Working with PDF documents online can be surprisingly easy using our PDF editor. You can fill out ttb complete get here with no trouble. In order to make our editor better and simpler to use, we continuously implement new features, taking into consideration suggestions from our users. Starting is effortless! All you should do is stick to the next easy steps below:

Step 1: Access the form in our tool by clicking the "Get Form Button" in the top part of this page.

Step 2: When you access the tool, you'll see the document all set to be filled out. Aside from filling out various fields, it's also possible to do other sorts of things with the Document, such as adding any textual content, modifying the initial textual content, adding images, putting your signature on the document, and more.

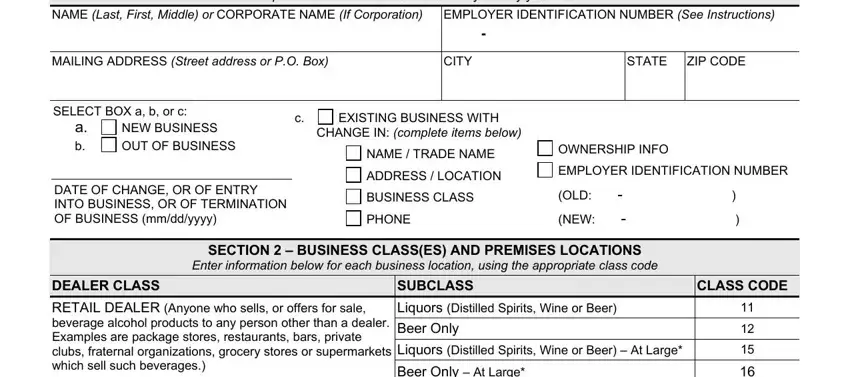

This document needs some specific details; to ensure accuracy, you need to adhere to the following tips:

1. When filling in the ttb complete get, make certain to incorporate all necessary blank fields within the relevant section. It will help speed up the process, allowing your information to be handled swiftly and properly.

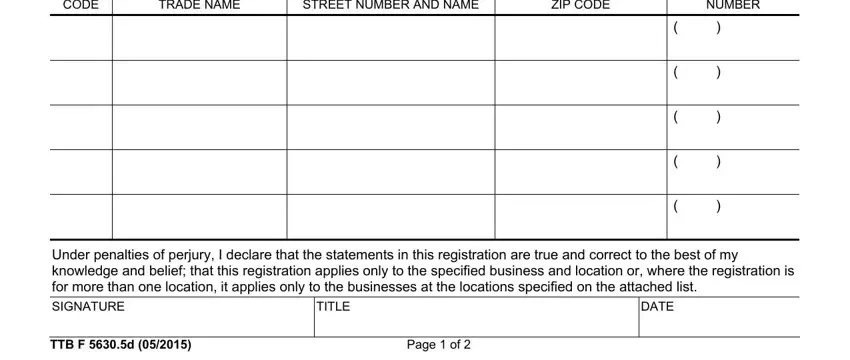

2. Once your current task is complete, take the next step – fill out all of these fields - CLASS CODE, TRADE NAME, STREET NUMBER AND NAME, ZIP CODE, NUMBER, Under penalties of perjury I, SIGNATURE, TITLE, DATE, TTB F d, and Page of with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It is easy to make a mistake while completing your NUMBER, so be sure you reread it before you decide to send it in.

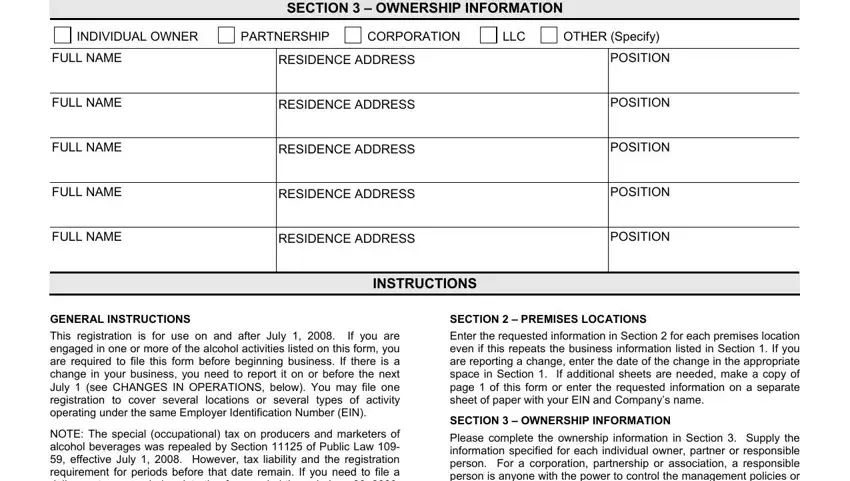

3. Completing SECTION OWNERSHIP INFORMATION, INDIVIDUAL OWNER, PARTNERSHIP, CORPORATION, LLC, OTHER Specify, FULL NAME, FULL NAME, FULL NAME, FULL NAME, FULL NAME, RESIDENCE ADDRESS, RESIDENCE ADDRESS, RESIDENCE ADDRESS, and RESIDENCE ADDRESS is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Step 3: Revise the information you have inserted in the form fields and then hit the "Done" button. After creating a7-day free trial account here, it will be possible to download ttb complete get or email it promptly. The PDF will also be accessible through your personal account menu with all of your modifications. FormsPal ensures your data confidentiality by having a protected method that in no way records or shares any sensitive information provided. Feel safe knowing your documents are kept confidential whenever you work with our services!