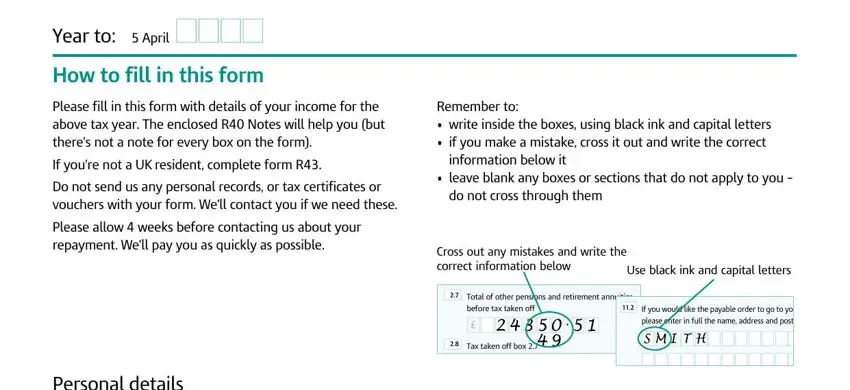

If you wish to fill out r40 claim form, you don't have to install any kind of software - just give a try to our online PDF editor. To keep our editor on the cutting edge of practicality, we aim to integrate user-driven features and enhancements on a regular basis. We are at all times grateful for any feedback - play a pivotal part in reshaping the way you work with PDF forms. To get the process started, consider these basic steps:

Step 1: Press the orange "Get Form" button above. It is going to open up our pdf tool so you can start filling out your form.

Step 2: After you open the online editor, you'll notice the form prepared to be filled out. Other than filling out different fields, you may also perform other sorts of things with the form, specifically putting on any text, editing the original textual content, inserting illustrations or photos, affixing your signature to the document, and more.

It's an easy task to fill out the pdf with this practical tutorial! Here's what you need to do:

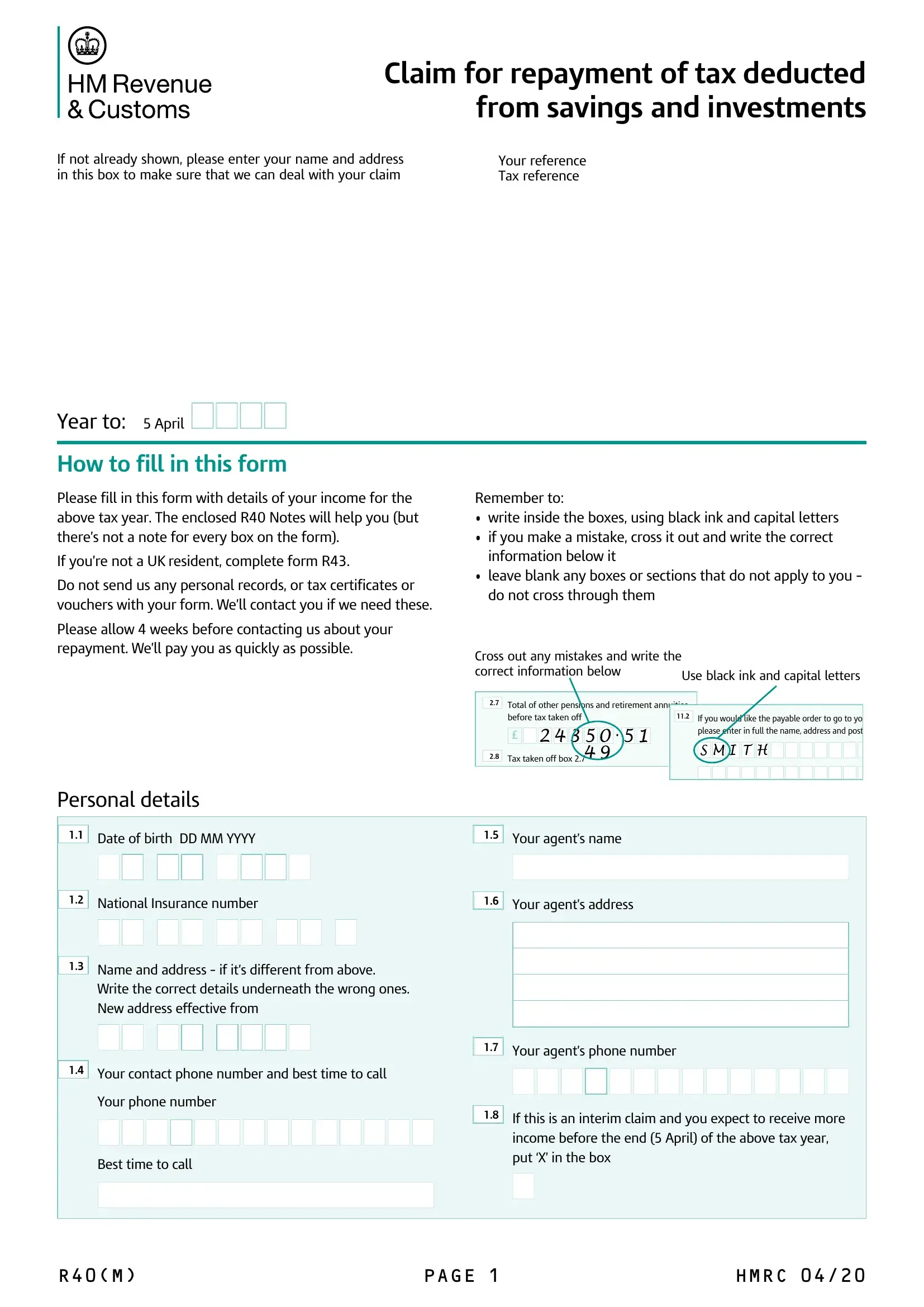

1. Before anything else, once filling in the r40 claim form, start out with the form section that has the next blank fields:

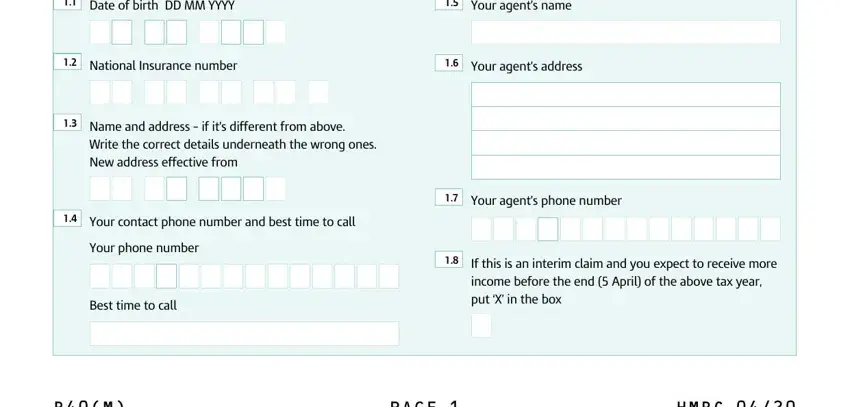

2. The subsequent stage would be to complete the next few blank fields: Date of birth DD MM YYYY, Your agents name, National Insurance number, Your agents address, Name and address if its, Write the correct details, Your contact phone number and, Your agents phone number, Your phone number, Best time to call, If this is an interim claim and, income before the end April of, PAGE, and HMRC.

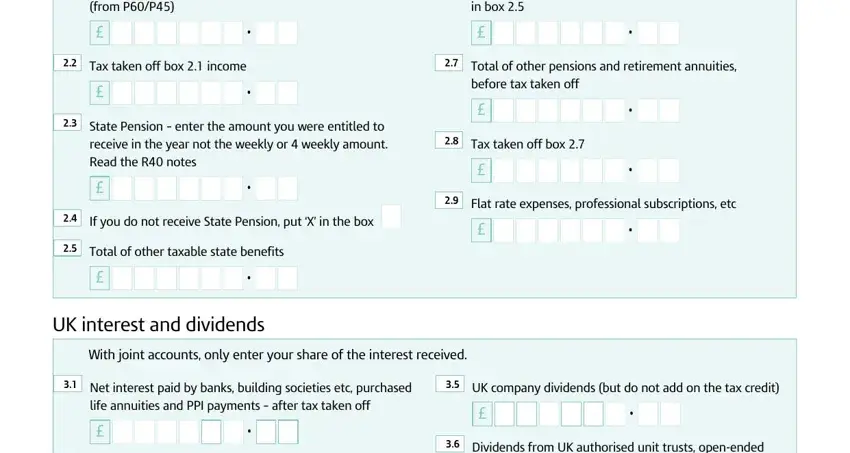

3. In this part, check out from PP, Tax taken off box income, State Pension enter the amount, If you do not receive State, Total of other taxable state, UK interest and dividends, in box, Total of other pensions and, before tax taken off, Tax taken off box, Flat rate expenses professional, With joint accounts only enter, Net interest paid by banks, UK company dividends but do not, and life annuities and PPI payments. All these will need to be completed with highest precision.

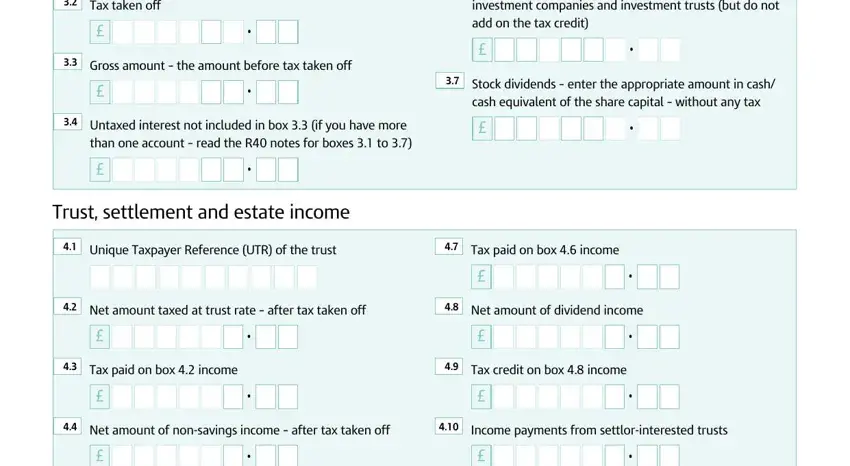

4. The next section requires your information in the subsequent places: Tax taken off, Gross amount the amount before, investment companies and, Stock dividends enter the, cash equivalent of the share, Untaxed interest not included in, Trust settlement and estate income, Unique Taxpayer Reference UTR of, Tax paid on box income, Net amount taxed at trust rate, Net amount of dividend income, Tax paid on box income, Tax credit on box income, Net amount of nonsavings income, and Income payments from. Make certain you fill out all needed information to move further.

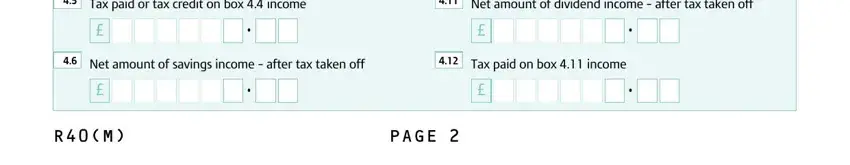

5. The form should be wrapped up within this part. Below there can be found an extensive list of blank fields that require appropriate information in order for your form submission to be accomplished: Tax paid or tax credit on box, Net amount of dividend income, Net amount of savings income, Tax paid on box income, and PAGE.

It's easy to get it wrong when completing the Tax paid or tax credit on box, therefore ensure that you look again before you send it in.

Step 3: You should make sure your information is correct and just click "Done" to conclude the process. Make a 7-day free trial plan at FormsPal and obtain instant access to r40 claim form - download or modify from your FormsPal account. FormsPal provides safe form editor with no personal data recording or sharing. Rest assured that your data is safe with us!