form c3 can be filled out online without difficulty. Just make use of FormsPal PDF editor to perform the job without delay. To have our editor on the leading edge of practicality, we work to put into operation user-driven features and enhancements on a regular basis. We're always looking for feedback - assist us with revampimg how you work with PDF docs. Getting underway is effortless! All that you should do is stick to the following simple steps below:

Step 1: Just press the "Get Form Button" at the top of this page to get into our pdf form editing tool. This way, you will find all that is needed to work with your document.

Step 2: This tool helps you customize the majority of PDF forms in a range of ways. Enhance it with personalized text, correct existing content, and include a signature - all possible in minutes!

This PDF form requires some specific information; in order to guarantee accuracy, please be sure to pay attention to the next steps:

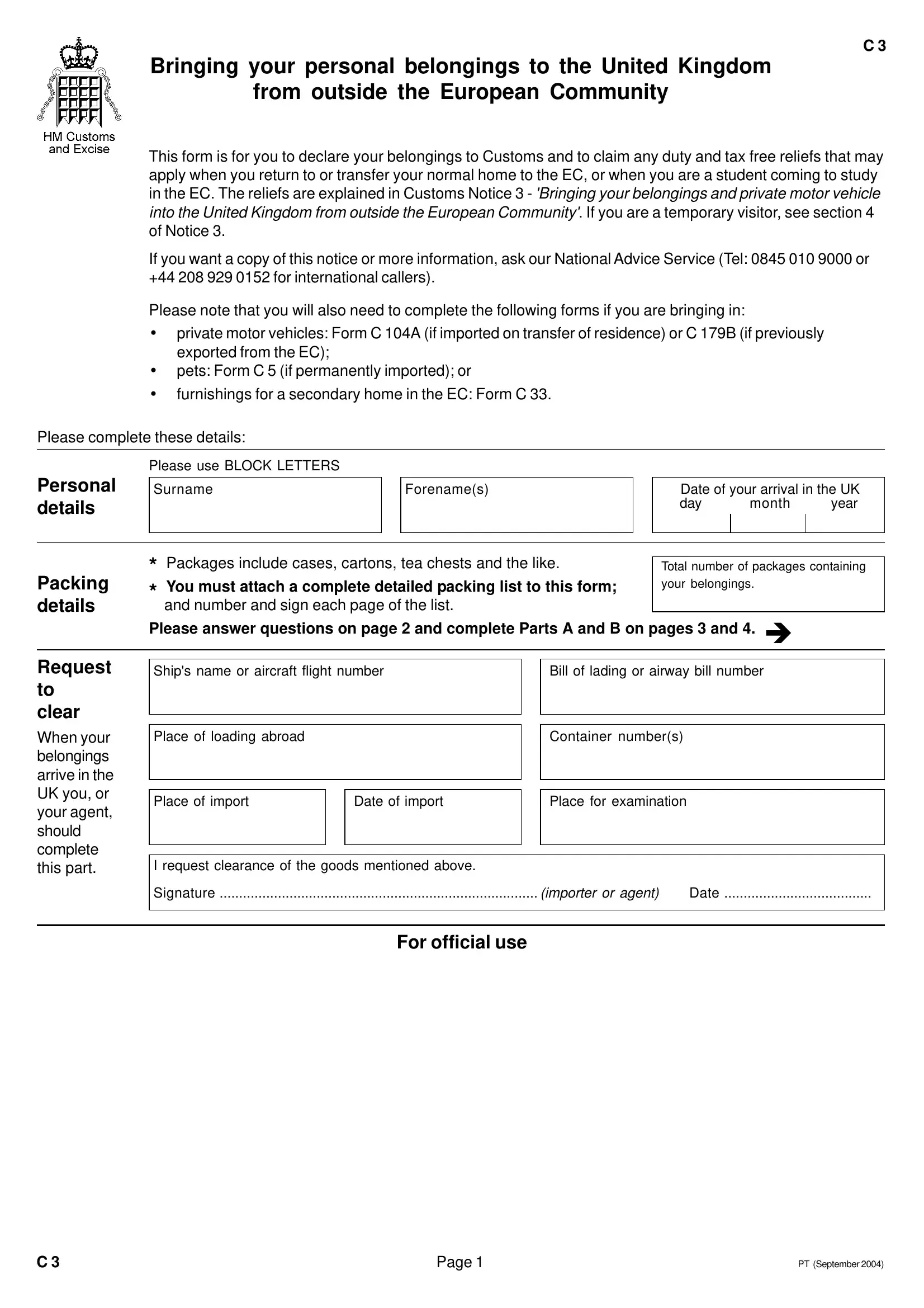

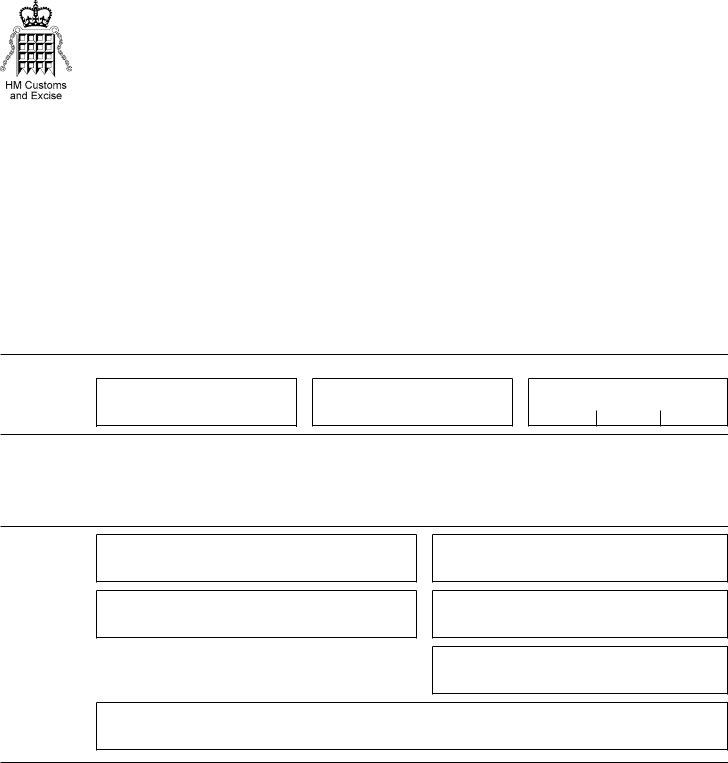

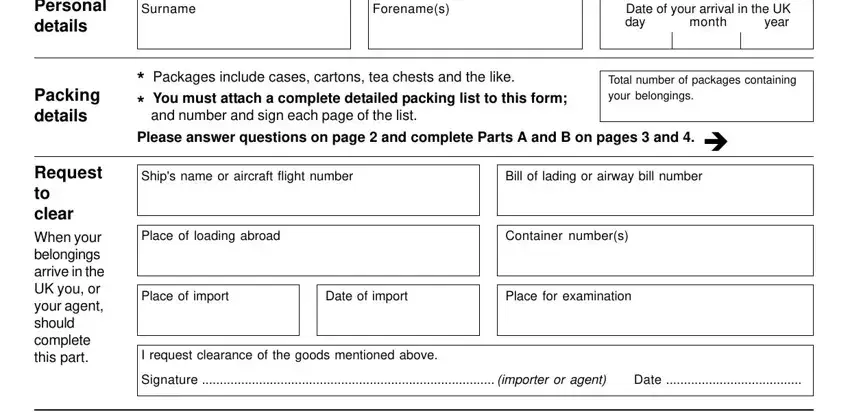

1. The form c3 will require certain details to be inserted. Be sure the subsequent blanks are completed:

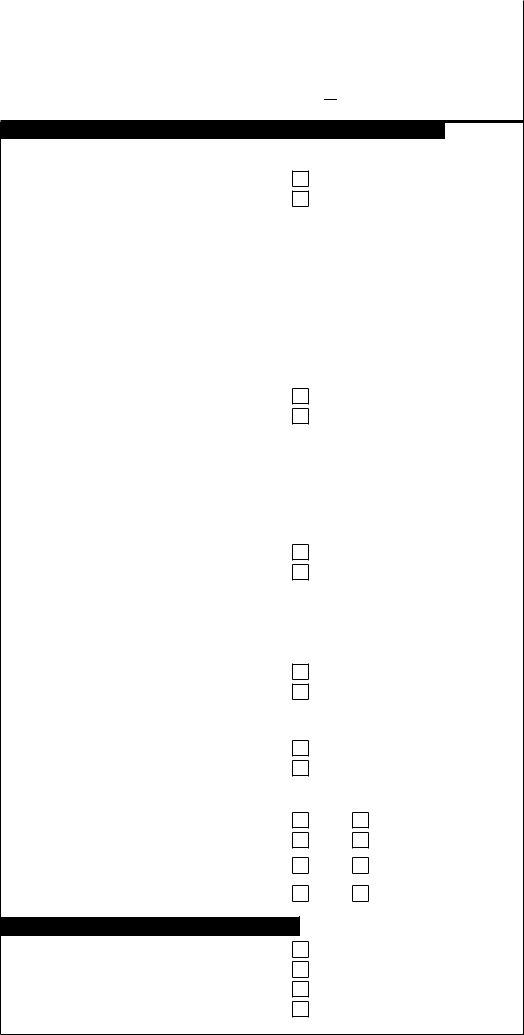

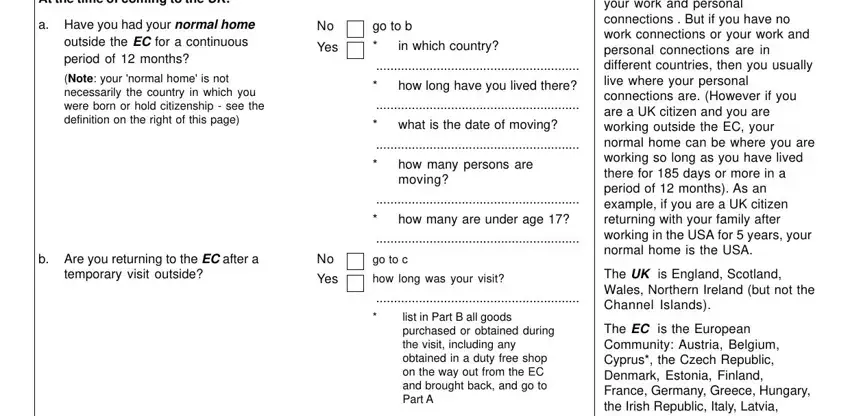

2. Right after filling in the last section, go to the next step and fill out the essential details in all these blank fields - Your normal home is where you, The UK is England Scotland Wales, The EC is the European Community, At the time of coming to the UK, a Have you had your normal home, b Are you returning to the EC, temporary visit outside, No Yes, No Yes, in which country, go to b how long have you lived, what is the date of moving, how many persons are moving, how many are under age, and go to c how long was your visit.

Be extremely careful while filling out No Yes and go to c how long was your visit, as this is the part where a lot of people make mistakes.

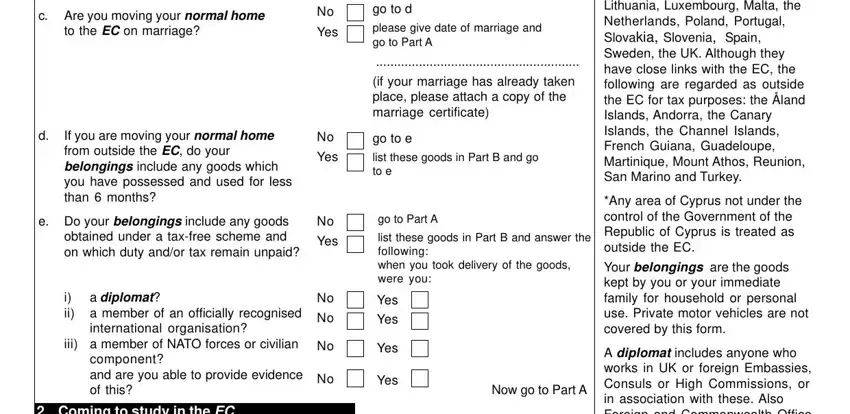

3. Completing The EC is the European Community, Any area of Cyprus not under the, A diplomat includes anyone who, c Are you moving your normal home, to the EC on marriage, If you are moving your normal home, No Yes, No Yes, e Do your belongings include any, No Yes, i ii, a diplomat a member of an, iii a member of NATO forces or, component and are you able to, and Coming to study in the EC is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

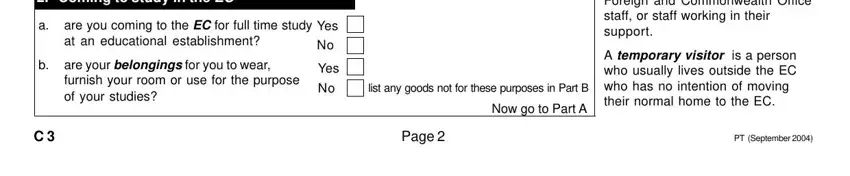

4. Filling out A diplomat includes anyone who, A temporary visitor is a person, Page, PT September, Coming to study in the EC, are you coming to the EC for full, are your belongings for you to, Yes No, Yes No, and list any goods not for these is crucial in this fourth step - ensure that you take the time and fill out each and every empty field!

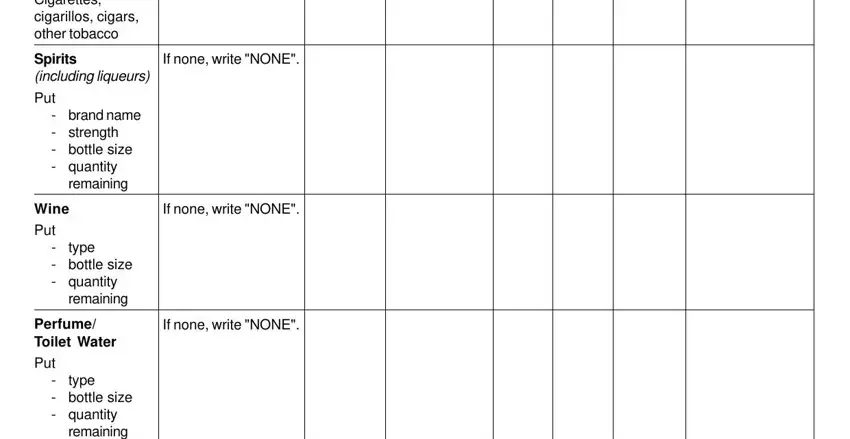

5. The last point to submit this form is essential. Ensure to fill out the displayed form fields, like If none write NONE, If none write NONE, If none write NONE, Tobacco products Cigarettes, Spirits including liqueurs Put, brand name strength bottle size, remaining, Wine Put bottle size quantity, type, remaining, Perfume Toilet Water Put bottle, type, and remaining, prior to finalizing. Neglecting to do this may give you a flawed and possibly invalid paper!

Step 3: Make sure that your information is correct and then click "Done" to proceed further. Get the form c3 once you sign up for a free trial. Conveniently gain access to the pdf form in your personal cabinet, along with any edits and adjustments automatically kept! We do not share the details you use while filling out documents at our site.