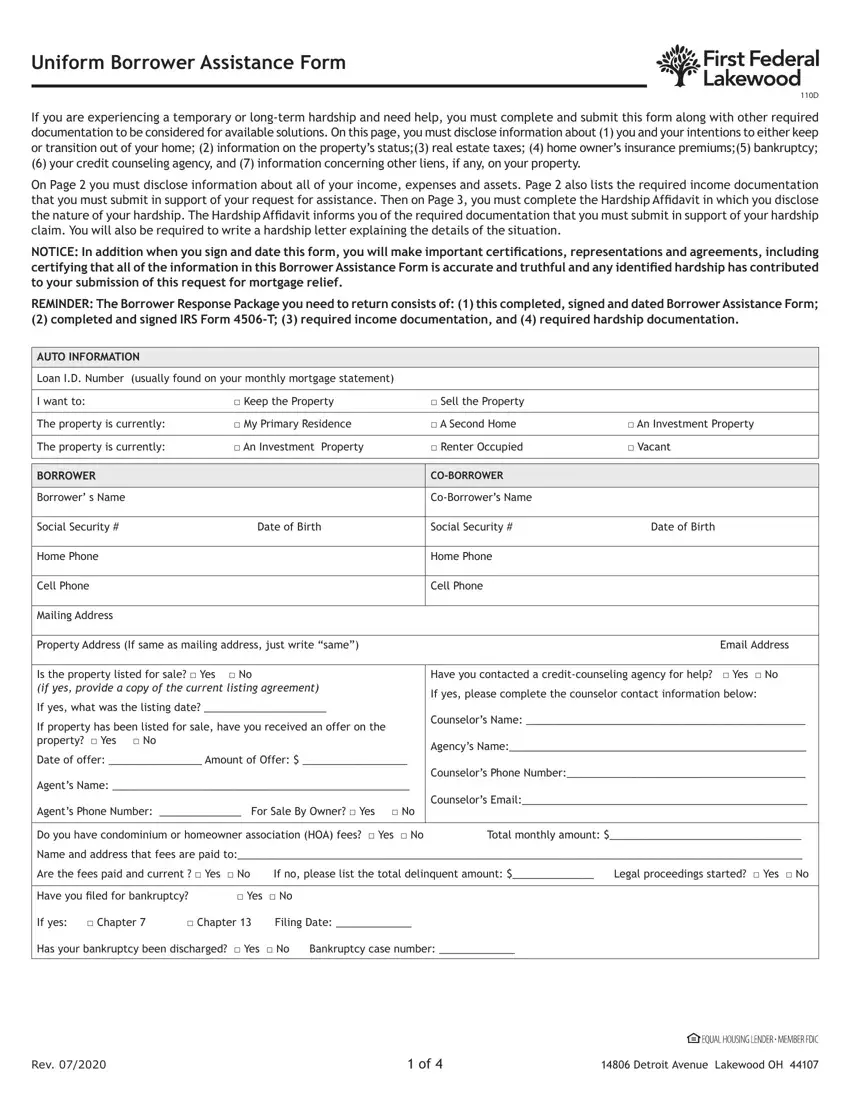

Uniform Borrower Assistance Form

110D

If you are experiencing a temporary or long-term hardship and need help, you must complete and submit this form along with other required documentation to be considered for available solutions. On this page, you must disclose information about (1) you and your intentions to either keep or transition out of your home; (2) information on the property’s status;(3) real estate taxes; (4) home owner’s insurance premiums;(5) bankruptcy;

(6) your credit counseling agency, and (7) information concerning other liens, if any, on your property.

On Page 2 you must disclose information about all of your income, expenses and assets. Page 2 also lists the required income documentation that you must submit in support of your request for assistance. Then on Page 3, you must complete the Hardship Affidavit in which you disclose the nature of your hardship. The Hardship Affidavit informs you of the required documentation that you must submit in support of your hardship claim. You will also be required to write a hardship letter explaining the details of the situation.

NOTICE: In addition when you sign and date this form, you will make important certifications, representations and agreements, including certifying that all of the information in this Borrower Assistance Form is accurate and truthful and any identified hardship has contributed to your submission of this request for mortgage relief.

REMINDER: The Borrower Response Package you need to return consists of: (1) this completed, signed and dated Borrower Assistance Form;

(2) completed and signed IRS Form 4506-T; (3) required income documentation, and (4) required hardship documentation.

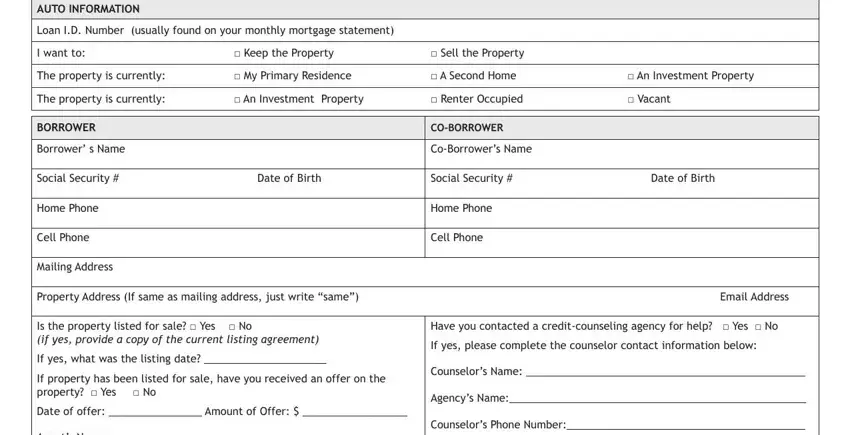

AUTO INFORMATION

|

Loan I.D. Number |

(usually found on your monthly mortgage statement) |

|

|

|

|

|

|

|

|

|

I want to: |

|

□ Keep the Property |

□ Sell the Property |

|

|

|

|

|

|

|

The property is currently: |

□ My Primary Residence |

□ A Second Home |

□ An Investment Property |

|

|

|

|

|

|

The property is currently: |

□ An Investment Property |

□ Renter Occupied |

□ Vacant |

|

|

|

|

|

|

|

|

|

|

|

|

|

BORROWER |

|

|

CO-BORROWER |

|

|

|

|

|

|

|

|

Borrower’ s Name |

|

|

Co-Borrower’s Name |

|

|

|

|

|

|

|

|

Social Security # |

|

Date of Birth |

Social Security # |

Date of Birth |

|

|

|

|

|

|

|

Home Phone |

|

|

Home Phone |

|

|

|

|

|

|

|

|

Cell Phone |

|

|

Cell Phone |

|

|

|

|

|

|

|

|

Mailing Address |

|

|

|

|

|

|

|

|

|

Property Address (If same as mailing address, just write “same”) |

|

Email Address |

|

|

|

|

|

Is the property listed for sale? □ Yes |

□ No |

Have you contacted a credit-counseling agency for help? □ Yes □ No |

|

(if yes, provide a copy of the current listing agreement) |

If yes, please complete the counselor contact information below: |

|

|

|

|

|

If yes, what was the listing date? _____________________ |

Counselor’s Name: ________________________________________________ |

|

If property has been listed for sale, have you received an offer on the |

|

|

|

|

property? □ Yes |

□ No |

|

Agency’s Name:___________________________________________________ |

|

|

|

|

|

Date of offer: ________________ Amount of Offer: $ __________________ |

|

|

|

Agent’s Name: ___________________________________________________ |

Counselor’s Phone Number:_________________________________________ |

|

|

|

|

Agent’s Phone Number: ______________ For Sale By Owner? □ Yes □ No |

Counselor’s Email:_________________________________________________ |

|

|

|

|

|

|

|

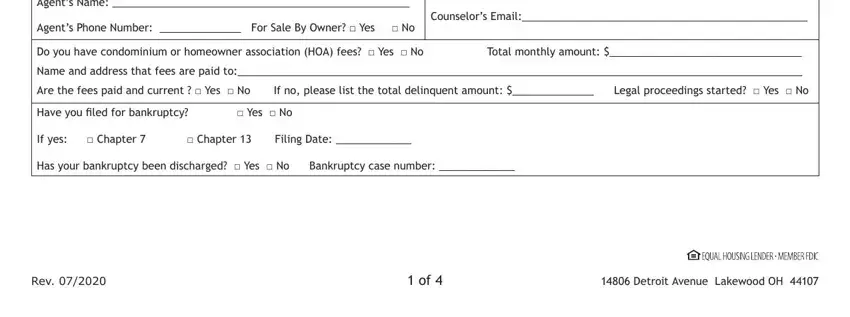

Do you have condominium or homeowner association (HOA) fees? □ Yes □ No |

Total monthly amount: $_________________________________ |

Name and address that fees are paid to:_________________________________________________________________________________________________

|

|

|

|

|

|

|

Are the fees paid and current ? □ Yes |

□ No |

If no, please list the total delinquent amount: $______________ |

Legal proceedings started? □ Yes □ No |

|

|

|

|

|

Have you filed for bankruptcy? |

□ Yes |

□ No |

|

|

If yes: |

□ Chapter 7 |

□ Chapter 13 |

Filing Date: _____________ |

|

Has your bankruptcy been discharged? |

□ Yes |

□ No |

Bankruptcy case number: _____________ |

|

Rev. 07/2020 |

1 of 4 |

14806 Detroit Avenue Lakewood OH 44107 |

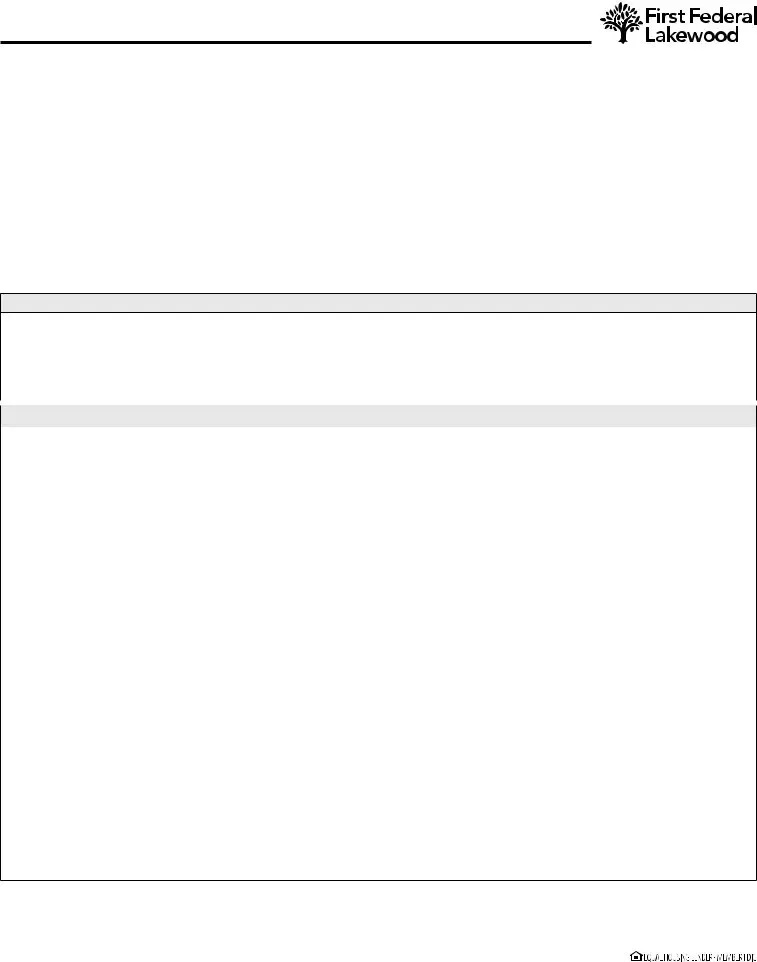

Uniform Borrower Assistance Form

110D

|

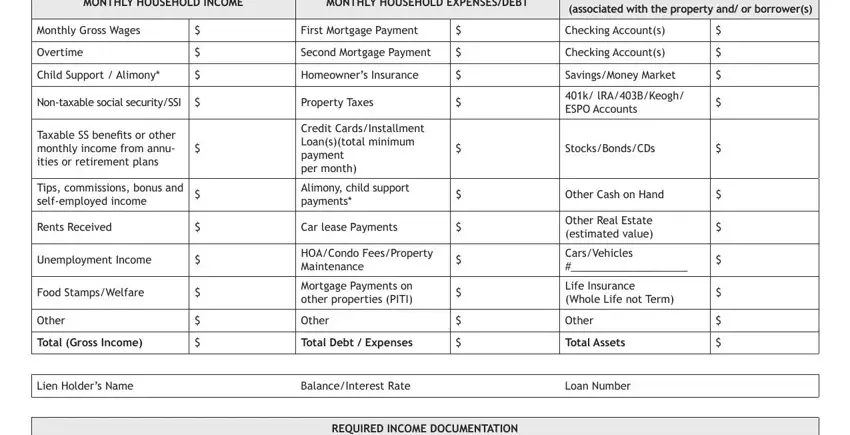

MONTHLY HOUSEHOLD INCOME |

MONTHLY HOUSEHOLD EXPENSES/DEBT |

HOUSEHOLD ASSETS |

|

(associated with the property and/ or borrower(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Monthly Gross Wages |

$ |

First Mortgage Payment |

$ |

Checking Account(s) |

$ |

|

|

|

|

|

|

|

|

Overtime |

$ |

Second Mortgage Payment |

$ |

Checking Account(s) |

$ |

|

|

|

|

|

|

|

|

Child Support / Alimony* |

$ |

Homeowner’s Insurance |

$ |

Savings/Money Market |

$ |

|

|

|

|

|

|

|

|

Non-taxable social security/SSI |

$ |

Property Taxes |

$ |

401k/ lRA/403B/Keogh/ |

$ |

|

ESPO Accounts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable SS benefits or other |

|

Credit Cards/Installment |

|

|

|

|

|

Loan(s)(total minimum |

|

|

|

|

monthly income from annu- |

$ |

$ |

Stocks/Bonds/CDs |

$ |

|

payment |

|

ities or retirement plans |

|

|

|

|

|

|

per month) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tips, commissions, bonus and |

$ |

Alimony, child support |

$ |

Other Cash on Hand |

$ |

|

self-employed income |

|

payments* |

|

|

|

|

Rents Received |

$ |

Car lease Payments |

$ |

Other Real Estate |

$ |

|

(estimated value) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unemployment Income |

$ |

HOA/Condo Fees/Property |

$ |

Cars/Vehicles |

$ |

|

Maintenance |

#____________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Food Stamps/Welfare |

$ |

Mortgage Payments on |

$ |

Life Insurance |

$ |

|

other properties (PITI) |

(Whole Life not Term) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

$ |

Other |

$ |

Other |

$ |

|

|

|

|

|

|

|

|

Total (Gross Income) |

$ |

Total Debt / Expenses |

$ |

Total Assets |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lien Holder’s Name |

|

Balance/Interest Rate |

|

Loan Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REQUIRED INCOME DOCUMENTATION |

|

|

|

|

|

|

|

|

|

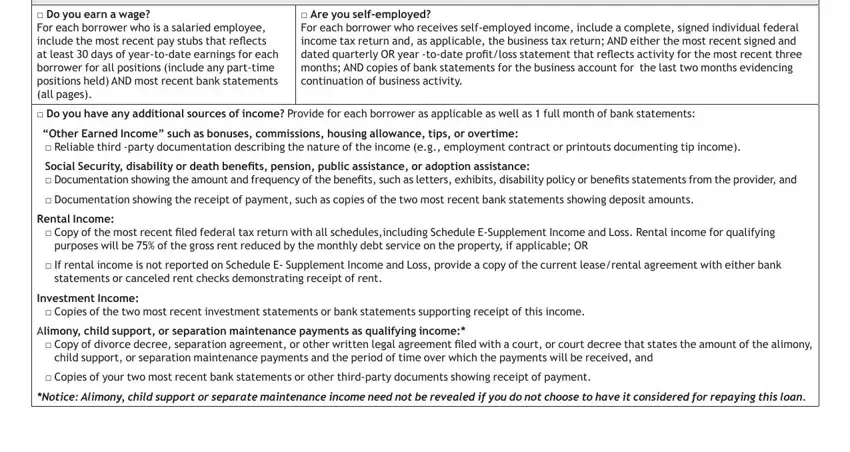

□Do you earn a wage?

For each borrower who is a salaried employee, include the most recent pay stubs that reflects at least 30 days of year-to-date earnings for each borrower for all positions (include any part-time positions held) AND most recent bank statements (all pages).

□Are you self-employed?

For each borrower who receives self-employed income, include a complete, signed individual federal income tax return and, as applicable, the business tax return; AND either the most recent signed and dated quarterly OR year -to-date profit/loss statement that reflects activity for the most recent three months; AND copies of bank statements for the business account for the last two months evidencing continuation of business activity.

□ Do you have any additional sources of income? Provide for each borrower as applicable as well as 1 full month of bank statements:

“Other Earned Income” such as bonuses, commissions, housing allowance, tips, or overtime:

□ Reliable third -party documentation describing the nature of the income (e.g., employment contract or printouts documenting tip income).

Social Security, disability or death benefits, pension, public assistance, or adoption assistance:

□Documentation showing the amount and frequency of the benefits, such as letters, exhibits, disability policy or benefits statements from the provider, and

□Documentation showing the receipt of payment, such as copies of the two most recent bank statements showing deposit amounts.

Rental Income:

□Copy of the most recent filed federal tax return with all schedules,including Schedule E-Supplement Income and Loss. Rental income for qualifying purposes will be 75% of the gross rent reduced by the monthly debt service on the property, if applicable; OR

□If rental income is not reported on Schedule E- Supplement Income and Loss, provide a copy of the current lease/rental agreement with either bank statements or canceled rent checks demonstrating receipt of rent.

Investment Income:

□ Copies of the two most recent investment statements or bank statements supporting receipt of this income.

Alimony, child support, or separation maintenance payments as qualifying income:*

□Copy of divorce decree, separation agreement, or other written legal agreement filed with a court, or court decree that states the amount of the alimony, child support, or separation maintenance payments and the period of time over which the payments will be received, and

□Copies of your two most recent bank statements or other third-party documents showing receipt of payment.

*Notice: Alimony, child support or separate maintenance income need not be revealed if you do not choose to have it considered for repaying this loan.

Rev. 07/2020 |

2 of 4 |

14806 Detroit Avenue Lakewood OH 44107 |

Uniform Borrower Assistance Form

110D

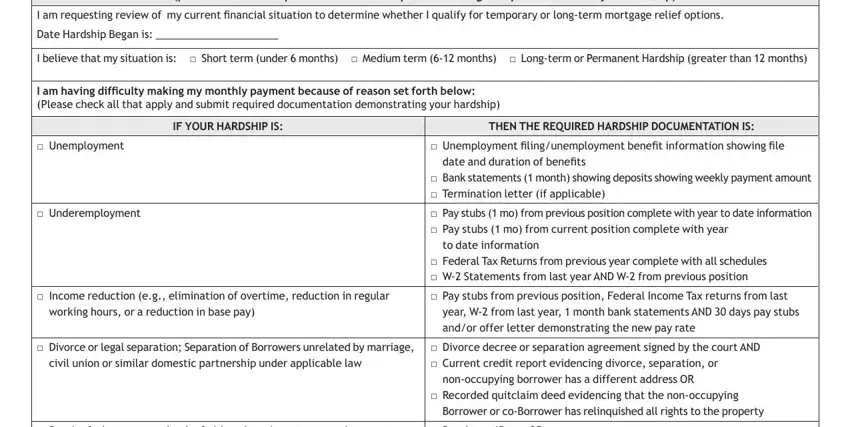

HARDSHIP AFFIDAVIT

(provide a written explanation with this request describing the specific nature of your hardship)

I am requesting review of my current financial situation to determine whether I qualify for temporary or long-term mortgage relief options.

Date Hardship Began is: _____________________

I believe that my situation is: □ Short term (under 6 months) □ Medium term (6-12 months) □ Long-term or Permanent Hardship (greater than 12 months)

I am having difficulty making my monthly payment because of reason set forth below: (Please check all that apply and submit required documentation demonstrating your hardship)

IF YOUR HARDSHIP IS: |

THEN THE REQUIRED HARDSHIP DOCUMENTATION IS: |

|

|

□ Unemployment |

□ Unemployment filing/unemployment benefit information showing file |

|

date and duration of benefits |

|

□ Bank statements (1 month) showing deposits showing weekly payment amount |

|

□ Termination letter (if applicable) |

|

|

□ Underemployment |

□ Pay stubs (1 mo) from previous position complete with year to date information |

|

□ Pay stubs (1 mo) from current position complete with year |

|

to date information |

|

□ Federal Tax Returns from previous year complete with all schedules |

|

□ W-2 Statements from last year AND W-2 from previous position |

|

|

□ Income reduction (e.g., elimination of overtime, reduction in regular |

□ Pay stubs from previous position, Federal Income Tax returns from last |

working hours, or a reduction in base pay) |

year, W-2 from last year, 1 month bank statements AND 30 days pay stubs |

|

and/or offer letter demonstrating the new pay rate |

|

|

□ Divorce or legal separation; Separation of Borrowers unrelated by marriage, |

□ Divorce decree or separation agreement signed by the court AND |

civil union or similar domestic partnership under applicable law |

□ Current credit report evidencing divorce, separation, or |

|

non-occupying borrower has a different address OR |

|

□ Recorded quitclaim deed evidencing that the non-occupying |

|

Borrower or co-Borrower has relinquished all rights to the property |

|

|

□ Death of a borrower or death of either the primary or secondary wage |

□ Death certificate OR |

earner in the household |

□ Obituary or newspaper article reporting the death |

|

|

□ Long-term or permanent disability; Serious illness of a borrower/ |

□ Doctor’s certificate of illnessor disability OR |

co-borrower or dependent family member |

□ Medical bills OR |

|

□ Proof of monthly insurance benefits or government assistance |

|

(if applicable) |

|

|

□ Disaster (natural or man-made) adversely impacting the property or |

□ Insurance claim OR |

Borrower ‘s place of employment |

□ Federal Emergency Management Agency grant or Small Business |

|

Administration loan OR |

|

□ Borrower or Employer property located in a federally declared disaster area |

|

|

□ Distant employment transfer |

□ Letter from employer stating date of transfer |

|

□ Documentation supporting any changes to income as a result of transfer |

|

(e.g. letter from employer, pay stubs, etc) |

|

|

□ Business failure |

□ Tax return from the previous year (including all schedules) AND |

|

□ Proof of business failure supported by one of the following: |

|

• Bankruptcy filling for the business; or |

|

• Two months recent bank statements for the business account evidencing |

|

cessation of business activity; OR |

|

• Most recent signed and dated quarterly or year-t o-date profit and loss |

|

statement |

|

|

Rev. 07/2020 |

3 of 4 |

14806 Detroit Avenue Lakewood OH 44107 |

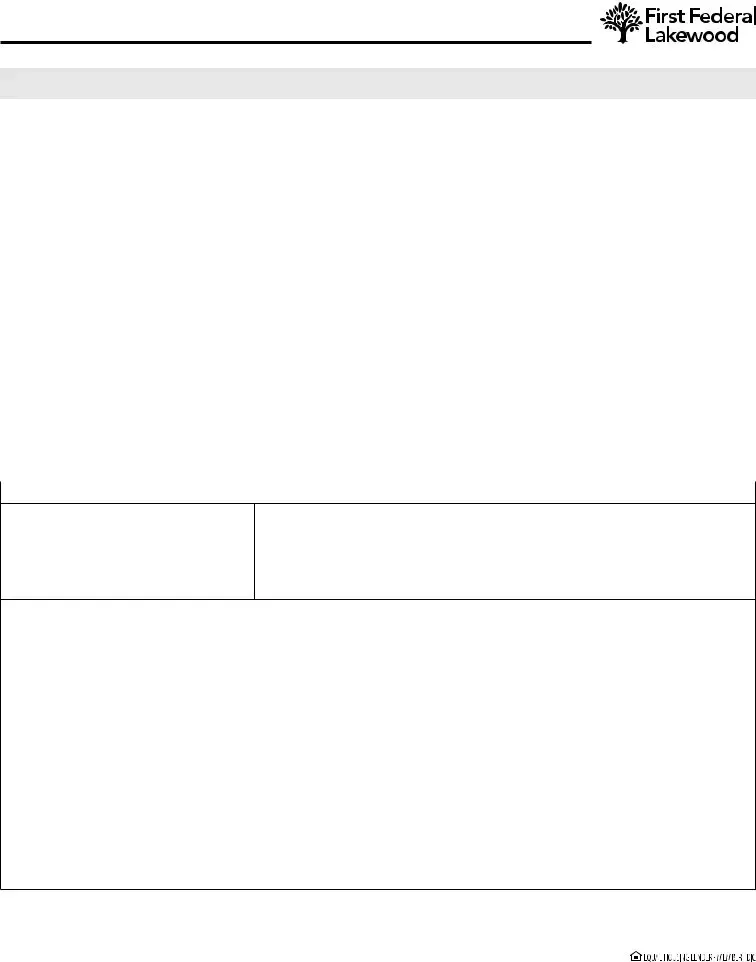

Uniform Borrower Assistance Form

110D

BORROWER/CO-BORROWER ACKNOWLEDGMENT AND AGREEMENT

1.I certify that all of the information in this Borrower Assistance Form is truthful and the hardship(s) identified above has contributed to submission of this request for mortgage relief.

2.I understand and acknowledge that the Servicer, owner or guarantor of my mortgage, or their agent(s) may investigate the accuracy of my statements, may require me to provide additional supporting documentation, and that knowingly submitting false information may violate Federal and other applicable law.

3.I understand the Servicer will obtain a current credit report on all borrowers obligated on the Note.

4.I understand that if I have intentionally defaulted on my existing mortgage, engaged in fraud or misrepresented any fact(s) in connection with this request for mortgage relief or if I do not provide all required documentation, the Servicer may cancel any mortgage relief granted and may pursue foreclosure on my home and/or pursue any available legal remedies.

5.I certify that my property has not received a condemnation notice.

6.I certify that I am willing to provide all requested documents and to respond to all Servicer communications in a timely manner.

I understand that time is of the essence.

7.I understand that the Servicer will use this information to evaluate my eligibility for available relief options and foreclosure alternatives, but the Servicer is not obligated to offer me assistance based solely on the representations in this document or other documentation submitted in connection with my request.

8.If I am eligible for a repayment plan, forbearance plan, workout option and/or modification and I accept and agree to all terms of such plan, I also agree that the terms of this Acknowledgment and Agreement are incorporated into such plan by reference as if set forth in such plan in full. My first timely payment following my Servicer’s determination and notification of my eligibility or prequalification for a modification, repayment plan or forbearance plan (when applicable) or other workout option will serve as acceptance of the terms set forth in the notice sent to me that sets forth the terms and conditions of the workout option, modification repayment plan or forbearance plan.

9.I agree that when the Servicer accepts and posts a payment during the term of any repayment plan, modification,forbearance plan or other workout option, it will be without prejudice to, and will not be deemed a waiver of, the acceleration of my loan or foreclosure action and related activities and shall not constitute a cure of my default under my loan unless such payments are sufficient to completely cure my entire default under my loan.

10.I agree that any prior waiver as to my payment of escrow items to Servicer in connection with my loan has been revoked.

11.If I qualify for and enter into a repayment plan, forbearance plan, modification and/or other workout option I agree to the establishment of an escrow account and the payment of escrow items if an escrow account never existed on my loan.

12.I understand that Servicer will collect and record personal information that I submit in this Borrower Response Package and during the evaluation process, including, but not limited to, my name, address, telephone number, social security number, credit score, income, payment history, and information about my account balances and activity. I understand and consent to the Servicer’s disclosure of my personal information and the terms of any relief or foreclosure alternative that I receive to any investor, insurer, guarantor, or servicer that owns, insures, guarantees, or services my first lien or subordinate lien (if applicable) mortgage loan(s) or to any HUD certified housing counselor.

13.I consent to being contacted concerning this request for mortgage assistance at any cellular or mobile telephone number I have provided to the Lender. This can include text messages and telephone calls to my cellular or mobile telephone

Name (print) |

Signature |

Date |

|

|

|

Name (print) |

Signature |

Date |

*Before mailing, make sure you have signed and dated the form and attached copies of the appropriate documentation*

Rev. 07/2020 |

4 of 4 |

14806 Detroit Avenue Lakewood OH 44107 |