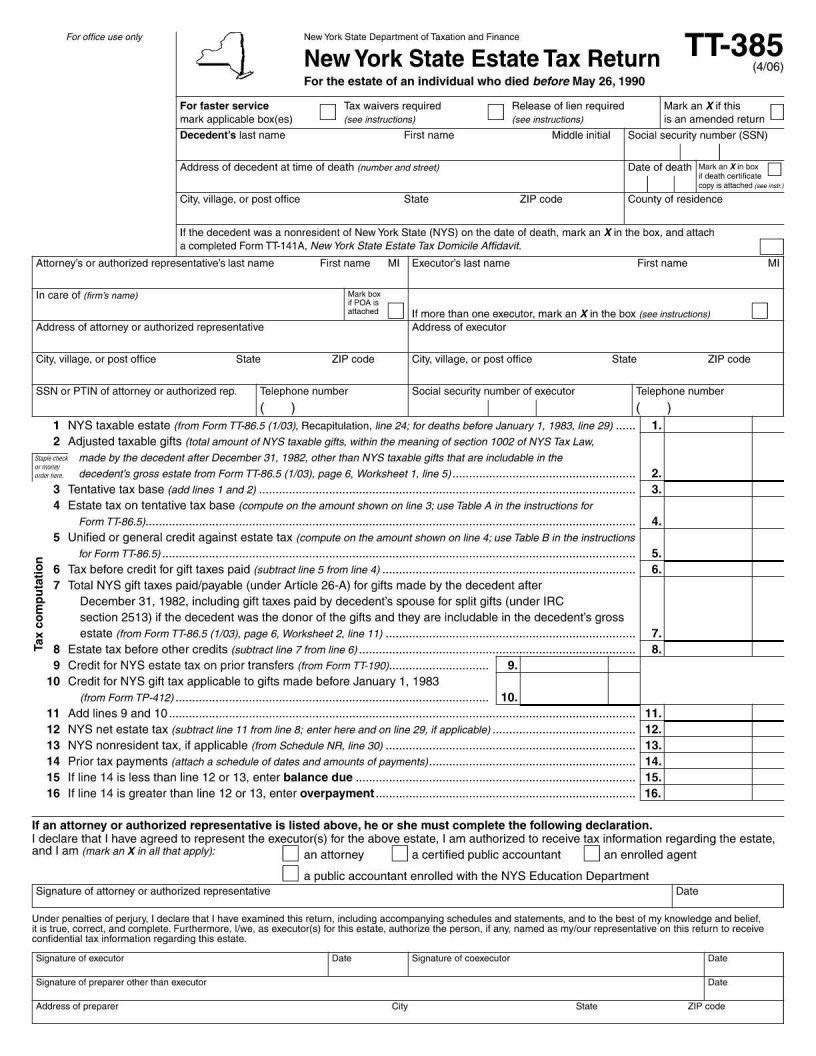

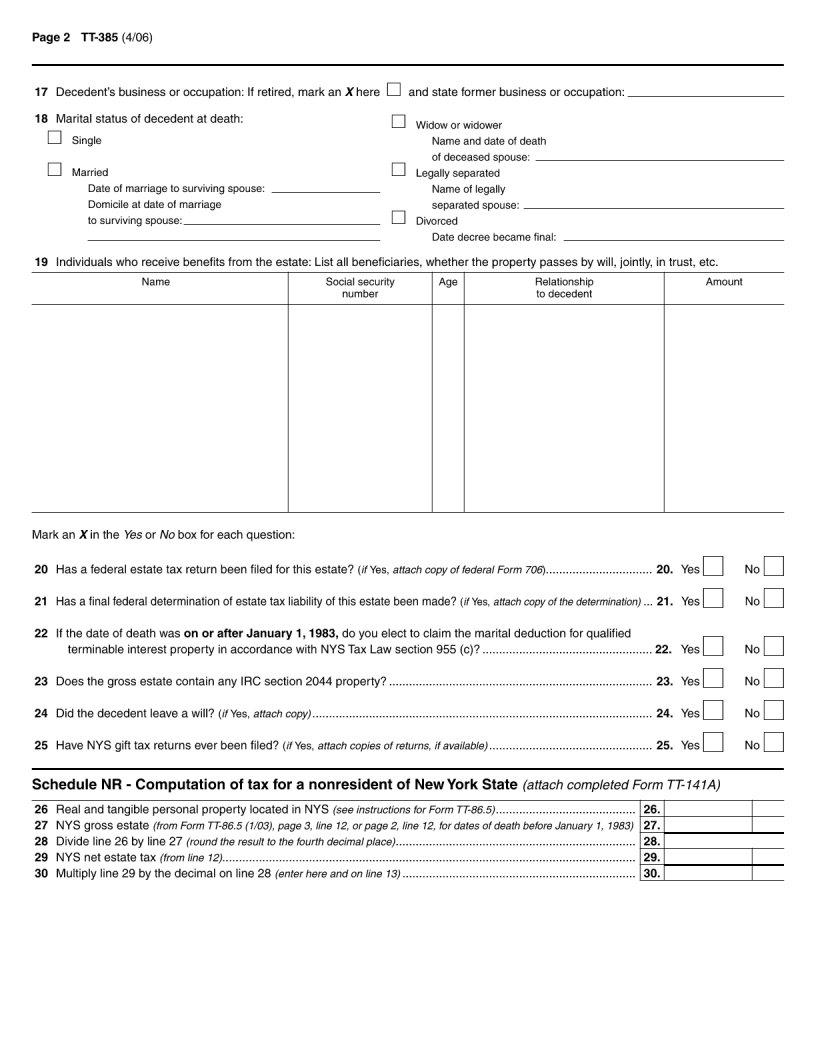

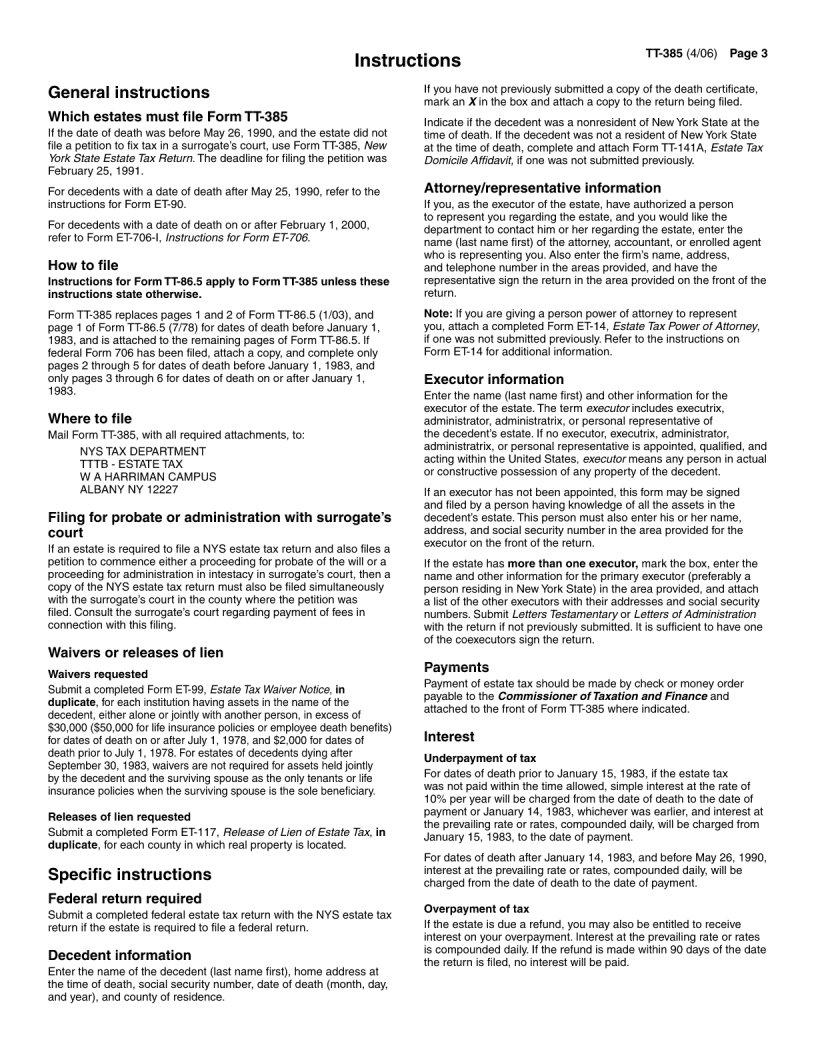

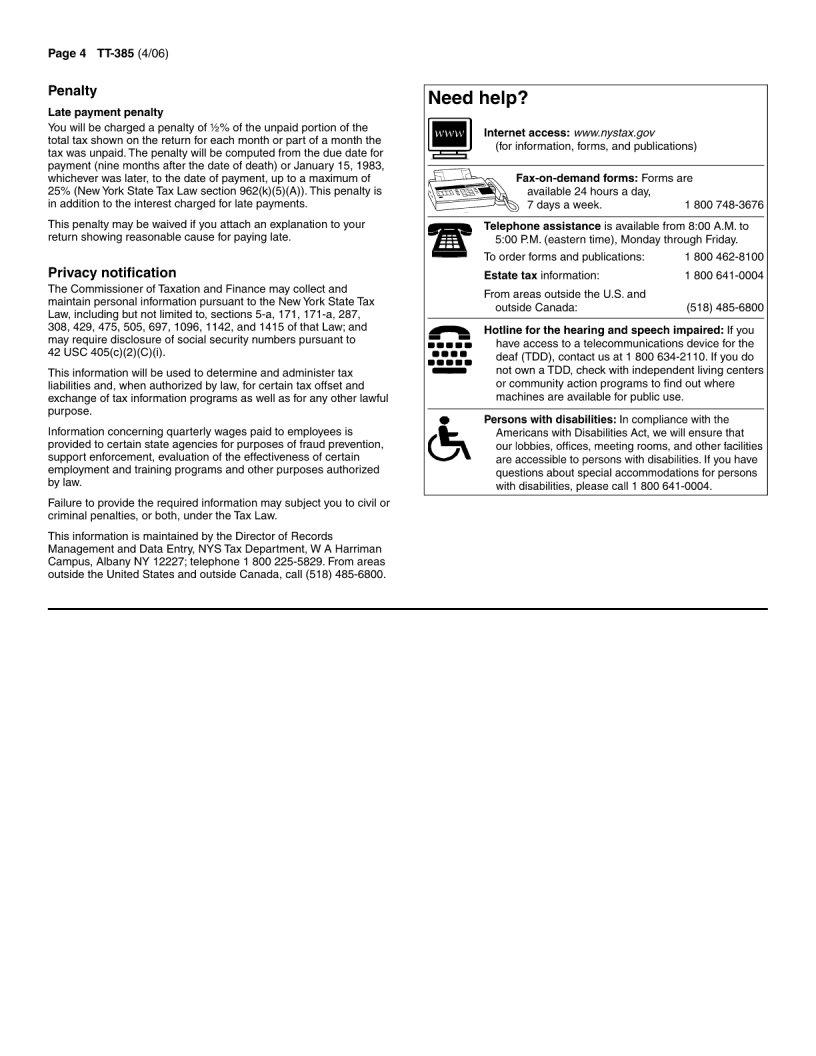

The TT-385 form, utilized exclusively by the New York State Department of Taxation and Finance, serves as a comprehensive New York State Estate Tax Return for individuals who passed away prior to May 26, 1990. This document is pivotal for the legal and financial processing of an individual's estate, encompassing detailed sections that require the submission of various pieces of information including the decedent’s personal details, such as full name, social security number, address at the time of death, and date of death. Additionally, the form calls for specifics regarding the estate's valuation, adjustments for taxable gifts made after December 31, 1982, and calculates both tentative tax bases and estate taxes due using a series of detailed instructions and tax tables provided. It also inquires about prior tax payments or overpayments, executors or administrators of the estate, and the necessity for tax waivers or releases of lien, alongside a section dedicated to any attorney or authorized representative’s declaration who might be involved in the process. Furthermore, the form navigates through marital status, the decedent’s business or occupation, and provides a medium for listing beneficiaries of the estate. Intricate yet vital for accurate estate management and compliance with New York State tax laws, the TT-385 facilitates a transparent and structured approach to estate tax return filing for deceased individuals, underscoring the importance of meticulously compiled and reported financial and personal information.

| Question | Answer |

|---|---|

| Form Name | Tt 385 Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | HARRIMAN, TT-86, TT-141A, ET-14 |