The idea around our PDF editor was to help it become as easy to use as possible. The general procedure of filling in fillable tsp 3 easy should you comply with these steps.

Step 1: The first thing requires you to press the orange "Get Form Now" button.

Step 2: Now you will be on your file edit page. You can include, enhance, highlight, check, cross, insert or remove fields or words.

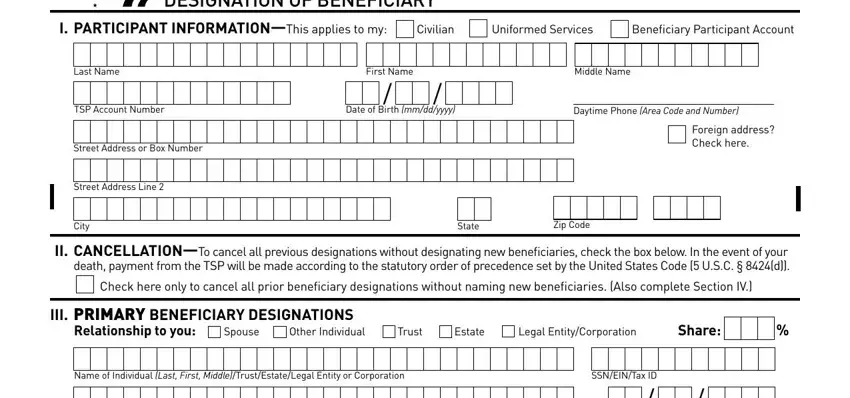

You have to enter the following data to be able to create the template:

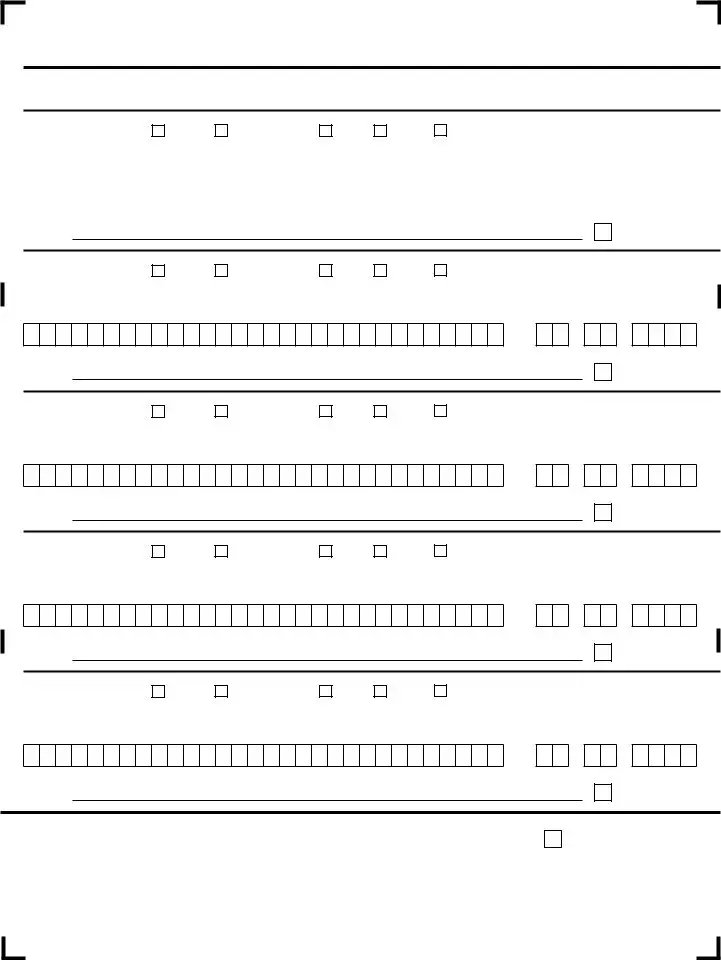

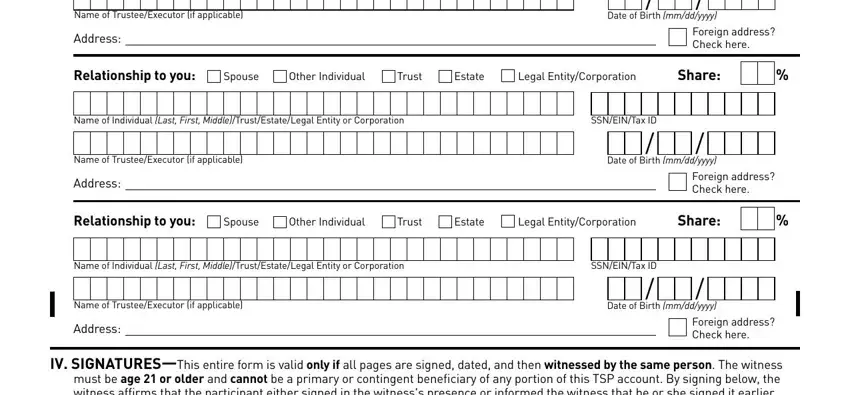

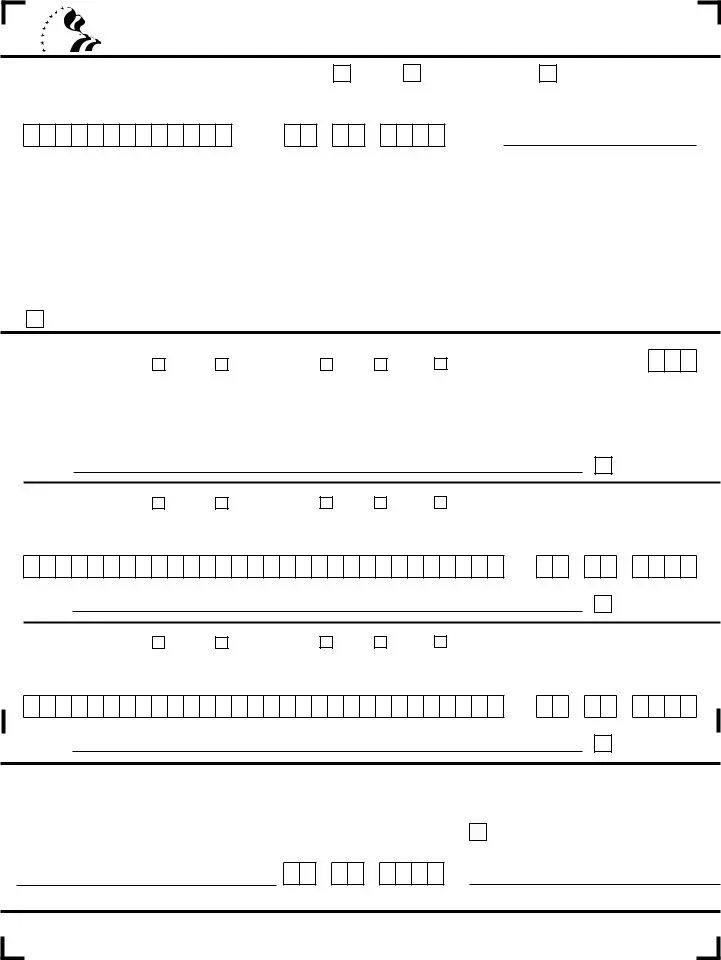

You have to type in the crucial data in the Name of TrusteeExecutor if, Address, Date of Birth mmddyyyy, Foreign address Check here, Relationship to you, Spouse, Other Individual, Trust, Estate, Legal EntityCorporation, Share, Name of Individual Last First, SSNEINTax ID, Name of TrusteeExecutor if, and Address space.

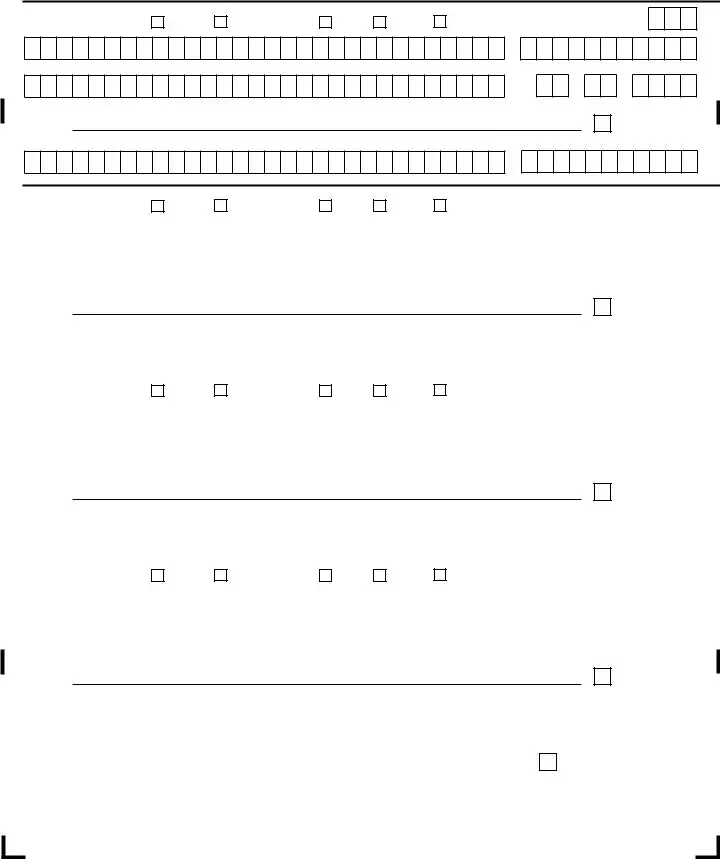

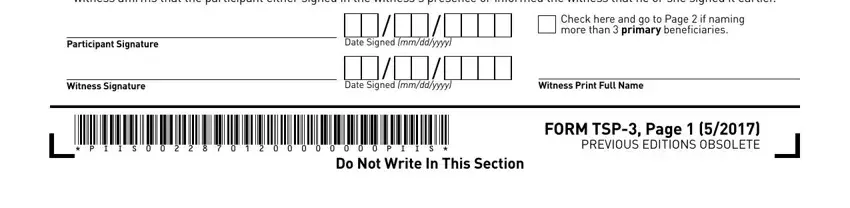

The software will demand you to insert particular fundamental details to automatically complete the part IV SIGNATURESThis entire form is, Check here and go to Page if, Participant Signature, Date Signed mmddyyyy, Witness Signature, Date Signed mmddyyyy, P I I S P I I S, Do Not Write In This Section, Witness Print Full Name, and FORM TSP Page PREVIOUS EDITIONS.

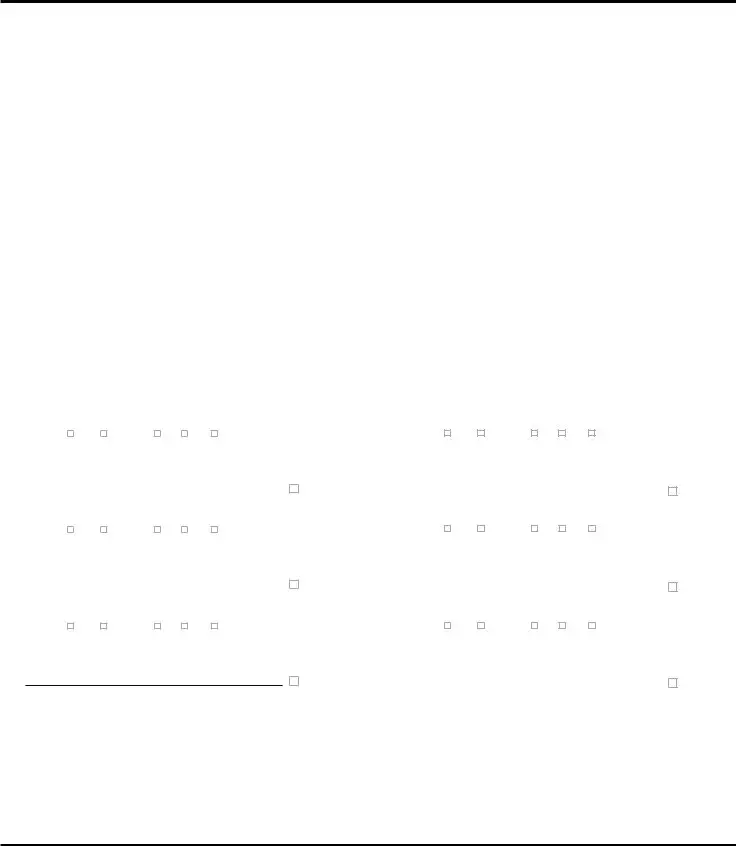

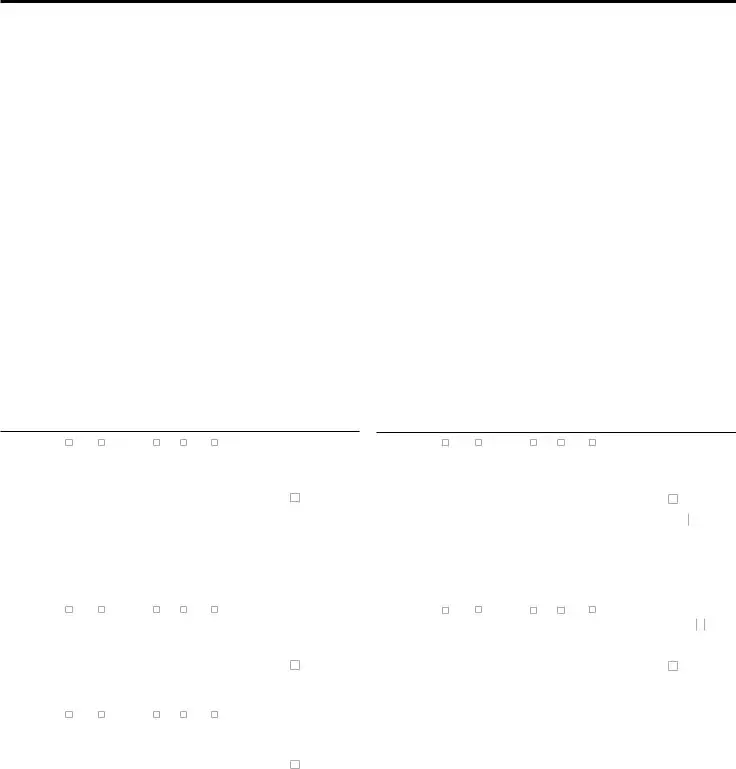

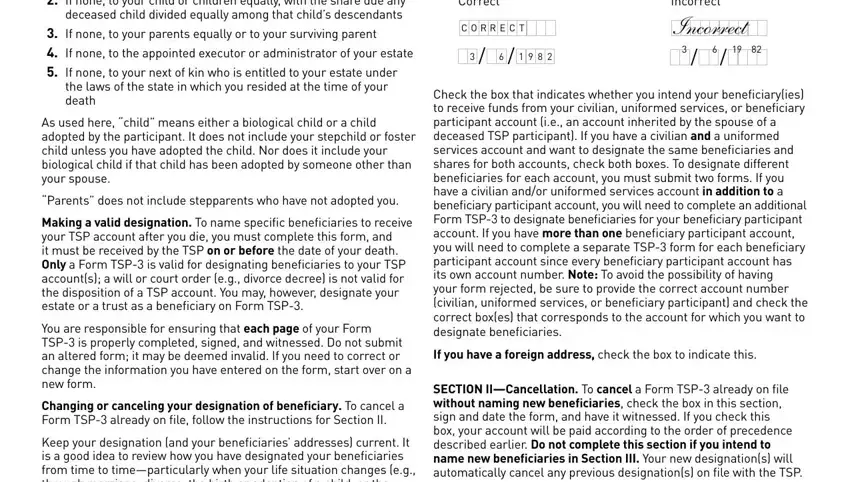

The Correct, E C, Incorrect, Incorrect, Check the box that indicates, If you have a foreign address, SECTION IICancellation To cancel a, Complete this form only if you, If none to your parents equally, the laws of the state in which you, As used here child means either a, Parents does not include, Making a valid designation To name, You are responsible for ensuring, and Changing or canceling your field will be the place to include the rights and obligations of either side.

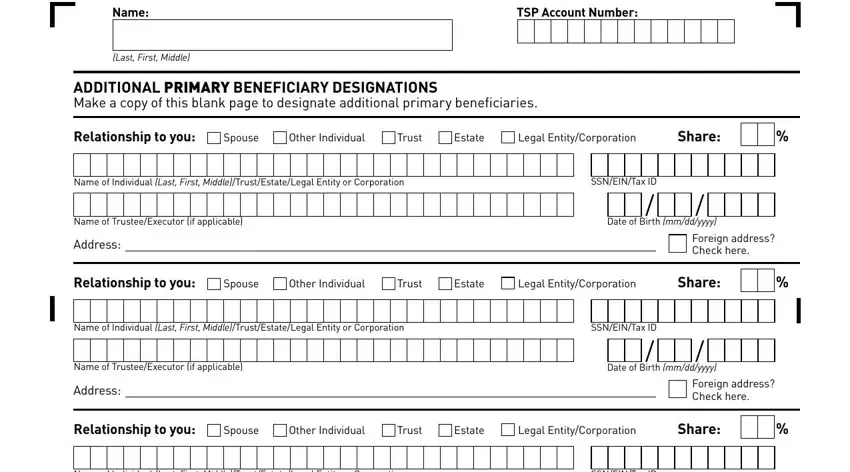

End up by reading all these fields and filling them out accordingly: Name, Last First Middle, TSP Account Number, ADDITIONAL PRIMARY BENEFICIARY, Relationship to you, Spouse, Other Individual, Trust, Estate, Legal EntityCorporation, Share, Name of Individual Last First, SSNEINTax ID, Name of TrusteeExecutor if, and Address.

Step 3: As soon as you've hit the Done button, your document should be accessible for upload to any kind of gadget or email address you identify.

Step 4: Try to make as many copies of your form as you can to remain away from potential worries.

O

O  R

R R

R  E

E  C

C  T

T

3

3

6

6  9

9  8

8  2

2 NCORRECT

NCORRECT