U.S. Bank Commercial Fleet Card

Application Checklist

Please ensure the following materials are included and/or completed prior to submitting the Commercial Fleet Card Application.

ENSURE the Application is complete and accurate:

OComplete all parts of Section 1.

OIF you anticipate monthly charge volume of $25,000.00 OR LESS on the U.S. Bank Fleet Card(s), please complete Section 2 AND sign in Section 4.

OIF you anticipate monthly charge volume of GREATER than $25,000.00 on the Fleet Card(s), please read Section 3 AND sign in Section 4. Submit all additional requested information (for example, financial statements as specifically described in Section 3 of this Application and Section 15 of the Agreement) and return with completed Application.

ORead the attached Commercial Fleet Card Terms and Conditions (“Agreement”) and keep it for your records, along with a copy of this Application.

OIs the Application signed and dated?

ODoes the Application contain all required information?

HELP us speed up the processing of your documents!

In completing the Commercial Fleet Card Application, please note that performing the following actions will shorten the time for processing:

OThe signer’s title must be the same and consistent on all pages.

OIf you have been requested to send financial statements, please be sure they contain the following documents: O Balance Sheet

O Income Statement/Profit and Loss

O Statement of Cash Flows (if available) O Auditor’s Opinion (if available)

O Latest interim statements if last annual statement is older than five (5) months

OSend completed documents via express or courier delivery service, email or fax to avoid delays and to ensure delivery.

OIf you are unsure of the legal name of your company or the signer’s title, please verify by calling your Controller’s office, or discuss your options with your U.S. Bank Representative.

THE FULL AND COMPLETE LEGAL NAME MUST BE INSERTED IN ALL AREAS THAT REQUIRE THE LEGAL NAME. VARIATIONS OR ABBREVIATIONS OF THE LEGAL NAME ON THIS DOCUMENT OR ANY ATTACHED OR ACCOMPANYING DOCUMENTS CANNOT BE ACCEPTED.

Send completed applications and financial statements to your U.S. Bank Representative as a .pdf file, by fax to U.S. Bank at

866‐645‐3676 or mail to:

U.S. Bank

Attn: Credit Administration

PO Box 13050

Overland Park, Kansas 66282‐3050

If you have any questions about the Fleet Card program, please call your U.S. Bank Sales Representative.

VOYCPS0911V1 (R 09/11) |

1 OF 6 |

U.S. Bank Commercial Fleet Card

Application

The issuer of the U.S. Bank Fleet Card is U.S. Bank National Association ND (“U.S. Bank.)

1.Complete all parts of Section 1.

2.IF you anticipate monthly charge volume of $25,000.00 OR LESS on the Fleet Card(s), please complete Section 2 AND sign in Section 4.

3.IF you anticipate monthly charge volume of GREATER than $25,000.00 on the Fleet Card(s), please read Section 3 AND sign in Section 4.

4.Read the attached Commercial Fleet Card Terms and Conditions (“Agreement”) and keep it for your records, along with a copy of this Application.

5.Return completed Application and all additional requested information (for example, financial statements as specifically described in Section 3 of this Application and Section 15 of the Agreement) to U.S. Bank by fax to 866‐645‐3676 or mail to: PO Box 13050 Overland Park, Kansas 66282‐3050. Applications can also be sent directly to your U.S. Bank Representative as a .pdf file

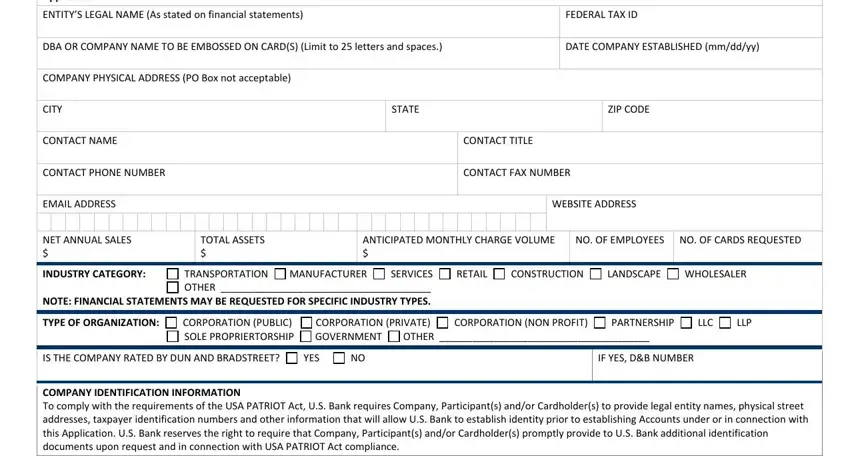

SECTION 1 ‐ COMPANY (“COMPANY”) INFORMATION

NOTE: Attach a copy of Business License, Articles of Incorporation/Organization, Certificate in Good Standing or Secretary of State Filing when returning this Application.

ENTITY’S LEGAL NAME (As stated on financial statements)

DBA OR COMPANY NAME TO BE EMBOSSED ON CARD(S) (Limit to 25 letters and spaces.)

DATE COMPANY ESTABLISHED (mm/dd/yy)

COMPANY PHYSICAL ADDRESS (PO Box not acceptable)

ANTICIPATED MONTHLY CHARGE VOLUME

$

|

|

|

|

|

|

|

|

|

|

INDUSTRY CATEGORY: |

TRANSPORTATION |

MANUFACTURER |

SERVICES |

RETAIL |

CONSTRUCTION |

LANDSCAPE |

WHOLESALER |

|

OTHER ______________________________________ |

|

|

|

|

|

NOTE: FINANCIAL STATEMENTS MAY BE REQUESTED FOR SPECIFIC INDUSTRY TYPES. |

|

|

|

|

|

|

|

|

|

|

|

|

TYPE OF ORGANIZATION: |

CORPORATION (PUBLIC) |

CORPORATION (PRIVATE) |

CORPORATION (NON PROFIT) |

PARTNERSHIP |

LLC |

LLP |

|

SOLE PROPRIERTORSHIP |

GOVERNMENT |

OTHER ______________________________________ |

|

|

IS THE COMPANY RATED BY DUN AND BRADSTREET?

COMPANY IDENTIFICATION INFORMATION

To comply with the requirements of the USA PATRIOT Act, U.S. Bank requires Company, Participant(s) and/or Cardholder(s) to provide legal entity names, physical street addresses, taxpayer identification numbers and other information that will allow U.S. Bank to establish identity prior to establishing Accounts under or in connection with this Application. U.S. Bank reserves the right to require that Company, Participant(s) and/or Cardholder(s) promptly provide to U.S. Bank additional identification documents upon request and in connection with USA PATRIOT Act compliance.

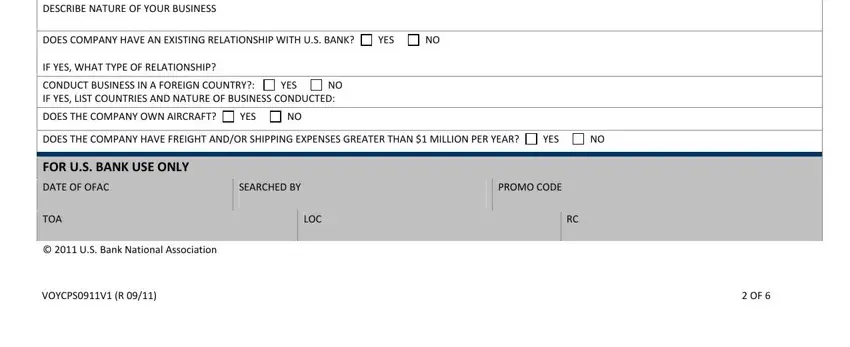

DESCRIBE NATURE OF YOUR BUSINESS

DOES COMPANY HAVE AN EXISTING RELATIONSHIP WITH U.S. BANK? |

YES |

NO |

|

|

|

IF YES, WHAT TYPE OF RELATIONSHIP? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONDUCT BUSINESS IN A FOREIGN COUNTRY?: |

YES |

NO |

|

|

|

|

|

|

IF YES, LIST COUNTRIES AND NATURE OF BUSINESS CONDUCTED: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DOES THE COMPANY OWN AIRCRAFT? |

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DOES THE COMPANY HAVE FREIGHT AND/OR SHIPPING EXPENSES GREATER THAN $1 MILLION PER YEAR? |

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

FOR U.S. BANK USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE OF OFAC |

SEARCHED BY |

|

|

|

PROMO CODE |

|

|

|

|

|

|

|

|

|

|

|

|

TOA |

|

|

|

LOC |

|

|

|

|

|

RC |

|

|

|

|

|

|

|

|

|

|

|

© 2011 U.S. Bank National Association |

|

|

|

|

|

|

|

|

|

|

VOYCPS0911V1 (R 09/11) |

|

|

|

|

|

|

|

|

|

2 OF 6 |

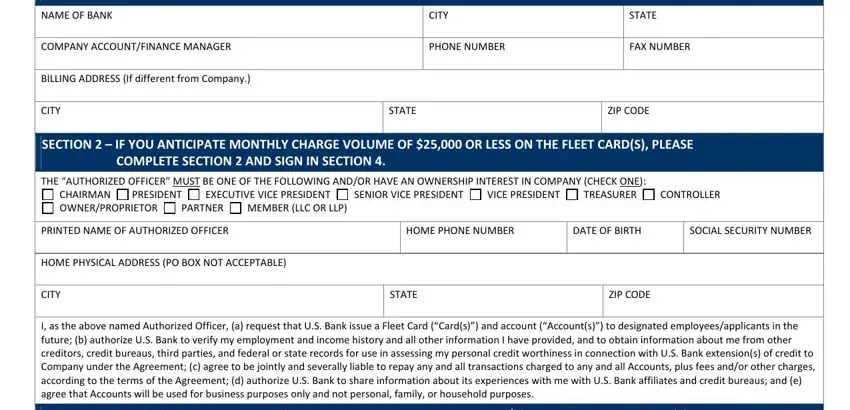

BANK AND BILLING INFORMATION

NAME OF BANK |

|

CITY |

|

STATE |

|

|

|

|

|

COMPANY ACCOUNT/FINANCE MANAGER |

|

PHONE NUMBER |

|

FAX NUMBER |

|

|

|

|

|

BILLING ADDRESS (If different from Company.) |

|

|

|

|

|

|

|

CITY |

STATE |

ZIP CODE |

|

|

|

|

|

|

|

|

|

|

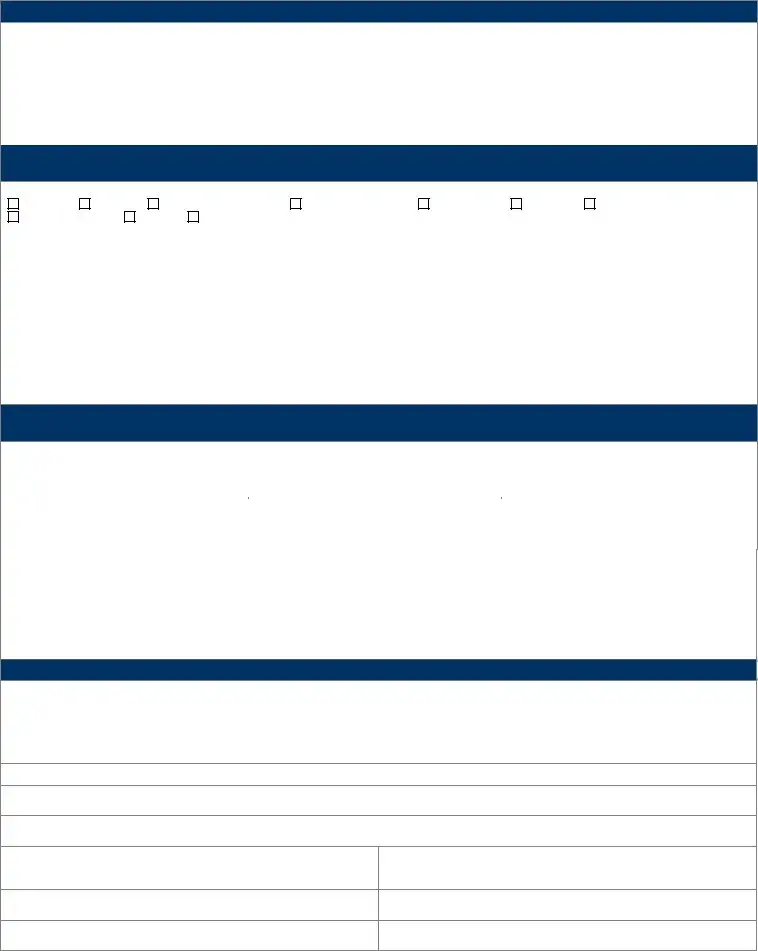

SECTION 2 – IF YOU ANTICIPATE MONTHLY CHARGE VOLUME OF $25,000 OR LESS ON THE FLEET CARD(S), PLEASE COMPLETE SECTION 2 AND SIGN IN SECTION 4.

THE “AUTHORIZED OFFICER” MUST BE ONE OF THE FOLLOWING AND/OR HAVE AN OWNERSHIP INTEREST IN COMPANY (CHECK ONE): |

|

|

CHAIRMAN |

PRESIDENT |

EXECUTIVE VICE PRESIDENT |

SENIOR VICE PRESIDENT |

VICE PRESIDENT |

TREASURER |

CONTROLLER |

OWNER/PROPRIETOR |

PARTNER |

MEMBER (LLC OR LLP) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PRINTED NAME OF AUTHORIZED OFFICER |

|

|

|

HOME PHONE NUMBER |

DATE OF BIRTH |

|

SOCIAL SECURITY NUMBER |

|

|

|

|

|

|

|

|

|

HOME PHYSICAL ADDRESS (PO BOX NOT ACCEPTABLE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

STATE |

|

|

ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I, as the above named Authorized Officer, (a) request that U.S. Bank issue a Fleet Card (“Card(s)”) and account (“Account(s)”) to designated employees/applicants in the future; (b) authorize U.S. Bank to verify my employment and income history and all other information I have provided, and to obtain information about me from other creditors, credit bureaus, third parties, and federal or state records for use in assessing my personal credit worthiness in connection with U.S. Bank extension(s) of credit to Company under the Agreement; (c) agree to be jointly and severally liable to repay any and all transactions charged to any and all Accounts, plus fees and/or other charges, according to the terms of the Agreement; (d) authorize U.S. Bank to share information about its experiences with me with U.S. Bank affiliates and credit bureaus; and (e) agree that Accounts will be used for business purposes only and not personal, family, or household purposes.

SECTION 3 – IF YOU ANTICIPATE MONTHLY CHARGE VOLUME OF GREATER THAN $25,000 ON THE FLEET CARD(S), PLEASE

READ SECTION 3 AND SIGN IN SECTION 4.

Along with this Application, please attach a copy of your most recent annual financial statement(s) according to the grid below. If the most recent annual financial statements are more than five (5) months old, please attach the most recent interim financial statements as well.

MONTHLY CHARGE VOLUME |

|

FINANCIAL STATEMENTS REQUIRED |

YEARS |

|

|

|

|

|

|

=< $50,000.00 |

|

YES |

|

|

|

1 |

|

|

|

|

|

|

$50,000.01 ‐ $250,000.00 |

|

YES |

2 |

|

|

|

|

|

|

=> $250,000.01 |

|

YES |

3 |

|

|

|

|

|

|

By completing this Application, Company acknowledges and agrees that: (a) all information provided in this Application is true, complete and accurate and Company has the authority to provide such information and complete such Application; (b) Company requests that U.S. Bank establish an Account in the name of Company and to issue Cards in accordance with the Agreement; (c) U.S. Bank will review this Application and may, at its sole discretion, grant such request, but that U.S. Bank is under no obligation to do so; (d) Company shall be bound by the Agreement upon signing this Application; and (e) U.S. Bank is authorized to investigate, obtain, and exchange reports and information regarding this Application and any resulting Accounts with credit reporting agencies and other parties with legitimate business needs for such reports or information. If this Application is approved, Company and U.S. Bank agree that the Agreement attached to this Application shall constitute the entire agreement between Company and U.S. Bank. This Application must be signed by at least one of the following: Chairman, President, Executive Vice President, Senior Vice President, Vice President, Treasurer, Controller, Owner/Proprietor, Partner or Member (LLC or LLP only).

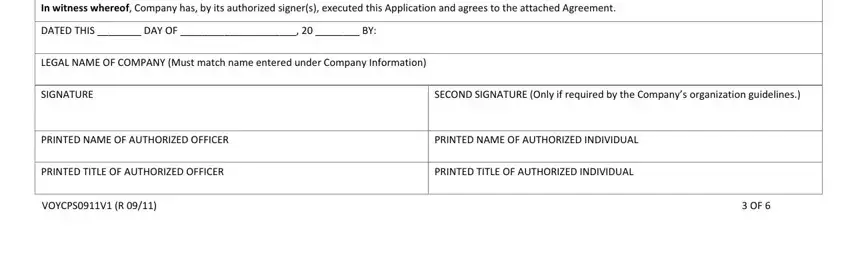

SECTION 4 – AUTHORIZATION AND EXECUTION

By signing below, each individual signing this Application in his or her capacity as an authorized signing officer of Company, certifies and warrants that: (a) all action required by Company’s organizational documents to authorize the signer(s) to act on behalf of Company in all actions taken under this Application and the attached Agreement, including, but not limited to, the authority to incur Debt on behalf of Company, has been taken; (b) each signer is empowered in the name of and on behalf of Company to enter into all transactions contemplated in this Application and the attached Agreement; and (c) the signatures appearing on all supporting documents of authority are authentic. Company has read, understands and agrees to the Agreement attached to this Application and U.S. Bank is entitled to act in reliance upon the authorizations and certifications set forth in this Application.

In witness whereof, Company has, by its authorized signer(s), executed this Application and agrees to the attached Agreement.

DATED THIS ________ DAY OF _____________________, 20 ________ BY:

LEGAL NAME OF COMPANY (Must match name entered under Company Information)

SECOND SIGNATURE (Only if required by the Company’s organization guidelines.)

PRINTED NAME OF AUTHORIZED OFFICER

PRINTED NAME OF AUTHORIZED INDIVIDUAL

PRINTED TITLE OF AUTHORIZED OFFICER

PRINTED TITLE OF AUTHORIZED INDIVIDUAL

VOYCPS0911V1 (R 09/11) |

3 OF 6 |

COMMERCIAL FLEET CARD TERMS AND CONDITIONS

The Commercial Fleet Card Terms and Conditions (the “Agreement”) is entered into, by and between U. S. Bank National Association ND (“U.S. Bank”) and the entity that signed the Application as “Company” for the establishment of a Fleet Card Program. This Agreement supersedes any previous and like agreements with Company.

1.EFFECTIVE DATE. The Agreement shall not become effective until U.S. Bank has 1) approved the credit worthiness of Company and 2) approved this Application. The “Effective Date” of this Agreement shall be the date signed by Company.

2.SCOPE OF FLEET CARD PROGRAM. The “Fleet Card Program” includes transaction processing, reporting and payment systems with respect to purchases of motor fuels and other products and services by commercial and government organization fleet vehicle operations. Upon approval, as indicated above, U.S. Bank will issue Cards and establish related Accounts for Company, and those of its subsidiaries or affiliates that Company may designate to U.S. Bank in writing while this Agreement is in effect and that U.S. Bank approves as participant(s) (known here after as “Participant” and “Participants”). Company shall furnish a list, in writing, to U.S. Bank designating such Participant(s) and legal business names, if business activities are conducted under a name other than Company’s. Company shall have the right to exclude any Participant from the Fleet Card Program upon written notice to U.S. Bank. Company and/or authorized Participant shall designate employees to U.S. Bank that should receive cards (“Cardholders”) and/or be issued Account numbers. Company shall be responsible for selecting personal identification number(s) (“PIN(s)”), driver identification number(s) (“Driver ID(s)”) or vehicle identification number(s) (“Vehicle ID(s)”) pursuant to the Fleet Card Program. Unless U.S. Bank notifies Company to the contrary, or a Card has been terminated as provided herein, all Cards will be cancelled upon the expiration or termination of this Agreement. All Accounts established and Cards issued hereunder shall be used solely for business purposes and shall be governed by this Agreement. “Account” means any account established by U.S. Bank pursuant to this Agreement in the name of Company, its Participants and/or Cardholders, to which Debt is charged, regardless of whether or not a Card is issued.

3.LIABILITY. Company, and if applicable, Authorized Officer, shall be liable for all Debt incurred or arising by virtue of the use of a Card and/or Account of Company, Participant or any Cardholder. “Debt” means all amounts charged to an Account including without limitation all purchases, fees, Finance Charges, and other charges or amounts due that are owed to U.S. Bank by Company, its Authorized Officer(s), affiliates, Participants, and/or Cardholders.

a.Joint and Several Liability. Company and the Authorized Officer are jointly and severally liable to U.S. Bank for all Debt. This liability structure applies to any product credit limit (“PCL”) when Section 2 of the Application has been completed.

b.Corporate Liability. Company is solely liable to U.S. Bank for all Debt. This liability structure applies to any PCL when Section 2 of the Application has not been completed.

4.BILLING PROCEDURE. U.S. Bank will send to the Company a periodic billing statement (the “Statement”), which will itemize all charges for the billing period. The “New Balance” shown on the Statement shall be due in full and payable in U.S. Dollars upon Company’s receipt of the Statement.

5.FINANCE CHARGES. If Company’s New Balance is not paid in full on or before the “Due Date” shown on the Statement, a Finance Charge will be charged to the Company. This Finance Charge will be computed using the Average Daily Balance (“ADB”) method resulting in the “Balance Subject to Finance Charge.” The “Periodic (monthly) Rate” is then applied against this amount to arrive at the “Finance Charge.” To arrive at the ADB, U.S. Bank will take the beginning balance on Company’s account each day, add debits and any new purchases (except in the states of IL, ME, MA, MN, MS, MT, and NM) from the date of posting (if the New Balance is not received), then subtract any payments or credits, returned check fees, and unpaid Finance Charges. The result will be the “Daily Balance.” U.S. Bank will then add all the Daily Balances for the billing cycle and divide by the total number of days in the billing cycle. The result will be the “Average Daily Balance.” The Finance Charge will be assessed at a Periodic (monthly) Rate for Company’s state of mailing address as provided on the Finance Charge Rate Schedule.

6.DELINQUENCY. An Account will become delinquent unless U.S. Bank receives the amount shown on the Statement as Total Payment Due, less any disputed amounts, before the next billing date (approximately twenty five (25) days). Any unpaid portion of the Total Payment Due will be shown on subsequent Statements as the "Previous Balance." In the event of Company’s delinquency, U.S. Bank may elect to terminate this Agreement immediately upon notice to Company. Court costs plus reasonable attorney fees (as allowed by law) may be added to any delinquent balance referred to an attorney for collection.

7.DISPUTED BILLINGS. Company may notify U.S. Bank of any disputes regarding charges or billings hereunder in writing, by telephone or by electronic means, such as Fleet Commander Online. Written communications relating to billing disputes must be sent to U.S. Bank at PO Box 13050 Overland Park, Kansas 66282‐3050. Communications should include the Company’s and, if applicable, the Participant’s name(s) and account number(s), the dollar amount of any dispute or suspected error and a description of the dispute or error. Any communication regarding a dispute or suspected error must be received in written form by U.S. Bank within sixty

(60)days after the Statement Date on the Statement on which the disputed or incorrect charge first appeared.

8.LOST OR STOLEN CARD(S) OR COMPROMISED ACCOUNT(S). Company shall immediately, upon receipt of such information, notify U.S. Bank either: 1) by telephone at 800‐987‐6591; 2) in writing addressed to U.S. Bank at PO Box 13050 Overland Park, Kansas 66282‐3050; 3) via facsimile at 800‐987‐6592; or 4) by an agreed upon electronic means as to any lost or stolen Cards, PINs, Driver IDs, or Vehicle IDs. Company shall also immediately notify U.S. Bank either: 1) by telephone at 800‐987‐ 6591; 2) in writing addressed to U.S. Bank at PO Box 13050 Overland Park, Kansas 66282‐3050; 3) via facsimile at 800‐987‐6592; or 4) by an agreed upon electronic means to cancel a PINs, Driver IDs, or Vehicle IDs. After notification has been made to U.S. Bank to cancel such Card(s), PINs, Driver IDs or Vehicle IDs, use of such Card(s), PINs, Driver IDs or Vehicle IDs are expressly prohibited. Company and/or Cardholder are liable for the unauthorized use of the Card until U.S. Bank receives notification of the lost or stolen Card or to cancel the PIN, Driver ID, or Vehicle ID. Neither Company, nor Cardholder shall be liable for any purchase, fees, finance charges or other charge incurred or arising by virtue of the use of a Card following receipt by U.S. Bank of notice of such loss, theft or request to cancel PIN, Vehicle ID, or Driver ID. If fewer than ten (10) Cards are issued to Company, liability will not exceed fifty U.S. Dollars ($50.00) per Card once U.S. Bank has been notified of the lost or stolen Card(s) and confirms that such transactions were, in fact, unauthorized. If ten (10) or more Cards are issued to Company, Company shall be liable for all unauthorized use as provided above, that is, until U.S. Bank has been notified of the lost or stolen Card(s) and confirms that such transactions were, in fact, unauthorized. In such cases, liability is not limited to fifty U.S. Dollars ($50.00) per Card. Company agrees to assist U.S. Bank in determining the facts, circumstances and other pertinent information related to any loss, theft or possible unauthorized use of the Card(s) and to comply with such procedures as may be required by U.S. Bank in connection with the investigation. U.S. Bank is not responsible for controlling the use of any Card(s), other than as specifically provided herein.

9.PRICING. The fees listed below may apply to this Agreement. Failure of U.S. Bank to apply any fee or charge outlined in this Agreement at any time does not preclude U.S. Bank from ever applying such fee or charge. U.S. Bank reserves the right to change pricing upon thirty (30) days prior notice to Company.

a.If any check for payment of an Account is returned unpaid, U.S. Bank will charge a returned check fee (“Return Check Fee”) of the lesser of fifteen U.S. Dollars ($15.00) or the maximum determined by law in Company’s state of mailing address.

b.Finance Charge as provided in Section 5 of the Terms and Conditions.

c.U.S. Bank will charge a foreign currency conversion fee (“Foreign Currency Conversion Fee”) of two percent (2.0%) for transactions made outside the United States and the Statement will reflect the conversion into U.S. Dollars on transactions that have occurred in a different currency and an applicable exchange rate for such conversions.

d.The following fees may be charged to businesses with monthly charge volume of less than eight thousand U.S. Dollars ($8,000.00):

•Account Set‐Up Fee (a one time, per Account, fee): $45.00, and/or

•Monthly Card Fee (per Card; per month): 1‐25 Cards ‐ $2.00; 26‐100 Cards ‐ $1.75; 101‐200 Cards ‐ $1.50.

10.CONFIDENTIALITY. U.S. Bank considers the Fleet Card Program to be a unique service involving proprietary information of U.S. Bank. Company agrees that the Fleet Card Program reports, manuals, documentation, systems, processes and related materials (whether or not in writing) are confidential and will be circulated only to

employees and agents of Company, and only to the extent necessary for Company to participate in the Fleet Card Program. U.S. Bank agrees that it will maintain all non‐public data relative to Company’s Account(s) under the Fleet Card Program as confidential information and U.S. Bank agrees to use such data regarding Company

VOYCPS0911V1 (R 09/11) |

4 OF 6 |

COMMERCIAL FLEET CARD TERMS AND CONDITIONS

exclusively for the providing of services to Company hereunder and not to release such information to any other party except its agents; provided, however, that U.S. Bank must disclose transaction information to merchants and third party processors. If Company participates in the Fleet Card Program through a third party, Company consents to U.S. Bank sharing certain customer, transaction, and volume information with such third party. U.S. Bank may collect, maintain and, at its option, disseminate information and data concerning charge activity which does not contain any direct or indirect identification of Company. The parties agree to take all reasonable steps to safeguard such proprietary information and not to release such information to any party, or agent not essential to participation in the Fleet Card Program.

11.TERM, TERMINATION AND SUSPENSION.

a.This Agreement shall remain in full force and effect for an initial term of three (3) years from the Effective Date of this Agreement, and shall continue thereafter until terminated by Company, U.S. Bank upon thirty (30) days prior written notice to the other party. The effective date of termination shall be stated in such written notice of termination. All Cards and related Accounts shall be deemed canceled effective upon termination of this Agreement.

b.Notwithstanding the foregoing, either party shall have the right to terminate this Agreement immediately, by written notice of such termination to the other party, upon any one (1) or more of the following events: (i) dissolution or liquidation of the other Party, or Parent thereof, if applicable; (ii) insolvency of the other party or Parent thereof, if applicable, or the filing of a bankruptcy or insolvency proceeding by the other party, the appointment of a receiver or trustee for benefit of creditors of the other party or if the other party enters into an arrangement with its creditors; (iii) any material and adverse change in the financial condition of the other party; or (iv) any failure by the other party to perform a material obligation of this Agreement.

c.Upon termination of this Agreement for any reason, Company shall ensure destruction of all Cards and return all confidential information of U.S. Bank to U.S. Bank. Company, and Authorized Officer if applicable, shall remain liable for all Debt incurred or arising by virtue of the use of a Card and/or Account prior to the termination date.

d.U.S. Bank shall have the right to suspend any and all services and Debt to Company under this Agreement in the event that: (i) Company has breached any term of this Agreement; (ii) Debt due from Company, in the aggregate, exceeds any of the ACL or the PCL as these terms are defined in Section 16 of this Application; or (iii) an Account becomes delinquent. An Account will become Delinquent unless U.S. Bank receives the New Balance, less any disputed amounts, on or before the Due Date. Court costs plus reasonable attorney fees (as allowed by law) may be added to any delinquent balance referred to an attorney for collection.

e.Rights, Debt or liabilities that arise prior to the suspension or termination of this Agreement shall survive the suspension or termination of this Agreement.

12.INDEMNIFICATION.

a.Except to the extent that any injury is due to Company’s or a Participant’s negligent acts or omissions, U.S. Bank shall indemnify and hold Company and Participants harmless against all losses, damages, costs, expenses and liability which may result in any way from any negligent or wrongful act or omission of U.S. Bank, its agents, employees and subcontractors. U.S. Bank shall indemnify and hold Company and Participants harmless against demands, claims, suits, or proceedings alleging infringement of any patent of the United States, or any trademark, service mark, copyright or other proprietary right arising out of or incident to this Agreement.

b.Except to the extent that any injury is due to U.S. Bank’s negligent acts or omissions, Company shall indemnify and hold U.S. Bank harmless against all losses, damages, costs, expenses and liability which may result in anyway from any negligent or wrongful act or omission of Company, Participants, its agents, employees and subcontractors. Company and Participants shall indemnify and hold U.S. Bank harmless against demands, claims, suits, or proceedings alleging infringement of any patent of the United States, or any trademark, service mark, copyright or other proprietary right arising out of or incident to this Agreement.

13.LIMITATION OF LIABILITY. IN NO EVENT SHALL COMPANY, PARTICIPANT(S), U.S. BANKOR ANY AFFILIATE OF U.S. BANK BE LIABLE TO THE OTHER PARTY FOR ANY CONSEQUENTIAL, SPECIAL, INDIRECT, OR PUNITIVE DAMAGES OF ANY NATURE.

14.WARRANTIES. Company warrants the truth, completeness and accuracy of the following in connection with this Agreement: (i) The financial information and all other information provided to U.S. Bank; (ii) This Agreement is a valid, binding and enforceable agreement; (iii) The execution of this Agreement and the performance of its Debt are within Company’s power, has been authorized by all necessary action and does not constitute a breach of any agreement of Company with any party; (iv)

Company has and continues to comply with all applicable state and federal statutes, ordinances, rules, regulations and requirements of governmental authorities as they relate to the use of the Card and/or participation in the Fleet Card Program; (v) the execution of this Agreement and the performance of its Debt under this Agreement will not cause a breach by it of any duty arising in law or equity; and (vi) Company possesses the financial capacity to perform all of its Debt under this Agreement. The parties agree that the failure of any of the above representations and warranties to be true during the term of this Agreement shall constitute a material breach of this Agreement and U.S. Bank will have the right, upon notice to Company, to immediately terminate this Agreement and all amounts outstanding hereunder shall be immediately due and payable. U.S. Bank hereby disclaims any and all warranties with respect to goods and services purchased with its Cards and/or Accounts, including, without limitation, the implied warranty of merchantability or fitness for a particular purpose. This warranty and damages disclaimer shall apply whether U.S. Bank acts as card issuer, arranger of third party credit, or otherwise.

15.FINANCIAL INFORMATION. Since this Agreement is for an extension of credit with a financial institution and not a vendor services agreement, Company shall provide information as requested by U.S. Bank to perform periodic credit reviews. Unless such information is publicly available or available through U.S. Bancorp (the parent Company of U.S. Bank) or any of its subsidiaries, Company shall either provide: (i) if Company anticipates monthly charge volume of equal to or less than $25,000.00, information about an authorized officer whom U.S. Bank may underwrite on behalf of Company within Section 2 of the Application, or (ii) if Company anticipates monthly charge volume of greater than $25,000.00 but less than $50,000.00, last years annual financial statements, or (iii) if Company anticipates monthly charge volume of greater than $50,000.00 but less than $250,000.00, the last two (2) years of annual financial statements, or (iv) if Company anticipates monthly charge volume of greater than $250,000.00, the last three (3) years of annual financial statements. If the initial set of financial statements is older than five (5) months when provided, Company must also provide interim financial statements. Annually thereafter, as soon as available and in any event not later than one hundred twenty (120) days after the end of each fiscal year of Company, Company must provide the previous years financial statements. U.S. Bank prefers audited financial statements that have been prepared by Company’s independent certified public accountant. In the event U.S. Bank requires additional information to conduct its review of Company, or if Company’s monthly charge volume increases such that the information it provided as described in 15.(i) above is no longer sufficient for underwriting Company, Company agrees to provide to U.S. Bank the information set forth in 15.(ii), (iii) or (iv) above, as the case may dictate, and, if requested, such other information regarding the business, operations, affairs, and financial condition of Company as U.S. Bank may reasonably request. Such information may include, but is not limited to, quarterly financial statements, organizational charts, executive biographies and other formal documentation.

16.AGGREGATE PRODUCT CREDIT LIMIT AND ACCOUNT CREDIT LIMITS. Subject to credit approval by U.S. Bank, an account credit limit (an “ACL”) for each Account and an aggregate product credit limit (the “PCL”) for all Accounts shall be established by U.S. Bank pursuant to this Agreement.

a.Revising the PCL. U.S. Bank, at its sole discretion, shall have the right to revise the PCL. U.S. Bank shall provide notice to Company of any decrease in the PCL which results in a revised PCL that is lower than the aggregate current amount outstanding on all Accounts. Upon such event, Company shall have ten (10) days to make a payment to U.S. Bank that is sufficient to reduce the aggregate current amount outstanding to an amount that is equal to or less than the revised PCL.

b.Revising ACLs. U.S. Bank, at its sole discretion, shall have the right to revise any ACL. (1) Company Accounts. U.S. Bank shall provide notice to Company of any decrease in an ACL which results in a revised ACL that is lower than the aggregate current amount outstanding on the Account. Upon such event, Company shall have ten (10) days to make a payment to U.S. Bank on the Account that is sufficient to reduce the aggregate current amount outstanding for such Account to an amount that is equal to or less than the revised ACL. (2) Fraudulent Activity. U.S. Bank may revise any ACL and/or limit spending activity on any Account for which fraudulent activity is suspected.

17.CHANGE IN TERMS OF THE AGREEMENT. U.S. Bank may change the terms of this Agreement at any time by giving Company notice. If permitted by applicable law, such changes will apply to existing Account balances as well as future purchases. If Company does not accept the changes, Company must notify U.S. Bank in writing within

VOYCPS0911V1 (R 09/11) |

5 OF 6 |

COMMERCIAL FLEET CARD TERMS AND CONDITIONS

twenty‐five (25) days after the date of the notice that Company refuses to accept the changes and elects to terminate this Agreement. Should Company elect to terminate this Agreement pursuant to this Section, all outstanding Debt shall become due and payable by Company to U.S. Bank, according to the terms of the existing Agreement. Company will also be responsible for ensuring the destruction of all Cards.

18.REGISTERED MARKS AND TRADEMARKS. Company has no right, title or interest, proprietary or otherwise, in or to the name or any logo, copyright, service mark or trademark owned or licensed by U.S. Bank.

19.NOTICES. Except with respect to notices relating to the status of individual Cards which may be established in writing between U.S. Bank and Company or a Participant,

all notices, requests and other communication provided for hereunder must be directed to Company at the address on the Application and to U.S. Bank at PO Box 13050 Overland Park, Kansas 66282‐3050. Unless otherwise specified herein, requests and other communication provided for hereunder must be in writing, postage prepaid, hand delivered or by any means approved by U.S. Bank. Either party may, by written notice to the other, change its notification address.

20.GOVERNING LAW. The validity, interpretation and performance of this Agreement will be controlled by and construed under the laws of the State of North Dakota (without giving effect to the conflict of law principles thereof) and applicable federal laws.

21.EMPLOYMENT OF AGENTS. U.S. Bank may, in its sole discretion, employ affiliates or subsidiaries of U.S. Bank as agents to perform part or all of its Debt under this Agreement at any time without consent of Company; provided, however, that such action shall not affect its Debt to Company hereunder.

22.FLEET CONTACT. The Fleet Contact listed on the Application is authorized to provide U.S. Bank with the information necessary to establish the Account records and Cards, including, but not limited to, PINs, Vehicle IDs, Driver IDs, and related information. U.S. Bank is authorized to send all Account information and Cards produced to the Fleet Contact’s attention. Company may, at any time, by written notice to U.S. Bank, change its Fleet Contact or designate a different Fleet Contact than is listed on the Fleet Card Application.

23.ASSIGNMENT. This Agreement and any and all rights and Debt associated with the same may be assigned without prior notice to Company. All of U.S. Bank’s rights under this Agreement shall also apply to any assignee of this Agreement. Company may not assign or transfer this Agreement or any rights or Debt hereunder, by merger, of law, or otherwise, without the prior written consent of U.S. Bank.

24.CUSTOMER SERVICE. Company may contact U.S. Bank’s customer service center 24/7 at 800‐987‐6591 for Fleet Program customer service. Company may contact Fleet Services customer service center 24/7 at 800‐987‐6589 for merchant authorization support.

25.SEVERABILITY. Should any provision of this Agreement be declared invalid for any reason, such decision shall not affect the validity of any other provisions, which other provisions shall remain in full force and effect as if this Agreement had been executed with the invalid provision(s) eliminated. The parties shall use their best efforts to agree upon a valid substitute provision in accordance with the purpose of this Agreement and the intent of the parties.

26.NOTICE TO OHIO RESIDENTS: The Ohio laws against discrimination require that all creditors make credit equally available to all creditworthy customers, and that credit reporting agencies maintain separate credit histories on each individual upon request. The Ohio Civil Rights Commission administers compliance with this law.

VOYCPS0911V1 (R 09/11) |

6 OF 6 |