We were making this PDF editor with the concept of making it as easy to use as it can be. For this reason the entire process of completing the uct forms will likely to be easy as you go through these particular actions:

Step 1: Select the orange button "Get Form Here" on the website page.

Step 2: You're now on the document editing page. You can edit, add text, highlight selected words or phrases, put crosses or checks, and add images.

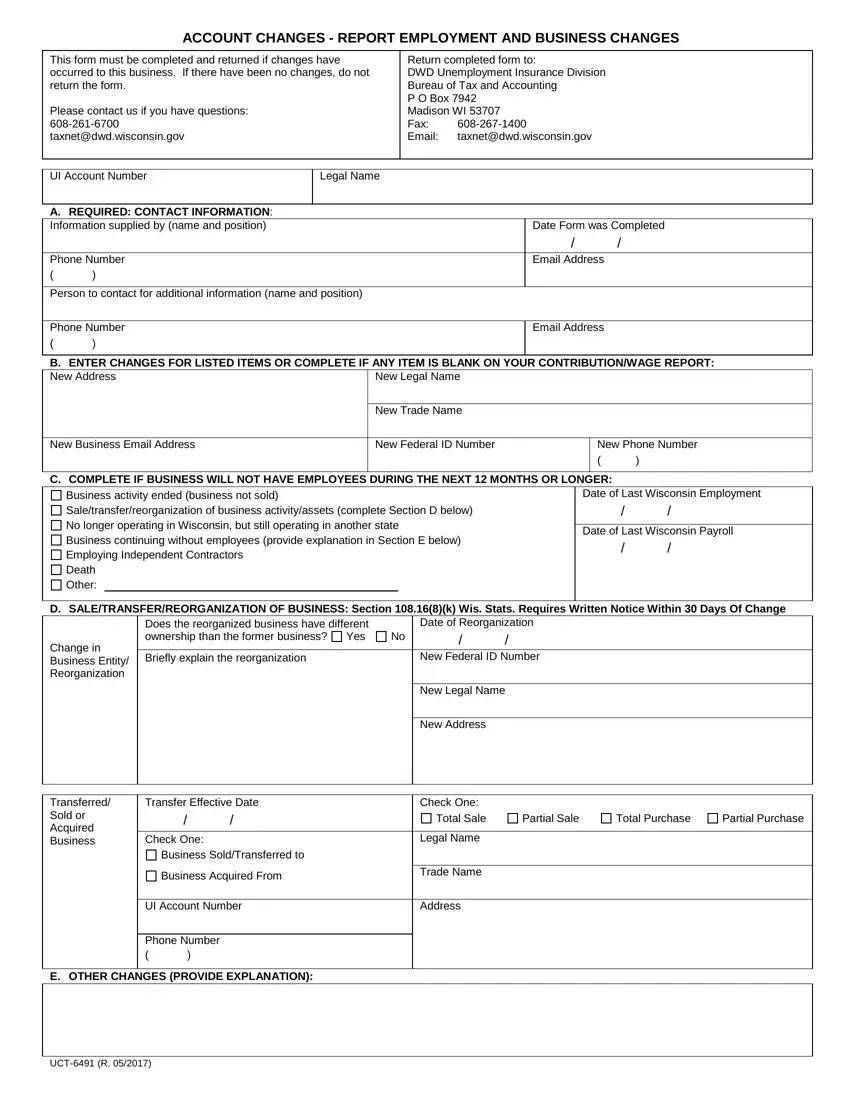

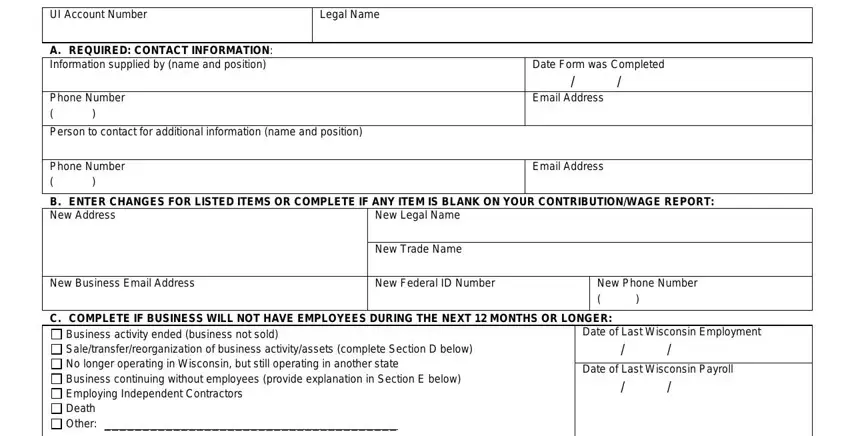

Fill in the uct forms PDF and provide the content for every single part:

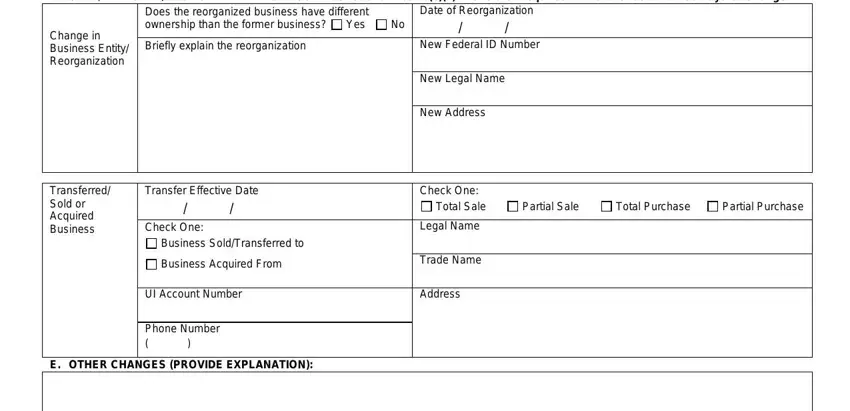

Fill in the D SALETRANSFERREORGANIZATION OF, Does the reorganized business have, Briefly explain the reorganization, Date of Reorganization New, Change in Business Entity, New Legal Name, New Address, Check One, Total Sale, Partial Sale, Total Purchase, Partial Purchase, Legal Name, Trade Name, and Address fields with any particulars that is demanded by the software.

Step 3: Hit the "Done" button. At that moment, it is possible to export the PDF document - upload it to your electronic device or deliver it through email.

Step 4: Just be sure to generate as many copies of your form as possible to remain away from possible problems.