Filling in the tsp form 78 printable file is a breeze with this PDF editor. Stick to the next actions to create the document in no time.

Step 1: Choose the orange button "Get Form Here" on the following website page.

Step 2: Now you can modify your tsp form 78 printable. The multifunctional toolbar lets you include, erase, transform, and highlight content material or perhaps perform other commands.

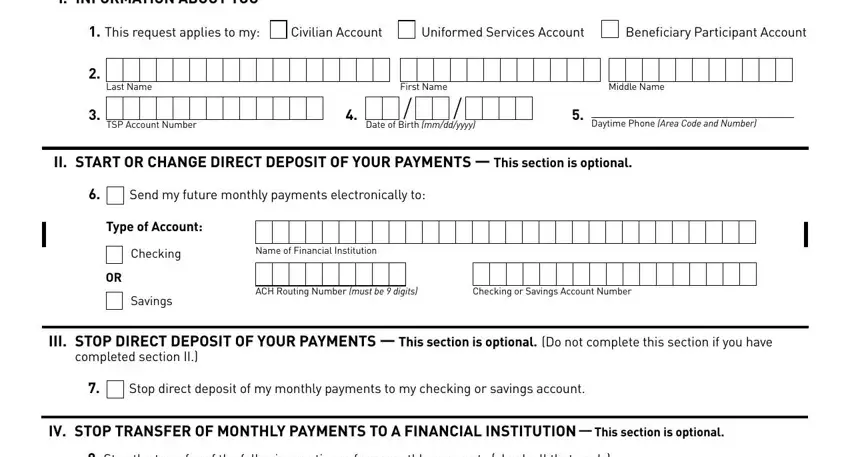

Complete the next parts to complete the template:

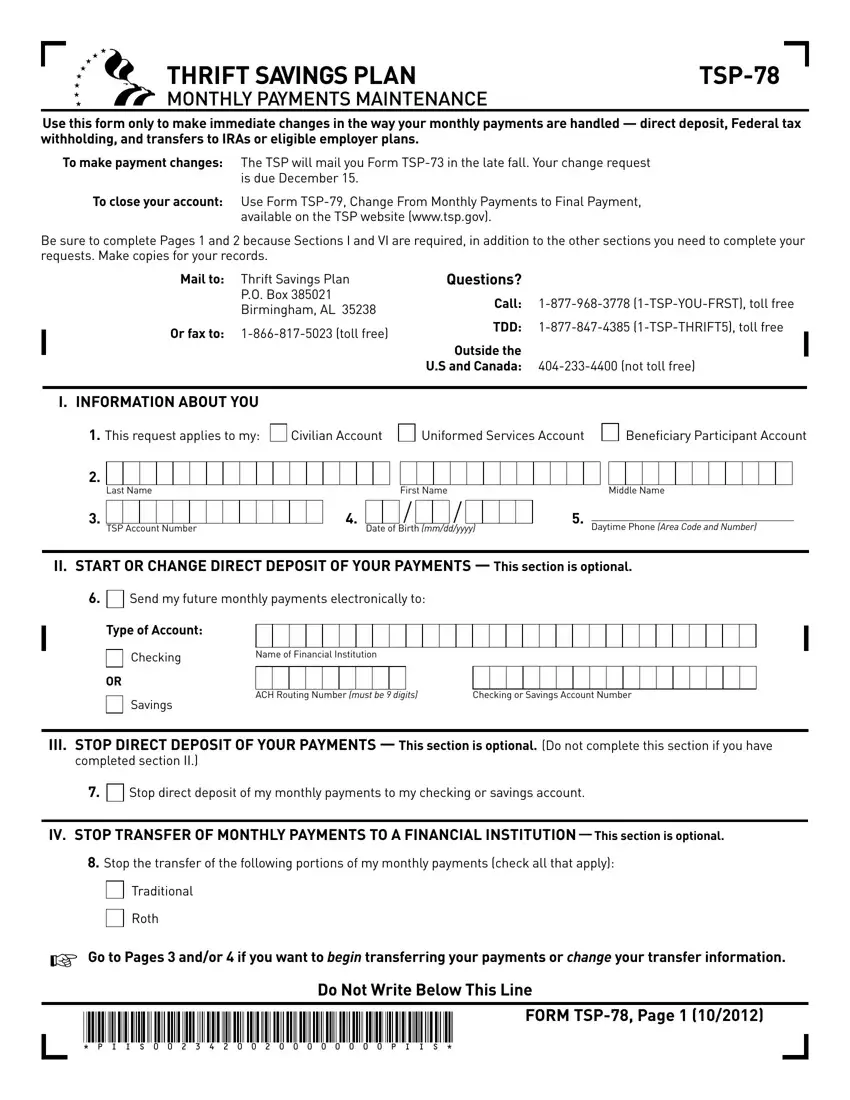

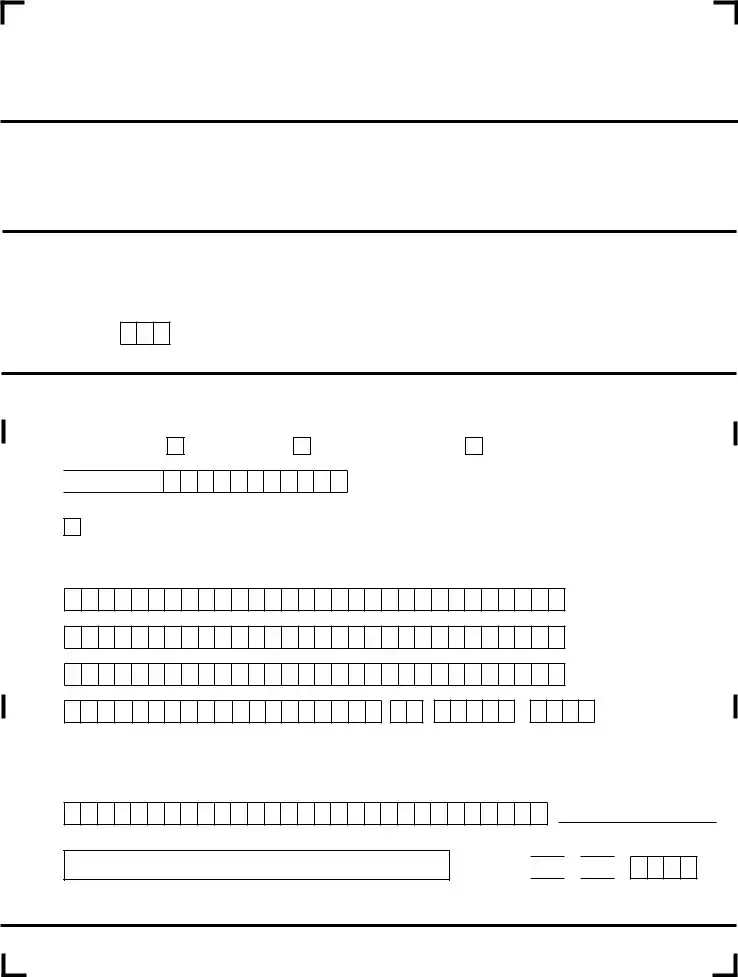

Put down the information in the Stop the transfer of the, Traditional, Roth, Go to Pages andor if you want to, Do Not Write Below This Line, FORM TSP Page, and P I I S P I I S area.

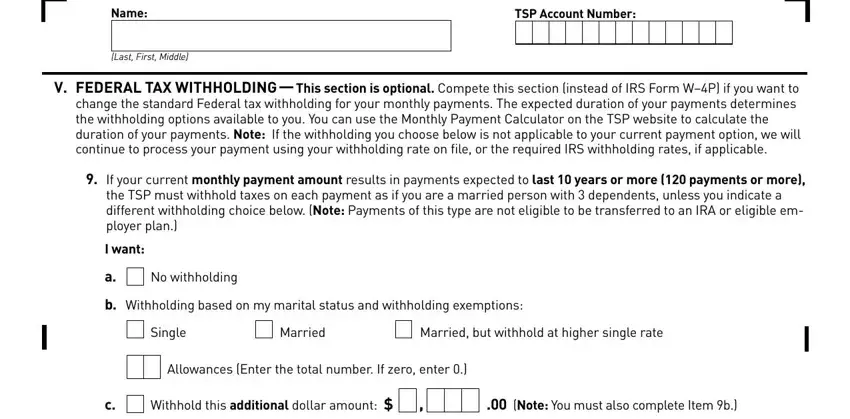

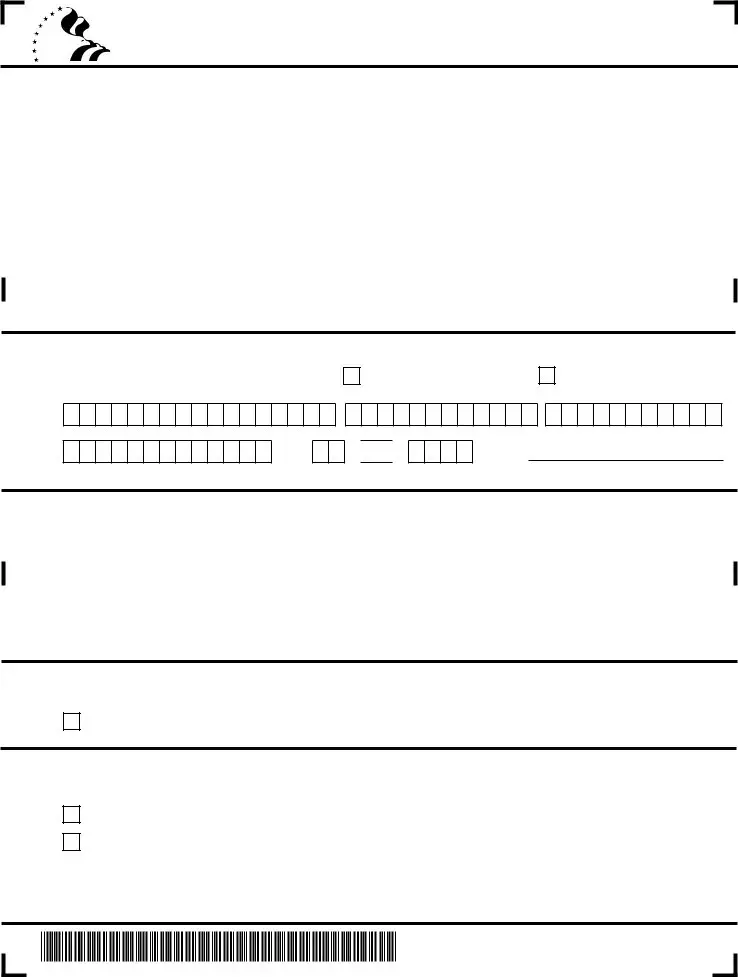

Write the fundamental details once you are within the Name, Last First Middle, TSP Account Number, V FeDeRAL TAx WITHHOLDING This, If your current monthly payment, I want, No withholding, b Withholding based on my marital, Single, Married, Married but withhold at higher, Allowances Enter the total number, Withhold this additional dollar, and Note You must also complete Item b section.

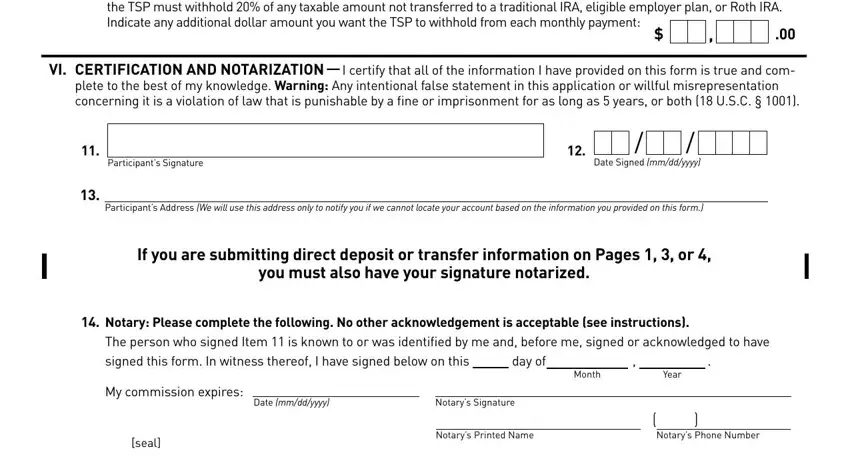

The the TSP must withhold of any, VI ceRTIFIcATION AND NOTARIzATION, plete to the best of my knowledge, Participants Signature, Date Signed mmddyyyy, Participants Address We will use, If you are submitting direct, Notary Please complete the, day of, My commission expires, Date mmddyyyy, Notarys Signature, seal, Notarys Printed Name, and Month space is the place where each party can insert their rights and responsibilities.

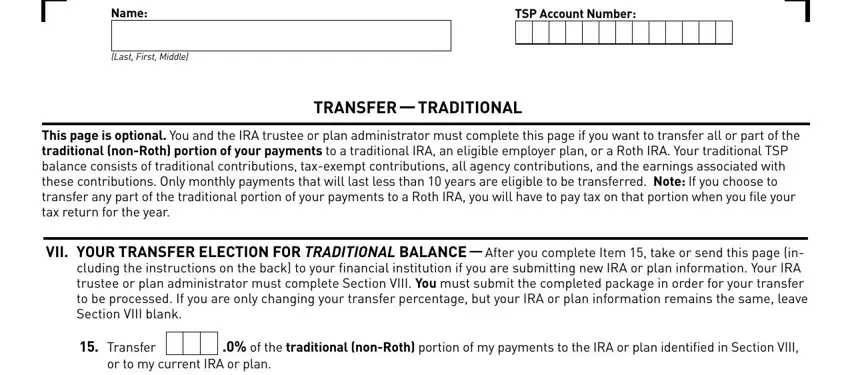

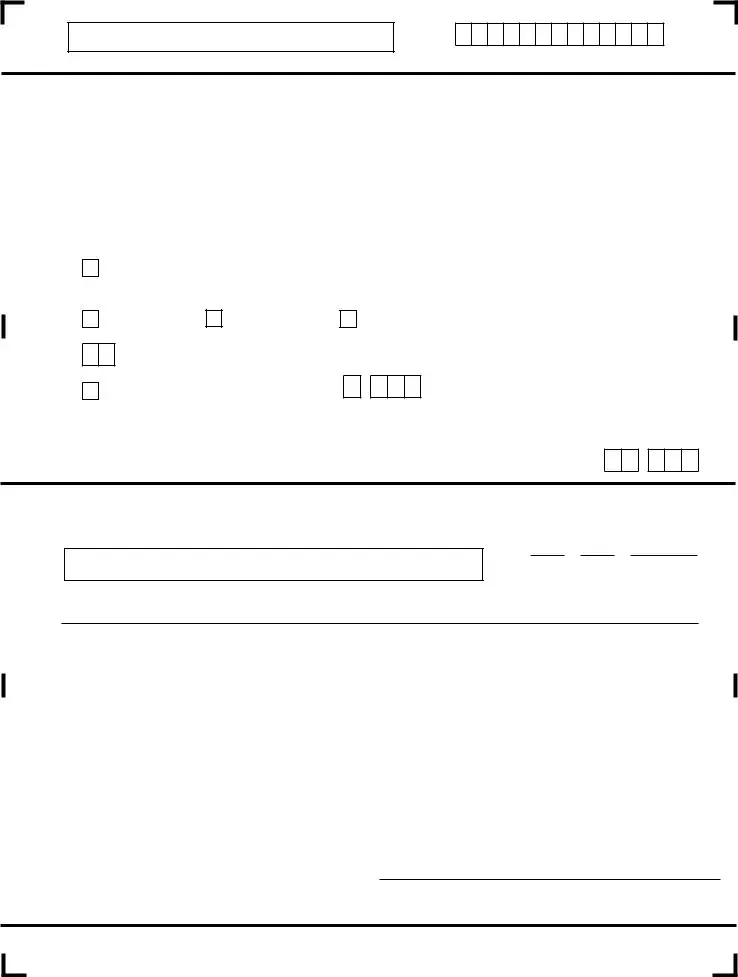

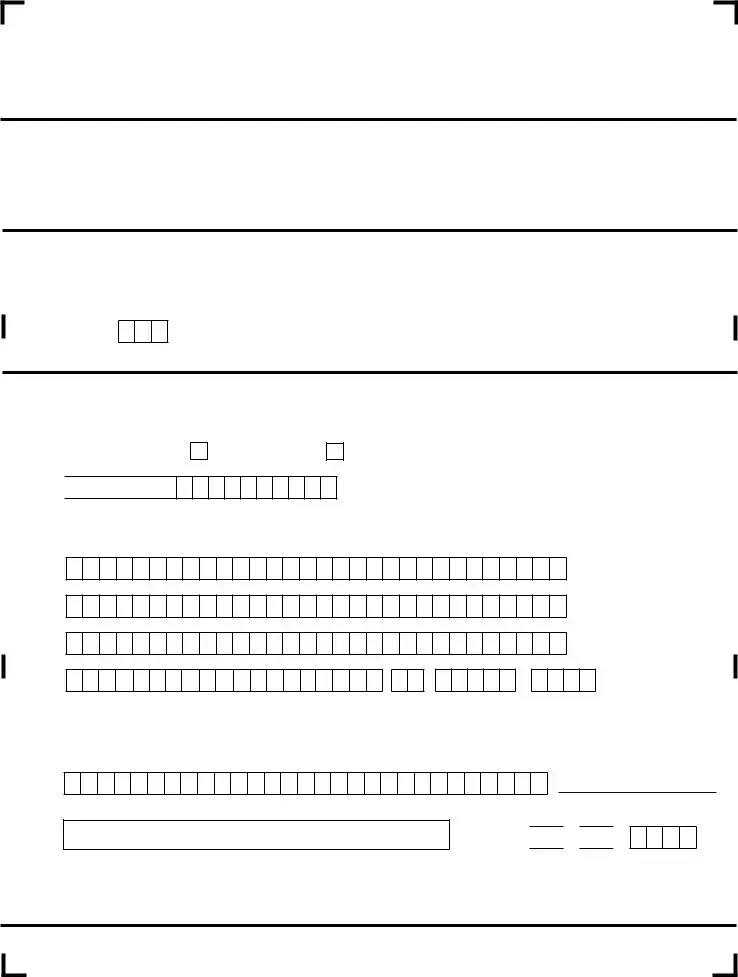

Review the areas Name, Last First Middle, TSP Account Number, TRANSFeR TRADITIONAL, This page is optional You and the, VII YOUR TRANSFeR eLecTION FOR, Transfer, of the traditional nonRoth, and or to my current IRA or plan and thereafter fill them out.

Step 3: Select the "Done" button. Now it's easy to upload the PDF document to your electronic device. As well as that, it is possible to forward it via electronic mail.

Step 4: Make sure you keep away from possible future complications by making as much as two copies of your document.

/

/

/

/

/

/

/

/

/

/

/

/

/

/