We found the finest web programmers to design this PDF editor. The application will let you prepare the tsp 99 printable form document without difficulty and won't take a lot of your time and effort. This easy-to-follow instruction will allow you to begin.

Step 1: The first thing is to select the orange "Get Form Now" button.

Step 2: Once you've got accessed the editing page tsp 99 printable form, you'll be able to find all the actions intended for the form within the upper menu.

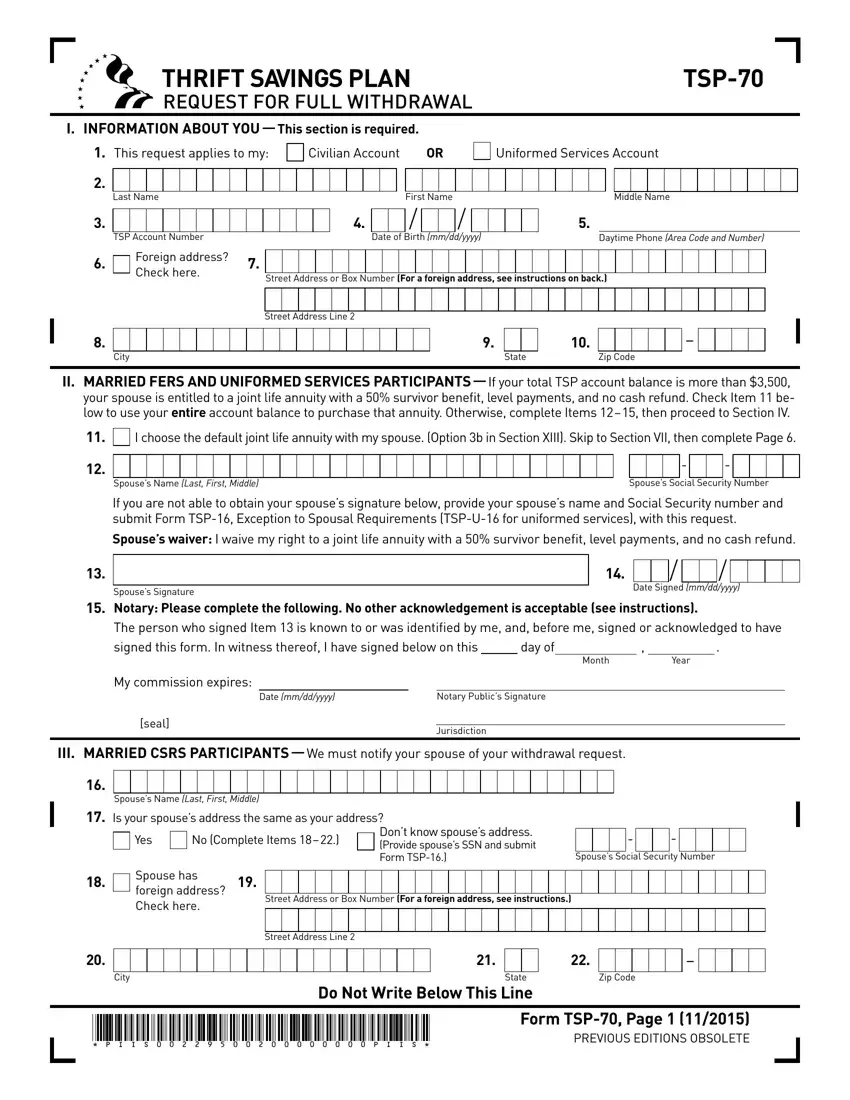

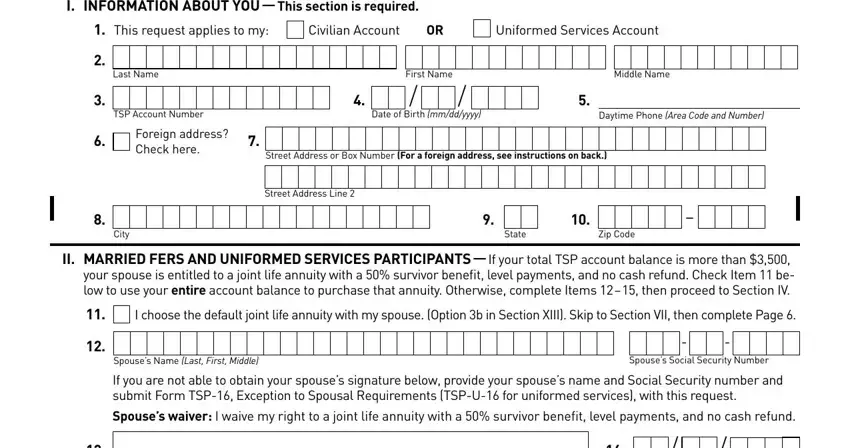

These sections are what you are going to fill in to get your finished PDF document.

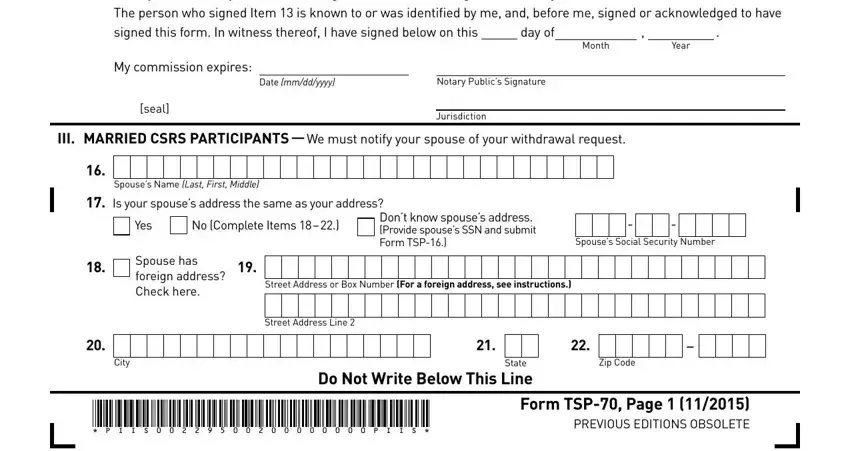

Note the required information in Spouses Signature Notary Please, day of, My commission expires, Date mmddyyyy, Notary Publics Signature, seal, Jurisdiction, III MARRIED CSRS PARTICIPANTS We, Month, Year, Spouses Name Last First Middle, Is your spouses address the same, Yes, No Complete Items, and Dont know spouses address Provide area.

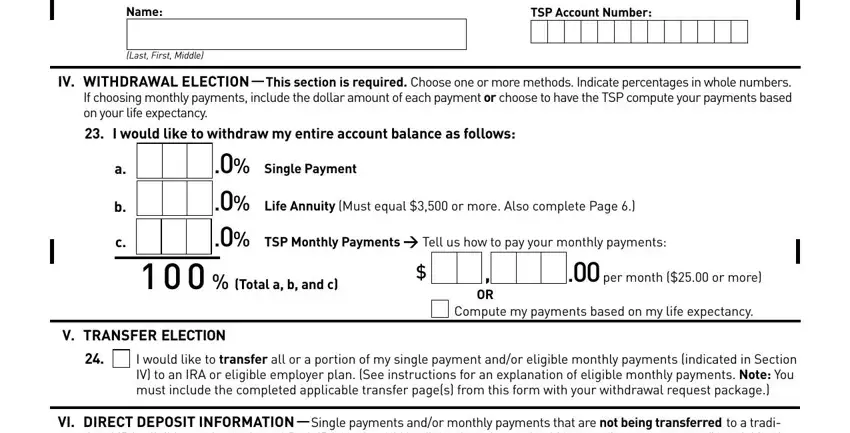

Inside the segment talking about IV WITHDRAWAL ELECTION This, Single Payment Life Annuity Must, Total a b and c, per month or more, Compute my payments based on my, V TRANSFER ELECTION, I would like to transfer all or a, and VI DIRECT DEPOSIT INFORMATION, you have got to write down some necessary information.

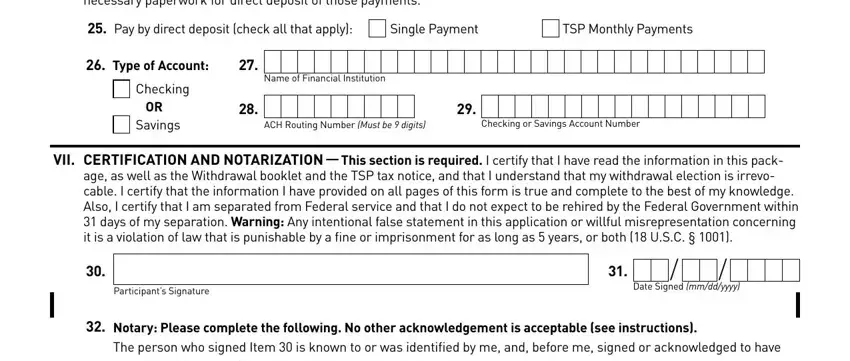

For box VI DIRECT DEPOSIT INFORMATION, Pay by direct deposit check all, Single Payment, TSP Monthly Payments, Type of Account, Checking, OR Savings, Name of Financial Institution, ACH Routing Number Must be digits, Checking or Savings Account Number, VII CERTIFICATION AND NOTARIZATION, age as well as the Withdrawal, Participants Signature, Date Signed mmddyyyy, and Notary Please complete the, identify the rights and obligations.

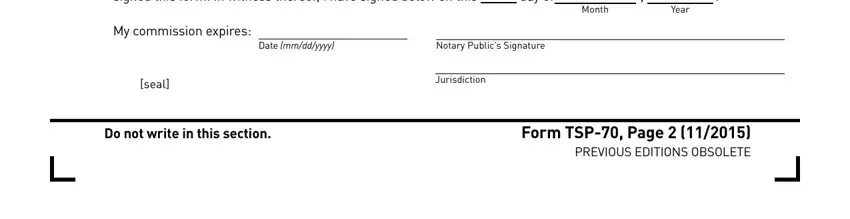

Fill out the template by reading these fields: Notary Please complete the, day of, My commission expires, Date mmddyyyy, Notary Publics Signature, seal, Jurisdiction, Month, and Year.

Step 3: Click "Done". It's now possible to upload the PDF document.

Step 4: To protect yourself from possible future issues, ensure that you have up to two copies of each separate form.