The phoenix university tax id completing process is simple. Our PDF tool allows you to work with any PDF document.

Step 1: Choose the "Get Form Here" button.

Step 2: At this point, you can begin modifying the phoenix university tax id. The multifunctional toolbar is at your disposal - insert, erase, transform, highlight, and do many other commands with the text in the file.

Feel free to type in the next details to prepare the phoenix university tax id PDF:

Type in the demanded information in Title II of Higher Education Act, Federal Financial Aid Application, Grant Programs Federal Grant, Scholarships Federal, University Tuition Adjustments, and Loans Federal Direct Loan DL box.

You can be asked for some vital information in order to complete the Loans Federal Direct Loan DL, and C O N S U M E R I N F O R M A T I field.

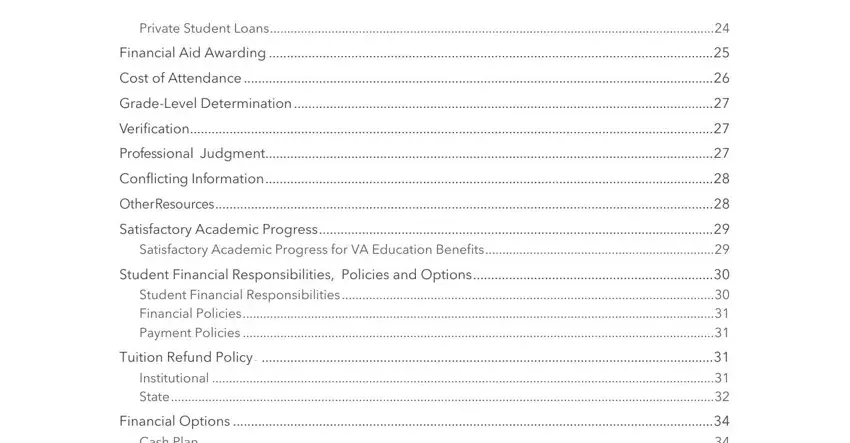

The Private Student Loans, Financial Aid Awarding, Cost of Attendance, GradeLevel Determination, Verification, Professional Judgment, Conflicting Information, Other Resources, Satisfactory Academic Progress, Student Financial Responsibilities, Tuition Refund PolicyF, and Financial Options Cash Plan space is where both parties can put their rights and responsibilities.

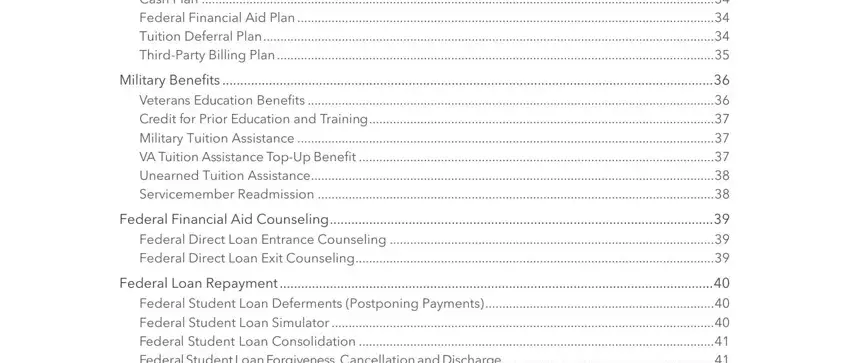

Finalize by reviewing the next fields and filling them out as needed: Financial Options Cash Plan, Military Benefits Veterans, Federal Financial Aid Counseling, and Federal Loan Repayment Federal.

Step 3: Press the Done button to save the document. So now it is ready for upload to your device.

Step 4: It will be better to have duplicates of the form. You can rest easy that we are not going to disclose or check out your information.