This PDF editor was designed to be as simple as possible. Since you stick to these steps, the process of filling out the aztaxes gov tpt form will be effortless.

Step 1: Press the "Get Form Now" button to get started on.

Step 2: So, you may update the aztaxes gov tpt. This multifunctional toolbar helps you insert, get rid of, adjust, highlight, and also carry out several other commands to the content material and fields within the form.

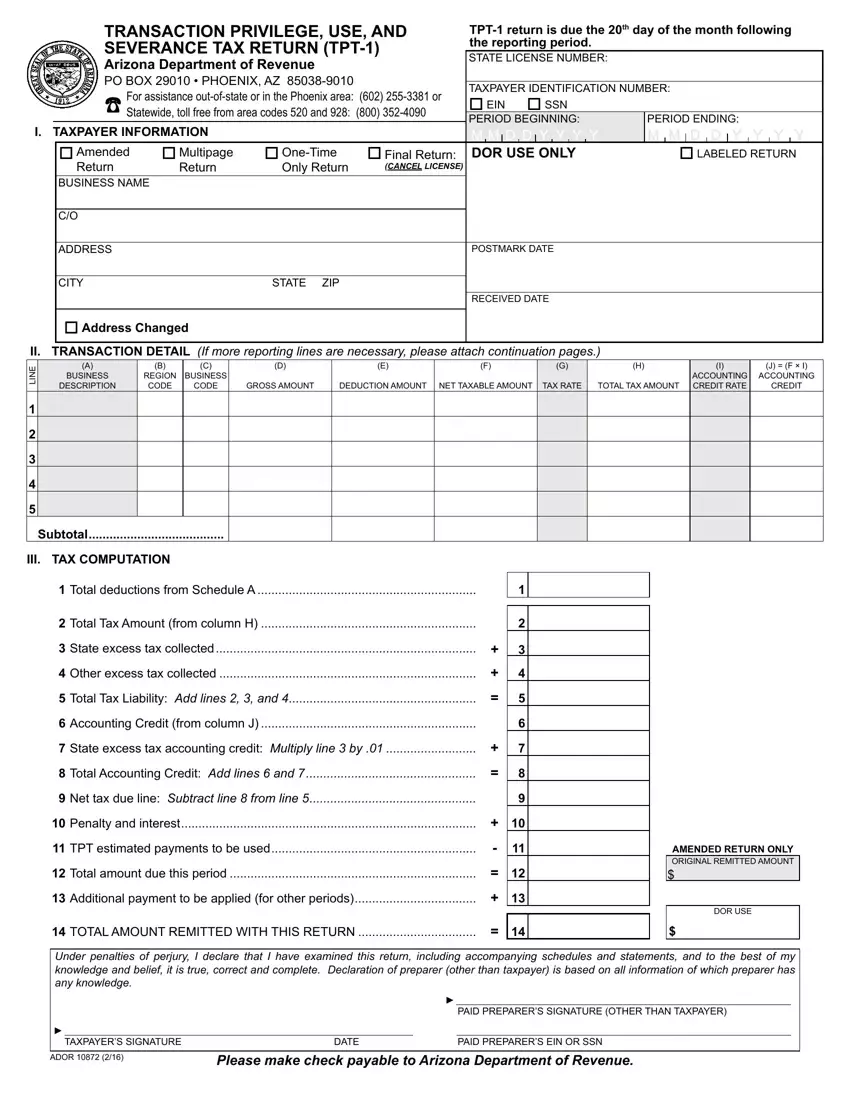

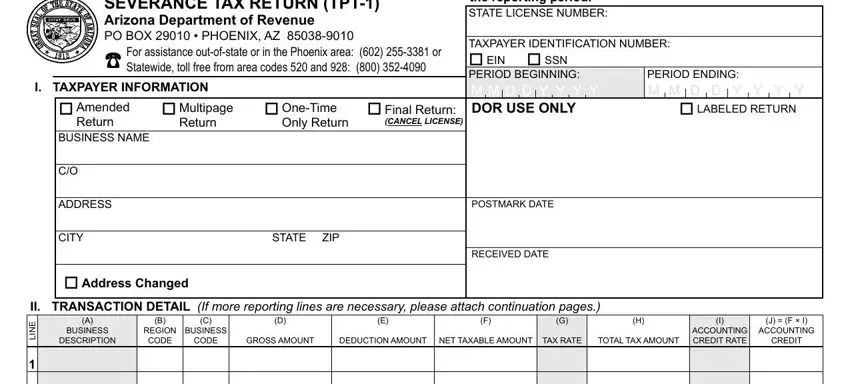

Prepare the aztaxes gov tpt PDF and provide the information for every single section:

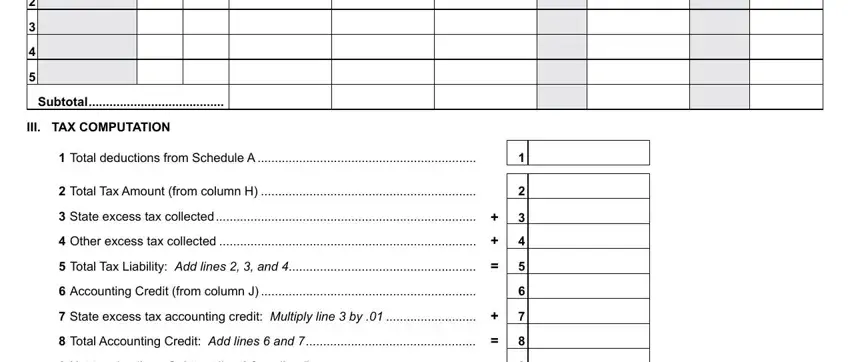

You should fill out the Subtotal, III TAX COMPUTATION, Total deductions from Schedule A, Total Tax Amount from column H, State excess tax collected, Other excess tax collected, Total Tax Liability Add lines, Accounting Credit from column J, State excess tax accounting, Total Accounting Credit Add lines, and Net tax due line Subtract line area with the demanded data.

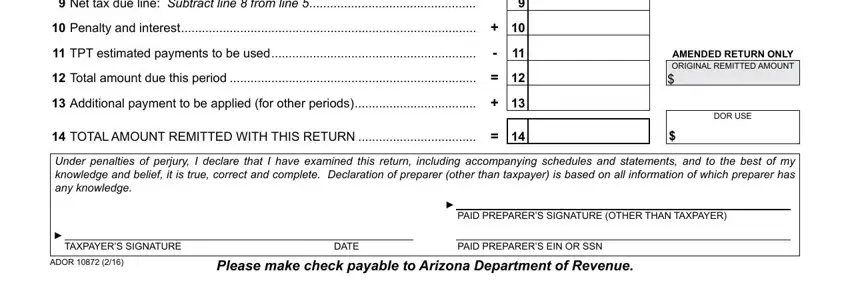

It is necessary to put down particular details inside the box Net tax due line Subtract line, Penalty and interest, TPT estimated payments to be used, Total amount due this period, Additional payment to be applied, AMENDED RETURN ONLY ORIGINAL, DOR USE, TOTAL AMOUNT REMITTED WITH THIS, Under penalties of perjury I, PAID PREPARERS SIGNATURE OTHER, TAXPAYERS SIGNATURE, DATE, PAID PREPARERS EIN OR SSN, ADOR, and Please make check payable to.

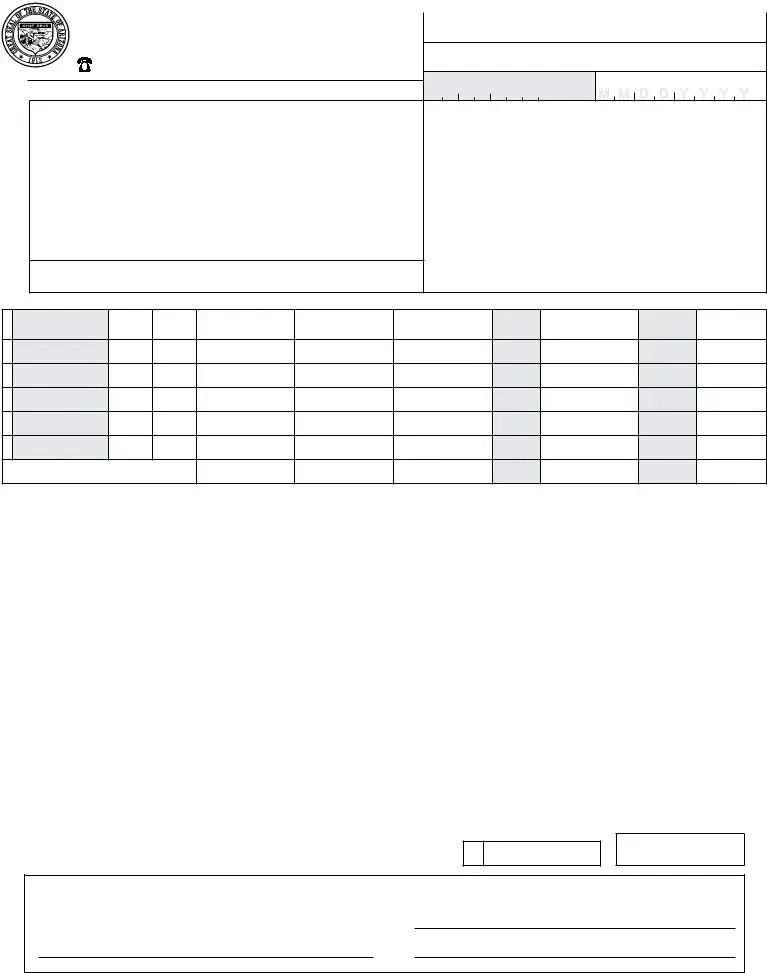

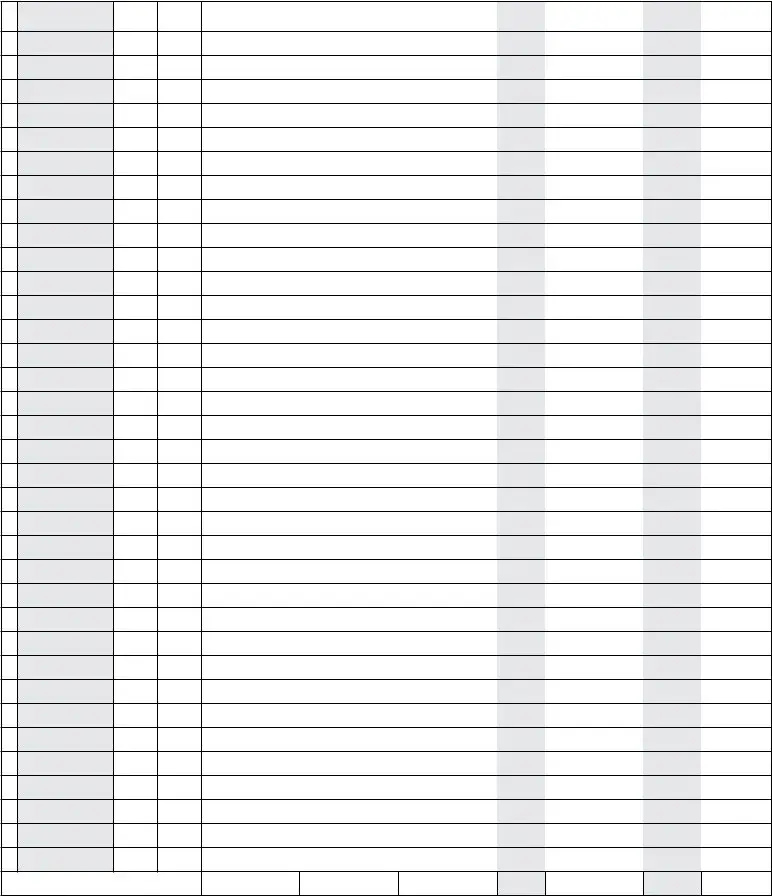

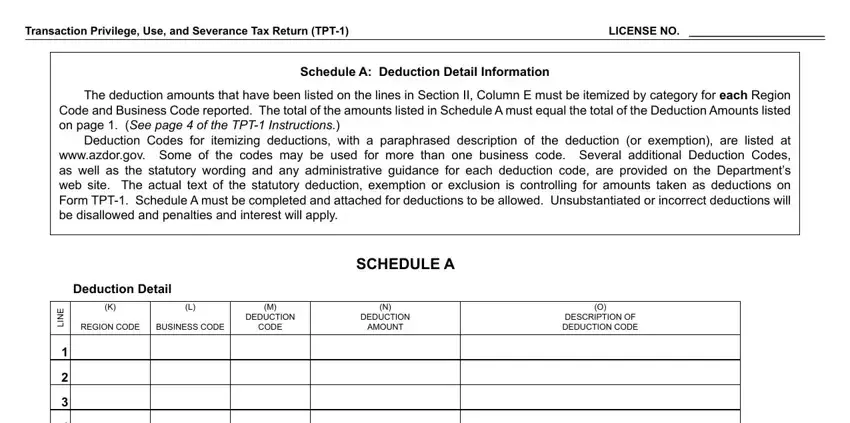

You will need to identify the rights and obligations of both sides in part Transaction Privilege Use and, LICENSE NO, Schedule A Deduction Detail, The deduction amounts that have, Deduction Codes for itemizing, Deduction Detail, REGION CODE, BUSINESS CODE, M DEDUCTION CODE, N DEDUCTION AMOUNT, O DESCRIPTION OF DEDUCTION CODE, SCHEDULE A, and E N I L.

Terminate by checking the following fields and filling them out as required: .

Step 3: Press the "Done" button. So now, you can export your PDF file - upload it to your electronic device or forward it by using electronic mail.

Step 4: Create copies of your template. It will prevent future troubles. We cannot see or reveal your details, for that reason you can be confident it will be safe.