMBERS

8:00 a.m. ‑ 5:00 p.m.

Monday through Friday

(except Arizona holidays)

Phoenix Area

(602) 255‑3381

Within Arizona

1 (800) 352‑4090

Online Filing:

Form TPT‑1 may be filed online. www.AZTaxes.gov is the Arizona Department of

Revenue’s taxpayer service center web site that provides taxpayers with the ability to file tax returns and pay taxes due, conduct other transactions, and review tax

account information over the internet. Save time and expense and comply with due date requirements with ease and convenience. File and pay online by becoming a registered business at www.AZTaxes.gov. For taxpayers electing to file and pay taxes electronically, the Department must receive the filing and payment on or before the last business day of the month; therefore, this transaction must be initiated before 5:00 p.m. of the preceding day.

Who Must File:

All businesses with income subject to transaction privilege tax, county excise tax, use or severance tax must file a Form TPT‑1 return even if there is no tax liability due for the period. City tax for “program” cities is also reported on Form TPT‑1. A list of the “program” cities is found in Table II of the TRANSACTION PRIVILEGE AND OTHER TAX RATE TABLES (“TAX RATE TABLES”) which are available on the Department’s web site (www.azdor.gov).

Most of the larger cities administer their transaction privilege taxes independently of the state and are called

reported on Form TPT‑1. A listing of “non‑program” cities is found in Table III of the

TAX RATE TABLES.

Due Date for Form

Arizona Revised Statutes (A.R.S.) § 42‑5014 states that Form TPT‑1 is due on the 20th day of the month following the month (or other reporting period) in which the tax

is collected or accrued. (This date is used for the computation of penalties or interest that applies to returns or payments that are filed late.) However, A.R.S. § 42‑5014 allows that a return will be considered to be filed timely if it is received by the Department on or before the second to last business day of the month. A business

day is any day except Saturday, Sunday, or a legal Arizona state holiday. See “Online

Filing” above for the due date of electronically filed returns, .

Late Filing Penalty – Other Penalties

All returns that are not filed timely are subject to a late filing penalty. The late filing penalty imposed by A.R.S. § 42‑1125(A), as qualified by A.R.S. § 42‑5014(E),

is computed against the total amount of tax reported on the return, without any

deduction for tax that was paid on or before the due date. A late payment penalty and

other penalties may apply as provided in A.R.S. § 42‑1125. Penalties and interest are assessed based on the statutory due date of the 20th day of the month.

Amended Returns:

Form TPT‑1 must also be used to amend original returns that were filed for any previous reporting periods. To amend a previously filed Form TPT‑1, check the box in Section I marked “Amended Return” and complete the return with the corrected numbers. Amended Form TPT‑1 returns require some changes in the reporting of certain lines on the return as specifically noted in these instructions. See the instruction items shown with an asterisk (*).

PLEASE NOTE: All of the lines in the

DUE DATE: An amended return which claims a refund or credit must be filed within

four years of the due date of the original return or four years from the date the original return was filed, whichever date is later. A taxpayer may not use an amended return

to change a payment of estimated tax or to change the application of a claimed estimated tax payment.

ADOR 10872 (4/19) |

Page 1 |

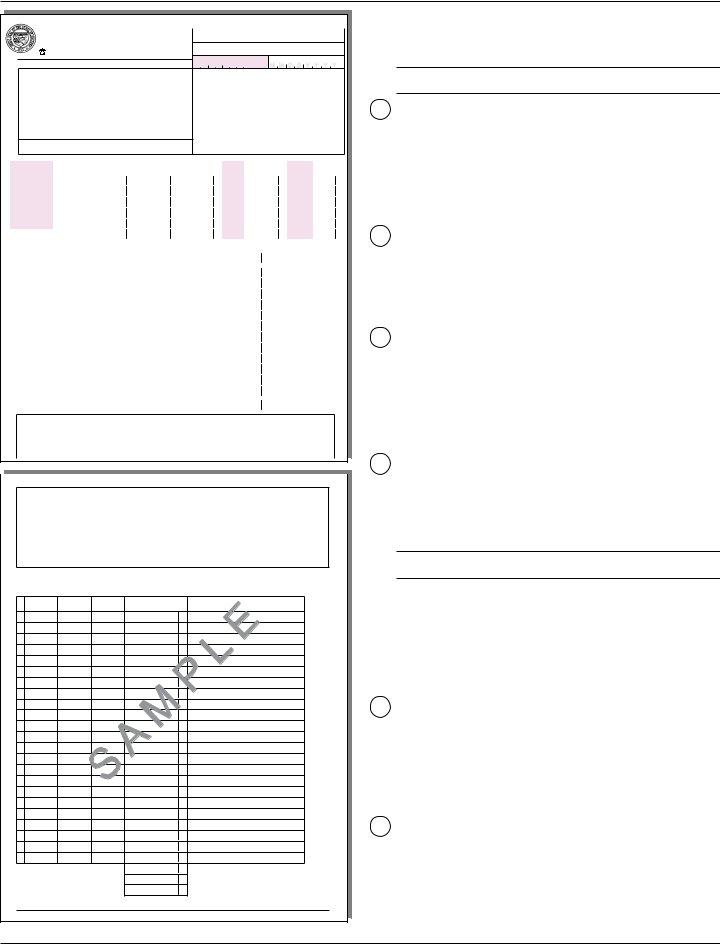

Transaction Privilege, Use,

and Severance Tax Return

TRANSACTION PRIVILEGE, USE, AND |

||

SEVERANCE TAX RETURN |

the reporting period. |

|

STATE LICENSE NUMBER: |

||

Arizona Department of Revenue |

||

|

PO BOX 29010 • PHOENIX, AZ |

|

TAXPAYER IDENTIFICATION NUMBER: |

|

|

|

|

||

FOR ASSISTANCE |

(602) |

|

|

|

|

|||

EIN |

SSN |

|

|

|

|

|

||

STATEWIDE, TOLL FREE FROM AREA CODES 520 AND 928: (800) |

PERIOD BEGINNING: |

PERIOD ENDING: |

|

|

|

|||

I. TAXPAYER INFORMATION |

|

M M D D Y Y Y Y |

M M D D |

Y |

Y |

Y |

Y |

|

Amended |

Multipage |

Final Return: DOR USE ONLY |

LABELED RETURN |

|||

Return |

Return |

Only Return |

(CANCEL LICENSE) |

|

||

BUSINESS NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

C/O |

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|

|

|

|

POSTMARK DATE |

|

|

|

|

|

|

|

|

CITY |

|

STATE ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RECEIVED DATE |

|

Address Changed

II. TRANSACTION DETAIL (If more reporting lines are necessary, please attach continuation pages.)

LINE |

|

(A) |

(B) |

(C) |

(D) |

(E) |

(F) |

|

|

(G) |

(H) |

(I) |

|

(J) = (F × I) |

|||

|

BUSINESS |

REGION |

BUSINESS |

|

|

|

|

|

|

|

|

|

ACCOUNTING |

|

ACCOUNTING |

||

|

DESCRIPTION |

CODE |

CODE |

GROSS AMOUNT |

DEDUCTION AMOUNT |

NET TAXABLE AMOUNT |

TAX RATE |

TOTAL TAX AMOUNT |

CREDIT RATE |

|

CREDIT |

||||||

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtotal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

III. TAX COMPUTATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Total deductions from Schedule A |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

1 |

|

|

1 |

|

|

|

|

|

|

|

|

|

||||

|

|

Total Tax Amount (from column H) |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

2 |

|

|

2 |

|

|

|

|

|

|

|

|

|

||||

|

3 |

State excess tax collected |

|

|

+ |

3 |

|

|

|

|

|

|

|

|

|

||

|

4 |

Other excess tax collected |

|

|

+ |

4 |

|

|

|

|

|

|

|

|

|

||

|

5 |

Total Tax Liability: Add lines 2, 3, and 4 |

|

= |

5 |

|

|

|

|

|

|

|

|

|

|||

|

6 |

..............................................................Accounting Credit (from column J) |

|

|

6 |

|

|

|

|

|

|

|

|

|

|||

|

7 |

State excess tax accounting credit: Multiply line 3 by .01 |

+ |

7 |

|

|

|

|

|

|

|

|

|

||||

|

8 |

Total Accounting Credit: Add lines 6 and 7 |

|

= |

8 |

|

|

|

|

|

|

|

|

|

|||

|

9 |

................................................Net tax due line: Subtract line 8 from line 5 |

|

|

9 |

|

|

|

|

|

|

|

|

|

|||

|

10 |

Penalty and interest |

|

|

|

+ |

10 |

|

|

|

|

|

|

|

|

|

|

|

11 |

TPT estimated payments to be used |

|

- |

11 |

|

|

|

|

AMENDED RETURN ONLY |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

ORIGINAL REMITTED AMOUNT |

|

|||

|

12 |

Total amount due this period |

....................................................................... |

|

= |

12 |

|

|

|

|

$ |

|

|

|

|

||

|

13 |

Additional payment to be applied (for other periods) |

+ |

13 |

|

|

|

|

|

|

|

|

|

||||

|

|

TOTAL AMOUNT REMITTED WITH THIS RETURN |

= |

|

|

|

|

|

$ |

DOR USE |

|

|

|||||

|

14 |

14 |

|

|

|

|

|

|

|

|

|||||||

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

|

|

|

|

|

|

► |

|

|

|||

|

|

|

|

|

|

|

PAID PREPARER’S SIGNATURE (OTHER THAN TAXPAYER) |

||||

|

|

|

► |

|

|

|

|

|

|

|

|

|

|

|

|

TAXPAYER’S SIGNATURE |

DATE |

|

PAID PREPARER’S EIN OR SSN |

|

|||

|

|

|

|

|

|

|

|

||||

|

|

|

ADOR 10872 (2/16) |

Please make check payable to Arizona Department of Revenue. |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transaction Privilege, Use, and Severance Tax Return |

|

LICENSE NO. ______________________ |

|

|

|||||

Schedule A: Deduction Detail Information

The deduction amounts that have been listed on the lines in Section II, Column E must be itemized by category for each Region Code and Business Code reported. The total of the amounts listed in Schedule A must equal the total of the Deduction Amounts listed on page 1. (See page 4 of the

Deduction Codes for itemizing deductions, with a paraphrased description of the deduction (or exemption), are listed at www.azdor.gov. Some of the codes may be used for more than one business code. Several additional Deduction Codes, as well as the statutory wording and any administrative guidance for each deduction code, are provided on the Department’s web site. The actual text of the statutory deduction, exemption or exclusion is controlling for amounts taken as deductions on Form

SCHEDULE A

Deduction Detail

LINE |

(K) |

(L) |

(M) |

(N) |

(O) |

|

DEDUCTION |

DEDUCTION |

DESCRIPTION OF |

||||

REGION CODE |

BUSINESS CODE |

|||||

CODE |

AMOUNT |

DEDUCTION CODE |

||||

|

|

|

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

A Subtotal of Deductions ..............................

B Deduction Totals from Additonal Page(s) ..

CTotal Deductions (line A + line B = line C)..

Total Must Equal Total on Page 1, Section III, line 1

ADOR 10872 (3/15)

INSTRUCTIONS

The following numbered instructions correspond to the numbered

sections of the sample Form TPT‑1. An example of completing

Section II of Form TPT‑1 and Schedule A is provided on page 4. When completing this form, please print or type in black ink.

Section I – Taxpayer Information

1 *Business Name and Address

If you are preparing a blank form, write in the correct information. If you are completing a preprinted form, check the accuracy of the business name and mailing address printed on the form. Make corrections on the form as required. If you make changes to the address, check the “Address Changed” box. If the return is an *amended return, a

multipage return, a one‑time only return, or if you are canceling your license and this is your final return, please check the appropriate

box.

2State License Number

If you are preparing a blank form, write in the correct number. If you are completing a preprinted form, check the accuracy of the Transaction Privilege Tax or Use Tax license number printed on the form. This number should include all eight (8) numerical digits. The state license number must also be placed in the top right hand corner

of all other pages of the return.

3Taxpayer Identification Number

In addition to the Transaction Privilege Tax License Number, a Taxpayer Identification Number is also required when filing any return. Check the accuracy of the Taxpayer Identification Number. The Taxpayer Identification Number is the number that the licensee uses to report federal income tax for the business: either the federal employer identification number (EIN) or social security number (SSN). Missing, incorrect or illegible Taxpayer Identification Numbers

may result in a penalty and will cause delays in processing the return.

4 Reporting Period

Check the accuracy of the PERIOD BEGINNING and the PERIOD ENDING boxes, and make corrections if necessary. If this

information is missing, write in the correct periods in an eight‑digit

format (MMDDYYYY). Taxpayers that have been authorized by the Department to file on a quarterly or annual basis must enter the first

and last months of the quarter or year in these periods.

Section II – Transaction Detail

*Note: For an amended return, complete Section II (and Schedule

A)with the corrected numbers. Include all lines that were present on the original return, even if there are no changes to some lines. See below for special instructions for certain lines in Section III Tax Computation.

For any return which requires more than five lines, use a continuation sheet to report the additional lines, and check the “multipage return” box in Section I.

5Business Code Description [Column A]

This column will identify your type of business, or “code.” For example, “retail,” “restaurant/bar,” “contracting,” etc. A list of business codes and other reporting categories, and the corresponding business code numbers, can be found in Table I of the TAX RATE TABLES.

When reporting “program” city tax on the TPT‑1, write the city name in this column. A list of “program” cities can be found in Table II of the

TAX RATE TABLES.

6Region Code [Column B]

This column identifies the county or city in which you conduct business, or the special region code required of some businesses. For counties or special regions, the region code will be three letters

(e.g., MAR for Maricopa County). For program cities, the region code

will be two letters (e.g., KM for Kingman). Please refer to the TAX RATE TABLES for the appropriate region codes. (See Tables II, IV,

or V.)

ADOR 10872 (4/19) |

Page 2 |

Transaction Privilege, Use, |

|

and Severance Tax Return |

INSTRUCTIONS |

7Business Code [Column C]

For reporting state and county tax, this column identifies the three‑digit number corresponding to your business codes, which can be found in Table I of the TAX RATE TABLES. (e.g., 017 is the business code number for a retail business).

For reporting program city tax, this column identifies the category of city tax that is being reported. These three‑digit numbers can be found in Table II of the TAX RATE TABLES. Please note that these numbers may vary by city.

8Gross (Receipts) Amount [Column D]

For each line item (reported business code or city), enter the gross

income in column D. Enter the gross amount of money, cash or other consideration you received during the reporting period of the return

(if you are using the cash receipts basis of accounting), or the total amount of revenue you invoiced, billed or otherwise recognized during this reporting period (if you are using the accrual basis of accounting). For both methods of reporting, the amount reported as gross income should include the tax amount collected. The tax will be deducted in column E.

9Deduction Amount [Column E]

Enter that portion of the reported gross receipts that is deductible or

exempt income. (For most deductions or exempt income, the seller

should retain appropriate documentation relating to the deductible or exempt income.) Deductions are to be itemized by category in Schedule A on page 2 of the TPT‑1 form. Unsubstantiated or incorrect deductions will be disallowed and penalties and interest may apply. (See separate instructions for completing Schedule A on page 4.) Common deductions include income from: sales for resale; labor or delivery charges for retail sales; sales of exempt manufacturing equipment; and exempt retail food sales.

Deduction for Taxes

The most common deduction is the deduction for tax itself. The gross receipts in column D should include whatever tax you have collected. Deduct this tax amount to avoid calculating tax on an amount that already includes tax. You are allowed to deduct state, county, and city taxes you collected and included in your gross amount. Or, if you did not separately charge and collect tax, you are allowed to assume that the tax collected is a part of the gross receipts amount, and you can factor that tax.

Tax Factoring

Tax factoring is appropriate only when the taxes were not separately charged to the customer or charged to the customer at an incorrect rate.

Taxes can be factored from gross receipts by using a mathematical formula, or by using the “factors” provided on the Department’s web site. (Additional information about factoring is provided in the

Department’s TRANSACTION PRIVILEGE TAX PROCEDURES TPP 00‑1 and TPP 00‑2 available at www.azdor.gov.)

10Net Taxable Amount [Column F]

Subtract column E from column D. Enter the result in column F. This is the net income that is subject to tax.

11Tax Rate [Column G]

If you receive your tax returns by mail or file online, the tax rates for your code or for the cities for which you report should be preprinted on Form TPT‑1. If they are not preprinted or you obtain a blank form, you can find the tax rates by checking the TAX RATE TABLES, which are available on the Department’s web site

(www.azdor.gov) and are updated frequently. The tax rate shown on the return should be expressed as a decimal. (For example,

6.3% = .06300)

12Total Tax Amount [Column H]

Multiply column F by column G. Enter the result in column H.

Accounting Credit

The State of Arizona provides a credit for accounting and reporting expenses. The accounting credit is applicable only to state

Transaction Privilege Tax or Severance Tax; it does not apply to city, county or other taxes. (See Table I of the TAX RATE TABLES for the state business codes eligible for the accounting credit.) The Department allows this credit to taxpayers who file and pay their

transaction privilege taxes timely and in full. If these conditions are not met, the accounting credit will be disallowed. The credit is equal to 1% of the amount of state tax due, but cannot exceed $10,000 for

a calendar year. [See A.R.S. § 42‑5017 and Arizona Administrative Code (A.A.C.) Rule R15‑5‑2007 for more information.]

13Accounting Credit Rate [Column I]

The accounting credit rate for your code should be preprinted on the form. If you are preparing a blank form, you can find the accounting credit rates in Table I of the TAX RATE TABLES.

14*Accounting Credit [Column J]

Multiply column F by column I. Enter the result in column J. This is

your accounting credit. (For an *amended return in which the state transaction privilege tax liability is increased, the accounting credit is limited to what was claimed on the original return.)

Subtotals

It is only necessary to add the amounts in columns E, H and J. For

multipage returns, you may enter the grand totals of all columns E, H and J on this line.

15Section III – Tax Computation

Line 1: Total Deductions from Schedule A

Enter the sum of the deduction amounts entered in Schedule A, which should equal the sum of all amounts entered in column E.

Line 2: Total Tax Amount

This amount should be the sum of the amounts entered in column H

on page 1 plus any additional pages.

Line 3: State Excess Tax Collected

By law, if you collected more tax than is calculated as due, the combined excess must be reported and paid to the Department of Revenue. Excess state tax collected should be entered on line 3.

Line 4: Other Excess Tax Collected

Other excess tax (city or county) collected/charged should be entered

on line 4.

Line 5: Total Tax Liability

Add lines 2, 3, and 4 and enter the sum on line 5.

Line 6: Accounting Credit

This amount should be the sum of the amounts entered in column J

on page 1 plus any additional pages.

Line 7: State Excess Tax Accounting Credit

Multiply line 3 by .01 and enter the result on line 7.

Line 8: Total Accounting Credit

Add lines 6 and 7 and enter the result on line 8.

Line 9: Net Tax Due

Subtract line 8 from line 5 and enter the result on line 9.

Line 10: Penalty and Interest

By law, returns that are filed late are assessed a late filing penalty of 4.5% per month or any portion of a month up to a maximum of 25% of

the amount of tax reported on the return without any deduction for tax paid on or before the due date. The late payment penalty is .5%

per month up to a maximum of 10%. The maximum total of these two penalties cannot exceed 25 percent of the tax due.

ADOR 10872 (4/19) |

Page 3 |

Transaction Privilege, Use,

and Severance Tax Return

Arizona’s interest rate is the same as the federal rate and continues to accrue until taxes are paid. Interest rate tables are available on the Department’s web site, or you may contact the Department at one of the phone numbers listed on page 1. Late payments of estimated tax are also subject to penalty and interest.

*Line 11: Estimated Tax Payments

Visit AZTaxes.gov to make your Transaction Privilege Tax Estimated

Payment. (Note: For an *amended return in which an estimated tax payment was claimed on the original, do not restate the payment.)

Annual Estimated Tax Payment Filing Requirements

Some taxpayers are required to make a single Annual Estimated Tax Payment on June 20th. These are taxpayers that have previously had an annual tax liability of $1,000,000 or more, or those who can reasonably anticipate such a liability in the current year. (See A.R.S.

§ 42‑5014, A.A.C. Rule R15‑5‑2215 for additional information and instructions.)

Line 12: Total Amount due this Period

Add lines 9 and 10. Subtract line 11 from this amount and enter the

result on line 12.

Line 13: Additional Payment to be Applied

If you owe a tax, penalty or interest liability originating from the filing of a previous TPT‑1 return, you may include payment of this liability

with this return. Please enter the amount of the additional payment on line 13.

*Line 14: Total Amount Remitted With This Return

Add lines 12 and 13 and enter the result on line 14. (For an *amended return, you may note the amount paid with the original return in the box to the right of line 12. On line 14, indicate only the additional amount remitted with the amended return. If the amended return is claiming a refund, leave line 14 blank and the Department will compute the refund due.)

Signature

Sign the return. Every return must be signed by the taxpayer or the

taxpayer’s authorized agent as noted.

Paid preparer’s signature. If the return has been prepared by a paid preparer, the return must include the paid preparer’s signature and

Taxpayer Identification Number.

SCHEDULE A INSTRUCTIONS (Page 2)

16IN Schedule A, the deductions that have been taken in column E on page 1 must be itemized by category. The total of the amounts

listed in Schedule A should equal the total of the amounts listed in column E. The deductions taken on all lines in Section II, including lines that report city tax, must be itemized. To view all codes and the

statutory language of the deductions for which codes are provided, as well as any administrative guidance provided by the Department, please go to www.azdor.gov/Forms/TransactionPrivilegeTax.aspx and click on “TPT‑1 Deduction Codes.”

Schedule A should be completed as follows: In columns K (Region Code) and L (Business Code), list the region code and business code corresponding to the line on which the deduction was taken in Section II on page 1. In column M (Deduction Code), choose the appropriate deduction code from the Deduction Code List. In column

N (Deduction Amount), list the description of each deduction code. In column O (Description of Deduction Code), list the specific amount of each deduction.The total itemized deductions in Schedule A should equal the total of the deduction amounts in column E in Section II.

INSTRUCTIONS

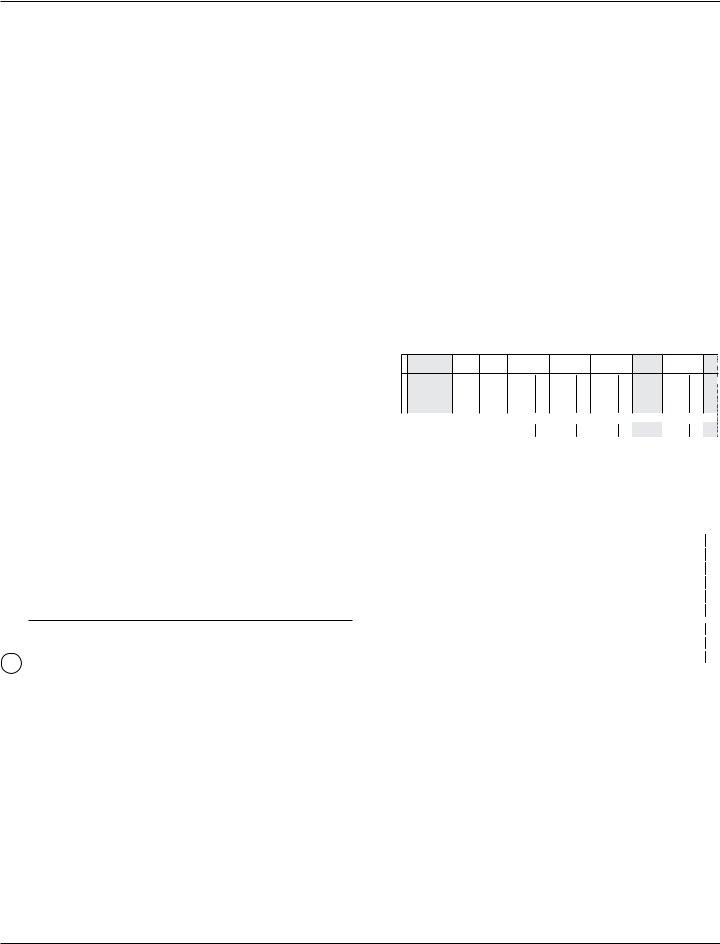

Example: Completing Section II and Schedule A

A retailer located in Carefree (which has a 3% city privilege tax rate) has $2,174.50 of gross receipts which breaks down as follows:

GROSS RECEIPTS |

$2,174.50 |

DEDUCTIONS: |

|

Nontaxable Sales for Resale |

400.00 |

Exempt Delivery Charges |

120.00 |

State and County Tax ($1,500 × 7.3%) |

109.50 |

Carefree City Tax ($1,500 × 3.0%) |

45.00 |

TOTAL DEDUCTION AMOUNT |

<$674.50> |

NET TAXABLE AMOUNT |

$1500.00 |

Carefree is a “program” city (located in Maricopa County) whose city taxes are administered and collected by the Department on Form TPT‑1. Combined state and county taxes are reported on one line in

Section II, and city taxes are reported on a separate line in Section

II.In reporting the state transaction privilege tax and county excise taxes, MAR is the Region Code for Maricopa County, and 017 is the state Business Code for retail sales. In reporting the Carefree privilege tax, CA is the Region Code and 017 is the Business Code for Carefree’s city retail privilege tax.

In Section II on the front of the form, the income, deductions and

tax are reported as follows:

II.TRANSACTION DETAIL (If more transaction locations, please attach additional sections.)

LINE |

(A) |

(B) |

(C) |

(D) |

(E) |

(F) |

(G) |

(H) |

|

BUSINESS |

REGION |

BUSINESS |

GROSS |

DEDUCTION |

NET TAXABLE |

|

TOTAL TAX |

ACC |

|

|

DESCRIPTION |

CODE |

CODE |

AMOUNT |

AMOUNT |

AMOUNT |

TAX RATE |

AMOUNT |

CRE |

1 |

Retail |

MAR |

017 |

2174 50 |

674 50 |

1500 00 .07300 |

109 50 |

|

|

2 |

Carefree |

CA |

017 |

2174 50 |

674 50 |

1500 00 .03000 |

45 00 |

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtotal |

|

|

1349 00 |

|

|

154 50 |

|

|

On Schedule A, the deductions are itemized as follows:

SCHEDULE A

Deduction Detail

LINE |

(K) |

(L) |

(M) |

(N) |

(O) |

|

|

DEDUCTION |

DESCRIPTION OF |

DEDUCTION |

|

||||

REGION CODE |

BUSINESS CODE |

|

|||||

CODE |

DEDUCTION CODE |

AMOUNT |

|

|

|||

|

|

|

|

|

|||

1 |

MAR |

017 |

551 |

Tax Collected or Factored |

154 |

50 |

|

2 |

MAR |

017 |

503 |

Sales for Resale |

400 |

00 |

|

3 |

MAR |

017 |

549 |

Services Provided by Seller |

120 |

00 |

|

4 |

CA |

017 |

551 |

Tax Collected or Factored |

154 |

50 |

|

5 |

CA |

017 |

503 |

Sales for Resale |

400 |

00 |

|

6 |

CA |

017 |

549 |

Services Provided by Seller |

120 |

00 |

|

A Subtotal of Deductions |

|

|

1349 |

00 |

|

||

|

|

|

|||||

B Deduction Totals from Additonal Page(s) |

0 |

00 |

|

||||

|

|

|

|

|

|||

C Total Deductions (line A + line B = line C) |

1349 |

00 |

|

||||

|

Total Must Equal Total on Page 1, Section III, line 1 |

|

|

|

|||

You will notice that the Total Deductions listed in Schedule A is equal

to the total of the amounts listed in column E in Section II. The total from Schedule A is also to be entered on line 1 in Section III on page 1 of Form TPT‑1. Unsubstantiated or incorrect deductions will be

disallowed and penalties and interest may apply.

ADOR 10872 (4/19) |

Page 4 |