Maryland Department of Transportation

RETURN TO: |

COMPLETE ALL ITEMS. |

Minority Business Enterprise Office |

If an item does not apply, mark |

Maryland Department of Transportation |

“N.A.” |

7201 Corporate Center Dr. |

Use separate sheet(s) for |

Hanover, MD 21076 |

Additional information |

410-865-1269 |

|

1-800-544-6056 |

|

DISADVANTAGED BUSINESS ENTERPRISE PROGRAM

49 C.F.R. PART 26

UNIFORM CERTIFICATION APPLICATION

ROADMAP FOR APPLICANTS

•Should I apply?

oIs your firm at least 51% owned by a socially and economically disadvantaged individual(s) who also controls the firm?

oIs the disadvantaged owner a U.S. citizen or lawfully admitted permanent resident of the U.S.?

oIs your firm a small business that meets the Small Business Administration’s (SBA) size standard and does not exceed $22.41 million in gross annual receipts?

oIs your firm organized as a for-profit business?

If you answered “Yes” to all of the questions above, you may be eligible to participate in the U.S. DOT DBE program.

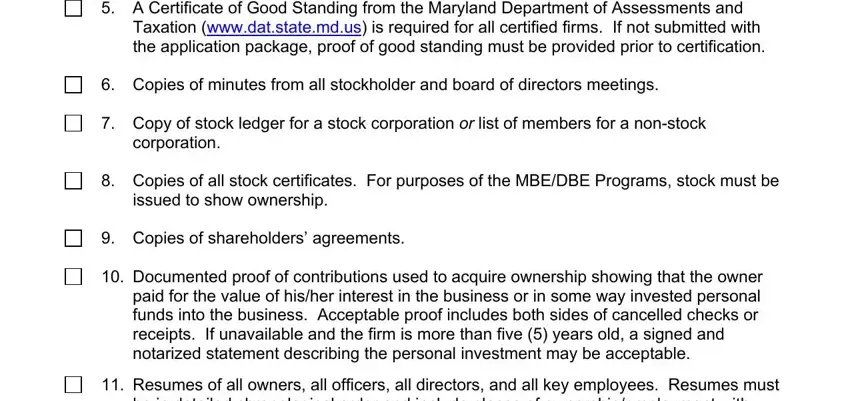

•Be sure to attach all of the required documents listed in the Document Checklist at the end of this form with your completed application.

•Where can I find more information?

oU.S. DOT – http://osdbuweb.dot.gov/business/dbe/index.html (this site provides useful links to the rules and regulations governing the DBE program, questions and answers, and other pertinent information)

oSBA – http://www.ntis.gov/naics (provides a listing of NAICS codes) and http://www.sba.gov/size/indextableofsize.html (provides a listing of SIC codes)

o49 CFR Part 26 (the rules and regulations governing the DBE program)

Under Sec. 26.107 of 49 CFR Part 26, dated February 2, 1999, if at any time, the Department or a recipient has reason to believe that any person or firm has willfully and knowingly provided incorrect information or made false statements, the Department may initiate suspension or debarment proceedings against the person or firm under 49 CFR part 29, take enforcement action under 49 CFR Part 31, Program Fraud and Civil Remedies, and/or refer the matter to the Department of Justice for criminal prosecution under 18 U.S.C. 1001, which prohibits false statements in Federal programs.

Page 1 of 14

Maryland Department of Transportation

A. Prior/Other Certifications |

Section 1: CERTIFICATION INFORMATION |

Is your firm currently certified for any of the following programs?

If Yes, check appropriate box(es))

DBE |

Name of certifying agency: |

Has your firm's state UCP conducted an on-site visit?

8(a)

SDB

B.Prior/Other Applications and Privileges

Has your firm (under any name) or any of its owners, Board of Directors, officers or management personnel, ever withdrawn an application for any of the programs listed above, or ever been denied certification, decertified, or debarred or suspended or otherwise had bidding privileges denied or restricted by any state or local agency, or Federal entity?

If yes, identify State and name of state, local or Federal agency and explain the natural of the action:

A. |

Contact Information |

Section 2: GENERAL INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) CONTACT PERSON |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

(3) Phone # |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(4) |

Other Phone |

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) |

Legal name of firm: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(5) |

Fax #: |

(6) E-mail: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(7) |

Website (if you have one): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(8) |

Street address of firm (No P.O.Boxes) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address 1 |

|

|

|

City |

|

|

|

|

County/Parish: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address 2 |

|

|

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(9) Mailing address of firm (if different): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address 1 |

|

|

City |

|

|

|

|

County/Parish: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address 2 |

|

|

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B.Business Profile

(1) |

Describe the primary activities of your firm: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) |

Federal Tax ID (if any): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3) |

This firm was established on |

Date: |

|

|

|

|

(4) |

I/We have owned this firm since |

Date: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(5) |

Method of acquisition (check all that apply): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Start new business |

|

|

Bought existing business |

Inherited business |

Secured concession |

|

|

|

|

Merger or consolidation |

|

|

Other (explain) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(6) |

Is your firm "for profit"? |

Yes |

No |

STOP! If your firm is NOT for-profit, then you do NOT qualify for this program and |

|

|

|

|

|

|

|

|

do NOT need to fill out this application. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|