Navigating the waters of unemployment insurance can often feel overwhelming for employers, but understanding the nuances of required documentation is essential. Among these documents, the UI-11W form stands out as a critical piece in the reporting process within the State of Nebraska. This specific form, mandated by the Department of Labor, plays a vital role in the unemployment insurance program, offering a structured medium for employers to report the gross quarterly wages paid to each employee. Uniquely designed to include wages that contribute to a 401K plan while excluding those allocated to Section 125 cafeteria plans, the UI-11W ensures that the Department of Labor has an accurate account of wages. It's important to note that the accuracy of this report directly impacts the calculation of unemployment insurance benefits, making it imperative for employers to furnish precise information. Employers are encouraged to leverage online platforms such as uiconnect.ne.gov for electronic filing, streamlining the submission process. Additionally, this form must be filed in conjunction with the Combined Tax Report (UI-11T), emphasizing its importance in the broader context of unemployment tax compliance. For employers navigating the intricacies of unemployment insurance reporting, mastering the UI-11W form becomes not just a requirement but a necessity for ensuring compliance and aiding in the smooth administration of unemployment benefits. Revised as of March 30, 2011, the UI-11W form, with its clear directives on wage reporting, stands as a beacon for employers, guiding them through the complexities of labor law compliance.

| Question | Answer |

|---|---|

| Form Name | Ui 11W Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | dol nebraska gove uiconnect, uiconnect ne gov, dol nebraska govuiconnect, ui 11w form |

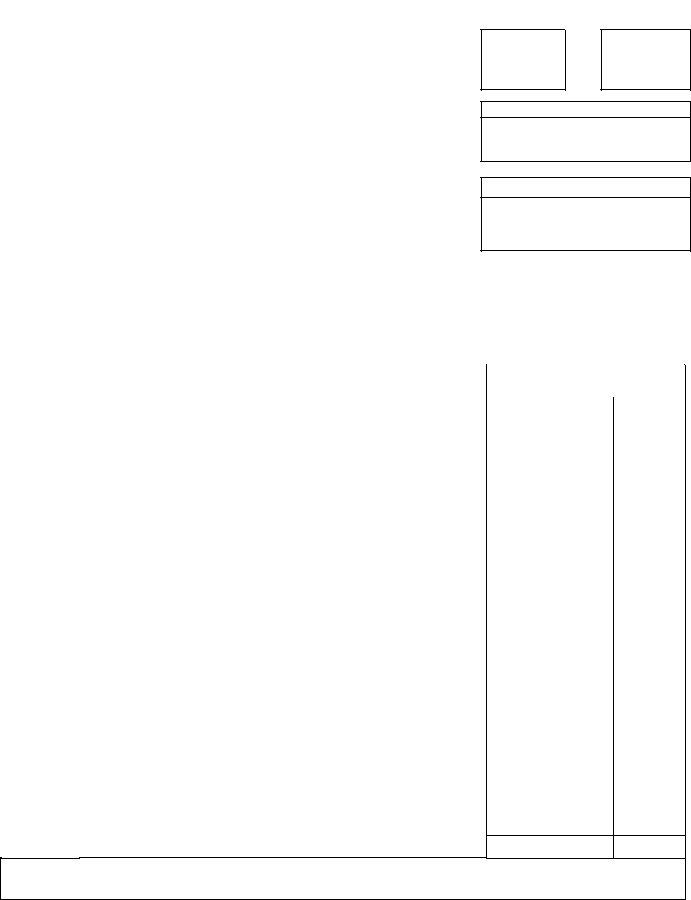

STATE OF NEBRASKA

DEPARTMENT OF LABOR

UNEMPLOYMENT INSURANCE

P O BOX 94600 LINCOLN, NEBRASKA

PHONE 402.471.9898 FAX 402.471.9994

WAGE REPORT UI

File electronically at uiconnect.ne.gov

YR QTR

Employer Account No.

Federal I.D. No.

Report gross quarterly wages paid to each employee. INCLUDE 401K plan. DO NOT include Section 125 cafeteria plan. Total of all pages reported must equal Line 2 Gross Wages on Combined Tax Report.

|

|

|

Page |

|

of |

|

|

THIS DOCUMENT MUST BE FILED WITH THE COMBINED TAX REPORT UI |

|

|

|

||||

|

|

|

|

|

|||

Social Security |

Gross wages paid each covered |

||||||

|

Number |

Employee’s Name |

employee in this quarter |

|

|||

000 00 0000 |

Last Name, 1st Initial, 2nd Initial |

Dollars |

|

Cents |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL OF THIS PAGE

TOTAL OF ALL PAGES

Print Preparer’s Name |

Phone Number |

Date |