Navigating the complexities of the Uniaccount Flexible Spending Account (FSA) claim form requires an understanding of its various components, designed to provide individuals with an avenue to manage their healthcare and dependent care expenses more effectively. This form is facilitated by customer service numbers and addresses for both mailing and faxing, ensuring accessibility for users to seek assistance or submit their claims conveniently. Firstly, it collects employee information, including basic personal details alongside employer data, highlighting an initial step towards claim submission. Thereafter, the form delves into the specifics of dependent care information, where it's essential for the claimant to furnish details about the dependent, the care provided, and associated costs, ensuring these expenses qualify under the established guidelines. Moreover, the form meticulously outlines the requirements for health care claims, stipulating the necessity of including an Explanation of Benefits or a detailed account of the expenses if the former isn't available. An important note made is the change effective from January 1, 2011, regarding over-the-counter medicines or drugs, which mandates having a prescription for reimbursement eligibility. Additionally, signatories must certify their claims' authenticity and compliance with tax implications. The form concludes with insightful summaries of what expenses might be eligible for reimbursement under both Health and Dependent Care FSAs, providing a useful reference to users for maximizing their benefits in adherence to IRS and other regulatory interpretations. Emphasizing the importance of preserving copies of the form and attachments for personal records, the document frames a comprehensive approach towards managing healthcare and dependent care expenses through FSAs.

| Question | Answer |

|---|---|

| Form Name | Uniaccount Fsa Form |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | uniaccount flexible spending claim form, uniaccount fsa, uniaccount anthem, you uniaccount fsa create |

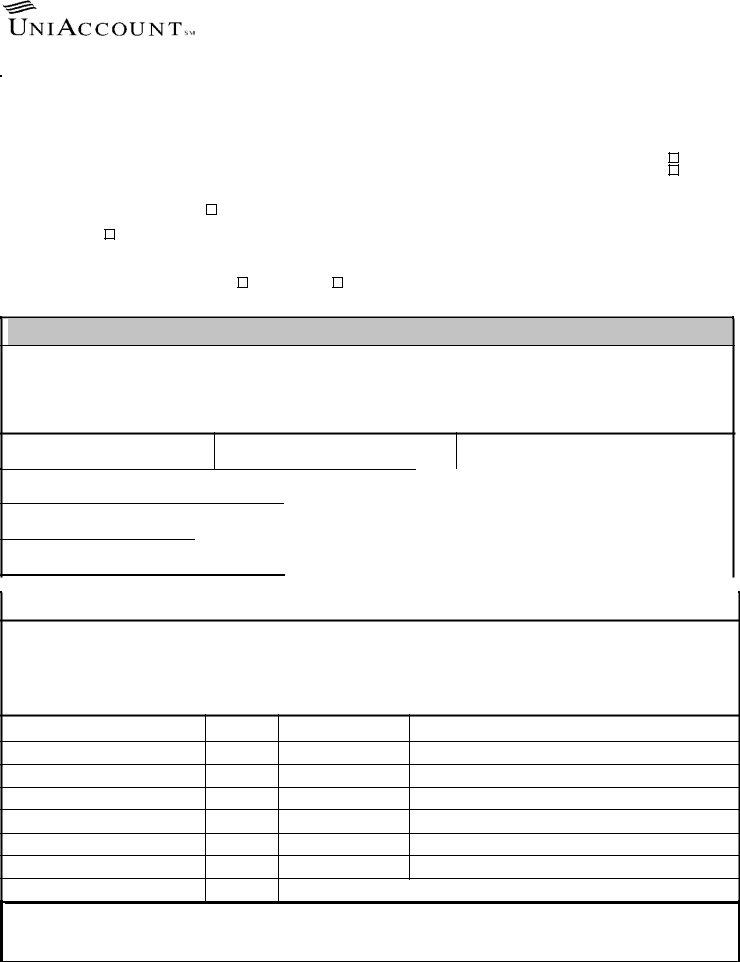

FLEXIBLE SPENDING ACCOUNTS CLAIM FORM |

Customer Service Voice: |

|

P. O. Box 4381 Woodland Hills Ca |

Customer Service Fax: |

|

|

SECTION A. |

|

|

|

EMPLOYEE INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Employer Name |

|

|

Employer’s Street Address |

|

City |

|

State |

Zip |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Member Identification Number |

|

Employee’s Last Name |

First Name |

|

|

MI |

Date Of Birth |

Gender |

||

|

|

|

|

|

|

|

|

|

|

|

|

M |

|

|

|

|

|

|

|

|

|

|

|

|

F |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Check here if the health |

Check here if |

|

Employee’s Street Address |

|

City |

|

State |

Zip |

||

|

|

care expenses below |

you have a new |

|

|

|

|

|

|

|

|

|

|

|

are also covered by |

address? |

|

|

|

|

|

|

|

|

|

|

|

another health care |

|

|

|

|

|

|

|

|

|

|

|

|

plan? |

|

|

|

|

|

|

|

|

|

|

|

|

Telephone Number(s): |

Day ( |

) |

- |

ext |

Evenings |

( |

) |

- |

ext |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you need additional claim forms, please |

|

|

|

|

|

|

|

|||

|

|

indicate how you would like to receive them: |

|

|

|

|

|

|

|

|

||

SECTION B.DEPENDENT CARE INFORMATION

INSTRUCTIONS:

1.Complete this Section, which includes the name of the dependent, the date(s) care was provided, the amount paid, the dependent care provider’s name address and Tax I.D. or Social Security number. Provider’s signature required OR you must attach a written statement from the dependent care provider. Dependent children must be under age 13 to qualify for reimbursement. See additional eligibility rules on reverse.

2.If care is provided in your home, complete this section and itemize the following on a separate piece of paper:

Room and board; transportation; other specific expenses incurred by the provider related to the care of your dependent(s). Wages paid to the provider; FICA and FUTA taxes

3.Keep a copy of this form and attached supporting documentation for your records.

Name of Provider (Please Print or Type)

Signature of Provider

Tax ID No.

Street Address of Provider

Dependent’s Name

Dependent’s Name

|

|

City |

|

|

State |

|

Zip Code |

|

|

|

|

|

|

|

|

Date of Birth |

Relationship To Employee |

Dependent Care Services Rendered |

Amount: |

||||

|

|

|

From: |

To: |

|

|

|

|

|

|

|

|

|||

Date of Birth |

Relationship To Employee |

Dependent Care Services Rendered |

Amount: |

||||

|

|

|

From: |

To: |

|

|

|

|

|

|

|

|

|

|

|

|

SECTION C. |

HEALTH CARE INFORMATION |

|

|

|

||

|

|

|

|

INSTRUCTIONS:

1.Attach Explanation of Benefits (EOB) showing amounts you are obligated to pay. If you do not have an EOB, please provide an explanation in the “Explanation”

Column below and attach an Itemized bill. Note: Itemized Bills contain the provider’s name, the date of service, the amount charged, and a description of the service provided. Credit card receipts, balance forward statements and canceled checks are not considered itemized bills. Please include no more than 6 receipts or EOBs per form.

2.Mail or fax this form and supporting documentation to the address or fax number listed at the top this form.

3.Keep a copy of this form and attached supporting documentation for your records.

* NOTE: Effective January 1, 2011, the cost of an

Date of Service (From/To) |

Amount |

Self/Dependent Name |

Provider/Explanation |

1.-

2.-

3.-

4.-

5.-

6.-

Total

I certify that either myself and/or my eligible dependents have incurred the expenses for which reimbursement is claimed from either the Health or Dependent Care Reimbursement Accounts and that I have not and will not deduct these expenses on my individual income tax return. I further certify this health care expense has not been reimbursed or is not reimbursable under any other Employer sponsored health care plan and that expenses have been paid.

REV 9/2010

SIGNATURE

DATE

\HEALTH CARE EXPENSES

The following is a summary of common expenses that may be eligible for reimbursement through a Health Flexible Spending Account. The information that follows is compiled from publications issued by the Internal Revenue service. The information below is meant to serve as a guide only and is subject to the interpretation of the law by the Internal Revenue Service, that of other government agencies, and changes to the law. All expenses must be incurred during the plan year in which contributions are made and while actively enrolled as defined by your employer in the Health Flexible Spending Account in order to be reimbursable.

Acupuncture Performed by a licensed practitioner |

Optometrist services within scope of license |

|

Services rendered by a treatment center for Alcoholism/Drug |

Orthodontia for non cosmetic reasons |

|

Dependency |

Oxygen |

|

Artificial Limbs |

Physical Exams that are non employment related |

|

Artificial Teeth |

Physical therapy |

|

Birth control pills and devices prescribed by a physician |

Psychiatric care |

|

Braille books and magazines |

Psychoanalysis |

|

Breast Reduction when physician substantiates medical necessity |

Psychologist services |

|

Car controls and other special equipment for the handicapped |

Schools special schooling to relieve handicap |

|

Chair - The cost of a reclining chair prescribed by a |

||

physician to alleviate a heart, back or other condition |

alleviate nicotine withdrawal |

|

Chiropractors Services within scope of license |

Sterilization |

|

Christian Science practitioners |

Surgery including experimental |

|

Contact Lenses and solutions |

Syringes, needles, and injections |

|

Crutches Purchase or rental |

Telephone special equipment for hearing impaired |

|

Deductibles and |

Television audio display equipment for hearing impaired |

|

insurance |

Therapy physical or occupational therapy |

|

Dental fees and |

Transplants |

|

Eyeglasses, lenses, frames, exams |

Transportation primarily for and essential to medical care as defined |

|

Eye surgery to correct vision, such as Radial Keratomy and |

below: |

|

Photorefractive Keratectomy |

* |

bus, taxi, train, or plane fare or ambulance service |

Fertility treatment including |

* |

car expenses, such as gasoline and oil; |

Founder’s Monthly |

* |

parking fees and tolls; |

(covers portion specifically for medical care) |

* |

transportation expenses for a parent who must accompany a |

Guide dog purchased by the visually or hearing impaired |

|

child who needs medical care; |

Halfway house care to help individual adjust from life in |

* |

transportation expenses for a nurse or other person who can |

mental hospital to community living |

|

give injections, medications, or other treatment required by a |

Health care equipment not for general use articles for |

|

patient who is traveling to get medical care and is unable to |

Furniture, household items, or appliances |

|

travel alone; |

Hearing aids and Hearing Aid Batteries |

* |

transportation expenses to see a mentally ill dependent if the |

Hospitalization, Including private room coverage |

|

visits are recommended as part of treatment |

Hypnosis for treatment of illness |

Instead of actual expenses it is acceptable to use a flat rate |

|

Insulin Medication |

provided by the IRS for each mile a car is used for medical |

|

Learning disability tutoring by licensed school or therapist |

purposes. |

|

for child with severe learning disability |

Vaccinations and immunizations |

|

Lifetime care advance payment to private institution for |

Vitamins and mineral supplements, only available by prescription |

|

care of mentally or physically handicapped patient |

and prescribed by a physician to treat a specific medical condition |

|

Medicines & Drugs |

Wheelchairs |

|

DEPENDENT CARE EXPENSES

The following is a summary of the types of expenses that may be eligible for reimbursement through a Dependent Care Flexible Spending Account. The information that follows is compiled from publications of the Internal Revenue Service. The information below is meant to serve as a guide only and is subject to the interpretation of the law

by the Internal Revenue Service, that of other government agencies, and changes to the law. Dependent care FSAs essentially operate in the same way as health FSAs, except for one important exception: The entire year’s contribution is not immediately available in a Dependent Care FSA. All expenses must be incurred during the plan

year in which contributions are made and while actively enrolled as defined by your employer in the Dependent Care Flexible Spending Account in order to be reimbursable.

Eligible Dependent: An eligible dependent is defined as any person who can be claimed by an employee as a dependent for federal tax purposes (under Section 151 (c ) of the tax code) and who:

∙is under age 13; or

∙requires

∙is the spouse of the employee and is physically or mentally incapable of care for himself or herself.

Expenses for care provided outside a taxpayer’s home may be claimed only for dependents under age 13 or other dependents who regularly spend at least eight hours per day in the taxpayer’s home. Also, expenses incurred during a plan year after a child attains age 13 are not reimbursable.

You may not claim dependent care expenses which exceed the lesser of: The fixed dollar maximum of your plan; your earned income; or (if you are married) your spouse's earned income. If your spouse is either a

Qualified care provider: Payments for dependent care services provided by dependents of either the taxpayer or the taxpayer’s spouse, or to a child of the taxpayer who is under age 19, do not qualify.

Expenses∙ incurred for care at a child care center are qualified only if the center:

∙

∙

Qualified expenses: A qualified expense must enable the employee (and spouse, if married) to be gainfully employed or to look for gainful employment. Qualified expenses only include the cost of services for the dependent’s

Schooling - Educational expenses incurred for a child below kindergarten level qualify as eligible expenses.

Camps and

Transportation, entertainment and food: The cost of transportation, entertainment, food or clothing cannot be reimbursed unless such items are incidental and cannot be separated from the cost of the care provided. This means that the cost of getting a child or other qualifying dependent from home to a care provider, or from school to a care provider is not a qualified expense. Public transportation fares (e.g., travel by bus, subway or taxi) do not qualify as an expense nor are any costs associated with operating a private car. This rule applies to providers as well as dependents; that is, transportation costs associated with bringing a care provider to an employee’s home are not qualified expenses.

Household expenses: Expenses paid for household services qualify if they: (1) pertain to services provided in the employee’s home that are “ordinary and usual” and “necessary to the maintenance of the household” (such as a maid, housekeeper or cook); and (2) are attributable at least in part to the care of the

qualifying individual. The services of a gardener or chauffeur, for example, would not qualify as eligible expenses.

FSACLMFRM:10/01/2001

Payroll taxes: Payment of payroll taxes by an employee in connection with compensation paid to a service provider is a qualified expense. These taxes include Social Security (FICA)/Medicare tax, federal unemployment tax (FUTA) or similar state payroll taxes.

FSACLMFRM:10/01/2001